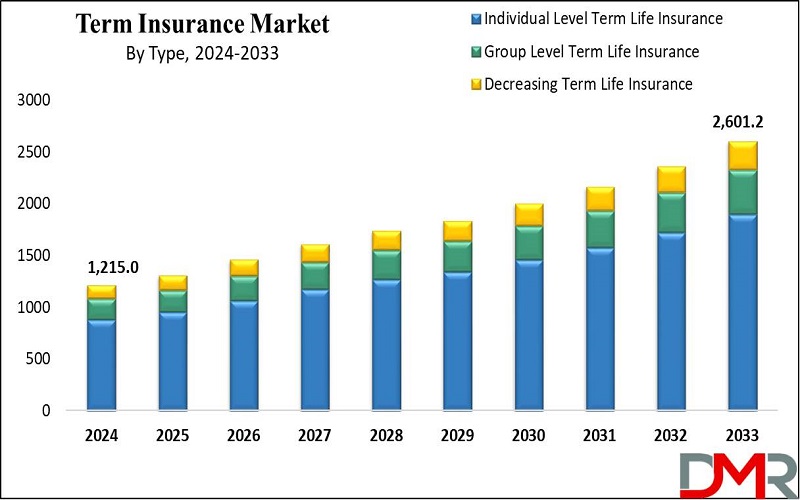

New York, Sept. 10, 2024 (GLOBE NEWSWIRE) -- The Global Term Insurance Market size is expected to reach USD 1,215.0 billion by 2024 and is further anticipated to reach USD 2,601.2 billion by 2033 according to Dimension Market Research. The market is anticipated to register a CAGR of 8.8% from 2024 to 2033.

Term insurance, a fundamental life insurance type, provides coverage for a specific duration at fixed premiums, giving affordable protection with assured death benefits to beneficiaries upon the insured's demise.

Many types include level and less-term policies, with premiums determined by age, health, and mortality rates. Also, InsurTech integration improves operational efficiency, cost reduction, and innovation in terms of insurance provision.

Individual-level term life insurance maintains its dominance in the global market and is also set to lead in 2024 by providing personalized coverage for 10 to 30 years, with premiums customized to factors like health & age.

The increase in demand for customized protection drives its steady growth. Group-level term insurance, catering to specific groups like company employees, is expected to significantly expand due to its collective coverage model, affordability, and ease of enrollment.

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/term-insurance-market/request-sample/

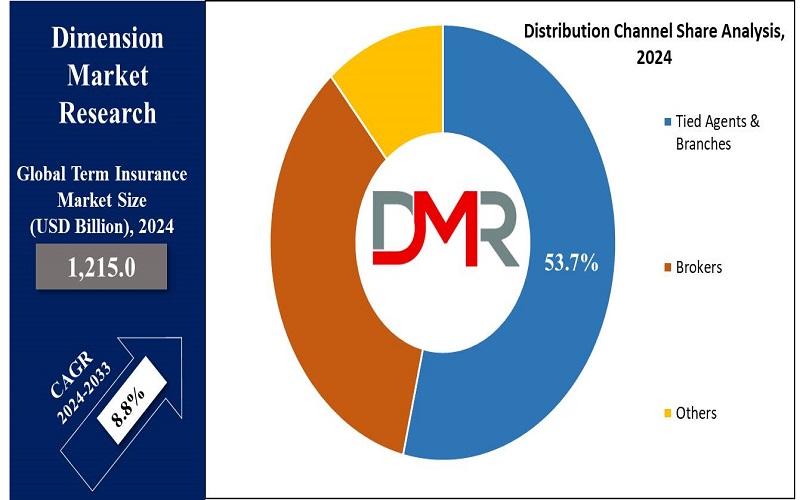

Tied agents & branches as distribution channels are anticipated to uphold their dominance in 2024 in the term insurance market contributing substantially to revenue. Tied agents, providing a single insurer, excel in personalized service & brand loyalty, fostering client trust. Meanwhile, brokers are also expected to have significant expansion, providing impartial advice and diverse product options, meeting consumer demands for customization and competitive pricing.

Important Insights

- The Term Insurance Market is expected to grow by USD 1,215.0 billion by 2033 from 2024 with a CAGR of 8.8% during the same forecasted period i.e. 2025 to 2033.

