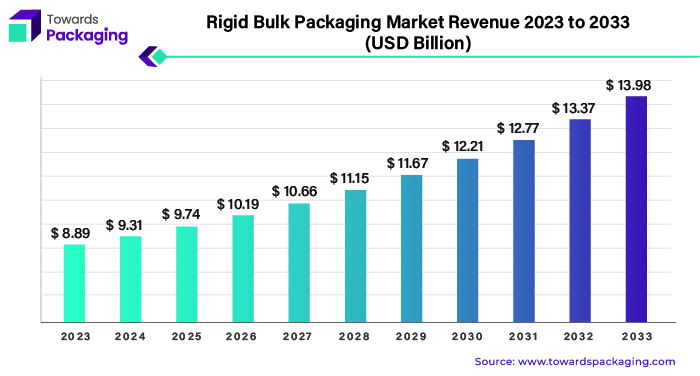

Ottawa, Aug. 21, 2024 (GLOBE NEWSWIRE) -- The global rigid bulk packaging market size is predicted to increase from USD 8.89 billion in 2023 to approximately USD 13.98 billion by 2033. The market is registering a CAGR of 4.63% from 2024 to 2033, a study published by Towards Packaging a sister firm of Precedence Statistics. The sustained growth in the rigid bulk packaging market is a result of rising demand in the food and beverage and pharmaceutical industries across the globe.

Get a comprehensive Rigid Bulk Packaging Market Size, Companies, Share a free sample: https://www.towardspackaging.com/personalized-scope/5201

Key Takeaways: Leading Factors of the Rigid Bulk Packaging Market.

- The rigid bulk packaging market size growth is projected from USD 9.74 billion (2025) to USD 12.21 billion (2030).

- The rigid bulk packaging industry grows at 4.63% CAGR (2023-2033).

- Growth in industrialization sector due to imports and exports is the major factor that drives the market.

- North America to perceive growth in manufacturing infrastructure due to high investments.

- Aside from industrial sector, food and beverages and pharmaceutical sector is anticipating growth in upcoming years.

- Abiding by environmental regulations will be a challenge for the rigid bulk packaging market.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Rigid Bulk Packaging: Consumer Preferences & Innovation

The rigid bulk packaging market revolves around the utilization of strong containers for transportation of large quantity and liquid products. Along with being durable and strong, maintaining the integrity of raw materials and providing protection from sensitive drug compositions are the leading objectives of the market. The unjust roads and changing climatical conditions on daily basis have increased the need for robust packaging and the consequence demands solid protection, that is, rigid-containers.

Different sectors according to their need and the structure of the product prefer packaging solutions, given the reason that they want the products delivered on time and this will, in return, increase their consumer base. Rigid bulk packaging market offers it to them and the demand for their market skyrockets.

Get a customized Rigid Bulk Packaging Market report designed according to your preferences: https://www.towardspackaging.com/customization/5201

E-commerce and Industrialization: Major Industry Support

The growth in industrialization sector is due to the surge in entrepreneurship, government initiatives, labour-saving intentions, and the desire for better goods and services, which has impacted the supply chain of the bulk packaging, given the reason it provides efficient and well-knit packaging.

E-commerce is also another driving factor for the demand of safety and to maintain the product quality during shipping process. Here, e-commerce is the result of high incomes due to the surge in economies heightens the demand for packaged food products. All these factors drive the rigid bulk packaging market which fulfils the requirements mentioned by the market consumers.

Regulatory Challenges to Hamper the Growth

The bulk containers need space to fit in, compared to flexible packaging, and excessive use of space can lead to uninvited accidents, and this can lead to strict regulations regarding the allotted storage capacity. As a result, bulk packaging is pushed to utilize single-use plastic, which is not reliable, hence it moves towards adopting eco-friendly alternatives. Although the increasing environmental concern is taken into consideration, the high distribution costs decrease the market consumers.

The forced choice of alternative materials, manufacturing and transportation expenditure hinders the growth of market. Apart from this, competitive packaging and its usage of lightweight property are also the posing challenges. Government regulations can influence the import and export policies and can affect the profit margins of the rigid bulk packaging market.

AI Intervention to Offer Opportunities in Upcoming Years

AI has improved the market by developing new designs every feature of the product, be it the properties or shipping prototypes. It can create new products analysing their weight, and requirement of the material. It can also analyse the consumer preference and based on that, can innovate product which will be cost-effective. Apart from this, AI can analyse the supply chain and predict the outcomes of leading consumers and leading regions as well. Along with material quality assessment, defects can be recognized easily with AI algorithms. In addition, it can keep track of consumer preferences and analyses features to enhance consumer satisfaction. Major factor like the sustainability of the packaging material can be analysed with the help of AI technology. The remarkable innovation in AI technologies will provide multiple opportunities to the leading market players to expand the rigid bulk packaging market.

For instance, in May 2024, Amcor launched a new programme, ‘Amcor Rigid Packaging Bottle of the Year’, in which new designs are innovated to suit the consumer trends in packaging, mostly in beverage, spirits and wine, food and dairy, home and personal care, and healthcare segments. Each segment has a different bottle concept in which designs and latest technology is used to cater to the preferences of consumers and also inculcating polyethylene terephthalate plastic to produce more liable packaging.

Shift on Lightweight and Eco-Friendly Packaging will Act as an Opportunity

The shift on lightweight usage of material will not lessen the versatility of the packaging, but in fact, highlight the recycling and reusing properties of the market which will increase the rate of consumer market. The eco-friendly and sustainability demand has paved a path for the market to use materials like recycled plastics, biodegradable polymers and other environment-based alternatives. The e-commerce growth, food and beverage industry, personal care and cosmetics, and pharmaceutical and healthcare industry are the groundbreaking factors which presents multiple opportunities for the rigid bulk packaging market.

All these sectors which are influenced by the sustainable drive will boost the demand of alternative packaging. Although the factors are minor, other services which add value to the packaging include providing packaging according to customer preferences and design, development and testing of the material also create opportunity for the market. Utilization of all the factors by the leading companies will rise the rigid bulk packaging market.

Asia-Pacific: The Rising E-commerce and Industrial Sector

Asia-Pacific is the leading region for the rigid bulk packaging market. The market in this region is driven by growing industrialization, food and beverage sector, rising transportation and production sector, and the emerging e-commerce sector. Countries like Japan, China, and India are the major contributors, given the reason that they have large populations and growing economies.

In November 2023, Amcor launched a recyclable polyethylene terephthalate bottle, in collaboration with Ann Abor, MI and Danone, for Danone’s Villavicencio water brand, which was made of 100% rPET and offers 21% less carbon printing. The company stated that they were able to embrace the local circular economy for PET through this launched product.

North America has established itself as the mature market with its focus on sustainability, given the reason it has developed infrastructure as its support system. In addition, driving demand of environmental enthusiasts has led them towards eco-friendly packaging solution. Food and beverage industry is the region’s highest contributor of the rigid bilk packaging market.

In January 2024, Greif in collaboration with IonKraft, had announced a new pilot-project, in which barrier technology and plasma-based coating was created to challenge the recyclability and sustainability in plastic jerrycan packaging. The barriers being non-reactive, chemically inert and 100% recyclable has provided innovative and sustainable packaging solution.

Europe is leading the sustainability drive due to the region’s strict government regulations which focuses on the packaging’s waste material. The prioritization of recyclable and reusable material which leads to innovation of alternative materials is the goal of the region. The chemical industry is the region’s highest contributor in the rigid bulk packaging market.

In February 2023, Schoeller Allibert met the requirements of modern pharmaceutical companies, wherein the foldable container range, Magnum Optimum Hopper 1208, helped to move their products safely during the distribution process. The company had also stated some of its special features which are zero plastic waste, a specialist cap and closures dispenser with a 1200mm x 800mm footprint and a usable volume of 725 litres.

