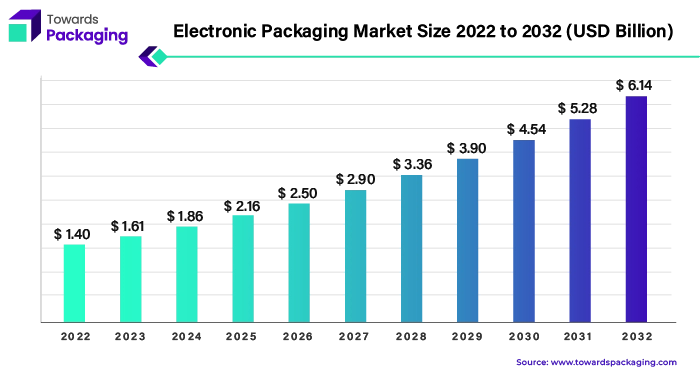

Ottawa, Aug. 14, 2024 (GLOBE NEWSWIRE) -- The global electronic packaging market size is predicted to increase from USD 1.86 billion in 2024 to approximately USD 6.14 billion by 2032, according to a study published by Towards Packaging a sister firm of Precedence Statistics.

The electronic packaging market is experiencing substantial growth due to advancements in electronic devices, increasing demand for miniaturized and high-performance electronic components, and growing adoption of IoT and AI technologies.

Get a comprehensive Electronic Packaging Market Size, Companies, Share a free sample: https://www.towardspackaging.com/personalized-scope/5151

Electronic Packaging Market Key Takeaways & Insights

- Asia Pacific dominated the Electronic Packaging Market in 2023.

- North America is on to grow at a significant growth rate in the forecast period.

- By material segment, the plastic material segment dominated the electronic packaging market in 2023.

- By product, the corrugated box segment holds the largest share in the market.

- By end use, the consumer electronics segment dominated the electronic packaging market in 2023.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Electronic Packaging: Growing with Product innovation

The electronic packaging market is poised for significant growth over the next decade. Electronic packaging plays a crucial role in the electronics industry, providing protection, mechanical support, and thermal management for delicate electronic components. The market is driven by the increasing demand for consumer electronics, advancements in technology, and the growing need for reliable and efficient packaging solutions.

The electronic packaging market is set to experience substantial growth due to rising consumer demand for advanced electronics, ongoing technological innovations, and a strong push towards sustainable packaging solutions. The market's expansion is further supported by the dominant manufacturing capabilities in the Asia Pacific region and the robust consumer electronics market in North America. As the industry evolves, companies that invest in innovative and eco-friendly packaging solutions are likely to thrive in this dynamic market.

Get a customized Electronic Packaging Market report designed according to your preferences: https://www.towardspackaging.com/customization/5151

Consumer Electronics’ Expansion: Driving Market's Growth

The increasing popularity of consumer electronics is a major driver of the electronic packaging market. As consumers around the world continue to embrace smartphones, tablets, laptops, and TVs, the need for effective and innovative packaging solutions has grown significantly.

Consumers today expect their electronic devices to be sleeker, lighter, and more durable. This shift in consumer preferences has led to a surge in demand for advanced packaging solutions that can protect these devices during shipping and handling while also enhancing their aesthetic appeal.

A notable example of innovation in this sector is Apple. The company has made significant strides in reducing its environmental footprint by adopting more sustainable packaging practices. In recent years, Apple has transitioned to using recycled materials for its product packaging. For the iPhone 12, Apple removed the plastic wrap from the packaging, reducing the amount of plastic used by 600 metric tons. This move not only supports environmental sustainability but also aligns with consumer expectations for greener products.

- Recent developments in the electronic packaging industry highlight the ongoing innovation and adaptation to market demands. For example, in 2023, Samsung introduced eco-friendly packaging for its Galaxy series. The new packaging uses minimalistic designs and recyclable materials, reducing waste and promoting sustainability. This shift is part of Samsung's broader commitment to environmental responsibility, and it resonates well with environmentally conscious consumers.

Miniaturization Trends in Packaging to Support Market

The trend towards the miniaturization of electronic devices is significantly driving the demand for high-density packaging solutions. This allows manufacturers to pack more functionality into smaller devices, meeting the consumer demand for compact yet powerful electronics.

Consumers today prefer electronic devices that are not only powerful but also portable and lightweight. This trend is particularly evident in products like smartphones, wearables, and tablets. As these devices become smaller, the components within them must also shrink. This is where high-density packaging solutions come into play, enabling manufacturers to fit more components into limited space without compromising performance.

- Recent developments in the industry further illustrate the importance of high-density packaging. For instance, in 2023, Intel announced its new 3D packaging technology called Foveros. This technology stacks multiple layers of chips vertically, allowing for greater performance and reduced power consumption. Foveros is expected to revolutionize the way chips are integrated into devices, making them more efficient and compact.

Skilled Labor Shortage: Market's Largest Challenge

The electronic packaging industry heavily relies on skilled professionals who possess a deep understanding of materials, design, and manufacturing processes. However, a shortage of such skilled labor is becoming a significant restraint, impacting the industry's ability to innovate and maintain efficient production.

Electronic packaging is not just about enclosing a product; it involves intricate processes that require specialized knowledge. Professionals in this field need to understand the properties of different materials, the intricacies of thermal management, and the complexities of miniaturization. As technology advances, the demand for such expertise increases, making skilled labor a critical component of the industry's success.

Recent developments highlight the ongoing efforts to address the skilled labor shortage. In 2023, several major technology companies, including Intel and Samsung, announced partnerships with educational institutions to develop specialized training programs. These programs aim to equip students with the necessary skills for careers in electronic packaging and semiconductor manufacturing. By investing in education and training, these companies hope to build a pipeline of skilled workers to support future growth.

Bio-Based Materials: Upcoming Opportunity for Market

The growing emphasis on sustainability is creating significant opportunities in the electronic packaging market. As consumers and businesses alike prioritize eco-friendly practices, the demand for bio-based and sustainable packaging materials is on the rise. This shift is driving innovation and opening new avenues for growth within the industry.

Environmental concerns are prompting a reevaluation of traditional packaging materials. Conventional plastics, often derived from non-renewable resources, contribute to pollution and landfill waste. In contrast, bio-based plastics, recycled content, and biodegradable materials offer more sustainable alternatives. These materials not only reduce environmental impact but also align with global sustainability goals.

Recent advancements in sustainable materials highlight the industry's commitment to eco-friendly packaging. In 2023, Tetra Pak announced a significant milestone in its journey towards sustainable packaging. The company introduced a new package made entirely from renewable materials, including a bio-based plastic derived from sugarcane. This innovation not only reduces the carbon footprint but also showcases the potential of bio-based materials in electronic packaging.

Asia's Largest Share: Dominance to Remain the Same

Asia Pacific dominated the electronic packaging market, largely due to the presence of major players like China, India, and Taiwan. These countries are leading global electronics production, driven by their robust manufacturing capabilities and significant investments in technology. China continues to be a powerhouse in electronics manufacturing, producing a substantial portion of the world's electronic goods. Despite challenges such as the US-China trade tensions and disruptions caused by COVID-19, China's role in the global electronics supply chain remains crucial.

- In December 2023, India witnessed a remarkable growth in electronics exports, reaching USD 2.63 billion, a 14.41% increase from the previous year. This growth highlights India's rising prominence in the electronics manufacturing sector. The Indian government is also pushing for increased value addition in electronics manufacturing, which is expected to boost the packaging industry. For instance, the production of mobile phones in India is projected to reach USD 50 billion by March 2024, significantly driving the demand for electronic packaging solutions.

India is emerging as a key player in the global electronic packaging market. The country is investing heavily in electronics manufacturing, aiming to become a global leader. This growth is supported by government initiatives and policies that promote domestic production and innovation.

India's electronics exports have seen a significant boost, with the government targeting a market value of USD 115 billion by 2024. The focus on mobile phone production, which is expected to reach USD 50 billion by March 2024, highlights the potential for growth in the electronic packaging market. Companies in India are increasingly adopting sustainable packaging solutions to align with global trends and regulatory requirements.

North America is one of the largest markets for electronic packaging, driven by the high demand for consumer electronics and the expanding e-commerce sector. The United States leads the region, with a significant portion of the market due to its consumption of high-end electronics. This has resulted in a growing need for innovative and protective packaging solutions. The rise of online sales further accelerates the demand for customized packaging that ensures safe delivery of electronics.

- In November 2023, the U.S. government unveiled a national plan for advanced packaging under the CHIPS for America Programme. This initiative aims to secure and strengthen the American supply chain for advanced electronics, highlighting the strategic importance of packaging in the electronics industry.

Europe represents a significant market for electronic packaging, characterized by a strong emphasis on sustainability and innovation. European countries are at the forefront of adopting eco-friendly packaging materials and practices. The region's regulatory environment, which promotes sustainable packaging, drives innovation and the development of recyclable and biodegradable materials.

- In January 2024, Fedrigoni, an Italian company, completed the acquisition of HKK3's full share capital, including the Arjowiggins China group. This acquisition aims to enhance Fedrigoni's position in the global market, particularly in sustainable packaging solutions.

Plastic to be Widely Utilized in Electronic Packaging

Plastic leads the electronic packaging market due to its versatility and cost-effectiveness. It provides essential features like electrical insulation and protection from environmental factors, making it a preferred choice for various electronic components. Additionally, plastic's ability to be molded into different shapes and sizes enhances its appeal in the market.

Corrugated Boxes to Remain Largest Utilized Product

Corrugated boxes dominate the product segment as they offer robust protection during transportation and storage. Their unique design, consisting of fluted corrugated sheets between linerboards, ensures that electronic items remain secure from impacts and vibrations. This eco-friendly and recyclable option is widely used for packaging delicate electronics.

Consumer Electronics to Hold Lion's Share in the Market

Consumer electronics are the primary end-use segment for electronic packaging, driven by the high demand for products like smartphones, tablets, and laptops. The packaging solutions in this segment focus on protecting fragile components while also enhancing the unboxing experience for consumers, which is crucial in a competitive market.

More Insights in Towards Packaging

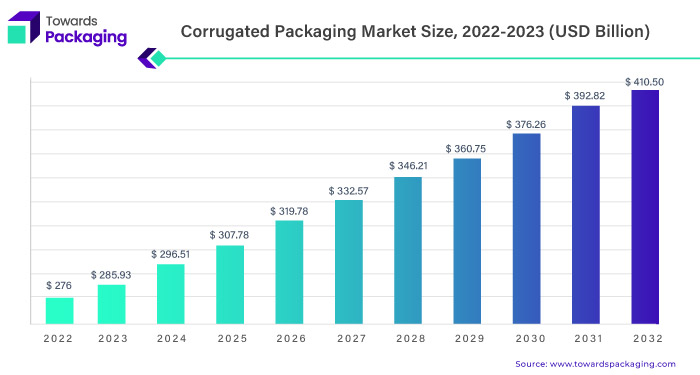

Corrugated Packaging Market Size and Trends

The global corrugated packaging market size accepted to grow from USD 276 billion in 2022 and it is predicted to hit around USD 410.50 billion by 2032, at 4.10% CAGR from 2023 to 2032.

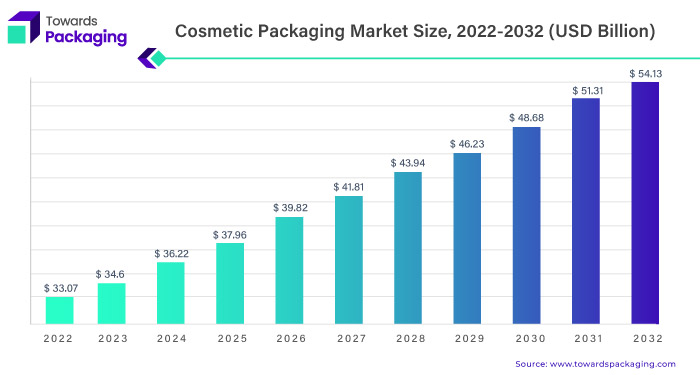

Cosmetic Packaging Market Size, Opportunities and Future Analysis

The global cosmetic packaging market size accounted for USD 33.07 billion in 2022 to reach USD 54.13 billion by 2032 at 4.5% CAGR from 2023 to 2032.

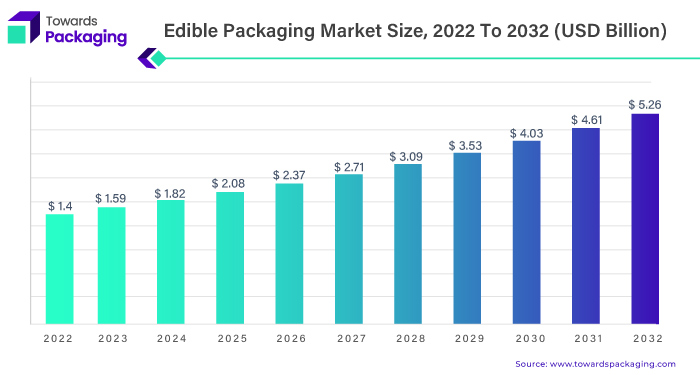

Edible Packaging Market Size, Share and Growth 2023-2032

The global edible packaging market size current valuation, standing at USD 1.4 billion in 2022 projected to culminate zenith of USD 5.26 billion by 2032 at 14.2% CAGR between 2023 and 2032.

- The global active packaging market size is estimated to grow from USD 19.2 billion in 2022 at 7.5% CAGR to reach an estimated USD 39.51 billion by 2032, between 2023 and 2032.

- The global antimicrobial packaging market size was at USD 10.77 billion in 2022 to hit around USD 18.81 billion by 2032, at 5.7% CAGR between 2023 to 2032.

- The global automotive packaging market size is estimated to grow from USD 8.18 billion in 2022 to reach an estimated USD 13.87 billion by 2032, at 5.4 % CAGR between 2023 and 2032.

- The global frozen food packaging market size is predicted to grow from USD 43.36 billion in 2022 to reach USD 71.67 billion by 2032, at 5.2% CAGR from 2023 to 2032.

- The global flexible packaging market size is estimated to grow from USD 283 billion in 2022 to reach an expected USD 445.82 billion by 2032, at 4.7% CAGR during the forecast period 2023 to 2032.

- The global food packaging market size was valued at USD 356.5 billion in 2022 and is expected to reach USD 659.80 Billion by 2032 and is poised to grow at a CAGR of 6.4% during the forecast period 2023 to 2032.

- The global smart packaging market size was estimated at USD 36.04 billion in 2022 to set a foot on USD 68.99 billion by 2032 with a registered CAGR of 6.8% from 2023 to 2032.

Recent Developments in the Electronic Packaging Market

- In March 2024, A report by The Brainy Insights highlights the growing adoption of flexible electronics, particularly in wearables, as a key driver for the market. This trend is pushing the development of new packaging materials with lightweight and flexible properties.

- In March 2024, Logitech International announced that it would begin accepting applications for the 2024 edition of its Future Positive Challenge. This annual initiative, now in its second year, aims to identify and support entrepreneurs, startups, and companies worldwide that can contribute to the development of more sustainable products in the consumer electronics sector. The challenge focuses primarily on innovative packaging solutions that protect products while reducing environmental impact. These solutions include moldable materials, renewable or recyclable resources, and alternatives to foil printing.

- In September 2023, Sealed Air entered a partnership with Sparck Technologies, a leading provider of 3D automated packaging solutions. Under this collaboration, Sealed Air will have the exclusive rights to distribute Sparck Technologies' 3D CVP automated packaging solutions in Australia, South Korea, Japan, and South Korea. Through this alliance, Sealed Air's customers will gain access to the most advanced automated packaging solutions in the industry, enabling them to enhance efficiency and create a safer work environment.

- In January 2024, INEOS Styrolution, a leading global styrenics company, unveiled a new grade of methyl methacrylate butadiene styrene known as Zylar EX350. This innovative material is specifically designed for use in carrier tapes for electronic component packaging, offering an ideal blend of stiffness and toughness. Zylar EX350 provides enhanced design flexibility and optimal protection, supporting electronic components more effectively than traditional polystyrene or styrene-butadiene copolymer blends. Its advanced properties allow for the creation of deeper pockets with improved rigidity, catering to a variety of market needs with greater versatility.

- In February 2024, Intel Corp (INTC) introduced Intel Foundry, a new sustainable systems foundry business tailored for the AI era. Alongside this launch, Intel revealed an expanded roadmap for its processes, aimed at maintaining leadership through the latter part of this decade. The announcement included strong backing from ecosystem partners such as Synopsys, Cadence, Siemens, and Ansys. These partners are committed to supporting Intel Foundry customers by providing tools, design flows, and IP portfolios that are optimized for Intel’s advanced packaging and Intel 18A process technologies.

Key Market Companies

- UFP Technologies Inc.

- Sealed Air Corporation

- DuPont de Nemours, Inc.

- SCHOTT AG

- Sonoco Products Company

- AMETEK Inc.

- STMicroelectronics NV

- Samsung Electronics Corporation Ltd.