- Individual term life insurance is expected to lead in 2024 with personalized coverage for 10-30 years, while group term insurance is set to grow due to collective coverage and affordability.

- Tied agents & branches will maintain dominance in term insurance distribution, providing personalized service, while brokers expand, meeting diverse consumer needs.

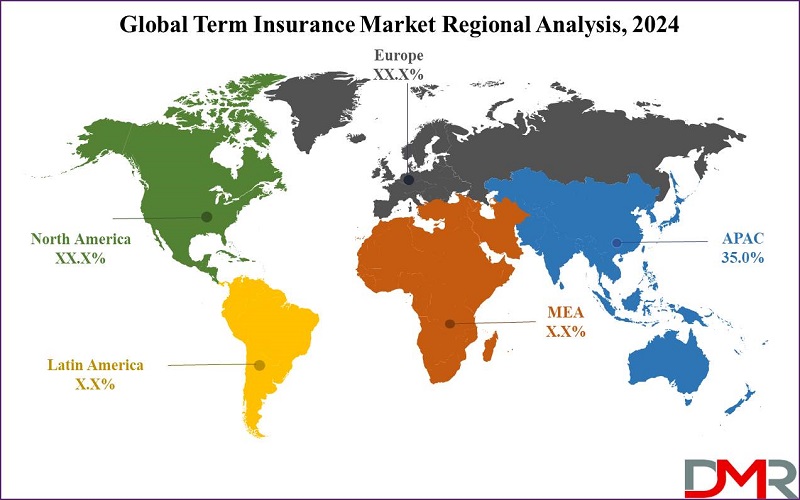

- Asia Pacific is expected to lead term insurance market growth, contributing over 35% of revenue by 2024, due to factors like population size, rising awareness, and supportive policies.

Global Term Insurance Market: Growth Drivers & Trends

- Increasing Awareness and Demand: Growing awareness about financial security and risk management has led to an increased demand for term insurance globally. Consumers are becoming more conscious of the need for protection against unforeseen events, such as premature death, which drives the uptake of term insurance policies.

- Digitalization and Insurtech Innovation: Technological developments and the rise of Insurtech companies have changed the insurance industry, making it smooth for customers to look into and purchase term insurance policies online. Digital platforms offer convenience, transparency, and personalized solutions, attracting a wider customer base and driving market growth.

- Emerging Markets and Middle-Class Expansion: Economic development in emerging markets, along with the expansion of the middle class, has driven the growth of the term insurance market. As disposable incomes rise, individuals look to safeguard their families' financial futures, leading to a higher uptake of term insurance products in these regions.

- Changing Demographics and Aging Population: Population aging, mainly in developed economies, has developed a greater need for life insurance products, like term insurance. As individuals age, they become more aware of mortality risks & the need to leave a financial legacy for their loved ones, driving the need for term insurance coverage.

- Regulatory Support and Market Liberalization: Favorable regulatory environments & market liberalization initiatives in various countries have supported the expansion of the term insurance market. Governments & regulatory bodies often launch policies to encourage insurance penetration, improve consumer protection, & promote competition among insurers, which ultimately drives market growth.

- Product Innovation and Customization: Insurers are constantly innovating and customizing term insurance products to meet changing customer needs and preferences. Features like flexible coverage options, riders for critical illness or disability, and the ability to change to permanent insurance policies provide added value to customers, driving adoption & market growth.

Term Insurance Market: Competitive Landscape

In the global term insurance market, players compete for market share through competition in product innovation, pricing, distribution channels, and customer service. They compete to create personalized products, competitive pricing, and efficient distribution channels like agents, brokers, & digital platforms. Superior customer service and strong brand recognition are also important in a landscape shaped by evolving consumer preferences and regulatory shifts.

Some of the major players in the market include Prudential Financial, AIG, Aegon Life Insurance Company Ltd, Bajaj Allianz Life Insurance Co Ltd, AIA Group, United Health Group, and more.

Some of the prominent market players:

- Prudential Financial

- AIG

- Aegon Life Insurance Company Ltd

- Bajaj Allianz Life Insurance Co Ltd

- AIA Group

- United Health Group

- China Life Insurance

- AXA

- Zurich Insurance Group

- Allianz SE

- Other Key Players

Transform your business approach with strategic insights from our report. Get in touch to request our brochure today! : https://dimensionmarketresearch.com/report/term-insurance-market/download-reports-excerpt/

Term Insurance Market Scope

| Report Highlights | Details |

| Market Size (2024) | USD 1,215.0 Bn |

| Forecast Value (2033) | USD 2,601.2 Bn |

| CAGR (2024-2033) | 8.8% |

| Leading Region in terms of Revenue Share | Asia Pacific |

| Percentage of Revenue Share by Leading Region | % |

| Historical Data | 2018 - 2023 |

| Forecast Data | 2024 - 2033 |

| Base Year | 2023 |

| Estimate Year | 2024 |

| Segments Covered | By Type, By Distribution Channel |

| Regional Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Term Insurance Market Segmentation

By Type

- Individual Level Term Life Insurance

- Group Level Term Life Insurance

- Decreasing Term Life Insurance

By Distribution Channel

- Tied Agents & Branches

- Brokers

- Others

Purchase the Competition Analysis Dashboard Today: https://dimensionmarketresearch.com/checkout/term-insurance-market/

Regional Analysis

Asia Pacific is expected to drive major growth in the term insurance market, contributing over 35% of revenue by 2024. Factors like large population, rising awareness in countries like India & China, and supportive government policies supporting industry development.

Further, Europe shows promising growth due to regulatory reforms & economic uncertainties prompting a focus on financial security. Both regions benefit from technological development and increased competition, emphasizing term insurance's role in financial planning & protection amid growing risk awareness.

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/term-insurance-market/request-sample/

By Region

North America

- The U.S.

- Canada

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Browse More Related Reports

- Pet Insurance Market is expected to reach a market value of USD 11.8 billion in 2024 and is projected to show subsequent growth by reaching a value of USD 54.6 billion in 2033 at a CAGR of 18.6% in the forthcoming period of 2024 to 2033.

- Travel Insurance Market is expected to reach a market value of USD 25.3 billion in 2024, globally, which will further grow to USD 95.9 billion by 2033 at a CAGR of 16.0%.

- Healthcare Insurance Market is expected to project a market value of USD 2,584.8 billion in 2024 which will further reach USD 5,120.9 billion in 2033 at a CAGR of 7.9%.

- Generative AI in Customer Services Market is expected to reach a value of USD 490.4 million by the end of 2024, and it is further anticipated to reach a market value of USD 3,673.7 million by 2033 at a CAGR of 25.1%.

- Educational Tourism Market size is expected to reach a market value of USD 416.8 billion in 2024 which will further increase and will reach USD 1,301.6 billion in 2033 at a CAGR of 13.5%.

- Education & Learning Analytics Market size is expected to reach a market value of USD 13.0 billion in 2024 which is further anticipated to reach USD 79.7 billion in 2033 at a CAGR of 22.3%.

- Mobile Banking Market is expected to reach a value of USD 2.2 billion by the end of 2024, and it is further anticipated to reach a market value of USD 11.2 billion by 2033 at a CAGR of 20.0%.

- Europe Creator Economy Market is expected to reach a value of USD 13.4 billion by the end of 2024, and it is further anticipated to reach a market value of USD 84.1 billion by 2033 at a CAGR of 22.6%.

- NLP in Finance Market is expected to reach a value of USD 5.7 billion in 2023, and it is further anticipated to reach a market value of USD 57.5 billion by 2032 at a CAGR of 29.2%.

Recent Developments in the Term Insurance Market

- February 2024: The Nagaland government unveiled a fully-funded life insurance scheme to reduce financial burdens from the sudden loss of family breadwinners.

- February 2024: LIC of India launched LIC Index Plus, a unit-linked life insurance plan providing both insurance cover and savings, with bonus additions.

- January 2024: Kotak Mahindra Life Insurance launched a unit-linked term plan, T.U.L.I.P, providing life coverage up to 100 times the annual premium.

- December 2023: ABSLI introduced "ABSLI Salaried Term Plan," a tailored protection solution for salaried professionals, providing personalized cover options, like a Return of Premium feature.

- November 2023: Zurich Insurance Group planned to acquire a 51% stake in Kotak General Insurance for USD 488 million, with potential additional investment.

- August 2023: India's government implemented a tax rule impacting life insurance policies with high premiums, making traditional plans less appealing to risk-averse investors.

About Dimension Market Research (DMR):

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts into work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world.

We also believe that our clients don’t always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.