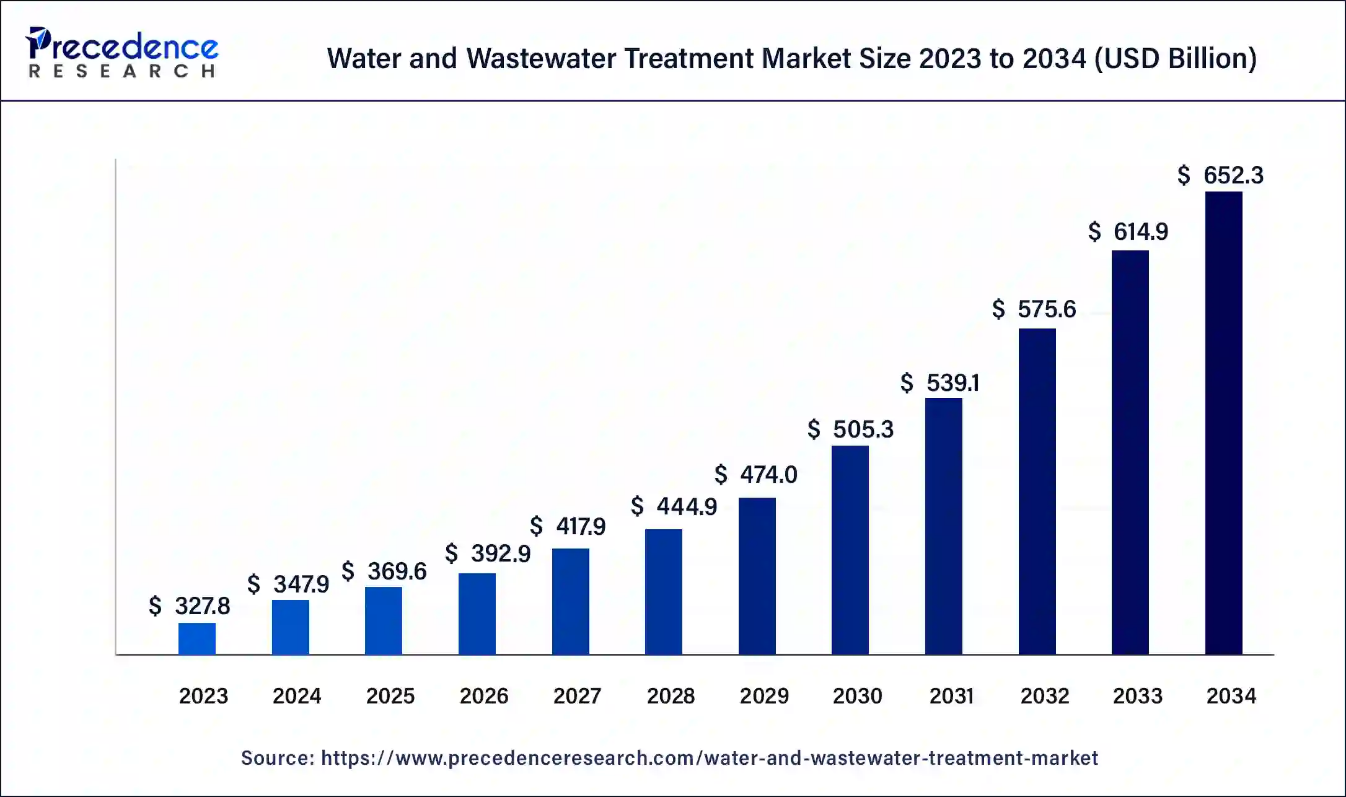

Ottawa, Aug. 21, 2024 (GLOBE NEWSWIRE) -- The water and wastewater treatment market size is predicted to increase from USD 327.8 billion in 2023 to approximately USD 652.3 billion by 2034. The market is expanding at a CAGR of 6.5% from 2024 to 2034, According to Precedence Research. The water and wastewater treatment market is driven by an increasing number of industries, increasing toxic wastewater, and changing consumer preferences.

The water and wastewater treatment market refers to the industry involved in the processes, technologies, and services used to treat water to make it suitable for consumption, industrial use, and environmental discharge. Wastewater treatment is an important water usage that entails treating billions of gallons of wastewater and sewage produced each day before it is discharged into the environment. Treatment plants lower toxins in wastewater to levels that nature can manage, but storm runoff may still affect rivers and lakes.

The Complete Study is Immediately Accessible | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/2395

Maintaining clean water is critical for many reasons, including safeguarding fisheries, conserving aquatic ecosystems, encouraging enjoyment and quality of life, and reducing disease spread. The primary purpose of wastewater treatment is to eliminate suspended particles before releasing effluent back into the environment. Primary treatment eliminates around 60% of suspended particles, whereas subsequent treatment removes more than 90%. All living organisms require proper water treatment to maintain their health and well-being.

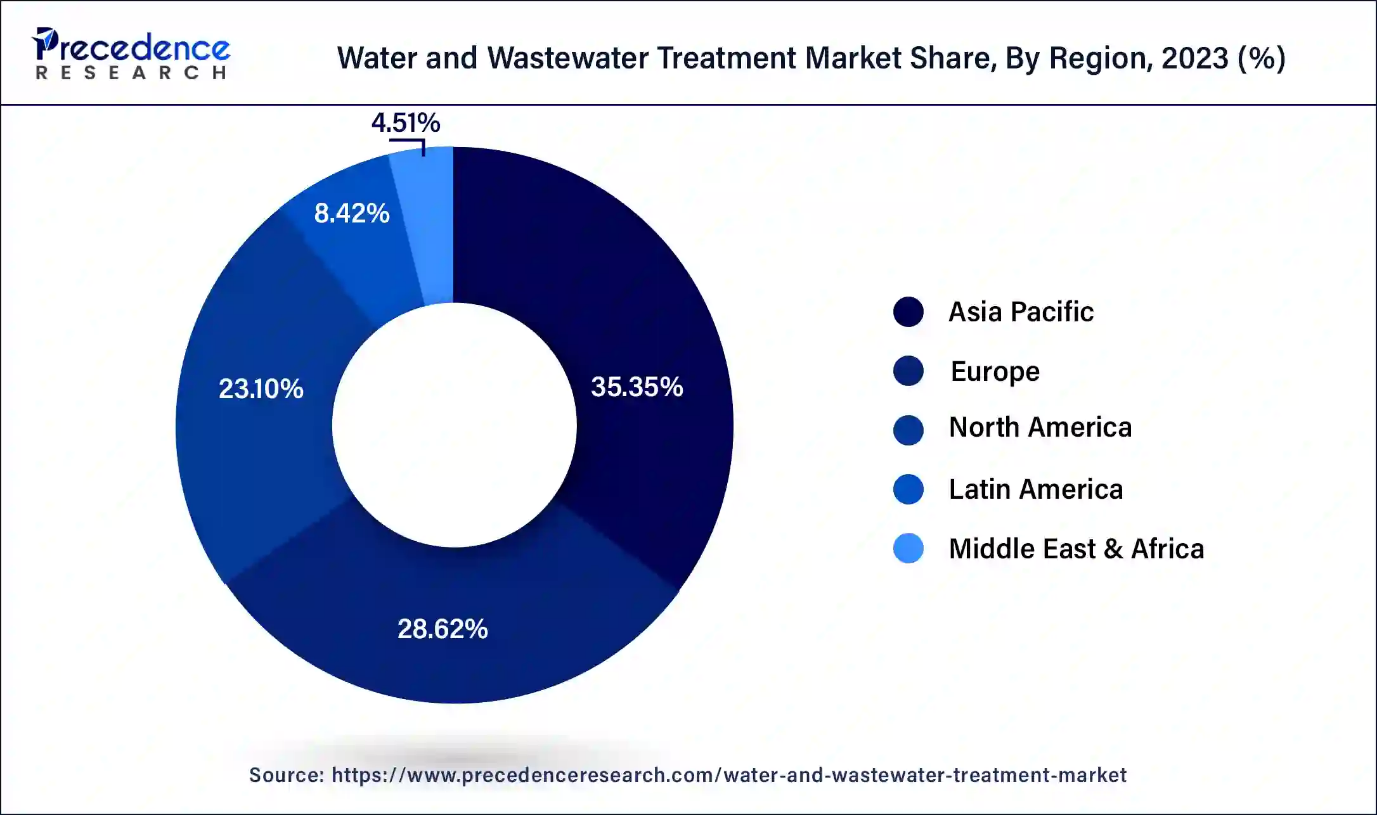

- Asia Pacific dominated the water and wastewater treatment market with the largest market share of 35.35% in 2023.

- By equipment, the membrane separation segment has generated the largest market share of 34.73% in 2023.

- By process, the tertiary segment accounted for the biggest market share of 43.79 in 2023.

- By process, the secondary segment is expected to grow at the fastest rate during the forecast period.

- By application, the industrial segment has contributed the highest market share of 66.1% in 2023.

- By application, the municipal segment is expected to grow at the fastest rate during the forecast period.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Water and Wastewater Treatment Market Regional Analysis

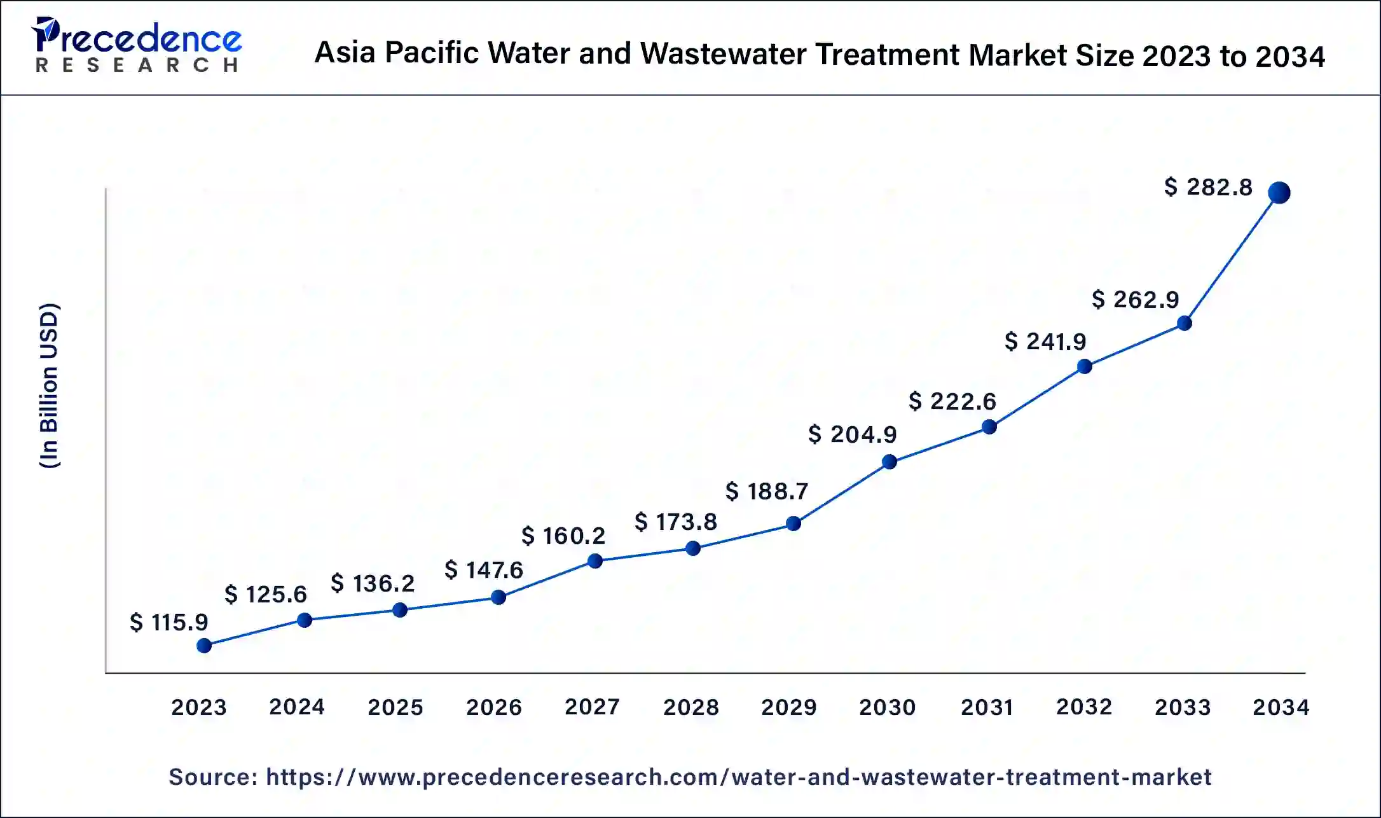

The Asia Pacific water and wastewater treatment market size accounted for USD 125.6 billion in 2024 and is predicted increase from USD 115.9 billion in 2023 to USD 282.8 billion by 2034, growing at a notable CAGR of 8.6% from 2024 to 2034.

Asia Pacific led the water and wastewater treatment market is observed to sustain the positions owing to the substantial number of industries. Industries such as textiles, chemicals, electronics, and food processing generate enormous amounts of polluted wastewater. The region's rapid development necessitates wastewater treatment for environmental protection, industrial expansion, and human well-being. Innovative solutions and investments in wastewater treatment technology are critical to the region's future.

- For instance, the Stickney Water Reclamation Plant, near Stickney, Illinois, is the world's biggest wastewater treatment facility, serving more than 2.4 million people in Chicago and 46 suburban cities. The formal name is "The Crappiest Place on Earth."

- In July 2024, Almar Water Solutions, a division of Jameel Environmental Services, is collaborating with Moya Indonesia to extend its Asia-Pacific footprint and grow its respective water businesses.

Customize this study as per your requirement@ https://www.precedenceresearch.com/customization/2395

North America is observed to grow at the fastest rate in the water and wastewater treatment market during the forecast period. Wastewater treatment in North America is governed by a variety of agreements, rules, and regulations designed to safeguard public health. The Environmental Protection Agency (EPA) establishes and enforces wastewater treatment regulations throughout the United States, with the Clean Water Act serving as the cornerstone. Each state has its own environmental agency tasked with enforcing local legislation.

Industry groups such as the Water Environment Federation and the American Water Works Association help the industry grow by providing technical knowledge, advocating best practices, and enabling research and innovation. Wastewater treatment facilities are spread throughout North America, with densely populated areas such as New York and New Jersey having the largest densities due to urbanization and significant amounts of municipal and industrial wastewater.

Water And Wastewater Treatment Market Report Coverage

| Report Attribute | Key Statistics | |

| Base Year | 2023 | |

| Forecast Period | 2024 to 2034 | |

| Market Size in 2023 | USD 327.8 Billion | |

| Market Size in 2024 | USD 347.9 Billion | |

| Market Size by 2034 | USD 652.3 Billion | |

| CAGR 2024-2034 | 6.5 | % |

| Quantitative Units | Revenue/Size in USD Million/Billion and CAGR from 2024 to 2033 | |

| Segments Covered | Equipment, Process, Application and Regions | |

| By Equipment |

| |

| By Process |

| |

| By Application |

| |

| By Regions |

| |

| Country Scope | U.S., Canada, UK, Germany, France, Italy, Spain, Norway, Sweden, Denmark, Japan, China, India, Australia, South Korea, Thailand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait | |

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Water And Wastewater Treatment Market Segmental Analysis

Analysis by Equipment:

The membrane separation category dominated the water and wastewater treatment market in 2023. Membrane separation is a physical treatment process that extracts certain components from a solution by passing high-pressure feed water through a semi-permeable membrane. It outperforms competing procedures due to its short working space and high filtering efficiency.

Membranes may be classified into four types: microfiltration (MF), nanofiltration (NF), ultrafiltration (UF), and reverse osmosis. In industry, microfiltration is used to clarify liquids, sterilize them, and collect PM2.5. Ultrafiltration is used to purify and separate solutions containing macromolecules and colloidal particles. Nanofiltration is used to concentrate and purify macromolecular compounds in solution. Reverse osmosis is used to desalinate saltwater.

Analysis by Process:

The tertiary treatment process segment dominated the water and wastewater treatment market in 2023.

Tertiary treatment is the following step in wastewater treatment, eliminating recalcitrant pollutants that secondary treatment failed to eliminate. It employs modern treatment techniques to purify wastewater. Tertiary treatment methods can supplement standard biological treatment by stabilizing oxygen-demanding chemicals or removing nitrogen and phosphorus. It may also include physical-chemical separation methods like carbon adsorption, flocculation/precipitation, improved filtration membranes, ion exchange, dichlorination, and reverse osmosis.

The secondary segment is expected to grow at the fastest rate during the forecast period.

Secondary wastewater treatment seeks to break down biodegradable dissolved and suspended organic matter, eliminate dissolved nitrogenous and phosphorus components, and transform organic waste into non-polluting end products such as water, CO2, and biomass. It removes fine-suspended and dissolved degradable organic materials during initial treatment, permitting effluent release. Secondary treatment also reduces ammonia toxicity and nitrification oxygen demand in the stream, which reduces effluent quality for inland streams or lakes.

Analysis by Application:

The industrial segment dominated the water and wastewater treatment market in 2023.

The industrial process of water treatment is critical due to the growing importance of water as a valuable resource. Untreated water can disrupt industrial processes, resulting in streaking and scaling. Proper treatment lowers the presence of undesirable chemicals while improving water management. Advanced blowdown technologies can also decrease water contamination and equipment damage. As the economy improves, manufacturers may help by recovering resources and increasing earnings.

The municipal segment is expected to witness the fastest growth in the water and wastewater treatment market, with reverse osmosis technology used to treat wastewater from a variety of sources. This method eliminates ions, molecules, and bigger particles from drinking or cooking water, and rainfall for landscape irrigation and industrial cooling. Turbidity, suspended particles, bacteria, and viruses are removed using cost-effective ultrafiltration and reverse osmosis devices, making surface water safe to drink.

Water and Wastewater Treatment Market Dynamics:

Driver: Need to protect the ecosystem

Protection of the ecosystem from wastewater is the major driving factor of the water and wastewater treatment market. Wastewater treatment plants assist in cleansing water and alleviating problems like those seen in underdeveloped nations. Unclean water offers substantial health concerns, accounting for 1.7 million fatalities per year, with more than 90% occurring in underdeveloped nations.

Water-borne illnesses such as cholera and schistosomiasis remain common, with just a tiny percentage of home and urban wastewater treated. Wastewater treatment also benefits ecology since fish and aquatic life require clean water. Excessive levels of chemicals, such as nitrogen and phosphates, can produce excessive plant growth, producing toxins that deplete oxygen and create dead zones where fish and aquatic life cannot thrive.

Browse More Insights:

Industrial Wastewater Treatment Market Size, Share, and Trends 2024 to 2033

The global industrial wastewater treatment market size was exhibited at USD 17.23 billion in 2023 and is projected to be worth around USD 32.22 billion by 2033, poised to grow a CAGR of 6.50% during the forecast period from 2024 to 2033.

Water And Wastewater Treatment Market Size | Share and Trends 2024 to 2034

The global water and wastewater treatment market size was USD 327.8 billion in 2023, calculated at USD 347.9 billion in 2024 and is expected to reach around USD 652.3 billion by 2034, expanding at a CAGR of 6.5% from 2024 to 2034.

Wastewater Treatment Chemicals Market Size, Share, and Trends 2024 to 2034

The global wastewater treatment chemicals market size was reached at USD 35.95 billion in 2023 and it is projected to hit around USD 50.73 billion by 2032, poised to grow at a CAGR of 3.9%.

Pharmaceutical Water Market Size, Share, and Trends 2024 to 2034

The global pharmaceutical water market size was valued at USD 38.69 billion in 2023 and is predicted to hit USD 95.14 billion by 2033 with a CAGR of 9.2% from 2024 to 2033.

Bottled Water Market Size, Share, and Trends 2024 to 2034

The global bottled water market size accounted for USD 318.31 billion in 2023, and it is expected to hit around USD 538.58 billion by 2033, poised to grow at a CAGR of 5.4% from 2024 to 2033.

Baby Drinking Water Market Size, Share, and Trends 2024 to 2034

The global baby drinking water market size surpassed US$ 39.35 billion in 2023 and is expected to reach over US$ 98.29 billion by 2032, poised to grow at a CAGR of 11.6%.

Premium Bottled Water Market Size, Share, and Trends 2024 to 2033

The global premium bottled water market size was USD 20.71 billion in 2023, calculated at USD 22.17 billion in 2024 and is expected to reach around USD 40.89 billion by 2033, expanding at a CAGR of 7.04% from 2024 to 2033.

Water Purifier Market Size, Share, and Trends 2024 to 2034

The global water purifier market size accounted for USD 28.74 billion in 2023 and it is projected to hit around USD 63.99 billion by 2032, growing at a noteworthy CAGR of 9.30%.

Point-of-Use Water Treatment Systems Market Size, Share, and Trends 2024 to 2034

The global point-of-use water treatment systems market size reached USD 18.5 billion in 2023 and is estimated to hit around USD 91.53 billion by 2032, growing at a CAGR of 19.44%.

Water Treatment Chemicals Market Size, Share, and Trends 2024 to 2034

The global water treatment chemicals market size was estimated at USD 32.19 billion in 2022 and it is projected to hit around USD 45.81 billion by 2032, expanding at a CAGR of 3.59% during the forecast period from 2023 to 2032.

Restraint: Financial issues

Initial investment is a key restraint for the water and wastewater treatment market. A wastewater treatment facility requires a considerable initial investment, but it also covers maintenance, downtime, inefficient equipment, and operational costs. Old equipment can impair efficiency, take longer to treat wastewater and be more prone to failure, resulting in greater downtime and maintenance.

Energy consumption is a substantial cost in wastewater treatment facilities, accounting for 2-3% of a developed country's electrical power or 60 TWh annually. Biological treatment is the principal energy source in municipal wastewater treatment, accounting for 50-60% of plant capacity.

- For instance, Membion, a Roetgen-based startup, has received a €5 million investment from TechVision Fonds and DeepTech & Climate Fonds to create membrane bioreactor modules for wastewater treatment with the goal of lowering operational costs.

Opportunity: Leveraging the IoT in wastewater treatment

The Internet of Things (IoT) has transformed wastewater treatment facilities (WWTPs) by gathering real-time data from smart meters at strategic locations. This data is analyzed and translated into high-value data, which provides a thorough picture of the system's status.

IoT technology also enables the wireless transmission of monitoring signals, allowing for increased management and oversight outside the plant site. It also enhances the quality of purification operations and promotes effective resource management by optimizing consumption and decreasing waste, resulting in lower operating costs.

Water and Wastewater Treatment Market Top Companies

- Suez Environnement S.A. (France)

- DuPont de Nemours, Inc. (U.S.)

- Veolia Environnement SA. (France)

- Xylem, Inc. (U.S.)

- 3M Company, Inc. (U.S.)

- Pentair plc (U.K.)

- Kurita Water Industries Ltd. (Japan)

- United Utilities Group PLC (U.K.)

- Trojan Technologies Inc. (Canada)

- Burns & McDonnell (U.S.)

- Kemira Oyj (Finland)

- Kingspan Group Plc (U.K.)

- The Dow Chemical Company (U.S.)

- BASF SE (Germany)

- Bio-Microbics, Inc. (U.S.)

- Calgon Carbon Corporation (U.S.)

- Thermax Limited (India)

- Wog Technologies (India)

- Golder Associates, Inc. (Canada)

- Clean TeQ Water Limited (Australia)

- SWA Water Technologies PTY LTD. (Australia)

- Adroit Associates Private Limited (India)

- Sauber Environmental Solutions Pvt. Ltd. (India)

- SPEC Limited (India), Ecolab, Inc. (U.S.)

- GFL Environmental Inc. (U.S.)

Recent Developments of Water and Wastewater Treatment Market:

- In May 2024, Schneider Electric is collaborating with SUEZ to build India's largest single-stage wastewater treatment plant in Delhi, supporting the Namami Gange program while also delivering energy management and NextGen automation solutions in accordance with the Delhi Jal Board Yamuna Action Plan.

- In May 2024, VA Tech Wabag received a $49 million repeat order from Kathmandu Upatyaka Khanepane Ltd. to design, develop, and manage three wastewater treatment plants in Nepal, using funding from the Asian Development Bank.

- In April 2024, Thermax opened a two-acre wastewater treatment plant in Pune that uses sophisticated manufacturing processes and automation to increase productivity and reduce waste.

- In November 2023, India is introducing modern sewage and wastewater treatment technologies, but it is critical to choose solutions that best meet local demands.

Segments Covered in the Report

By Equipment

- Membrane Separation

- Biological

- Disinfection

- Sludge Treatment

- Others

By Process

- Primary

- Secondary

- Tertiary

By Application

- Municipal

- Industrial

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2395

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsautomotive.com

For Latest Update Follow Us: