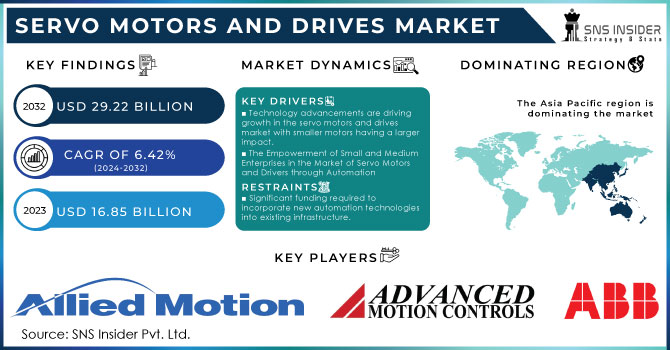

Austin, July 25, 2024 (GLOBE NEWSWIRE) -- The Servo Motors and Drives Market Size was valued at USD 16.85 billion in 2023, and is expected to reach USD 29.22 billion by 2032, and grow at a CAGR of 6.42% over the forecast period 2024-2032.

Get a Sample Report of Servo Motors and Drives Market @ https://www.snsinsider.com/sample-request/4413

Increased US manufacturing, supported by laws such as the IIJA, CHIPS Act, and IRA, is creating a surge in the need for automation. Servo systems, unlike standard motors, provide unparalleled accuracy in position, speed, and torque, making them perfect for automated manufacturing processes. The increase in automation, coupled with a significant rise in private-sector investment in semiconductors and clean technology, is driving the growth of the Servo Motors and Drives market. The future looks promising for the Servo Motors and Drives market in the US, with annual construction spending in manufacturing hitting USD 201 billion, marking a 70% year-over-year rise.

American factories are adopting Industry 4.0, as advanced and interconnected facilities result in increased need for servo motors and drives. Servo systems, unlike typical motors, offer better accuracy by continuously monitoring their positions. This is crucial for robots, an essential element of Industry 4.0. 84% of US manufacturers plan to increase spending on connecting factories within the next two years, which is in line with this. Servo drives easily connect with IIoT sensors, allowing instant changes for optimizing Industry 4.0. The connection between robots, Industrial IoT, and data analysis is essential for driving the future of smart factories in the United States.

Servo Motors and Drives Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 16.85 billion |

| Market Size by 2032 | USD 29.22 billion |

| CAGR | 6.42% by 2024-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Growth Drivers |

|

Do you have any specific queries or need any customization research on Servo Motors and Drives Market, Enquire Now @ https://www.snsinsider.com/enquiry/4413

Segment Analysis

Based on Category, Digital dominated the global servo motors and drives market with a 55% of market share in 2023. Demonstrating a preference for higher level systems among clients. Customers' demand for more advanced systems is responsible for the rise. Siemens and Mitsubishi Electric are at the forefront with their development of advanced devices featuring high-quality control and long-lasting durability. This trend aligns with broader shifts in the sector towards automation and energy efficiency. Due to advancements in automation and the expansion of manufacturing, digital servo systems are prepared to take advantage of new opportunities with their enhanced capabilities.

Based On Drive, AC Drive dominated the global servo motors and drives market with 56% of market share in 2023. Because of enhanced operational characteristics for effectively handling high current surges, amplified torque, high velocities, and decreased noise functionalities. Moreover, rapid advancements in technology and favorable administrative policies aimed at enhancing operations will also play a role in boosting the AC servo motors & drives market.

For instance, in September 2022, Kollmorgen introduced a new line of upgraded brushless AC servo motors called the EKM series. The new product is designed specifically to withstand tough conditions, providing advantages such as quick speed ratings up to 8000 RPM, efficient sealing against the elements, high power & torque density, and insulation for voltages up to 480 VAC.

By Category

- Digital

- Analog

By Drive

- AC drive

- DC drive

By Application

- Oil & gas

- Meta cutting & forming

- Material handling equipment

- Packaging and labeling machinery

- Robotics

- Medical robotics

- Rubber & plastics machinery

- Warehousing

- Automation

- Extreme environment applications

- Semiconductor machinery

- AGV

- Electronics

- Others

Regional Analysis

Asia Pacific dominated the servo motors and drives market with share of 38% of market share in 2023. The increasing investment in manufacturing and process industries is fueling the demand for automation solutions. Moreover, a rise in research and development efforts is leading to advancements in servo technology. Developing economies are fueling market expansion through the integration of real-time performance monitoring systems as part of their digital transformation efforts. Companies such as Panasonic show a clear focus on innovation by implementing their AI-enabled servo system (MINAS A7), which effectively reduces the workload for humans. Equipped with features like precise control and improved energy efficiency, this system is set to revolutionize the industry when it is launched globally in January 2024.

North America is the fastest growing in the servo motor and drivers market with 25% of share in 2023. Government actions, such as improving infrastructure, funding renewable energy, and bringing manufacturing back to domestic soil, are driving up the need for more advanced automation. This is evident in the United States' emphasis on developing a domestic semiconductor sector, resulting in a requirement for precise servo systems in chip production facilities. Manufacturers in North America are giving importance to automation and implementing Industry 4.0 in order to stay competitive. Ford and General Motors are making significant investments in automated assembly lines that use servo systems for power. Ultimately, leading servo motor and drive companies in North America such as Rockwell Automation and Emerson Automation Solutions are continuously developing new technologies. The increasing need for sustainable manufacturing techniques is being addressed by the latest developments in compact and eco-friendly servo systems. North America is set to experience significant expansion in the Servo Motors and Drives market, securing its future leadership through government backing, emphasis on advanced manufacturing, and technological progress.

Buy a Single-User PDF of Servo Motors and Drives Market Analysis & Outlook Report 2024-2032 @ https://www.snsinsider.com/checkout/4413

Key Takeaways

- Obtain a comprehensive understanding of the current market conditions, factors that facilitate expansion, and constraints.

- Evaluate the cost efficiency of servo systems to enhance decision-making regarding investments.

- Identify potential customer segments and tailor marketing tactics effectively.

- Recognize important patterns and chances to guide decisions on investing and expanding.

Table of Contents – Major Key Points

1. Introduction

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Servo Motors and Drives Market Segmentation, By Category

8. Servo Motors and Drives Market Segmentation, By Drive

9. Servo Motors and Drives Market Segmentation, By Application

10. Regional Analysis

11. Company Profiles

12. Competitive Landscape

13. Use Case and Best Practices

14. Conclusion

Access Complete Report Details of Servo Motors and Drives Market Report 2024-2032 @ https://www.snsinsider.com/reports/servo-motors-and-drives-market-4413

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.