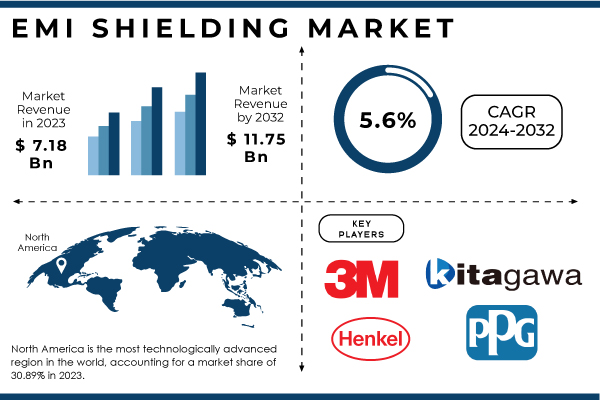

Pune, July 09, 2024 (GLOBE NEWSWIRE) -- The EMI Shielding Market Size was valued at USD 7.18 Billion in 2023 and is expected to reach USD 11.75 Billion by 2032, growing at a CAGR of 5.6% over the forecast period.

The EMI shielding market has been witnessing substantial growth attributed to the increasing demand for wireless communication within diverse industry sectors including consumer electronics, automotive, and telecommunications among others. In addition, various government regulations insisting on conformity to electromagnetic compatibility (EMC) standards are also pushing market expansion. The rising popularity of the Internet of Things (IoT), joined with the expansion of wireless communication technology, including 5G will continue to create an appetite for EMI shielding solutions.

Get a Sample Report of EMI Shielding Market @ https://www.snsinsider.com/sample-request/3596

Market Players Covered in this Report:

- 3M Company

- Henkel Corporation

- Kitagawa Industries

- Leader Tech,

- PPG Industries

- SCHAFFNER HOLDING

- ETS-Lindgren

- KGS

- Laird PLC

- PARKER HANNIFIN

- RTP Company

The consumer electronics industry, such as smartphones, tablets, and wearables integrate multiple electronic components that run at varying frequencies. These components may then interfere with one another, which degrades their performance if they are not adequately EMI-shielded. Companies like Huawei, Apple, and Samsung are investing heavily in the next generation of EMI shielded technologies to improve device performance and reliability.

Also, in the automotive segment, system integration of ADAS (Advanced Driver-Assistance Systems), engine control units, and infotainment systems need EMI shielding solutions. Now Tesla has started to tackle the issues associated with EMI shielding in their electronic systems so that they remain reliable and effective. The Healthcare Sector also needs EMI shielding for various devices like patient monitoring systems, for accurate results. For the functionality of medical devices, it is essential to have EMI shielding which will prevent interference from external electromagnetic sources. Medtronic and GE Healthcare have been using advanced EMI shielding to improve their products' accuracy, precision, and excellence.

EMI Shielding Market Report Scope & Overview:

| Report Attributes | Details |

| Market Size in 2023 | USD 7.18 billion |

| Market Size in 2032 | USD 11.75 billion |

| CAGR (2024-2032) | 5.6% |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Market Driver |

|

Do you need any customization research on EMI Shielding Market, Speak to Our Analyst @ https://www.snsinsider.com/enquiry/2271

Segmentation Analysis

Material Insights: The conductive coatings & paints segment led the EMI Shielding Market and accounted for a share of 33.12% of global revenues in 2023. This segment provides a conductive surface that can be readily reflected and resist electromagnetic radiation, and sensitive electronic components are protected from interventions. Conductive polymers have mechanical properties similar to that of a polymer, yet possess the conductive ability like metals, and are lightweight and flexible which allows for them to be used in situations where metal shields simply cannot endure due to weight constraints. Metal shielding enclosures, typically manufactured from galvanized steel, aluminum, or stainless steel form a Faraday cage effect to protect electronic assemblies by not allowing EMI penetration through the electrical components. EMI/EMC filters are key market products and they have an essential role in improving the function safely as well as without any interference from other electronic systems.

Industry Insights: The consumer electronics segment dominates the segment as it is bound to employ EMI shielding for the production of numerous electronic components, as well as wireless communication modules operating at different frequencies. Due to a lack of EMI shielding, these components may affect each other which eventually leads to performance reduction. Components of the automotive system like ADAS, ECUs, or ABS are critical components in any car without some form of high-level EMI shielding there could be an issue with correct operation.

The telecommunications sector is the fastest-growing segment by industry, for example, 4G & 5G networks also require EMI shielding to prevent outside noise and ensure that the signal being transmitted is not disrupted. In addition to upholding performance and minimizing interference levels of electromedical devices, such as patient monitoring systems proper EMI shielding for medical equipment.

Regional Developments

Due to high investments in technological advancements, North America is the leading region with a market share of 30.89% in 2023. The North American healthcare sector is expected to advance due to the increasing regional population and rising disposable income, driving the demand for EMI shielding products.

Asia Pacific is the fastest-growing region driven by advancements in the consumer electronics sector, rapid industrialization, and development in infrastructure. The demand for telecommunications and information technology is likely to increase in the coming years, further propelling the market in the region. The surge in demand and manufacturing of EVs and other industrial activities in the region also drives the market.

Future Growth

Technological advancements and rising demand across different industries are anticipated to further boost the growth of the EMI shielding market in the future. IoT, 5G, and EV growth factors will reinforce the development of new EMI shielding solutions. The future of electronic systems will be highly complex and densely crowded, which means it will require ever more advanced EMI shielding technologies to provide optimal performance as well as safety. Miniaturization is well placed to meet the increasing demand for compact, efficient 5G capable EMI shielding materials in consumer electronic devices. Increasing 5G networks further accelerates the requirement for EMI shielding solutions, coupled with the growing EV market. On the other hand, in aerospace & defense and healthcare industries, companies have a greater emphasis on lightweight which is likely to create growth opportunities for manufacturers of EMI shielding materials by making them lightweight as well as flexible yet efficient.

Recent Developments

- May 2024: Indian Institute of Technology (IIT) Mandi has come up with an exceptional eco-friendly composite cloth for EMI shielding. This blend of kenaf fiber, amplified by carbon nanotubes and then infused with High-Density Polyethylene is 100% recyclable and biodegradable as municipal garbage.

- December 2023: Solvay introduced an epoxy prepreg and bonding solution called the SolvaLite 716 FR which is suitable for structural parts & reinforcements in upscale BEVs launched by automotive customers.

- February 2023: Researchers came up with a flexible, transparent material that blocks EMI while allowing high-quality infrared wireless signals to pass efficiently through. The silver mesh polymer material is used for self-cleaning and is resistant to corrosion.

Buy an Enterprise User PDF of EMI Shielding Market Outlook Report 2024-2032 @ https://www.snsinsider.com/checkout/2271

Key Takeaways

- The report suggests various growing factors and opportunities created for the EMI shielding market.

- Analyzing the key market segments that can help businesses to gain competitive advantages.

- Staying informed about the latest developments in materials and technologies will be vital for businesses to adapt and thrive in the evolving EMI shielding market.

- This report empowers businesses with the information regarding product development, market expansion, and investment strategies.

Table of Contents – Major Key Points

1. Introduction

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. EMI Shielding Market Segmentation, By Material

7.1 EMI shielding tapes & laminates

7.2 Conductive coatings & paints

7.3 Conductive polymers

7.4 Metal shielding

7.5 EMI/EMC filters

8. EMI Shielding Market Segmentation, By End-Use

8.1 Conduction

8.2 Radiation

9. EMI Shielding Market Segmentation, By Industry

9.1 Consumer electronics

9.2 Automotive

9.3 Aerospace

9.4 Telecom & IT

9.5 Healthcare

9.6 Others

10. Regional Analysis

11. Company Profiles

12. Competitive Landscape

13. Use Case and Best Practices

14. Conclusion

Access Complete Report Details @ https://www.snsinsider.com/reports/emi-shielding-market-2271

About SNS Insider

At SNS Insider, we believe that businesses should have access to the best market intelligence and insights, regardless of their size or industry. That's why we offer a range of solutions tailored to meet the unique needs of each client, from startups to big corporations. With a passion for our work and an unwavering commitment to delivering value, we are dedicated to helping our clients achieve their full potential.