New York, Sept. 05, 2024 (GLOBE NEWSWIRE) -- Overview:

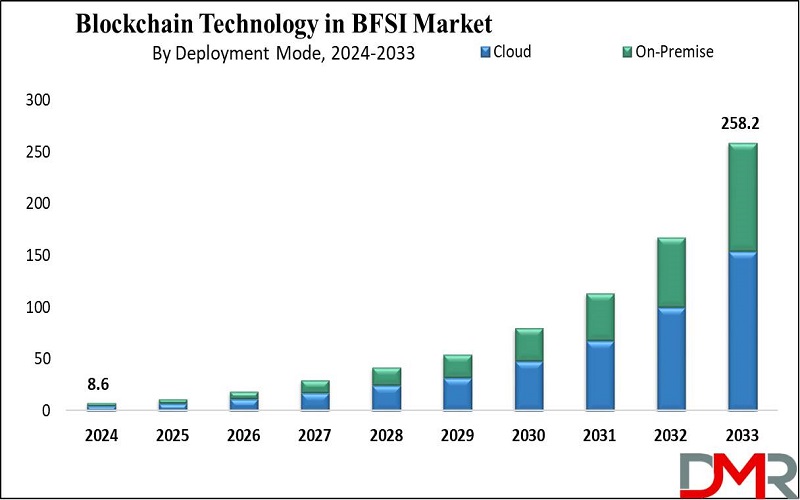

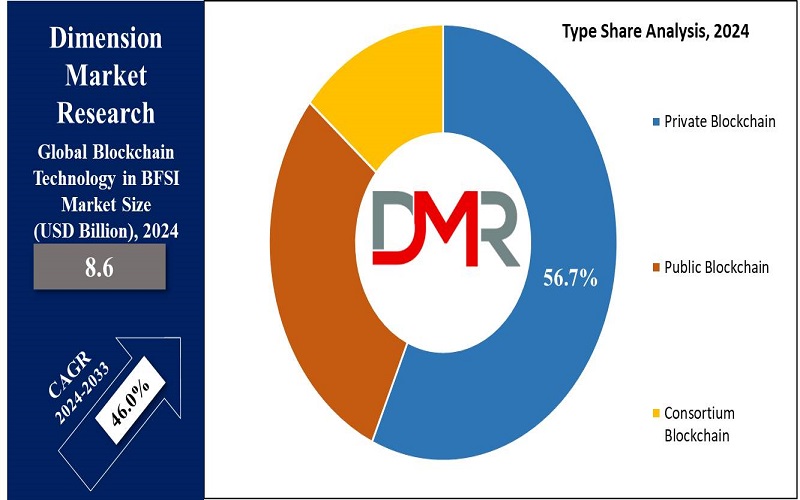

The Global Blockchain Technology in BFSI Market size is expected to reach USD 8.6 billion by 2024 and is further anticipated to reach USD 258.2 billion by 2033 according to Dimension Market Research. The market is anticipated to register a CAGR of 46.0%% from 2024 to 2033.

Blockchain technology is transforming the Banking, Financial Services, and Insurance (BFSI) sector by improving security, transparency, and operational efficiency. It assists cryptocurrencies and applications like smart contracts, identity management, & fraud prevention.

The global blockchain market in BFSI is expanding largely due to the adoption of distributed ledger technology, which minimizes fraud, streamlines processes, and lowers operational costs. Key growth drivers include the need for efficient business processes, secure transaction platforms, and regulatory changes favoring digital ledger technologies.

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/blockchain-technology-in-bfsi-market/

The US Overview

In the US, the Blockchain Technology in BFSI Market is expected to reach USD 2.9 billion in 2024 at a CAGR of 43.0% over the forecast period of 2024 to 2033

Further US BFSI market provides growth opportunities for blockchain through advanced digital identity management, asset tokenization, & the demand for secure, transparent transactions. Adoption is driven by efficiency needs & regulatory changes favoring digital ledgers.

However, regulatory uncertainty and integration challenges with legacy systems impact the implementation, requiring significant resources and causing hesitation.

Important Insights

- The Blockchain Technology in BFSI Market is expected to grow by USD 246.1 billion by 2033 from 2025 with a CAGR of 46.0 %.

- The private blockchain segment is anticipated to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- The cloud segment is expected to dominate the Blockchain Technology in BFSI Market in 2024.

- The Banking Sector is expected to have the largest revenue share in 2024 in the Blockchain Technology in the BFSI market.

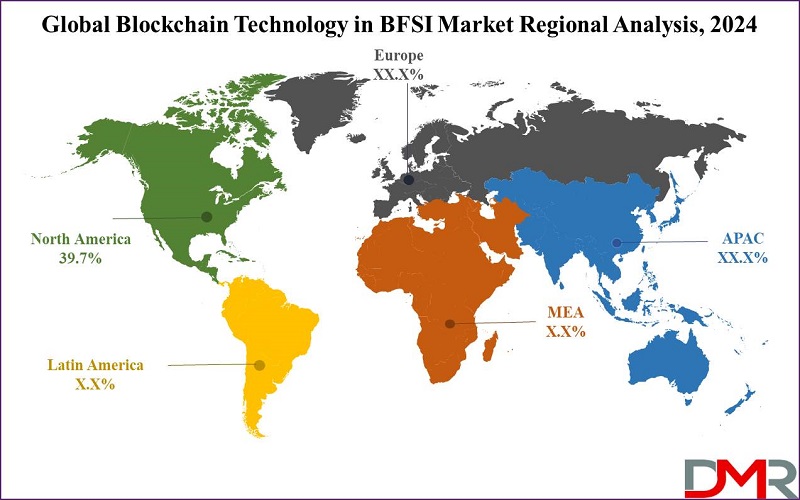

- North America is anticipated to hold a 39.7% share of revenue in the Global Blockchain Technology in BFSI Market in 2024.

Global Blockchain Technology in BFSI Market: Trends

- Central Bank Digital Currencies (CBDCs): Various central banks are exploring or piloting digital currencies using blockchain to modernize financial systems.

- DeFi Integration: Decentralized Finance (DeFi) platforms are gaining popularity, providing traditional financial services like lending & borrowing without intermediaries.

- Tokenization of Assets: Real-world assets like real estate and commodities are being tokenized, making them more accessible & liquid.

- Interoperable Blockchains: Efforts to enhance interoperability between different blockchain platforms are mostly, aiming to create a more unified and functional blockchain ecosystem.

Blockchain Technology in BFSI Market: Competitive Landscape

The BFSI blockchain market is characterized by strong innovation & fast adoption. Financial institutions are partnering with tech startups & investing in blockchain development to improve services.

The market evolves with developments in security, scalability, and compliance, as companies develop customized solutions for fraud prevention, transaction transparency, and operational efficiency, fueling growth in this sector.

Some of the major players in the market include IBM, Accenture, Microsoft, SAP, Oracle, and more.

Some of the prominent market players:

- IBM

- Accenture

- Microsoft

- SAP

- Oracle

- Amazon Web Services

- JP Morgan Chase

- Auxesis Group

- Bitfury Group

- AlphaPoint

- Other Key Players

Transform your business approach with strategic insights from our report. Get in touch to request our brochure today! : https://dimensionmarketresearch.com/report/blockchain-technology-in-bfsi-market/download-reports-excerpt/

Blockchain Technology in BFSI Market Scope

| Report Highlights | Details |

| Market Size (2024) | USD 8.6 Bn |

| Forecast Value (2033) | USD 258.2 Bn |

| CAGR (2024-2033) | 46.0% |

| The US Market Size (2024) | USD 2.9 Bn |

| Percentage of Revenue Share by Leading Region | 39.7% |

| Historical Data | 2018 - 2023 |

| Forecast Data | 2025 - 2033 |

| Base Year | 2023 |

| Estimate Year | 2024 |

| Segments Covered | By Component, By Technology, By Application |

| Regional Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Global Blockchain Technology in BFSI Market: Driver

- Enhanced Security: Blockchain provides a secure & tamper-proof ledger, minimizing fraud and growing trust in financial transactions.

- Cost Efficiency: By automating processes & eliminating intermediaries, blockchain reduces operational costs & increases efficiency.

- Improved Transparency: Blockchain's decentralized nature ensures all participants have access to the same data, promoting transparency & reducing disputes.

- Faster Transactions: Blockchain technology allows faster settlement times in comparison to traditional banking systems, improving customer experience and liquidity management.

Global Blockchain Technology in BFSI Market: Restraints

- Regulatory Uncertainty: Changes in regulations across regions create challenges in the broader adoption of blockchain technology.

- Scalability Issues: Current blockchain solutions often struggle with processing high volumes of transactions effectively.

- High Initial Costs: Implementing blockchain technology needs significant investment in infrastructure & expertise.

- Interoperability Challenges: Integrating blockchain with current systems & other blockchains can be complex and problematic.

Global Blockchain Technology in BFSI Market: Opportunities

- Cross-border Payments: Blockchain can streamline & minimize the costs of international transactions, making cross-border payments faster & more efficient.

- Smart Contracts: Automating contract execution through smart contracts can lower legal costs & increase transaction efficiency.

- Identity Verification: Blockchain can improve KYC (Know Your Customer) processes by providing secure, immutable identity verification.

- Trade Finance: Blockchain can simplify & secure trade finance transactions, minimizing fraud and improving trust among trade partners.

Segment Analysis:

The Private Blockchain segment is expected to lead the BFSI market in 2024 due to its superior security & privacy features, critical for handling sensitive financial data with strict access control. Private blockchains, processing transactions among a limited number of participants, reduce risks & offer scalability and efficiency.

They handle high transaction volumes quickly, meet regulatory compliance needs, and provide tailored solutions for institutions. Their use in improving payment systems & securing insurance data drives growth, with scalability, privacy, and regulatory alignment continually supporting their market dominance.

Purchase the Competition Analysis Dashboard Today: https://dimensionmarketresearch.com/checkout/blockchain-technology-in-bfsi-market/

Blockchain Technology in BFSI Market Segmentation

By Type

- Public Blockchain

- Private Blockchain

- Consortium Blockchain

By Deployment Mode

- Cloud

- On-Premise

By Application

- Smart Contracts

- Security

- Digital Currency

- Trade Finance

- Record Keeping

- GRC Management

- Identity Management & Fraud Detection

By End User

- Banks

- Insurance

- Non-banking Financial Companies (NBFC)

Regional Analysis

North America is expected to lead the blockchain technology market in BFSI with a 39.7% share in 2024, driven by its advanced tech infrastructure, rapid adoption, and major financial and tech players. The US & Canada are leading the initiatives & investments in blockchain.

Further, Asia Pacific is emerging rapidly due to fast digitalization, supportive policies, &a strong fintech sector in countries like Japan, China, South Korea, and Singapore. Moreover, the EU (European Union) is also growing, with proactive regulation and fintech innovation in the UK, Germany, France, and Switzerland enhancing blockchain adoption.

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/blockchain-technology-in-bfsi-market/

By Region and Countries

By Region and Countries

North America

- The U.S.

- Canada

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Recent Developments in the Blockchain Technology in BFSI Market

- June 2024: Metallicus, the core developer of Metal Blockchain announced OneAZ Credit Union's enrollment in its Banking Innovation Program, which signifies OneAZ Credit Union's proactive approach to inspecting blockchain technology's potential & harnessing Metallicus' expertise to reduce its technological prowess.

- February 2024: The Reserve Bank of India (RBI) announced a detailed framework for a ‘regulatory sandbox’ that will provide a safe & protected environment for innovative fintech startups to test their product hypothesis before taking it to the market.

- December 2023: The Indian government announced that the Indian Banks' Digital Infrastructure Corporation (IBDIC) is considering implementing block letters of credit (LC) issuance to provide a framework for digital exploration, delivery, and implementation.

- September 2023: Citi launched Citi Token Services, which will tokenize clients’ deposits so they can be sent anywhere in the world instantly. With the new service, “if it’s … 5:00 p.m. in the U.S. and 5:00 a.m. in Singapore, one can send that immediately, within seconds.

- June 2023: JPMorgan unveiled that it will test the use of blockchain technology for the provision of dollar-based settlement services for Indian financial institutions. Dollar payments in India are usually made via the Swift messaging system through Nostro accounts held at US-based banks.

- April 2023: SEB & Crédit Agricole CIB launched so|bond, a “sustainable and open” platform for digital bonds built on blockchain technology.

Browse More Related Reports

- Stealth Technology market is projected to reach USD 47.4 billion in 2024 and grow at a compound annual growth rate of 7.0% from there until 2033 to reach a value of USD 86.8 billion.

- Remote Sensing Technology market is projected to reach USD 24.9 billion in 2024 and grow at a compound annual growth rate of 19.7% from there until 2033.

- Process Analytical Technology Market size is expected to be valued at USD 4.1 billion in 2024, and it is further expected to reach a market value of USD 13.8 billion by 2033 at a CAGR of 14.3%.

- Gi-Fi Technology market is projected to reach USD 1.4 billion in 2024 and grow at a compound annual growth rate of 14.9% from there until 2033 to reach a value of USD 4.8 billion.

- Automotive Battery Thermal Management System Market is projected to reach USD 3.5 billion in 2024 and grow at a compound annual growth rate of 21.7% from there until 2033 to reach a value of USD 20.7 billion.

- 5G Technology ROI market is projected to reach USD 60.6 billion in 2024 and grow at a compound annual growth rate of 128.9% from there until 2033 to reach a value of USD 104,834.4 billion.

- Smart Grid Analytics Market is projected to reach a value of USD 8.2 billion in 2024, and it is further anticipated to reach a market value of USD 24.2 billion by 2033 at a CAGR of 12.9%.

- Pervasive Computing Technology Market is projected to reach a value of USD 861.8 million in 2024, and it is further anticipated to reach a market value of USD 5,072.5 million by 2033 at a CAGR of 21.8%.

- Next-Generation Display Market was valued at USD 228.3 billion in 2023, and it is further anticipated to reach a market value of USD 650.4 billion by 2033 at a CAGR of 11.0%.

- Curved Televisions Market reached a value of USD 8.7 billion in 2023, and it is further anticipated to reach a market value of USD 74.9 billion by 2033 at a CAGR of 23.9%.

About Dimension Market Research (DMR):

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts into work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world.

We also believe that our clients don’t always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.