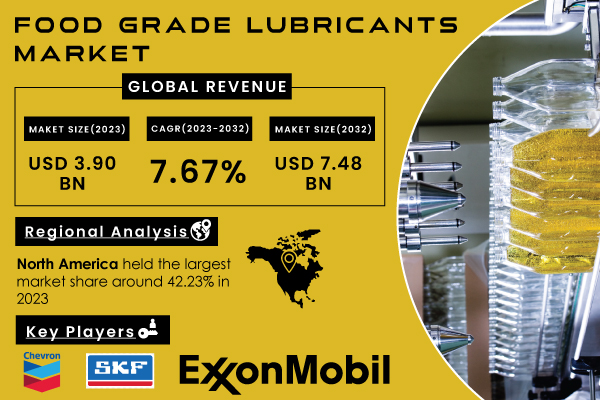

Austin, Sept. 10, 2024 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that The Food Grade Lubricants Market size is projected to reach USD 7.48 billion by 2032 and grow at a CAGR of 7.67% over the forecast period of 2024-2032.

Increased Focus on OEM Partnerships Drive Market Growth.

OEM partnerships have become increasingly focus for the Food Grade Lubricants market. New engineering solutions require a closer bond between equipment manufacturers and lubricant OEMs. In particular, driving efficiency through enhanced interactions between OEMs and equipment manufacturers is necessary. As a result, the level of interactions between equipment manufacturers and lubricant OEMs will increase. Large lubricant OEMs, such as Dow Chemical or ExxonMobil, are already collaborating with OEMs to create food-grade lubricants that seek to enhance the safety and life span of food production equipment.

Several recent examples confirm the growing importance of these partnerships. For example, in 2023, Dow Chemical partnered with prominent food processing equipment OEMs to develop a new generation of food-grade lubricants. The purpose of the initiative was to meet the rapidly changing regulatory and operational requirements of the food industry. ExxonMobil’s interactions with key OEMs, in this regard, resulted in the development and promotion of new lubrication solutions, which met the Food and Drug Administration’s latest requirements, that lubricants must be safe for incidental food contact.

Request Sample Report of Food Grade Lubricants Market 2024 @ https://www.snsinsider.com/sample-request/1703

Key Players:

- Chevron Corporation

- Kluber SKF

- Exxonmobil Corporation

- Total Energies SE

- BP plc.

- Lubrication Munchen SE & Co. KG

- Petro-Canada Lubricants Inc.

- FUCHS Petrolub AG

- The DOW Chemical Company And Illinois Tools Works Inc.

Technological progress in the field of lubricant production has notably influenced such performance characteristics as longevity, temperature stability, and safety. As a direct result, food processing companies are rapidly switching to products that can enhance the efficiency of performance. Some of the most recent developments in the field are aimed at enhancing the efficiency and safety of the food grade lubricants.

In 2023, SKF, for instance, launched a new series of high-performance food-grade lubricants with a new advanced synthetic formulation. The given tool can be viewed as a high-end solution due to its impressive stability at extremely low and high temperatures. As a result, it contributes to extending the longevity of the equipment used by the companies and reduce the level of maintenance needed.

In early 2024, Klüber Lubrication has released the new improved product of the food grade lubricants series that can be characterized by an extremely safe profile. The company has developed a new line of products that can be safely used in case of incidental contact with food, meeting the most stringent regulations applicable to the spheres.

Thus, the new technological solutions serve to ensure the maximum level of efficiency and in the meantime compliance with continually growing safety standards. In such a way, more and more food processing companies prefer to switch to new possible solutions as food grade lubricants, as they allow to rely on products that are more stable, longer lasting, and safer.

Food Grade Lubricants Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.90 Billion |

| Market Size by 2032 | US$ 7.48 Billion |

| CAGR | CAGR of 7.67% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By type (Synthetic Oil, Mineral Oil, Bio-based) • By application (Food, Beverages, Pharmaceuticals & Cosmetics, Others) • By Form (Oil, Grease) • By Grade (H1, H2, H3) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| DRIVERS | • The food and beverage industry's expansion. • Food safety regulations are very strict. |

If You Need Any Customization on Food Grade Lubricants Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/1703

Segmentation Analysis

By Production Technology

In 2023, synthetic oil held the largest market share around 46.23% in 2023. The market is dominated by synthetic oils, the most promising for use or varied operating conditions thus, polyalphaolefins and polyethylene glycols. It shows a significant superiority to mineral and plant oils. It has excellent thermal stability, low volatility, and high resistance to oxidation, which allows it to be used in especially difficult conditions, for example, in the food industry. The most valuable properties as lubricants, but also are resistant to water, which is especially important under the conditions of a food production.

By Form

Grease is currently leading over oil, primarily due to its superior performance in various applications within the food processing industry. Grease is preferred because of its ability to stay in place and provide continuous lubrication in high-load, high-pressure environments, which are common in food processing machinery. Its thicker consistency and adhesive properties make it ideal for applications where lubricants are subject to heavy loads and where oil might not stay in place or could drop off, leading to potential contamination issues.

By Grade

In the food-grade lubricants market, H1-grade lubricants are leading due to their stringent safety and compliance requirements. H1 lubricants are specifically formulated for incidental food contact, meaning they are designed for use in areas where direct contact with food may occur, although they are not intended to intentionally mix with food. This stringent certification is essential for maintaining high safety standards in the food processing industry, where even minimal contamination risks must be meticulously managed.

Regional Landscape:

North America is the leading region in the food-grade lubricants market and held the largest market share around 48.26% in 2023. The food-grade lubricants market prevails due to a combination of stringent regulatory standards, a long-established food processing industry, and a demand for high-quality safety compliance. While the United States accounts for the majority of the regional market, it is specifically because of the country’s Food and Drug Administration safety regulations. As per the FDA standards, the U.S. comprises areas in food processing where lubricants must be used that are safe for incidental contact with food. Given these specific requirements for utilizing food-grade lubricants for safety reasons, the U.S. will only continue to require more advanced quality products to remain compliant.

Recent dynamics also demonstrate that the overall market in North America is setting in, such as the announcement earlier in 2023 by Exxon Mobil and Dow Chemical that they have made new, innovative lubricants to comply with the latest FDA requirements. Thus, the current regulatory focus and the already vast industrial sector in the U.S. mark that the demand for food-grade lubricants will increase.

Buy Full Research Report on Food Grade Lubricants Market 2024-2032 @ https://www.snsinsider.com/checkout/1703

Recent Developments

- In 2024, Dow Chemical introduced an improved series of food-grade lubricants featuring advanced synthetic and bio-based formulations. These products are designed to offer enhanced stability and performance while adhering to the latest safety standards.

- In 2023, Klüber Lubrication expanded its portfolio with a new line of food-grade greases that offer exceptional resistance to washout and high-temperature stability. This development addresses the need for reliable lubrication in harsh environments, improving both machinery efficiency and compliance with food safety regulations.

Key Takeaways:

- H1-grade lubricants, specifically designed for incidental food contact, dominate the market due to stringent food safety regulations by authorities like the FDA and EFSA.

- North America holds the largest market share, driven by stringent regulatory standards, a well-established food processing industry, and strong demand for compliant products.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Food Grade Lubricants Market Segment, By Type

9. Food Grade Lubricants Market Segment, By Application

10. Food Grade Lubricants Market Segment, By Form

11. Food Grade Lubricants Market Segment, By Grade

12. Regional Analysis

13. Company Profile

14.Competitive Landscape

15. Conclusion

Access Complete Report Description of Food Grade Lubricants Market Report 2024-2032 @ https://www.snsinsider.com/reports/food-grade-lubricants-market-1703

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain