Pune, Sept. 10, 2024 (GLOBE NEWSWIRE) -- Diabetes Devices Market Size Analysis:

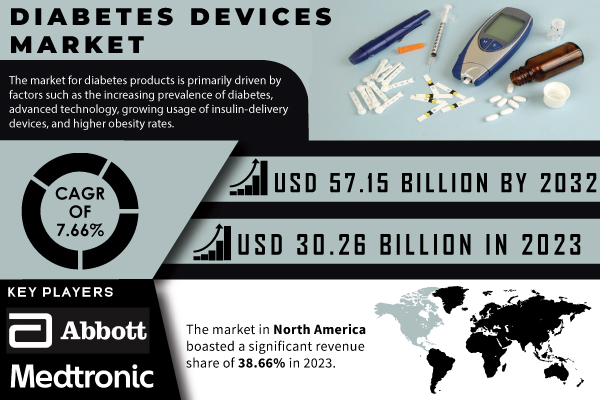

“According to SNS Insider, The Diabetes Devices Market Size was valued at USD 30.26 Billion in 2023 and is expected to reach USD 57.15 Billion by 2032 and grow at a CAGR of 7.66% over the forecast period 2024-2032.”

The market is expanding due to the rising proliferation of diabetes caused by aging, obesity, and poor lifestyle tendencies. Obesity is a huge contributor to the development of diabetes. According to the National Center for Biotechnology Information of October 2023, at the current rate, by 2035, about half or more of the global population will be overweight or obese. Most of the new diabetes type identified is type 2, and the causal agents are associated with changes in obesity and dietary cessations. The current risk multipliers such as overweight and obesity are causing diabetes to increase. As such, depression in blood and urine sugar, smoking, and high cholesterol levels are projected to increase the prevalence of diabetes, thus spurring the demand for diabetes devices.

Get a Sample Report of Diabetes Devices Market@ https://www.snsinsider.com/sample-request/3159

Key Diabetes Devices Companies:

- Medtronic plc

- Abbott Laboratories

- F.Hoffmann-La-Ltd.

- Bayer AG

- Lifescan, Inc.

- B Braun Melsungen AG

- Lifescan, Inc.

- Dexcom Inc.

- Insulet Corporation

- Ypsomed Holdings

- Companion Medical

- Sanofi

- Valeritas Holding Inc.

- Novo Nordisk

- Arkray, Inc.

The diabetic device manufacturers are looking to enlarge due to the high population of the elderly, availability of affordable healthcare, inexpensive labor, and non-rigorous regulatory structures. The designers are mainly concentrating on taking care of the market by discovering markets in underdeveloped countries. The need for diabetic devices is expanding by the new technologies, which are difficult to obtain given the health needs currently being experienced. For example, in December 2021, a company, a major player in the market, launched new glucose monitors. Many large companies are investing in creating devices and developing new technologies to seize a significant share of the market. For example, in June 2022, Abbott published a novel continuous monitoring glucose and ketones system from the innovative bio-wearing device.

Diabetes Devices Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 30.26 Billion |

| Market Size by 2032 | US$ 57.15 Billion |

| CAGR | CAGR of 7.66% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Segmentation Dynamics

The hospital pharmacies segment led based on the distribution channel, accounting for the largest revenue share of 54% in 2023 as a result of a large number of footprints and product availability. Inpatients and outpatients are the two types of pharmacies operational in the hospitals. The monitoring of continuous glucose is also expanding in hospitals as the use of these devices has become increasingly popular for continuous blood glucose level monitoring of outpatients as well as devices for the monitoring of ICU patients. As a result, these devices are being increasingly used in the hospital and are primarily distributed by the pharmacies that are affiliated with the hospitals.

The retail pharmacies segment is expected to witness the fastest CAGR over the forecast period, as they are the most convenient buying options for patients. Products dispensed by the retail pharmacies to the patients include medication, self-monitoring glucose supplies, insulin delivery tools, and OTC products. The retail pharmacist holds diabetes devices based on factors, which include physician preference, patient preference, profit margin, and insurance coverage.

Do you have any specific queries or need any customization research on Diabetes Devices Market, Enquire Now@ https://www.snsinsider.com/enquiry/3159

Diabetes Devices Market Key Segmentation:

By Type

- Blood Glucose Monitoring Devices

- Continuous Glucose Monitoring Devices

- Insulin Delivery Devices

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Diabetes Clinics/Centers

- Online Pharmacies

- Others

By End-Use

- Hospitals

- Homecare

- Diagnostic Centers

Regional Insights

The European market for diabetes devices is projected to experience a significant compound annual growth rate (CAGR) in the coming years due to the rising prevalence of diabetes and increased awareness of diabetes management and prevention. The top five countries in Europe with a high prevalence of diabetes are the Russian Federation, Germany, Turkey, Spain, and Italy. One of the key players in the market is Medtronic plc, which recently received approval for its latest continuous glucose monitor in Europe in October 2023. Other major players in the region include Hoffmann-La Roche AG, Ypsomed AG, and Insulet Corporation. Ypsomed AG is a major distributor of insulin pumps and auto-injectors in Europe.

In the UK, approximately 99.5% of the turnover in the diabetes devices market comes from small- and medium-sized companies. The UK is known for providing quality solutions, and it is expected that in-house manufactured medical devices will experience significant growth over the forecast period. Major companies operating in the market include F. Hoffmann-La Roche Ltd., Lifescan, Inc., Dexcom, Inc., Abbott Laboratories, and others. These companies are employing various strategies to secure a substantial market share. For instance, Dexcom, Inc. has announced the launch of the Dexcom G7 in Germany, Austria, Ireland, the UK, and Hong Kong.

Recent Developments

- In May 2023, Medtronic agreed to acquire EOFlow, a manufacturer of insulin devices. This acquisition is expected to enhance Medtronic's ability to serve more people with diabetes by combining EOFlow's technology with Medtronic's Meal Detection Technology algorithm and advanced CGM.

- In July 2023, CharmHealth and Bioverge confirmed their joint investment in a startup called My Diabetes Tutor, which focuses on improving the lifestyles of patients diagnosed with diabetes.

Key takeaways:

- The hospital pharmacies segment accounts for 54% of the total revenue in 2023, with a growing demand for CGMs among both in-patients and out-patients.

- The increasing prevalence of diabetes is driving a lucrative Compound Annual Growth Rate (CAGR) in Europe, particularly in countries like Germany, Russia, Turkey, and Spain.

Buy a Single-User PDF of Diabetes Devices Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/3159

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

- Incidence and Prevalence (2023)

- Prescription Trends, (2023), by Region

- Device Volume: Type and usage volumes of pharmaceuticals.

- Healthcare Spending: Expenditure data by government, insurers, and out-of-pocket by patients

6. Competitive Landscape

7. Diabetes Devices Market Segmentation, by Type

8. Diabetes Devices Market Segmentation, by Distribution Channel

9. Diabetes Devices Market Segmentation, by End-Use

10 Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Details of Diabetes Devices Market Outlook 2024-2032@ https://www.snsinsider.com/reports/diabetes-devices-market-3159

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.