Pune, July 23, 2024 (GLOBE NEWSWIRE) -- Finance and Accounting Business Process Outsourcing Market Size Analysis:

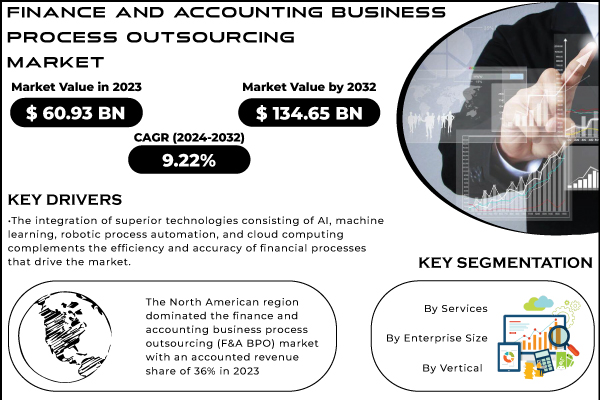

“As per the SNS Insider Research, The Finance and Accounting Business Process Outsourcing Market had a value of US$ 60.93 billion in 2023. This market is projected to reach US$ 134.65 billion by 2032, reflecting a significant compound annual growth rate (CAGR) of 9.22% over the forecast period of 2024-2032.”

Market Analysis

The F&A BPO market is growing with the aid of Businesses which can be more and more searching for cost-effective solutions to manage their financial process it reduces 35-58% of cost. F&A BPO vendors offer a compelling value proposition by leveraging economies of scale and advanced technology like cloud computing, automation, and data analytics. This improves businesses' efficiency, reduces operational prices, gains valuable insights from their financial data, and reduces 20-25% manual tasks. The complex and ever-changing regulatory landscape is creating a significant burden on corporations. Finance and Accounting Business Process Outsourcing service providers can offer specialized understanding to ensure compliance with evolving new govt. policies, allowing companies to navigate these challenges with more ease.

Beyond basic accounting and bookkeeping, Finance and Accounting Business Process Outsourcing are expanding to encompass strategic functions such as market research, consulting services, and legal support. This holistic technique empowers businesses to make informed decision and acquire their strategic objectives. Finance and Accounting Business Process Outsourcing service provides established operational infrastructure primarily based on contractual agreements. This allows corporations to leverage the information and advanced infrastructure of BPO companies, often located in developing countries, to streamline standardized finance and accounting operations.

Get a Sample Report of Finance and Accounting Business Process Outsourcing Market@ https://www.snsinsider.com/sample-request/4403

Major Players Analysis Listed in this Report are:

- Capgemini

- CKH Group

- Cognizant

- Teleperformance SE

- Fiserv, Inc.

- HCL Technologies Limited

- Infosys Limited

- Accenture plc

- Invensis Technologies Pvt Ltd

- Wipro Limited

- Outsourced Bookkeeping

- International Business Machines Corporation

- Sutherland

- Tata Consultancy Services Limited

- Genpact

- Other Players

Finance and Accounting Business Process Outsourcing Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 60.93 Billion |

| Market Size by 2032 | USD 134.65 Billion |

| CAGR | CAGR of 9.22% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Growth Drivers | • The integration of superior technologies consisting of AI, machine learning, robotic process automation, and cloud computing complements the efficiency and accuracy of financial processes that drive the market. • BPO provides specialized abilities and knowledge in finance and accounting, which can be difficult and expensive to keep in-house, especially for small and medium-sized organizations |

Recent Developments

- CKH Group partnered with local governments across Georgia in April 2024 to provide crucial auditing and staffing services, ensuring compliance with federal and state funding requirements.

- Genpact joined forces with Heubach GmbH, a leading pigment manufacturer, in August 2023 to revamp their financial and supply chain operations. This partnership leverages Genpact's expertise in smart operations to enhance efficiency, digital capabilities, and operational flexibility.

- Accenture acquired SKS Group, a specialist consultancy for SAP solutions in financial institutions, in January 2023. This acquisition strengthens Accenture's consulting, technology, and regulatory services portfolio, particularly for specialized banks.

Do you have any specific queries or need any customization research/data on Finance and Accounting Business Process Outsourcing Market, make an Enquiry Now@ https://www.snsinsider.com/enquiry/4403

Segment Analysis

By Services, The Order-to-Cash (O2C) segment held the dominant market share of 52% in 2023, because of its impact on diverse components of a business, along with cash flow, inventory management, and consumer experience. The Source-to-Pay (S2P) segment is projected to experience huge growth as companies increasingly outsource the procurement process to optimize costs and streamline operations.

By Enterprise Size, Large organizations dominated the Finance and Accounting Business Process Outsourcing market as they leveraged those services to include technological advancements, enhance accuracy, and generate actionable insights from financial data. However, the Small and Medium-sized Enterprises (SME) phase is anticipated to witness a huge boom as Finance and Accounting Business Process Outsourcing lets in them focus on core enterprise functions at the same time as outsourcing simple accounting and bookkeeping tasks.

By Vertical, The IT and Telecom segment held the largest market share 28% due to its dynamic nature and consistent need to adapt to new evolving technologies and market needs. The Banking, Financial Services, and Insurance (BFSI) section is expected to experience a significant boom due to the growing demand for specialized Finance and Accounting Business Process Outsourcing offerings encompassing fraud detection, anti-money laundering compliance, and financial analytics.

Finance and Accounting Business Process Outsourcing Market Key Segmentation:

By Service

- Order-to-Cash

- Source-to-Pay

- Record-to-Report

- Procure-to-Pay

- Multi Processed

By Enterprise Size

- SMEs

- Large Enterprises

By Vertical

- IT & Telecommunications

- BFSI

- Manufacturing

- Healthcare

- Media & Entertainment

- Energy & Utilities

- Travel & Logistics

- Retail

- Others

Regional Analysis

North America region held the dominant market share of 36% and is predicted to remain the dominant area due to a rising preference for price-effective BPO services that assist enterprise system outsourcing, worldwide growth, and a focus on core competencies. The U.S. Market is particularly keep on leveraging blockchain technology for secure financial transactions and record-keeping. The Asia Pacific is poised for considerable growth driven by cost savings, the adoption of advanced technology, and highly skilled professional personnel in international locations like China and India. China's advanced technological infrastructure and big talent pool make it a compelling market, even as India's supportive government regulations and expertise in finance and accounting function as a robust contender. European market is predicted to witness a significant boom with stringent information privacy and safety guidelines. The European Union's General Data Protection Regulation (GDPR) performs a vital position, and Finance and Accounting Business Process Outsourcing providers ought to ensure compliance to guard sensitive economic statistics. The U.K. The market suggests promise as the government encourages corporations to prioritize sustainability while selecting BPO companions.

Regional Coverage

• North America (US, Canada, Mexico)

• Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe])

• Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific)

• Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East])

• Africa [Nigeria, South Africa, Rest of Africa]

• Latin America (Brazil, Argentina, Colombia Rest of Latin America)

Buy an Enterprise-User PDF of Finance and Accounting Business Process Outsourcing Market Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/4403

Key takeaways

- The global Finance and Accounting Business Process Outsourcing market is thriving due to the demand for cost-effective, tech-driven financial process management.

- Emerging economies play a significant role, offering skilled workforces and advanced infrastructure for Finance and Accounting Business Process Outsourcing services.

- Different regions face varying priorities. North America prioritizes cost-effectiveness, while Asia Pacific emphasizes cost savings and technology adoption. Europe focuses on data privacy compliance, and the UK prioritizes sustainability and economic resilience.

- The report provides insights into the market size, growth projections, segmentation, recent developments, and key regional trends, aiding informed decision-making for businesses considering Finance and Accounting Business Process Outsourcing solutions.

Table of Contents – Major Key Points

1. Introduction

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Finance and Accounting Business Process Outsourcing Market Segmentation, by Service

8. Finance and Accounting Business Process Outsourcing Market Segmentation, by Enterprise Size

9. Finance and Accounting Business Process Outsourcing Market Segmentation, by Vertical

10. Regional Analysis

11. Company Profiles

12. Competitive Landscape

13. Use Case and Best Practices

14. Conclusion

Access Complete Report Details of Finance and Accounting Business Process Outsourcing Market Outlook 2024-2032@ https://www.snsinsider.com/reports/finance-and-accounting-business-process-outsourcing-market-4403

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.