- Taiwan Semiconductor Manufacturing Company Ltd. (TSMC)

- Intel Corporation

Electronic Packaging Market TOC

Introduction

- Research Objective

- Scope of the Study

- Definition and Taxonomy

Research Methodology

- Research Approach

- Data Sources

- Assumptions

Executive Summary

- Synopsis

- Analyst Recommendations

Market Overview

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Value chain analysis

- Raw Material Sourcing

- Manufacturing Process

- Logistics & Transportation

- Buyer Preferences

- Trends

- Market Trends

- Technological Trends

- Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitute

- Threat of New Entrants

- Degree of Competition

- PESTLE Analysis for 5 Leading Countries

- Regulatory Framework for Leading Countries/Regions

- Supply Demand Analysis

- Production & Consumption Statistics

- Export Import Statistics

- Price Trend Analysis

Global Electronic Packaging Market Assessment

- Overview

- Global Electronic Packaging Market Size Value (US$) and Volume (Billion Tons), By Material Type (2021 – 2033)

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Others

- Global Electronic Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Corrugated Box

- Thermoformed Trays

- Paper Box

- Blister Packs

- Clamshells

- Global Electronic Packaging Market Size Value (US$) and Volume (Billion Tons), By End Use Type (2021 – 2033)

- Consumer Electronics

- Automotive

- Aerospace and Defence

- Healthcare

- Others

- Global Electronic Packaging Market Size Value (US$) and Volume (Billion Tons), By Region Type (2021 – 2033)

- Asia Pacific

- North America

- Europe

- LAMEA

Asia Pacific Electronic Packaging Market Assessment

- Overview

- Asia Pacific Electronic Packaging Market Size Value (US$) and Volume (Billion Tons), By Material Type (2021 – 2033)

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Others

- Asia Pacific Electronic Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Corrugated Box

- Thermoformed Trays

- Paper Box

- Blister Packs

- Clamshells

- Asia Pacific Electronic Packaging Market Size Value (US$) and Volume (Billion Tons), By End Use Type (2021 – 2033)

- Consumer Electronics

- Automotive

- Aerospace and Defence

- Healthcare

- Others

North America Electronic Packaging Market Assessment

- Overview

- North America Electronic Packaging Market Size Value (US$) and Volume (Billion Tons), By Material Type (2021 – 2033)

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Others

- North America Electronic Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Corrugated Box

- Thermoformed Trays

- Paper Box

- Blister Packs

- Clamshells

- North America Electronic Packaging Market Size Value (US$) and Volume (Billion Tons), By End Use Type (2021 – 2033)

- Consumer Electronics

- Automotive

- Aerospace and Defence

- Healthcare

- Others

Europe Electronic Packaging Market Assessment

- Overview

- Europe Electronic Packaging Market Size Value (US$) and Volume (Billion Tons), By Material Type (2021 – 2033)

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Others

- Europe Electronic Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Corrugated Box

- Thermoformed Trays

- Paper Box

- Blister Packs

- Clamshells

- Europe Electronic Packaging Market Size Value (US$) and Volume (Billion Tons), By End Use Type (2021 – 2033)

- Consumer Electronics

- Automotive

- Aerospace and Defence

- Healthcare

- Others

LAMEA Electronic Packaging Market Assessment

- Overview

- LAMEA Electronic Packaging Market Size Value (US$) and Volume (Billion Tons), By Material Type (2021 – 2033)

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Others

- LAMEA Electronic Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Corrugated Box

- Thermoformed Trays

- Paper Box

- Blister Packs

- Clamshells

- LAMEA Electronic Packaging Market Size Value (US$) and Volume (Billion Tons), By End Use Type (2021 – 2033)

- Consumer Electronics

- Automotive

- Aerospace and Defence

- Healthcare

- Others

Company Profile

- Amkor Technology

- Company Overview

- Geographic Footprints

- Financial Performance

- Product Portfolio

- SWOT Analysis

- R&D Efforts

- Recent Developments & Strategic Collaborations

- Product Launch/M&A/Technical Collaboration

- ASE Group

- FUJITSU LIMITED

- Intel Corporation

- Texas Instruments

- Apple

- Sealed Air Corporation

- Nantong Fujitsu Microele

- KYOCERA CORPORATION

- Powertech Technology Inc

- Advanced Semiconductor Engineering Inc.

Conclusion & Recommendations

Act Now and Get Your Electronic Packaging Market Size, Companies and Insight 2032 @ https://www.towardspackaging.com/price/5151

Get the latest insights on packaging industry segmentation with our Annual Membership. Subscribe now for access to detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead in the dynamic packaging sector with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities: Subscribe to Annual Membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/