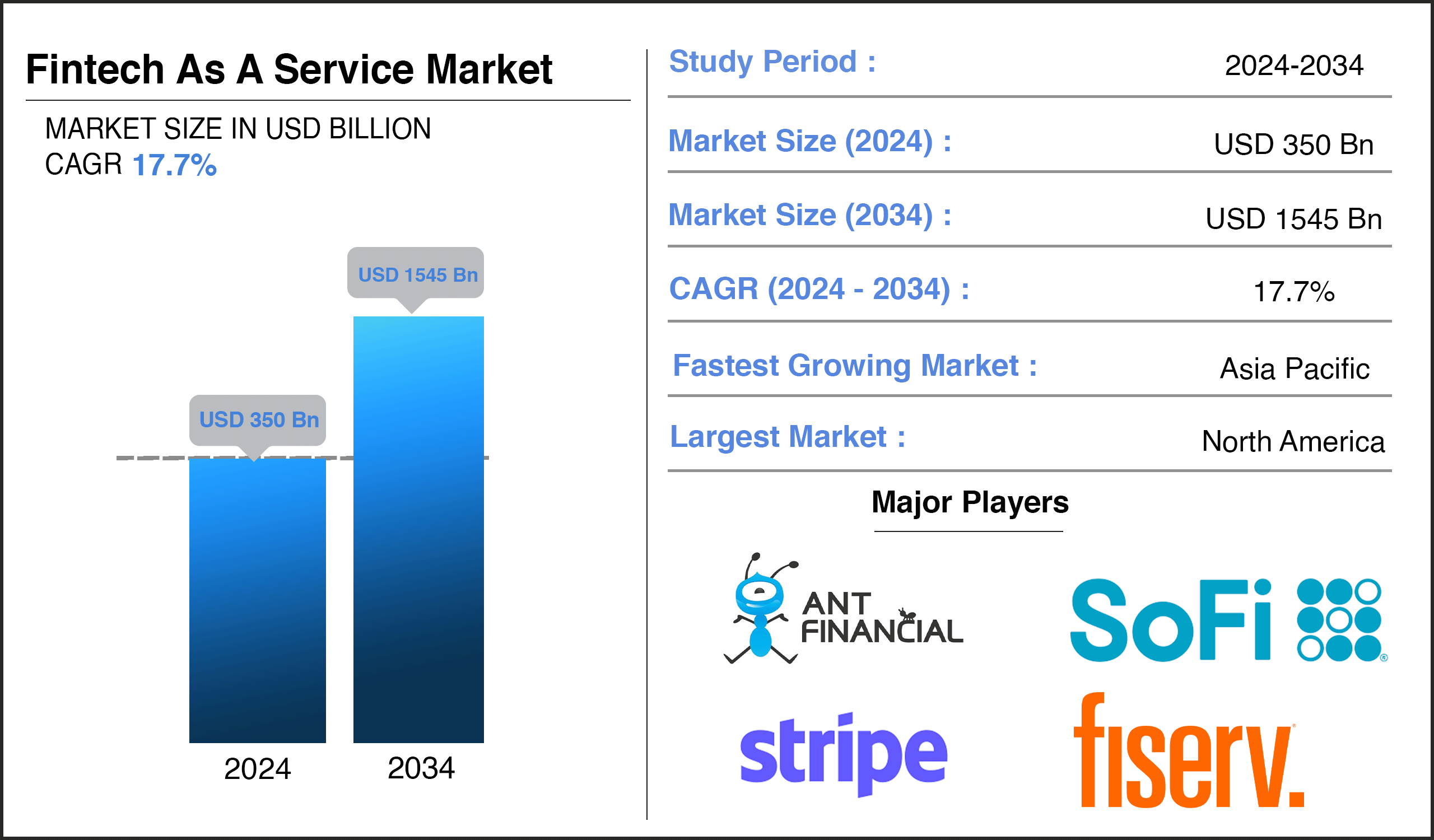

Covina, Sept. 04, 2024 (GLOBE NEWSWIRE) -- According to Prophecy Market Insights, the global fintech as a service [FaaS] market size and share is poised to expand from USD 350 Billion in 2024 to USD 1545 Billion by 2034, marking a compound annual growth rate (CAGR) of 17.7% over the next decade.

Fintech As A Service Market Report Overview

- What is Fintech As A Service [FaaS]?

Fintech As A Service is a rapidly emerging model that enables businesses, regardless of their industry, to integrate financial technology solutions into their operations through a cloud-based, API-driven framework. FaaS provides a wide range of financial services, including payments, lending, insurance, wealth management, and compliance, all delivered as modular, customizable services.

This approach allows companies to offer financial products without needing to build their infrastructure from scratch, significantly reducing time-to-market and operational costs. The FaaS model is transforming how financial services are delivered and consumed, empowering non-financial enterprises to offer seamless financial solutions to their customers.

Download a Free Sample Research Report with Latest Industry Insights: https://www.prophecymarketinsights.com/market_insight/Insight/request-sample/5596

Our Free Sample Report includes:

- Overview & introduction of market study

- Revenue and CAGR of the market

- Drivers & Restrains factors of the market

- Major key players in the market

- Regional analysis of the market with a detailed graph

- Detailed segmentation in tabular form of market

- Recent developments/news of the market

- Opportunities & Challenges of the Market

Competitive Landscape:

The Fintech as a Service market is marked by swift growth, continuous technological innovation, and intense competition. Companies are broadening their global reach, emphasizing sustainability, and diversifying their service portfolios to maintain a competitive edge.

Some of the Key Market Players:

- Square, Inc.

- PayPal Holdings, Inc.

- Fiserv, Inc.

- Stripe, Inc.

- Adyen N.V.

- Plaid Inc.

- Tink

- SoFi Technologies, Inc.

- LendingClub Corporation

- Chime Financial, Inc.

- Revolut Ltd.

- Robinhood Markets, Inc.

- Ant Financial

- N26 GmbH

To Know More on Additional Market Players, Download a Free Sample Report Here: https://www.prophecymarketinsights.com/market_insight/Insight/request-pdf/5596

Analyst View:

The market for fintech as a service is expanding quickly as companies from many sectors realize how beneficial it is to include financial services in their products and services. The industry is growing because more people are using cloud computing APIs are being widely used, and people want seamless, customer-focused financial solutions.

Market Dynamics:

Drivers:

Increasing Adoption of Cloud-Based Solutions

- Cloud computing's broad use is a major factor propelling the target market. Fintech services may be provided with great scalability, flexibility, and lower costs thanks to cloud-based infrastructure, which also makes it simpler for companies to integrate and implement financial solutions.

Request for a Discounted Price on this Report @ https://www.prophecymarketinsights.com/market_insight/Insight/request-discount/5596

Market Trends:

Proliferation of APIs and Open Banking

- The rise of Application Programming Interfaces (APIs) and open banking initiatives are critical trends driving the target market. APIs enable easy integration of fintech services into existing systems, allowing businesses to offer a wide range of financial products and services quickly.

Segmentation:

Fintech As A Service Market is segmented based on Type, Technology, Application, and Region.

Type Insights

- Payments is anticipated to boost the growth for target market as this segment includes a broad range of services such as digital wallets, online payment gateways, mobile payment solutions, and cross-border payment platforms.

Technology Insights

- API is anticipated to boost the growth for target market as enable fintech companies to innovate rapidly by leveraging existing financial infrastructures and services. They allow businesses to scale their offerings quickly by adding new functionalities, such as payment processing or identity verification, through API integrations.

Application Insights

- Customer onboarding & account management is anticipated to boost the growth for target market as the onboarding process is often the first interaction a customer has with a financial service provider, making it a vital aspect of customer retention and satisfaction. Fintech companies prioritize seamless onboarding experiences to minimize friction, reduce dropout rates, and enhance customer loyalty.

Request a Customized Copy of Report @ https://www.prophecymarketinsights.com/market_insight/Insight/request-customization/5596

Recent Development:

- In June 2024, A number of Asia-Pacific nations, such as Singapore and Japan, have extended their open banking policies with the aim of promoting increased competition and innovation within the financial services sector. The extension makes banking data more accessible to third-party FaaS providers, which is a trend that encourages the development of new digital financial services and products.

Regional Insights

- North America: Services like fraud monitoring, data analytics, and customer onboarding are in great demand as businesses look to improve efficiency, maintain compliance, and provide individualized financial services. The region's strict regulatory framework has also changed to accommodate the development of fintech services, which has fuelled industry expansion even more.

- Asia Pacific: This region is gaining significant traction in the target market due to its swift acceptance of new technologies, substantial unbanked population, and robust drive towards digital financial inclusion. Due to rising smartphone usage and the emergence of digital payment channels, nations like China, India, and Southeast Asia are leading the way in this expansion.

Browse Detail Report on "Fintech As A Service Market Size, Share, By Type (Banking, Payments, Insurance, Investments, Lending, Accounting, Wealth management), By Technology (AI & ML, Blockchain, RPA, API, Big data), By Application (Fraud Monitoring, KYC Verification, Compliance & Regulatory Support, Data Analytics and Insights, Customer Onboarding & Account Management, Money management, Real estate mortgage services), and By Region - Trends, Analysis, and Forecast till 2034" with complete TOC @ https://www.prophecymarketinsights.com/market_insight/fintech-as-a-service-market-5596

Browse More Research Reports:

- AI Avatars Market Size & Share Research Report, 2024-2034

- Generative AI in Cybersecurity Market Size & Share Research Report, 2024-2034

- AdTech Market Size & Share Research Report, 2024-2034

- 5G NTN Market Size & Share Research Report, 2024-2034

- Online Poker Market Size & Share Research Report, 2024-2034

About Us:

Prophecy Market Insights is a specialized market research, analytics, marketing and business strategy, and solutions company that offer strategic and tactical support to clients for making well-informed business decisions and to identify and achieve high value opportunities in the target business area. Also, we help our client to address business challenges and provide best possible solutions to overcome them and transform their business.

Prophecy’s expertize area covers products, services, latest trends, developments, market growth factors, and challenges along with market forecast in various business areas such as Healthcare, Pharmaceutical, Biotechnology, Information Technology (IT), Automotive, Industrial, Chemical, Agriculture, Food and Beverage, Energy, and Oil and Gas. We also offer various other services such as, data mining, information management, and revenue enhancement suggestions.

Contact Us:

Prophecy Market Insights

US: 964 E. Badillo Street

#2042 Covina,

CA 91724

US toll-free: +1 860 531 2574

Rest of World: + 91 7775049802

Follow us on LinkedIn | Twitter