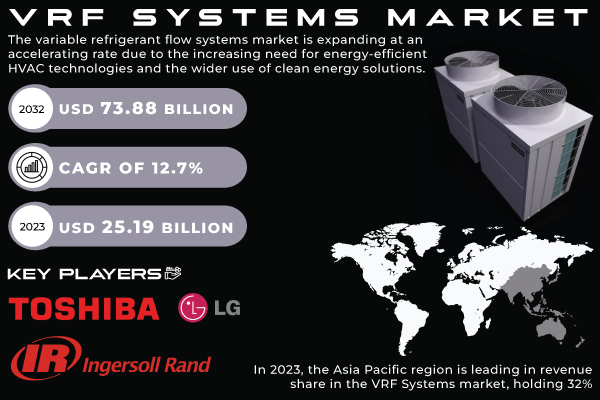

Pune, Aug. 27, 2024 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that, “The VRF Systems Market size was valued at USD 25.19 billion in 2023 and is expected to reach USD 73.88 billion by 2032 and grow at a CAGR of 12.7% over the forecast period 2024-2032.”

VRF Systems Driving Sustainable Building and Economic Growth

The VRF systems market is growing quickly because of its energy-efficient properties and its alignment with clean energy efforts. Government assistance, like the SEP initiative, continues to encourage its acceptance. VRF systems are perfect for commercial buildings, schools, and healthcare facilities due to their ability to provide major energy and operational cost benefits. Advancements in technology like IoT and AI improve performance and user experience, leading to market expansion. VRF systems are also compatible with sustainable construction methods, ensuring their importance in energy-efficient building projects. This market growth promotes the development of local economy, employment opportunities, and decrease in pollution, reflecting the favorable effects of SEP on state energy initiatives.

Download PDF Sample of VRF Systems Market @ https://www.snsinsider.com/sample-request/2439

Key Companies:

- LG Electronics

- Daikin Industries

- Fujitsu General Corporations

- Toshiba Corporation

- United Technologies Corporation

- Mitsubishi Electrical

- Midea Group

- Johnson Controls

- Lennox International

- Ingersoll Rand PLC

VRF Systems Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 25.19 Billion |

| Market Size by 2032 | USD 73.88 Billion |

| CAGR | CAGR of 12.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By System Type (Heat Recovery Systems, Heat Pump Systems) • By Component (Outdoor Units, Installation Services, Indoor Units, Control Systems And Accessories) • By Capacity (Up To 10 Tons, 11 To 18 Tons, 19 To 26 Tons, Above 26 Tons) • By Application (Commercial, Residential, Industrial) |

| Key Drivers | • Growth in VRF System Market Driven by Regulatory Changes |

If You Need Any Customization on VRF Systems Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/2439

The Role of VRF Systems in Promoting Sustainable Building Practices

As the Variable Refrigerant Flow (VRF) system market grows, it corresponds to worldwide trends moving towards energy-efficient, low-carbon buildings, mirroring the objectives of the U.S. Department of Energy's Building Technologies Office (BTO) to decrease carbon emissions. VRF systems improve energy efficiency in building projects and renovations, aiding the U.S. goal of reducing building greenhouse gas emissions by 65% by 2035 and 90% by 2050. They back fairness and reasonable prices, providing better HVAC options for communities lacking in resources. VRF systems, crucial for decreasing the significant emissions of the building sector, will see additional advantages by incorporating intelligent technologies such as solar panels and battery storage, leading to savings in costs, improved building regulations, and top-notch HVAC employment opportunities.

Expansion of the VRF market is driven by growth in residential construction and the adoption of heat pumps.

In the year 2023, heat pump systems dominated the VRF market with a 58% share, highlighting their importance in contemporary HVAC solutions. Their capacity to provide both heating and cooling using a reversible unit, as well as their versatility and energy efficiency, are in line with the increasing focus on energy-efficient building design. Major companies such as Daikin, Mitsubishi Electric, and LG have driven market expansion through the advancement of heat pump technologies. Daikin has broadened its heat pump selection, Mitsubishi Electric has improved product efficiency, and LG is still advancing in heat pump technology, all contributing to the heat pump segment's dominance in the VRF market.

In 2023, the residential sector led the VRF systems market with a 39% share, reflecting the growing adoption of air supply VRFs in Asia, Europe, and North America. This trend is driven by efforts to electrify buildings, reducing reliance on fossil fuels by replacing gas-powered systems with air source heat pumps, aligning with sustainability goals and evolving energy policies. The U.S. Census Bureau reports a peak in public residential construction investment at USD 9 billion in 2020. Innovations like Carrier China’s XCT8 VRF series and government-backed projects such as Al Hamra's Falcon Island and South Korea’s smart city initiative highlight the expanding market opportunities for VRF systems in residential applications.

Leadership and innovation in VRF systems market in Asia Pacific and North America at regional level.

In 2023, the Asia Pacific region led the VRF Systems market with a 32% revenue share. Major players such as Panasonic, Daikin, Toshiba, and Mitsubishi Electric significantly contribute to this dominance. Panasonic excels with advanced VRF systems featuring smart controls and enhanced energy efficiency. Daikin’s latest VRV X series offers superior performance and versatility, while Toshiba’s SMMS-e VRF system focuses on high efficiency and environmental impact reduction through advanced inverter technology. Mitsubishi Electric’s CITY MULTI VRF systems deliver reliable performance and energy conservation. These innovations underscore Asia Pacific’s pivotal role in driving the VRF market’s growth.

In 2023, North America captured 26% of the VRF systems market, emerging as the second fastest-growing region due to rising demand for energy-efficient and easy-to-install HVAC solutions. VRF systems are favored for their superior energy efficiency and adaptability, making them ideal for commercial and large residential applications. LG Electronics made a significant impact with its V5 multi-variable refrigerant flow (VRF) systems, offering advanced technology and multiple power options while meeting low global warming potential (GWP) refrigerant standards. Similarly, Daikin’s VRV Life series and Carrier’s updated VRF systems emphasize energy efficiency and regulatory compliance. These innovations reflect North America's shift towards sustainable HVAC solutions.

Buy Full Research Report on VRF Systems Market 2024-2032 @ https://www.snsinsider.com/checkout/2439

Recent Development of VRF Systems market

- In April 2022, Samsung India introduced India's first AI-powered Variable Refrigerant Flow (VRF) air conditioners, offering improved efficiency and quick cooling abilities.

- In July 2022, DAIKIN gained attention when it extended its patent non-assertion commitment for air conditioning units that use the low Global Warming Potential (GWP) refrigerant HFC-32.

Market Insights for VRF Systems market

- Comprehend the latest market patterns and potential opportunities for growth in the future.

- Obtain understanding of how government policies and regulations impact the market.

- Evaluate possible dangers and difficulties linked to the market.

- Recognize possible investment prospects in the VRF systems market.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 VRF System Sales Volumes, by Region (2023)

5.2 VRF System Technology Trends (Historic and Future)

5.3 System Deployment Trends and Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.4 Strategic Initiatives

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. VRF Systems Market Segmentation, by System Type

7.1 Chapter Overview

7.2 6 Heat Recovery Systems

7.2.2 Heat Recovery Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Heat Pump Systems

8. VRF Systems Market Segmentation, by Components

8.1 Chapter Overview

8.2 Outdoor Units

8.3 Installation Services

8.4 Indoor Units

8.5 Control Systems and Accessories

9. VRF Systems Market Segmentation, by Capacity

9.1 Chapter Overview

9.2 Up to 10 Tons

9.3 11 to 18 Tons

9.4. 19 to 26 Tons

9.5 Above 26 Tons

10. VRF Systems Market Segmentation, by Application

10.1 Chapter Overview

10.2 Commercial

10.3 Residential

10.4 Industrial

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Description of VRF Systems Market Report 2024-2032 @ https://www.snsinsider.com/reports/vrf-systems-market-2439

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.