Towards Packaging Popular Insights

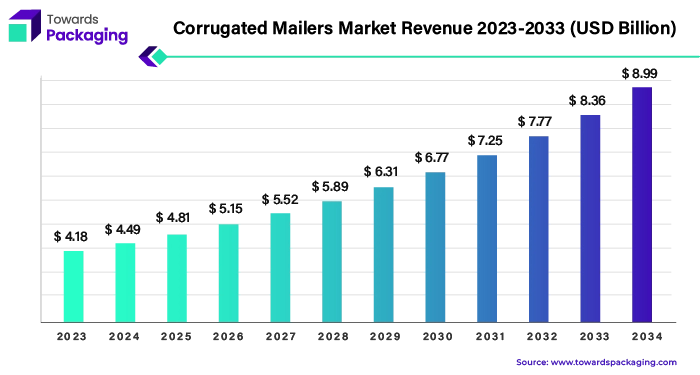

Corrugated Mailers Market Size, Growth, Development and Insight

The global corrugated mailers market size reached US$ 4.18 billion in 2023 and is projected to hit around US$ 8.99 billion by 2034, expanding at a CAGR of 7.30% during the forecast period from 2024 to 2033.

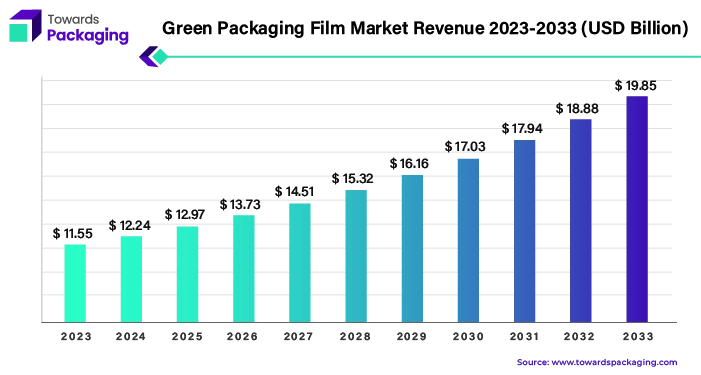

Green Packaging Film Market Size, Trends, Growth Rate

The global green packaging film market size reached US$ 11.55 billion in 2023 and is projected to hit around US$ 19.85 billion by 2033, expanding at a CAGR of 5.93% during the forecast period from 2024 to 2033.

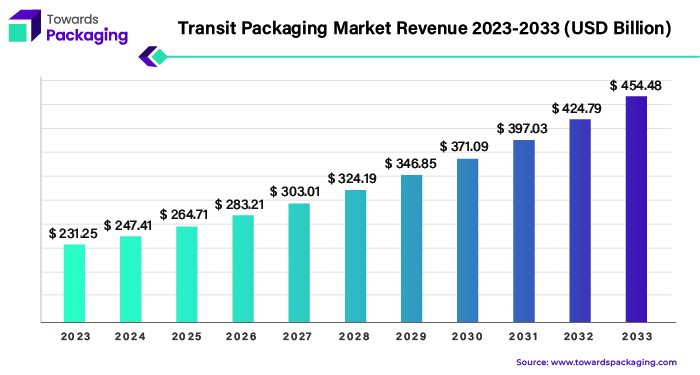

Transit Packaging Market Size, Companies Report 2023 - 2033

The global transit packaging market size reached US$ 231.25 billion in 2023 and is projected to hit around US$ 454.48 billion by 2033, expanding at a CAGR of 6.99% during the forecast period from 2024 to 2033.

- The global paper machinery market size reached US$ 3.83 billion in 2023 and is projected to hit around US$ 5.41 billion by 2033, expanding at a CAGR of 4.43% during the forecast period from 2024 to 2033.

- The global semiconductor packaging market size reached US$ 41.05 billion in 2023 and is projected to hit around US$ 108.82 billion by 2033, expanding at a CAGR of 10.24% during the forecast period from 2024 to 2033.

- The global adherence packaging market size reached US$ 1.1 billion in 2023 and is projected to hit around US$ 2.05 billion by 2033, expanding at a CAGR of 6.43% during the forecast period from 2024 to 2033.

- The global polystyrene packaging market size reached USD 24.58 billion in 2023 and is projected to hit around USD 37.92 billion by 2033, expanding at a CAGR of 4.43% during the forecast period from 2024 to 2033.

- The global ethical label market size is estimated to reach USD 1815.34 billion by 2033, up from USD 948.65 billion in 2023, at a compound annual growth rate (CAGR) of 6.83% from 2024 to 2033.

- The global wine packaging market size is estimated to reach USD 10.99 billion by 2033, up from USD 6.11 billion in 2023, at a compound annual growth rate (CAGR) of 6.19% from 2024 to 2033.

- The global corrugated boxes market size reached USD 163.07 billion in 2023 and is projected to hit around USD 269.19 billion by 2033, expanding at a CAGR of 5.14% during the forecast period from 2024 to 2033.

Major Breakthroughs in the Rigid Bulk Packaging Market

- In January 2024, Madras High Court gave orders to the Tamil Nadu Government to allow use of single-use plastics in primary packaging materials. The ban was removed from the use of plastic segment stating that there were practical difficulties faced when the single-use plastic regulation was implemented.

- In July 2024, Berry Global had launched a Closed Politainer System for Enhanced Safety and Dispensing, wherein the sensitive liquids will be checked without coming in their contact. The Politainer was able to deliver 75% plastic weight reduction and also reduced the costs and space which was compared to eight full trucks of rigid containers.

Robust Protection and Maintenance of the Product Quality

Plastic is the dominating segment due its properties which are versatility, lightweight and cost-effectiveness in turn makes its utilization ideal for the robust packaging. Although the excessive use of plastic has raised environmental concerns wherein the its non-biodegradable features and chemical leaching can harm the environment, its excellent advantages like the resistance to chemical products and shape alignment attracts the consumer market.

Metal is the fastest growing segment is the rigid bulk packaging market due to its properties which are durability, recyclability, and barrier protectability. Although the heavy weight, surface corrosion and the high expenses spend are the features and challenges of the metal segment, exposure of the product to oxygen and light, and solid protection provided to the product are the driving factors of the segment.

Palis Segment to Grow as a Leader in the Market in Market

Pails is the dominating segment in the rigid bulk packaging market due to their small size and cylindrical shape which is used for distributions of various products. The cost expenditure and the segment’s impact on the environment are also considering points. The chemical sector has contributed to the growth of pail segment as it completes the requirements of the particular sector.

Drums is the fastest growing segment in the market due large capacity storage and its cylindrical shape which is used for distribution of liquids and solid goods. Even though the heavy capacity feature and lightweight plastic preferred drum is in demand, the environmental impact is the challenge.

Rigid Bulk Packaging Market TOC

Executive Summary

- Market Overview

- Key Findings

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Challenges

Introduction

- Research Methodology

- Assumptions and Acronyms Used

- Market Definition and Scope

Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- Industry Trends

Industry Analysis

- Value Chain Analysis

- Porter’s Five Forces Analysis

- PESTLE Analysis

- Technology Roadmap

- Regulatory Landscape

Rigid Bulk Packaging Market Analysis, By Material

- Plastic

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

- Metal

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

- Wood

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

- Others

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

Rigid Bulk Packaging Market Analysis, By Product Type

- Pails

-

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

- Drums

-

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

- Intermediate Bulk Containers

-

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

- Boxes

-

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

- Others

-

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

Rigid Bulk Packaging Market Analysis, By Application

- Food and Beverages

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

- Pharmaceutical and Chemical

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

- Industrial

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

- Others

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

Rigid Bulk Packaging Market Analysis, By Region

- North America

-

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

- Asia Pacific

-

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

- Europe

-

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

- Latin America

-

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

- Middle East and Africa

-

- Market Size and Forecast

- Market Share Analysis

- Key Trends and Developments

- Competitive Landscape

Competitive Landscape

- Market Share Analysis

- Competitive Benchmarking

- Company Profiles

- Core Plastech International Inc.

- Greif Inc.

- BWAY Corporation

- SCHÜTZ GmbH & Co. KGaA

- Snyder Industries

- Berry Global Inc.

- Rehrig Pacific Company

- Schoeller Allibert

- Hoover Ferguson Group, Inc.

- Packaging Corporation of America

- Amcor PLC

- Mondi Group PLC

- Nefab Packaging AB

- Taihua Group

- Cleveland Steel Container

- Recent Developments

- Strategies Adopted by Leading Players

Opportunity Assessment

- Market Trends and Growth Drivers

-

- Emerging Markets

- Technological Advancements

- Regulatory Changes

- Consumer Preferences

- Market Segments with High Growth Potential

-

- Plastic

- Intermediate Bulk Containers (IBCs)

- Food and Beverages

- Regional Opportunities

-

- Asia Pacific

- Latin America

- Middle East and Africa

- Technological Innovations

-

- Smart Packaging

- Sustainable Materials

- Advanced Manufacturing Processes

- Strategic Partnerships and Collaborations

-

- Joint Ventures

- Research and Development

- Investment Opportunities

-

- Green Technologies

- Emerging Markets

New Product Development

- Market Research and Analysis

- Customer Needs Assessment

- Competitive Analysis

- Trend Analysis

- Product Design and Innovation

- Concept Development

- Design Prototyping

- Material Selection

- Testing and Validation

- Product Testing

- Market Testing

- Regulatory Compliance

- Production and Manufacturing

- Production Planning

- Supply Chain Management

- Scalability

- Launch and Marketing

- Go-to-Market Strategy

- Marketing and Promotion

- Sales Channels

- Post-Launch Evaluation

- Customer Feedback

- Performance Metrics

- Continuous Improvement

Plan Finances/ROI Analysis

- Financial Planning

- Budgeting

- Initial Investment

- Operational Costs

- Marketing and Sales Expenses

- Financial Forecasting

- Revenue Projections

- Cost Projections

- Profit Margins

- Cash Flow Management

- Cash Flow Statements

- Working Capital Requirements

- Budgeting

- Return on Investment (ROI) Analysis

- ROI Calculation

- Formula and Methodology

- Key Performance Indicators (KPIs)

- Break-Even Analysis

- Break-Even Point Calculation

- Contribution Margin Analysis

- Sensitivity Analysis

- Impact of Variables on ROI

- Scenario Planning

- ROI Calculation

- Investment Appraisal

- Net Present Value (NPV)

- NPV Calculation

- Discount Rates and Assumptions

- Internal Rate of Return (IRR)

- IRR Calculation

- Comparison with Benchmark Rates

- Payback Period

- Payback Period Calculation

- Analysis of Payback Period

- Net Present Value (NPV)

- Financial Risk Assessment

- Risk Identification

- Market Risks

- Operational Risks

- Financial Risks

- Risk Mitigation Strategies

- Risk Management Plans

- Contingency Planning

- Risk Identification

- Performance Monitoring

- Key Metrics and Benchmarks

- Financial Ratios

- ROI Benchmarks

- Regular Financial Reviews

- Performance Tracking

- Variance Analysis

- Adjustments and Revisions

- Financial Plan Adjustments

- Strategic Revisions Based on Performance

- Key Metrics and Benchmarks

Cross-Segment Analysis

- By Material

- Plastic

- Product Type:

- Pails

- Drums

- Intermediate Bulk Containers (IBCs)

- Boxes

- Others

- Application:

- Food and Beverages

- Pharmaceutical and Chemical

- Industrial

- Others

- Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

- Product Type:

- Metal

- Product Type:

- Pails

- Drums

- Intermediate Bulk Containers (IBCs)

- Boxes

- Others

- Application:

- Food and Beverages

- Pharmaceutical and Chemical

- Industrial

- Others

- Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

- Product Type:

- Wood

- Product Type:

- Pails

- Drums

- Intermediate Bulk Containers (IBCs)

- Boxes

- Others

- Application:

- Food and Beverages

- Pharmaceutical and Chemical

- Industrial

- Others

- Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

- Product Type:

- Others

- Product Type:

- Pails

- Drums

- Intermediate Bulk Containers (IBCs)

- Boxes

- Others

- Application:

- Food and Beverages

- Pharmaceutical and Chemical

- Industrial

- Others

- Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

- Product Type:

- Plastic

- By Product Type

- Pails

- Material:

- Plastic

- Metal

- Wood

- Others

- Application:

- Food and Beverages

- Pharmaceutical and Chemical

- Industrial

- Others

- Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

- Material:

- Drums

- Material:

- Plastic

- Metal

- Wood

- Others

- Application:

- Food and Beverages

- Pharmaceutical and Chemical

- Industrial

- Others

- Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

- Material:

- Intermediate Bulk Containers (IBCs)

- Material:

- Plastic

- Metal

- Wood

- Others

- Application:

- Food and Beverages

- Pharmaceutical and Chemical

- Industrial

- Others

- Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

- Material:

- Boxes

- Material:

- Plastic

- Metal

- Wood

- Others

- Application:

- Food and Beverages

- Pharmaceutical and Chemical

- Industrial

- Others

- Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

- Material:

- Others

- Material:

- Plastic

- Metal

- Wood

- Others

- Application:

- Food and Beverages

- Pharmaceutical and Chemical

- Industrial

- Others

- Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

- Material:

- Pails

- By Application

- Food and Beverages

- Material:

- Plastic

- Metal

- Wood

- Others

- Product Type:

- Pails

- Drums

- Intermediate Bulk Containers (IBCs)

- Boxes

- Others

- Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

- Material:

- Pharmaceutical and Chemical

- Material:

- Plastic

- Metal

- Wood

- Others

- Product Type:

- Pails

- Drums

- Intermediate Bulk Containers (IBCs)

- Boxes

- Others

- Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

- Material:

- Industrial

- Material:

- Plastic

- Metal

- Wood

- Others

- Product Type:

- Pails

- Drums

- Intermediate Bulk Containers (IBCs)

- Boxes

- Others

- Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

- Material:

- Others

- Material:

- Plastic

- Metal

- Wood

- Others

- Product Type:

- Pails

- Drums

- Intermediate Bulk Containers (IBCs)

- Boxes

- Others

- Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

- Material:

- Food and Beverages

- By Region

- North America

- Material:

- Plastic

- Metal

- Wood

- Others

- Product Type:

- Pails

- Drums

- Intermediate Bulk Containers (IBCs)

- Boxes

- Others

- Application:

- Food and Beverages

- Pharmaceutical and Chemical

- Industrial

- Others

- Material:

- Asia Pacific

- Material:

- Plastic

- Metal

- Wood

- Others

- Product Type:

- Pails

- Drums

- Intermediate Bulk Containers (IBCs)

- Boxes

- Others

- Application:

- Food and Beverages

- Pharmaceutical and Chemical

- Industrial

- Others

- Material:

- Europe

- Material:

- Plastic

- Metal

- Wood

- Others

- Product Type:

- Pails

- Drums

- Intermediate Bulk Containers (IBCs)

- Boxes

- Others

- Application:

- Food and Beverages

- Pharmaceutical and Chemical

- Industrial

- Others

- Material:

- Latin America

- Material:

- Plastic

- Metal

- Wood

- Others

- Product Type:

- Pails

- Drums

- Intermediate Bulk Containers (IBCs)

- Boxes

- Others

- Application:

- Food and Beverages

- Pharmaceutical and Chemical

- Industrial

- Others

- Material:

- Middle East and Africa

- Material:

- Plastic

- Metal

- Wood

- Others

- Product Type:

- Pails

- Drums

- Intermediate Bulk Containers (IBCs)

- Boxes

- Others

- Application:

- Food and Beverages

- Pharmaceutical and Chemical

- Industrial

- Others

- Material:

- North America

Strategic Recommendations

- Key Success Factors

- Strategic Initiatives for New Entrants

- Strategic Initiatives for Existing Players

Appendix

- List of Abbreviations

- Sources

- Research Methodology

- Disclaimer

Act Now and Get Your Rigid Bulk Packaging Market Size, Companies and Insight 2033 @ https://www.towardspackaging.com/price/5201

Get the latest insights on packaging industry segmentation with our Annual Membership. Subscribe now for access to detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead in the dynamic packaging sector with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities: Subscribe to Annual Membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/