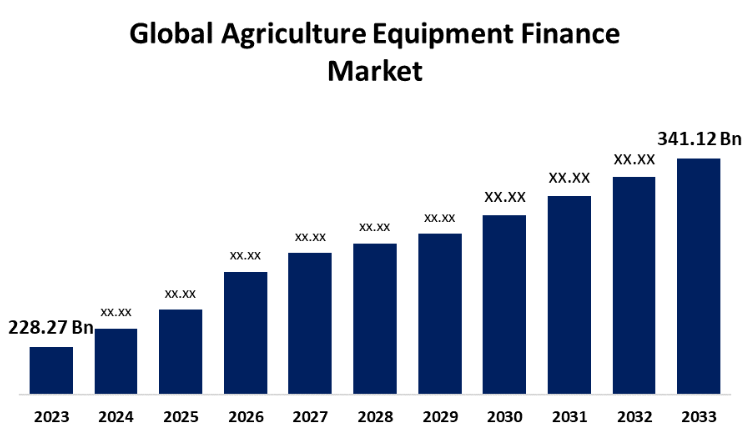

New York, United States , Aug. 09, 2024 (GLOBE NEWSWIRE) -- The Global Agriculture Equipment Finance Market Size is to Grow from USD 228.27 Billion in 2023 to USD 341.12 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 4.10% during the projected period.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/5504

A farm equipment loan is a loan that is only meant to be used to purchase equipment for a farm or other similar agricultural business. Depending on the conditions of the loan, a farmer might be able to buy new or used machinery, such as tractors, combines, harvesters, planters, and utility vehicles. Similar to other types of equipment financing, loans for agricultural equipment are typically secured by the machinery that farmers purchase. Furthermore, the market for agricultural tractors is developing gradually as a result of the growing mechanization of the agriculture industry and the need for increased productivity and efficiency. Several reasons, such as population growth, urbanization, increased food consumption, and technological developments in agricultural operations, have contributed to the market's steady growth. A primary driver of market growth is the easy and quick availability of financing. Furthermore, the industry is mainly propelled by the worldwide movement toward more agriculture mechanization. Another driving force in the sector is the increasing demand for rapid and simple loans via online financial platforms. Global company growth is also being facilitated by the development of blockchain technology, which ensures real-time information transparency of a loan to all parties involved. The low import tax on farm equipment is another factor driving industry expansion. However, one issue impeding the market's expansion is higher bank loan rates. The general globalization of the economy has altered the supply and demand for financial products. Bank finance was considered the most cost-effective source of funding for the previous 10 years.

Browse key industry insights spread across 212 pages with 125 Market data tables and figures & charts from the report on the "Global Agriculture Equipment Finance Market Size, Share, and COVID-19 Impact Analysis, By Type (Loans, Leases, and Line-of-Credit), By Product (Harvesters, Haying Equipment, Tractors, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."

Buy Now Full Report: https://www.sphericalinsights.com/checkout/5504

The lease segment is anticipated to hold the greatest share of the global Agriculture Equipment Finance market during the projected timeframe.

Based on the type, the global Agriculture Equipment Finance market is divided into loans, leases, and line-of-credit. Among these, the lease segment is anticipated to hold the greatest share of the global Agriculture Equipment Finance market during the projected timeframe. Leasing offers farmers a unique way to finance the assets they require now, with the option to buy, swap, renew, or return the equipment at a later date. Farmers can also profit from innovations, increased output, and better fuel efficiency through leasing, which enables them to try out the newest equipment models before making a purchase. From a financial perspective, leasing is an excellent way for farmers to increase cash flow and free up working capital.

The tractors segment is expected to grow at the fastest pace in the global Agriculture Equipment Finance market during the projected timeframe.

Based on the product, the global Agriculture Equipment Finance market is divided into harvesters, haying equipment, tractors, and others. Among these, the tractors segment is expected to grow at the fastest pace in the global Agriculture Equipment Finance market during the projected timeframe. Tractor loans for farmers are the industry norm for agricultural machinery. Tractor finance is necessary for industries and businesses. Thus, tractor loans are offered by leading banks. The country's rural and semi-urban areas are the ones with the most demand for tractor finance. They can buy new or used tractors due to farmer loans. These tractors have many applications in both industry and agriculture. If the farm has a tractor, it can generate more.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/5504

Asia Pacific is expected to hold the largest share of the global Agriculture Equipment Finance market over the forecast period.

Asia Pacific is expected to hold the largest share of the global Agriculture Equipment Finance market over the forecast period. driven by the need to preserve food security and the growing need for environmentally friendly farming practices. The growth of this industry is also being fueled by the spread of genetically modified organisms (GMOs) and the increase in agricultural diseases. Disease testing is the most crucial test used in agricultural biotesting due to it has the potential to detect and prevent crop illnesses. things like a well-established organic farming business, stringent regulations, and significant R&D costs. The United States, with its vast agricultural region and diverse climate, is the largest market segment.

North America is predicted to grow at the fastest pace in the global Agriculture Equipment Finance market during the projected timeframe. The primary cause of the increase is vast land areas, which has raised the demand for farm mechanization. To increase agricultural output, smart combine harvesters with monitoring devices are also being used more frequently in the region. As labor expenses rise yearly and more staff are required to run a larger farm, the profitability of the farm’s decreases. Farm owners find it time-consuming and unpleasant to operate their farms only through labor payments, as labor payments constitute a significant portion of farm revenues. Thus, farm owners employ agricultural machinery in their activities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Agriculture Equipment Finance Market include Adani Group, AGCO Corp., Agricultural Bank of China Ltd., Argo Tractors SpA, Barclays PLC, BlackRock Inc., BNP Paribas SA, Citigroup Inc., Deere and Co., ICICI Bank Ltd., IDFC FIRST Bank Ltd., IndusInd Bank Ltd., JPMorgan Chase and Co., Key Corp., Larsen and Toubro Ltd., Mahindra and Mahindra Ltd., and others.

Get Discount At @ https://www.sphericalinsights.com/request-discount/5504

Recent Developments

• In July 2024, A low-cost sustainable finance initiative for farmers was established by Tesco and NatWest. The cooperative effort aims to support 1,500 farmers associated with Tesco in implementing sustainable farming practices using targeted financing.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Agriculture Equipment Finance Market based on the below-mentioned segments:

Global Agriculture Equipment Finance Market, By Type

- Loans

- Leases

- Line-of-Credit

Global Agriculture Equipment Finance Market, By Product

- Harvesters

- Haying Equipment

- Tractors

- Others

Global Agriculture Equipment Finance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browse Related Reports

Global Agricultural Biologicals Market Size, Share, and COVID-19 Impact Analysis, By Function Type (Biopesticides, Biostimulants, and Biofertilizers), By Source (Microbial, Natural Products, and Biochemicals), By Application Method (Foliar Spray, Soil Treatment, Seed Treatment, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030

Global Online Nursery Market Size, Share, and COVID-19 Impact Analysis, By Type (Flowering Plants, Shrubs, Vegetable Seeds, Indoor Plants, Air-Purifying Plants, Others), By End User (B2B, B2C), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Premium Potting Soil Market Size, Share, and COVID-19 Impact Analysis, By Type (Soil without Fertilizer, Soil with Fertilizer), By Product (All-purpose Potting Soil, Lawn & Garden Soil, Professional Potting Soil), By Application (Indoor Gardening, Greenhouse, Lawn & Landscaping), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Farming as A Service Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Farm Management Solutions, Production Assistance, Access to Markets), By Delivery Model (Subscription, Pay-per-use), By End User (Farmers, Governments, Corporate, Financial Institutions, Advisory Bodies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter