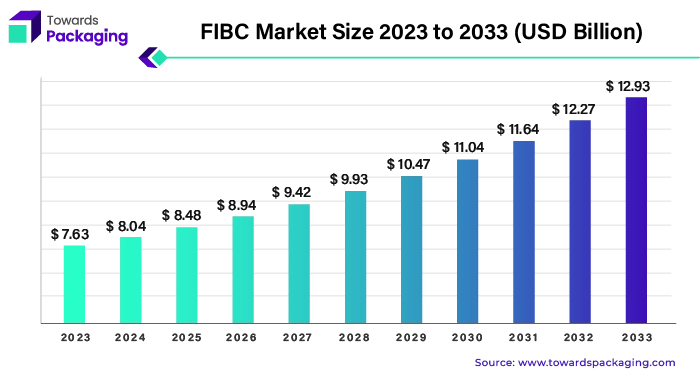

Ottawa, Aug. 29, 2024 (GLOBE NEWSWIRE) -- The global FIBC market size was valued at USD 7.63 billion in 2023 and is predicted to hit around USD 12.27 billion by 2032, according to a study published by Towards Packaging a sister firm of Precedence Statistics.

Get a comprehensive free sample: https://www.towardspackaging.com/personalized-scope/5200

Key Takeaways: Leading Factors of the Flexible Intermediate Bulk Container Market

- The flexible intermediate bulk container market size growth projected from USD 7.63 billion (2023) to USD 12.93 billion (2033).

- Anticipated CAGR at 5.42% between 2023 to 2033.

- The flexible intermediate bulk container industry grows at 5.42% CAGR (2023-2033).

- Demand for high quality packaging and rising industrialization are the major factors that drive the market.

- North America’s demand for cost-effective packaging solution drives the market growth.

- Aside from industrial and food and beverages sector, chemical and fertilizers sector is anticipating growth in upcoming years.

Get the latest insights on packaging industry segmentation with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

FIBC Market: Flexibility and Space Offering to Offer Expansion

The flexible intermediate bulk container market or FIBC market revolves around the transportation and storage of bulk materials granules, chemicals, and pharmaceuticals. Along with being a cost-effective packaging solution, reducing waste material by being reusing the previous bag are the leading objectives of the market. The storage optimization and the need for lower labour costs want a single solution, that is, the easy usage of lifted loops and folding of lightweight bags. The emerging economies and their developed infrastructure will need sustainable packaging requirement, which will rise the demand of the flexible container market.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

- In May 2024, Kite packaging, a UK based company, had launched Flexible Container Bulk Containers (FIBC) bags, which was designed to provide convenience, and it can be used across various sectors. Along with being reusable and cost-effective, the bags match industry standards and had received testing certification.

Different sectors according to their need and the structure of the product prefer packaging solutions, given the reason that they want the products in good conditions and this will, in return, increase their user base. The flexible intermediate bulk container market offers it to them and will increase the growth rate of the market.

AI Integration and Technology: Lucrative Opportunities to the Market

The flexible intermediate bulk container market will be enhanced and evolved with AI integration and technology. The manufacturing and labouring costs will be reduced and the complex processes like cutting and sealing will be simplified with advance technology. The search and development of new materials which will be lightweight and durable and will offer tear resistance, tensile strength and UV stability. The use of nanotechnology which include nanoparticles and nanofibers will improve the strength and barrier properties and the application of these innovations in FIBC market will thrive and raise the market at new heights.

Get a customized report designed according to your preferences: https://www.towardspackaging.com/customization/5200

| Technology | Application | Benefit |

| Static Dissipation Technology | Static accumulation | Transit of sensitive items |

| Barrier and Containment Solutions | Multi-layered structures | Improve product integrity |

Driver

Industrilzation Growth and Versatility of Containers Drives the Market

The growth in industrialisation sector has led to significant development in large-scale industrial projects which, in return, increase the demand of required material, which will need bulk packaging solution, that is, flexible intermediate bulk container packaging. The versatility of the container allows to adjust its size and shape accordingly with the industry and product requirement. The container’s filling, discharging and lifting facilities are one of the major factors which drives the market. The focus on sustainability packaging also attracts users and increases the growth rate of the FIBC market.

Restraint

Government Regulations and Global Economic Circle: A Hindrance

The flexible container material is made from polypropylene which is a petroleum-based product, can fluctuate its costs due to economic ups and downs. The global market attributes the flow of supply chain and prices of other commodities like crude oil can pose a challenge to the market. Apart from this, government regulations regarding utilization of reused containers also hinders the circular economy and also regulates the infrastructure of recycling processes. In addition, opposite alternative packaging materials are the intense competitive hindrances for the paper packaging market. Standard regulations are different in every region which can hinder the import and export of flexible intermediate bulk container market materials.

Opportunity

Industry Preferences Create Opportunities for the Market

Polypropylene being a recycle and reusable material is used in bulk packaging. The bulk packaging is used in many sectors like construction, agriculture, chemical and fertilizers, food and beverages and pharmaceutical due to its focus on providing protection from hazardous materials and ensuring product’s safety. The e-commerce has also impacted the growth of bulk container market. The expansion of markets due to rapid urbanisation and the geographical conditions of different regions also create opportunities for the market. Although the factors are minor, other services which add value to the packaging include filling the bulk and placing the pallet also create opportunity for the market by satisfying the user base.

Regional Insights

North America is observed to grow at a significant rate in the upcoming years in the flexible intermediate bulk container marketor FIBC market. The market in this region is driven by rapid chemical and food sector, focus on steady growth and growing construction sector. Countries like United States and Canada are leading contributors in the market.

In December 2022, New Water Capital, a private equity firm, had announced that they had invested in FIBC Sector with acquisition of North American companies, which are f Bulk Lift International LLC (Bulk Lift) and Bagwell Supply Ltd. (Bagwell). The investment created a large FIBC provider in North America which served purpose for food and beverage, chemical, pharmaceutical, minerals, and construction products industries.

Asia-pacific has established itself as the mature and leading marketplace with its focus on rapid industrialisation, given the reason it has different packaging solutions across the region. In addition, growth in trade activities due to manufacturing sector and a rapid growing population are the driving factors of the region. Countries like India, China and Japan are the leading contributors in the flexible intermediate bulk container market. The growing economy focuses on sustainability and has strict government regulations. The rising demand for sustainable packaging solutions due to increasing material waste is the goal of the region.

In April 2024, Packem Umasree, a Brazil- India joint venture has achieved great success and became the first company to manufacture 100% sustainable flexible intermediate bulk container which used recycled PET bottles. The company had established its first plant in India near Ahmedabad in which Umasree had 49% and Packem had 51% equity stake.

Major Advancements in the FIBC Market

| Company | FlexSack |

| Headquarters | Helena, Alabama, USA |

| Recent Development | In May 2023, Flexsack had launched new product which was an eco-friendly flexible intermediate bulk container (FIBCs) and which contained 30% recycled PP. The company also stated that the product was North America’s first recycled FIBC and the PCR bags are imported from India at a cost revenue with standard PP bags. |

| Company | Bharat Petroleum |

| Headquarters | Mumbai, Maharashtra, India |

| Recent Development | In December 2023, Bharat Petroleum Corporation Ltd (BPCL), launched a statement that they had received the approval of polypropylene unit project which had approved investment worth Rs. 5,044 crores. The project, for production of Polypropylene at Kochi Refinery, was initiated to meet the petrochemical demand in the country. |

Segmental Insights

By Packaging

Q-bags dominate the flexible intermediate bulk container market. It is the dominating container due to its components which provide load stability and security to the product, and is fair share is used for powdery products. It also dominates the market with its performance capability and it is on the way of being the largest segment due to its clear priorities, that is, product security.

Apart from this, there are many types of bags which have excellent qualities which provide enhance protection to the product and some of them are baffle bulk bags, circular bulk bags, U-panel bags, 4-panel bags, UN-certified bags and food grade bags. All these categories have advantageous stacking capabilities, are moisture resistance, have super strength holding heavyweights, and have adjustable size appearance. The certified bags and food grade bags follow strict government regulations to receive green signal from authorised organisations.

By Capacity

The above 750 kg dominates the flexible intermediate bulk container market. With its size, capacity and applicable use, it is preferred by the dominating and growing sectors the most. The 750 kg segment is primarily used in bulk material requirement sectors like construction and chemical and fertilizers. The capacity for heavy loads increases its popularity in other sectors like automation and bulk-material industry. The range differs from 250kg, between 250 kg to 750 kg, and above 750 kg. The 250 kg segment is preferred for lighter loads and can be handled manually. The in-between segment is preferred for its versatile usage. Each sector uses them according to their requirement.

More Insights in Towards Packaging

- The global transit packaging market size reached US$ 231.25 billion in 2023 and is projected to hit around US$ 454.48 billion by 2033, expanding at a CAGR of 6.99% during the forecast period from 2024 to 2033.

