Austin, Aug. 09, 2024 (GLOBE NEWSWIRE) -- Market Sizing:

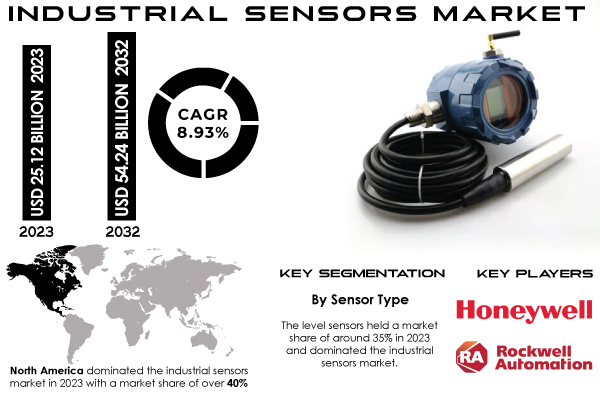

The Industrial Sensors Market Share is expected to be valued at USD 25.12 Billion in 2023. It is estimated to reach USD 54.24 Billion by 2032 with a growing CAGR of 8.93% over the forecast period 2024-2032.

Get a Sample Report of Industrial Sensors Market @ https://www.snsinsider.com/sample-request/1880

Key Players:

- Honeywell International

- Rockwell Automation

- Texas Instruments

- Panasonic Corporation

- TE Connectivity

- Amphenol Corporation

- Bosch Sensortec

- STMicroelectronics

- Siemens

- Dwyer Instruments

“Expansion of the Industrial Sensors Market: Understanding the Adoption of Industry 4.0 and Its Applications in the Automotive Sector”

The development of the industrial sensors market has been remarkable due to technological advancements and the growing adoption of automation. The industrial sensors boom has been driven by the quick adoption of Industry 4.0, as the logistics, production, and quality control make use of sensors in smart processes of production and predictive maintenance, among other applications. For instance, in 2020, the Trump administration has recently insisted that more than USD 1 billion of U.S. funds should be invested in the creation of the twelve new research and development halls for Industry 4.0 to receive AI and QIS research centers or so-called hubs. Little time has passed since the development and, thus, these hubs are still in progress and development process.

Industrial sensors are also highly used in the automotive industry as the sensors are used in safety systems and autonomous car driving systems. The United States of America was the world’s second country in terms of car production in 2022, as the number was 10 million cars produced, which was 5% more than in 2021. The global trend still seems to be leaning towards China with over 30 million vehicles produced. Although the given industry made up 5% of the US economy when one counts the purchase of cars themselves and the industries related to them. Incidentally, the current information would be valuable: the number of cars registered was over 290.8 million, and 13.75 million new automobiles were bought in 2022.

Industrial Sensors Market Report Scope & Overview:

| Report Attributes | Details |

| Market Size in 2023 | USD 25.12 billion |

| Market Size in 2032 | 54.24 billion |

| CAGR (2024-2032) | 8.93% |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Market Driver |

|

Do you need any customization research on Industrial Sensors Market, Speak to Our Analyst @ https://www.snsinsider.com/enquiry/1880

Segment Analysis:

"Contact Sensors Led in 2023 with Over 58% Share, While Non-Contact Sensors Poised for Significant Growth"

Contact sensors led the market in 2023 with a market share of more than 58%, needing direct contact with the product being measured for precise readings. They are commonly utilized in tasks like limit switches and tactile sensors, especially in manufacturing and conveyor systems.

Non-contact sensors are projected to experience substantial growth from 2024 to 2032, as they are used in a variety of industries such as automotive, manufacturing, aerospace, and healthcare. Their ability to detect position, speed, and distance without touching makes them more attractive in automated and precision-driven settings.

Key Regional Development:

In 2023, North America was the leader in the industrial sensors market, holding more than 40% market share. The growth of the local market has been propelled by technological advancements and the growing demand for automation. It was enhanced by the need to facilitate different processes and improve operational efficiency in many industries. Moreover, the Industry 4.0 trend and the increased interest in real-time machine monitoring have also promoted market expansion.

The Asia Pacific is anticipated to showcase the fastest CAGR during 2024-2032, which is the result of significant investments in smart technologies made by many countries, including China, India, and Japan. The automotive sector has been one of the beneficiaries of the expansion because industrial sensors can improve vehicle performance and safety. In addition, the development and introduction of electric cars and advanced driver-assistance systems also require more industrial sensors.

Recent Developments:

- In March 2024, Honeywell International Inc. introduced its smart sensor series. Its series has the new sensing technology improved for industrial applications that provide higher accuracy and reliability for measuring different physical parameters including temperature and pressure.

- In June 2024, Siemens AG announced its new Sitrans P320/P420 pressure sensors. The sensors are precise, stable, and high-performing available in the industry and can work in the demanding conditions of the industrial environment.

Buy an Enterprise User PDF of Industrial Sensors Market Outlook Report 2024-2032 @ https://www.snsinsider.com/checkout/1880

Key Takeaways:

- Customers will gain advantages from a thorough examination of market trends and technological advancements, which will assist in strategic planning and investment choices.

- Clients gain a competitive advantage in navigating the changing industrial sensor industry by understanding important market drivers and emerging opportunities.

- In-depth segment examination and local advancements provide customers with important insights to effectively position their products and services in diverse markets.

- Staying informed about recent advancements and new product introductions enables customers to stay current with industry changes and adjust their offerings in response.

- Knowing the factors that drive market growth and future opportunities helps clients create successful growth plans and take advantage of new trends.

Table of Contents – Major Key Points

1. Introduction

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Industrial Sensors Market Segmentation, By Sensor Type

- Position Sensors

- Gas Sensors

- Pressure Sensors

- Level Sensors

- Temperature Sensors

- Humidity & Moisture Sensors

- Flow Sensors

- Image Sensors

- Force Sensors

8. Industrial Sensors Market Segmentation, By Type

- Contact

- Non-contact

8. Industrial Sensors Market Segmentation, By Industry

- Process

- Oil and Gas

- Energy and Power

- Chemical

- Mining

- Pharmaceutical

- Food and Beverages

- Others

- Discrete

- Automotive

- Consumer Electronics

- Aerospace and Defense

- Others

9. Regional Analysis

10. Company Profiles

11. Competitive Landscape

12. Use Case and Best Practices

13. Conclusion

Access Complete Report Details @ https://www.snsinsider.com/reports/industrial-sensors-market-1880

About SNS Insider

At SNS Insider, we believe that businesses should have access to the best market intelligence and insights, regardless of their size or industry. That's why we offer a range of solutions tailored to meet the unique needs of each client, from startups to big corporations. With a passion for our work and an unwavering commitment to delivering value, we are dedicated to helping our clients achieve their full potential.