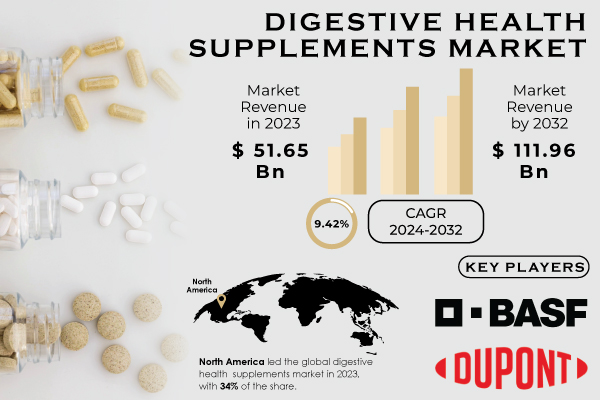

Pune, Sept. 11, 2024 (GLOBE NEWSWIRE) -- “According to SNS Insider, The Digestive Health Supplements Market Size was valued at USD 51.65 Billion in 2023 and is expected to reach USD 111.96 Billion by 2032 and grow at a CAGR of 9.42% over the forecast period 2024-2032.”

The increasing geriatric population and growing consumer health concerns have led to a rise in digestive disorders and a demand for safe medicines due to various product side effects. For instance, a research article released by the National Center for Biotechnology Information (NCBI) revealed that 11% of the American population suffers from chronic digestive diseases, reaching as high as 35% for those of a certain age. The gut plays a crucial role in the body's overall health, and taking care of it through health supplements and certain food items is important.

An increasing interest in gut health among consumers has spurred the research and development of Digestive Health Supplements products. An example of this is a 2020 study of a multinational population, where over 40% of individuals reported functional GI disorders. This has led to a growing need for natural and safe products among people. As a result, market participants are investing significant amounts of money to expand the already extensive range of products to meet the increasing demand. For example, in November 2020, Beroni Group, a diversified biopharmaceutical enterprise based in Australia, announced the introduction of the Beilemei brand of products in the Chinese market. This includes a probiotic health product that aims to balance human enteric flora.

Get a Sample Report of Digestive Health Supplements Market@ https://www.snsinsider.com/sample-request/3134

Key Digestive Health Supplements Companies:

- BASF SE

- Chr. Hansen Holding A/S

- Nestle SA

- International Flavors & Fragrances Inc.

- DuPont de Nemours Inc.

- Bayer AG

- Danone

- Arla Foods amba

- Sanofi

- Cargill Inc.

- Other players

Digestive Health Supplements Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 51.65 Billion |

| Market Size by 2032 | US$ 111.96 Billion |

| CAGR | CAGR of 9.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Segmental Insights

Probiotics led the ingredient type in 2023 and dominated the Digestive Health Supplements market with an 88% market share. Probiotics are live microorganisms known to promote healthy digestion by maintaining a healthy balance of gut bacteria. Customers' increasing preference for natural, non-pharmaceutical solutions to Digestive Health Supplements challenges has led to a stronger focus on probiotic-rich products. In the United States, government-reported statistics from 2023, as identified by the United States Department of Health and Human Services, revealed that consumers spent 14% more on probiotics compared to the previous year, making them the fastest-growing sub-segment in the Digestive Health Supplements market.

Dietary supplements and functional foods are two sources of probiotics that have seen a 30% increase in sales. Numerous research trials have confirmed the effectiveness of these products in addressing concerns such as gas, bloating, and irritable bowel syndrome. Customers are increasingly turning to preventive care, contributing to the growing popularity of probiotics. For example, probiotic pioneer and biotech business leader Bio-K Plus International Inc. introduced a new line of beneficial drinks called Essential following its launch in October 2020.

Digestive Health Supplements Market Key Segmentation:

By Ingredient Type

- Probiotics

- Prebiotics

- Digestive Enzymes/Food Enzymes

- Others

By Product Type

- Functional Foods & Beverages

- Vitamins & Dietary Supplements

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Hospital Pharmacies

- Online Pharmacies

- Others

Do you have any specific queries or need any customization research on Digestive Health Supplements Market, Enquire Now@ https://www.snsinsider.com/enquiry/3134

Regional Insights

The Digestive Health Supplements market in North America accounted for 34% of the total global sales in 2023. Some of the region’s most crucial players have established a solid presence here. For this product, market players are adopting several strategies such as collaborations and expansion of their product portfolio to stay ahead of the competition. In November 2020, for example; Kerry revealed it was buying the Canadian producer of probiotic supplements and drinks BioKPlus. The purchase was consistent with Kerry's efforts to boost its nutrition and probiotics technologies platform, particularly in animal health.

Asia Pacific market is expected to witness the fastest growth in terms of revenue, CAGR 9.6%, during the forecast period for Digestive Health Supplements products with players targeting the launch of their established brands in unpenetrated markets, such as countries from Southeast Asia, high growth within Digestive Health Supplements products for food and beverages consumed in Eastern Europe is likely.

Recent Developments

- In September 2021, Wedderspoon launched the Manuka Honey Digestive Gummies line. The product is available in two formulas: Berry and Tropical. Tropical gummies are designed with a special blend of prebiotic and premium ginger, chamomile & DE111 probiotic. Berry: DE111 probiotics plus Elderberry for Immune and Digestive Support

- TruBiotics (Probiotic) Respectively, PanTheryx Inc. acquired TruBiotics just less than 2 months ago in March of 2021. The addition of the TruBiotics brand to PanTheryx's ingredient offering and existing brands broadens the company's range of ingredients for nutritional supplements addressing immune, and Digestive Health Supplements across all life stages.

Key takeaways:

- As a type of ingredient, the largest segment is probiotics because consumers' demand for natural health solutions has increased.

- North America has the highest market share due to increased awareness and healthcare systems.

Buy a Single-User PDF of Digestive Health Supplements Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/3134

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

- Incidence and Prevalence (2023)

- Prescription Trends, (2023), by Region

- Device Volume: Ingredient Type and usage volumes of pharmaceuticals.

- Healthcare Spending: Expenditure data by government, insurers, and out-of-pocket by patients

6. Competitive Landscape

7. Digestive Health Supplements Market Segmentation, by Ingredient Type

8. Digestive Health Supplements Market Segmentation, by Product Type

9. Digestive Health Supplements Market Segmentation, by Distribution Channel

10 Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Details of Digestive Health Supplements Market Outlook 2024-2032@ https://www.snsinsider.com/reports/digestive-health-market-3134

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.