- The global paper machinery market size reached US$ 3.83 billion in 2023 and is projected to hit around US$ 5.41 billion by 2033, expanding at a CAGR of 4.43% during the forecast period from 2024 to 2033.

- The global semiconductor packaging market size reached US$ 41.05 billion in 2023 and is projected to hit around US$ 108.82 billion by 2033, expanding at a CAGR of 10.24% during the forecast period from 2024 to 2033.

- The global adherence packaging market size reached US$ 1.1 billion in 2023 and is projected to hit around US$ 2.05 billion by 2033, expanding at a CAGR of 6.43% during the forecast period from 2024 to 2033.

- The global polystyrene packaging market size reached USD 24.58 billion in 2023 and is projected to hit around USD 37.92 billion by 2033, expanding at a CAGR of 4.43% during the forecast period from 2024 to 2033.

- The global ethical label market size is estimated to reach USD 1815.34 billion by 2033, up from USD 948.65 billion in 2023, at a compound annual growth rate (CAGR) of 6.83% from 2024 to 2033.

- The global wine packaging market size is estimated to reach USD 10.99 billion by 2033, up from USD 6.11 billion in 2023, at a compound annual growth rate (CAGR) of 6.19% from 2024 to 2033.

- The global corrugated boxes market size reached USD 163.07 billion in 2023 and is projected to hit around USD 269.19 billion by 2033, expanding at a CAGR of 5.14% during the forecast period from 2024 to 2033.

- The global bioplastic packaging market size reached US$ 17.99 billion in 2023 and is projected to hit around US$ 87.98 billion by 2033, expanding at a CAGR of 17.2% during the forecast period from 2024 to 2033.

- The global plastic healthcare packaging market size reached US$ 24.8 billion in 2023 and is projected to hit around US$ 40.51 billion by 2033, expanding at a CAGR of 5.03% during the forecast period from 2024 to 2033.

Flexible Intermediate Bulk Container Market Segment TOC

Executive Summary

- Market Overview

- Key Findings

- Market Trends

- Competitive Landscape

- Market Opportunities

Introduction

- Definition and Scope

- Research Methodology

- Assumptions and Limitations

Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- Porter's Five Forces Analysis

FIBC Market Analysis

- Market Size and Forecast

- Value Chain Analysis

- Pricing Analysis

Competitive Landscape

- Market Share Analysis

- Competitive Strategies

- Recent Developments

- Company Profiles

- Global-Pak

- Bulk Lift International

- Isbir Sentetik

- Greif

- Bag Corp

- Berry Global Group, Inc.

- Rishi FIBC Solutions

- Jumbo Bag Limited

- Taihua Group

- Masterpack Group

- Conitex Sonoco

- DS Smith plc

- Bulk Container Europe BV

- LC Packaging International BV

FIBC Market Segmentation

- By Packaging

- Q-Bags

- Baffle Bags

- 6 Panel

- Circular Bags

- Others

- By Capacity

- Up to 250 Kg

- 250 Kg – 750 Kg

- Above 750 Kg

- By End-User

- Chemical and Fertilizers

- Building and Construction

- Food and Beverages

- Mining

- Pharmaceutical Products

- By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- LAMEA

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

- Latin America

- North America

North American FIBC Market Analysis

- Market Size and Forecast

- Value Chain Analysis

- Pricing Analysis

Market Segmentation

- By Packaging

- Q-Bags

- Baffle Bags

- 6 Panel

- Circular Bags

- Others

- By Capacity

- Up to 250 Kg

- 250 Kg – 750 Kg

- Above 750 Kg

- By End-User

- Chemical and Fertilizers

- Building and Construction

- Food and Beverages

- Mining

- Pharmaceutical Products

Go-to-Market Strategies

- Market Penetration

- Competitive Pricing

- Channel Expansion

- Sales Force Optimization

- Product Development

- Innovation

- Customization

- Sustainability

- Market Expansion

- Geographic Focus

- Strategic Alliances

- Digital Marketing

- Customer Engagement

- After-Sales Support

- Feedback Mechanism

- Trade Shows and Exhibitions

- Regulatory Compliance

- Certifications and Standards

- Regulatory Updates

- Safety and Quality Assurance

Challenges and Mitigation Strategies

- Supply Chain Disruptions

- Diversified Sourcing

- Inventory Management

- Price Fluctuations

- Cost Control

- Long-Term Contracts

- Regulatory Hurdles

- Proactive Compliance

- Training

Plan Finances/ROI Analysis for FIBC Market by Region

North America

- Investment Requirements:

- Capital Expenditure: Significant investments in manufacturing facilities and technology upgrades to meet high-quality standards and regulatory requirements.

- Operational Costs: Includes raw materials, labor, transportation, and logistics, which are relatively high due to the region’s advanced infrastructure.

- Marketing and Sales Costs: Expenses related to market penetration strategies, including competitive pricing, channel development, and digital marketing efforts.

- Revenue Potential:

- High Demand Sectors: Strong revenue opportunities in sectors such as chemicals, food and beverages, pharmaceuticals, and construction, which have substantial and consistent demand for FIBCs.

- Premium Pricing: Potential to command premium prices for high-quality, compliant, and innovative FIBCs due to stringent regulations and high industry standards.

- ROI Metrics:

- Gross Margin: Typically high due to the ability to leverage advanced manufacturing techniques and premium pricing.

- Payback Period: Generally shorter in North America due to strong market demand and established distribution networks.

- Profitability: High, driven by robust market demand and the ability to capture premium pricing in sectors with high-value products.

Europe

- Investment Requirements:

- Capital Expenditure: Investments needed for compliance with European standards, including advanced technology and machinery.

- Operational Costs: Includes costs related to high labor wages, energy costs, and stringent environmental regulations.

- Marketing and Sales Costs: Includes investments in regulatory compliance, market education, and participation in trade shows.

- Revenue Potential:

- Diverse Market Needs: Opportunities across various sectors including chemicals, food, and pharmaceuticals, with strong emphasis on sustainability and innovation.

- Regulatory Premiums: Potential to earn higher margins from products that meet European Union (EU) standards for safety and environmental impact.

- ROI Metrics:

- Gross Margin: Moderate to high, influenced by regulatory compliance costs and the ability to offer premium, compliant products.

- Payback Period: Moderately long due to high initial investment and regulatory hurdles, but offset by a stable and diverse market.

- Profitability: Good, driven by a broad range of end-user industries and the premium pricing associated with EU compliance.

Asia Pacific

- Investment Requirements:

- Capital Expenditure: Lower compared to North America and Europe due to lower labor and operational costs, but investments in quality control are necessary to meet international standards.

- Operational Costs: Relatively lower, with significant variations between countries in the region.

- Marketing and Sales Costs: Focus on establishing distribution networks and educating the market about FIBC benefits.

- Revenue Potential:

- High Growth Potential: Rapid industrialization and economic growth in countries like China and India create significant demand for FIBCs.

- Cost-Competitive Advantage: Opportunity to capture market share through competitive pricing and cost-effective production.

- ROI Metrics:

- Gross Margin: Moderate to high, influenced by the lower cost of production and competitive pricing strategies.

- Payback Period: Shorter due to rapid market growth and high demand.

- Profitability: High potential, driven by large market size and lower production costs.

LAMEA (Latin America, Middle East, and Africa)

- Investment Requirements:

- Capital Expenditure: Investments needed for setting up manufacturing units and distribution channels, with varying costs across countries.

- Operational Costs: Generally lower, but there may be additional costs related to infrastructure and logistics in less developed regions.

- Marketing and Sales Costs: Focus on market entry strategies, establishing brand presence, and local distribution partnerships.

- Revenue Potential:

- Emerging Markets: Growing demand in sectors like mining, construction, and agriculture, with increasing industrialization and economic development.

- Market Penetration: Opportunity to gain early-mover advantage in emerging markets with tailored FIBC solutions.

- ROI Metrics:

- Gross Margin: Generally moderate due to varying production and distribution costs, with opportunities to increase margins through market penetration.

- Payback Period: Can be variable depending on the specific market conditions and investment levels, but generally moderate to long.

- Profitability: Increasing, driven by market growth and expansion opportunities in emerging economies.

Supply Chain Intelligence/Streamline Operations for FIBC Market by Region

North America

- Supply Chain Intelligence:

- Real-Time Monitoring

- Data Integration

- Demand Forecasting

- Streamline Operations:

- Supplier Collaboration

- Lean Manufacturing

- Automation

Europe

- Supply Chain Intelligence:

- Regulatory Compliance Tracking

- Supplier Performance Analytics

- Supply Chain Mapping

- Streamline Operations:

- Sustainability Integration

- Inventory Optimization

- Cross-Docking

Asia Pacific

- Supply Chain Intelligence:

- Regional Demand Analytics

- Vendor Management Systems

- Logistics Optimization

- Streamline Operations:

- Cost Efficiency

- Local Partnerships

- Flexible Production

LAMEA (Latin America, Middle East, and Africa)

- Supply Chain Intelligence:

- Risk Management

- Supply Chain Visibility

- Local Market Insights

- Streamline Operations:

- Infrastructure Development

- Local Sourcing

- Process Standardization

Cross-Segments Analysis for FIBC Market

Companies vs. Packaging Types

- Global-Pak:

- Q-Bags

- Baffle Bags

- Circular Bags

- Bulk Lift International:

- Q-Bags

- 6 Panel

- Circular Bags

- Isbir Sentetik:

- Baffle Bags

- Circular Bags

- Others

- Greif:

- Q-Bags

- 6 Panel

- Baffle Bags

- Bag Corp:

- Q-Bags

- Baffle Bags

- Circular Bags

- Berry Global Group, Inc.:

- Q-Bags

- Baffle Bags

- Circular Bags

- Rishi FIBC Solutions:

- Baffle Bags

- 6 Panel

- Others

- Jumbo Bag Limited:

- Q-Bags

- Circular Bags

- Baffle Bags

- Taihua Group:

- Q-Bags

- 6 Panel

- Circular Bags

- Masterpack Group:

- Baffle Bags

- 6 Panel

- Others

- Conitex Sonoco:

- Q-Bags

- Circular Bags

- Baffle Bags

- DS Smith plc:

- Q-Bags

- Baffle Bags

- Circular Bags

- Bulk Container Europe BV:

- Q-Bags

- 6 Panel

- Circular Bags

- LC Packaging International BV:

- Q-Bags

- Baffle Bags

- 6 Panel

Companies vs. Capacity

- Global-Pak:

- Up to 250 kg

- 250 kg – 750 kg

- Above 750 kg

- Bulk Lift International:

- 250 kg – 750 kg

- Above 750 kg

- Up to 250 kg

- Isbir Sentetik:

- Up to 250 kg

- 250 kg – 750 kg

- Above 750 kg

- Greif:

- Above 750 kg

- 250 kg – 750 kg

- Up to 250 kg

- Bag Corp:

- Up to 250 kg

- 250 kg – 750 kg

- Above 750 kg

- Berry Global Group, Inc.:

- Up to 250 kg

- 250 kg – 750 kg

- Above 750 kg

- Rishi FIBC Solutions:

- 250 kg – 750 kg

- Above 750 kg

- Up to 250 kg

- Jumbo Bag Limited:

- Up to 250 kg

- 250 kg – 750 kg

- Above 750 kg

- Taihua Group:

- 250 kg – 750 kg

- Above 750 kg

- Up to 250 kg

- Masterpack Group:

- Up to 250 kg

- 250 kg – 750 kg

- Above 750 kg

- Conitex Sonoco:

- Above 750 kg

- 250 kg – 750 kg

- Up to 250 kg

- DS Smith plc:

- Up to 250 kg

- 250 kg – 750 kg

- Above 750 kg

- Bulk Container Europe BV:

- Up to 250 kg

- 250 kg – 750 kg

- Above 750 kg

- LC Packaging International BV:

- 250 kg – 750 kg

- Above 750 kg

- Up to 250 kg

Companies vs. End-Users

- Global-Pak:

- Chemical and Fertilizers

- Food and Beverages

- Building and Construction

- Bulk Lift International:

- Mining

- Chemical and Fertilizers

- Pharmaceutical Products

- Isbir Sentetik:

- Food and Beverages

- Chemical and Fertilizers

- Building and Construction

- Greif:

- Mining

- Food and Beverages

- Pharmaceutical Products

- Bag Corp:

- Chemical and Fertilizers

- Food and Beverages

- Building and Construction

- Berry Global Group, Inc.:

- Food and Beverages

- Mining

- Pharmaceutical Products

- Rishi FIBC Solutions:

- Building and Construction

- Chemical and Fertilizers

- Mining

- Jumbo Bag Limited:

- Chemical and Fertilizers

- Mining

- Building and Construction

- Taihua Group:

- Food and Beverages

- Pharmaceutical Products

- Mining

- Masterpack Group:

- Chemical and Fertilizers

- Building and Construction

- Food and Beverages

- Conitex Sonoco:

- Food and Beverages

- Chemical and Fertilizers

- Pharmaceutical Products

- DS Smith plc:

- Mining

- Building and Construction

- Food and Beverages

- Bulk Container Europe BV:

- Chemical and Fertilizers

- Food and Beverages

- Building and Construction

- LC Packaging International BV:

- Food and Beverages

- Pharmaceutical Products

- Mining

Companies vs. Regions

- Global-Pak:

-

- North America

- Europe

- Asia Pacific

- Bulk Lift International:

-

- Asia Pacific

- North America

- Europe

- Isbir Sentetik:

-

- Europe

- Asia Pacific

- LAMEA

- Greif:

-

- North America

- Europe

- LAMEA

- Bag Corp:

-

- North America

- Asia Pacific

- Europe

- Berry Global Group, Inc.:

-

- North America

- Europe

- Asia Pacific

- Rishi FIBC Solutions:

-

- Asia Pacific

- North America

- LAMEA

- Jumbo Bag Limited:

-

- Asia Pacific

- North America

- LAMEA

- Taihua Group:

-

- Asia Pacific

- LAMEA

- Europe

- Masterpack Group:

-

- Europe

- Asia Pacific

- North America

- Conitex Sonoco:

-

- North America

- Europe

- Asia Pacific

- DS Smith plc:

-

- Europe

- North America

- Asia Pacific

- Bulk Container Europe BV:

-

- Europe

- North America

- Asia Pacific

- LC Packaging International BV:

-

- Europe

- Asia Pacific

- LAMEA

Integration of AI in the FIBC Industry

- Predictive Maintenance

- Analysis of manufacturing equipment data

- Prediction of equipment failures

- Reduction of downtime and maintenance costs

- Demand Forecasting

- Machine learning models for sales data

- Market trend analysis

- Production schedule adjustments

- Quality Control

- AI-powered vision systems for defect detection

- Real-time issue identification and correction

- Consistency and quality assurance

- Supply Chain Optimization

- Inventory level optimization

- Logistics management

- Disruption prediction and mitigation

- Production Scheduling

- Optimization of production schedules

- Analysis of demand forecasts, machine availability, and labor resources

- Improvement in operational efficiency

- Product Design and Innovation

- Analysis of customer feedback and market trends

- Material property evaluation

- Innovation in product design

- Customer Insights

- Analysis of customer data and feedback

- Identification of preferences and buying behavior

- Targeted marketing and product development

- Automated Reporting

- Automation of financial and operational report generation

- Real-time insights

- Reduction of manual reporting tasks

- Energy Management

- Optimization of energy usage in manufacturing

- Analysis of consumption patterns

- Reduction of energy costs

- Robotics and Automation

- AI-powered robots for packing and sorting

- Improvement in speed and precision

- Enhanced safety in manufacturing processes

- Risk Management

- Evaluation of supply chain, market, and operational risks

- Development of mitigation strategies

- Personalized Customer Service

- AI chatbots and virtual assistants

- Real-time support for inquiries and orders

- Efficient issue resolution

Production and Consumption Data for FIBC Market

- Global Production Overview

- Total Production Volume

- Major Producing Countries

- Production Capacity by Region

- Regional Production Data

- North America

- Production Volume

- Key Manufacturers

- Europe

- Production Volume

- Key Manufacturers

- Asia Pacific

- Production Volume

- Key Manufacturers

- LAMEA

- Production Volume

- Key Manufacturers

- North America

- Global Consumption Overview

- Total Consumption Volume

- Major Consuming Countries

- Consumption Trends by Region

- Regional Consumption Data

- North America

- Consumption Volume

- Key End-User Industries

- Europe

- Consumption Volume

- Key End-User Industries

- Asia Pacific

- Consumption Volume

- Key End-User Industries

- LAMEA

- Consumption Volume

- Key End-User Industries

- North America

- Market Demand-Supply Analysis

- Supply and Demand Balance

- Factors Influencing Demand

- Factors Influencing Supply

- Growth Projections

- Forecasted Production Growth

- Forecasted Consumption Growth

- Emerging Trends in Production and Consumption

Market Trends and Opportunities

- Emerging Trends

- Technological Advancements

- Strategic Initiatives

SWOT Analysis

- Strengths

- Weaknesses

- Opportunities

- Threats

Conclusion

- Key Takeaways

- Future Outlook

Appendix

- Data Sources

- Abbreviations

- Methodology

- Contact Information

Act Now and Get Your Flexible Intermediate Bulk Container (FIBC) Market Size, Companies and Insight 2033 @ https://www.towardspackaging.com/price/5200

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/