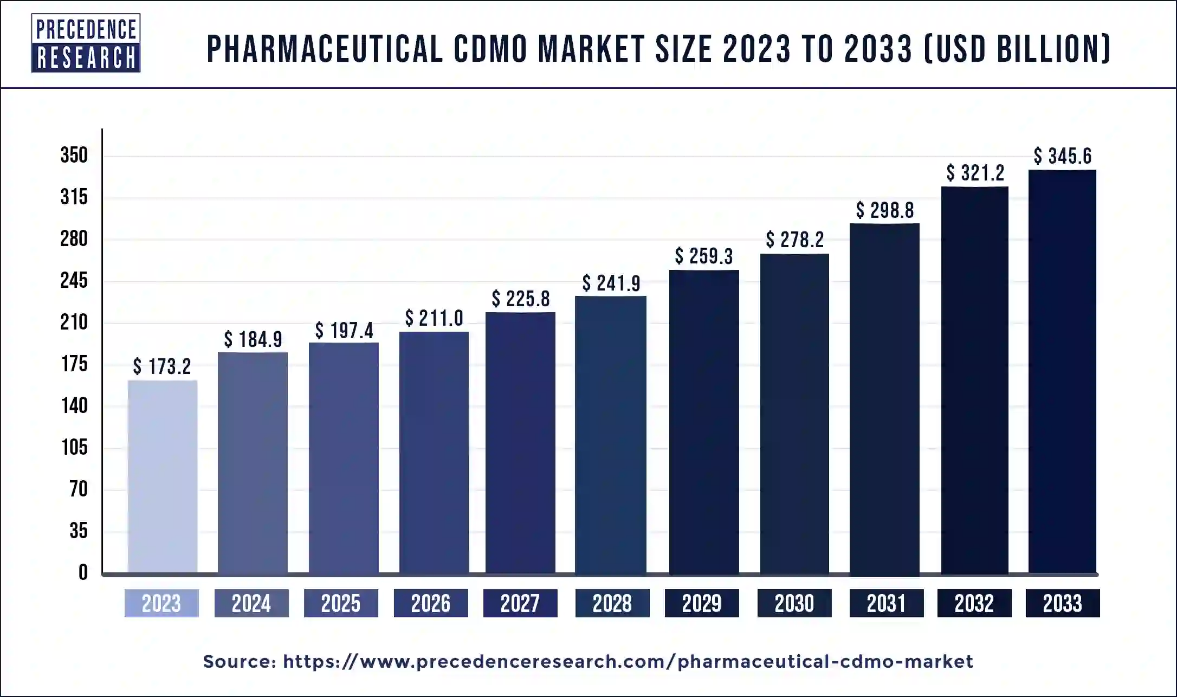

Ottawa, Sept. 11, 2024 (GLOBE NEWSWIRE) -- The global pharmaceutical CDMO market size is predicted to increase from USD 173.2 billion in 2023 to approximately USD 345.6 billion by 2033, According to Precedence Research. The pharmaceutical CDMO market is driven by the rising prevalence of various disorders.

Pharmaceutical CDMO Market Overview

CDMOs play a crucial role in the pharmaceutical industry, offering various services to support drug development. The growing focus on personalized medicine and therapeutics drives the pharmaceutical CDMO market. Contract research organizations (CROs) are embracing new technologies to accelerate research and enhance efficacy. Moreover, the increasing collaboration between CDMOs (Contract Development and Manufacturing Organizations) and pharmaceutical companies to create new formulations and products boosts the market.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/2936

Pharmaceutical CDMO Market Key Highlights:

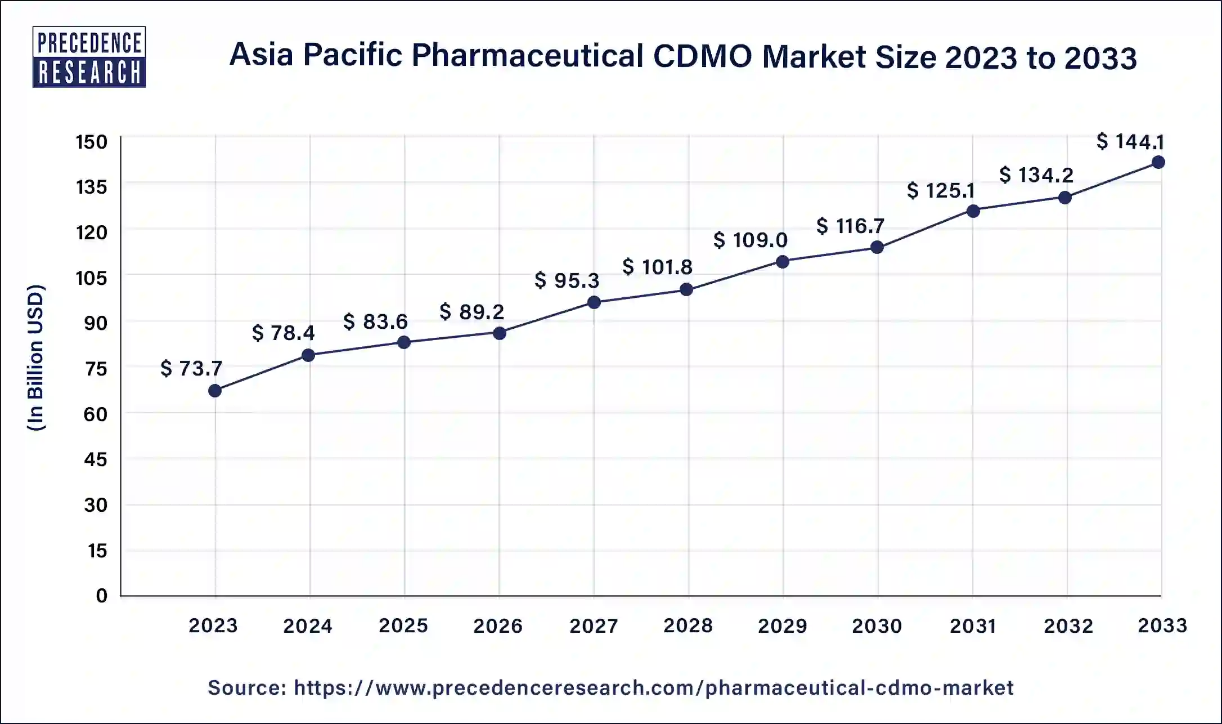

- Asia Pacific dominated the pharmaceutical CDMO market with the largest market share of 43% in 2023.

- North America is expected to grow at the fastest rate during the forecast period.

- By product, the API segment led the market in 2023.

- By product, the drug segment is expected to grow rapidly during the forecast period.

- By dosage form, the solid dose segment dominated the market in 2023.

- By indication, the pain segment led the market in 2023.

- By end-user, the big pharmaceutical companies segment dominated the market in 2023.

Pharmaceutical CDMO Market Regional Outlook

The Asia Pacific pharmaceutical CDMO market size accounted for USD 78.4 billion in 2024 and is expected to surpass around USD 144.1 billion by 2033, at a notable CAGR of 7% from 2024 to 2033.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Asia Pacific dominated the global pharmaceutical CDMO market in 2023.

The region is more appealing for pharmaceutical development and production due to its cheaper manufacturing, low labor costs, and favorable regulations governing the pharmaceutical industry. Moreover, the region’s dominance is further attributed to the increasing use of advanced manufacturing technologies, such as continual production and personalized medicine.

- In August 2024, Aptar CSP Technologies partnered with Porton Pharmatech, a global CDMO, to expand Activ-Blister Solutions across Asia Pacific.

North America is expected to witness significant growth in the market during the forecast period.

The market in North America is expected to expand at the fastest growth rate during the forecast period due to the increasing advancements in drug dissemination techniques. The growing demand for topical agents for pain alleviation, wound healing, and scar reduction further boosts the market. Moreover, the region's well-established healthcare and pharmaceutical industries and the rising demand for outsourcing services contribute to market expansion.

Pharmaceutical CDMO Market Report Coverage

| Report Attribute | Key Statistics |

| Market Size in 2024 | USD 184.9 Billion |

| Market Size by 2033 | USD 345.6 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.2% |

| Base Year | 2023 |

| Forecast Year | 2024 to 2033 |

| Segments Covered | Product, Drug Product, Dosage Form, Indication, End-User and Regions |

| Product | API |

| Drug Product | Oral Solid Dose, Semi-solid dose, Liquid Dose, Others |

| Dosage Form | Solid, Semi-Solid, Liquid Dose Formulation, Gas Dose Formulation |

| Indication | Cancer, Cardiovascular Disease, Diabetes, Pain, Respiratory disease, Other |

| End-User | Big Pharmaceutical Companies, Small & Medium-Sized Pharmaceutical Companies, Generic Pharmaceutical Companies, Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pharmaceutical CDMO Market Segments Outlook:

Product Outlook:

The API segment dominated the global market in 2023.

Population growth, aging demographics, and the rising prevalence of chronic diseases have increased the demand for APIs to develop targeted therapies. Specialized services, such as synthesis, purification, and analytical testing, are increasingly sought after. Outsourcing APIs can reduce costs for developing drugs and targeted therapies. Hence, outsourcing becomes crucial for many companies involved in drug development. The increasing need for targeted therapies and personalized medicine contributed to the segmental growth. Additionally, government policies supporting API production bolstered the segment.

- In July 2024, Eurofins CDMO Alphora Inc. expanded its API manufacturing facility in Mississauga, Canada, adding 15,000 sq. ft. of GMP processing and warehousing space, increasing its existing API and drug substance manufacturing capabilities.

- In February 2024, Bajaj Healthcare Ltd. signed a definitive CDMO agreement with UK/EU-based customers to supply 15 active pharmaceutical ingredients (APIs).

The drug segment is expected to witness the fastest growth during the forecast period.

Drugs are vital in treating, curing, preventing, or diagnosing diseases and promoting well-being. The increasing prevalence of chronic diseases worldwide boosts the need for novel drugs. However, CDMOs help in the efficient production of these novel drugs.

- In May 2023, Enzene Biosciences launched a new drug discovery division, expanding its CDMO services to the biotech industry and complementing its EnzeneXTM-equipped biologics manufacturing site in the US.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2936

Dosage Form Outlook:

The solid segment dominated the market in 2023.

The demand for solid dosage forms is rising significantly due to their long shelf life, stability, and ease of administration. Despite advancements in manufacturing technologies, pharmaceutical and biotech companies outsource manufacturing services required for solid dosage forms to CDMOs since they have both knowledge and tools, which are necessary for safe production.

- In May 2024, Piramal Pharma Limited’s Pharma Solutions business, the leading CDMO, opened a new production block in Pithampur, Madhya Pradesh, India, and upgrade oral solid dose capabilities.

Indication Outlook:

The pain indication segment dominated the pharmaceutical CDMO market in 2023 due to the heightened demand for painkillers. Outsourcing formulations required for pain relief drugs from CDMOs reduces manufacturing costs. CDMOs also ensure adequate safety levels in drug synthesis and production. The rising demand for pain relief medications further augmented the segment.

- In February 2024, Hikma Pharmaceuticals launched COMBOGESIC IV, approved by the US FDA for use in adults as an opioid-free pain relief medicine for mild to moderate pain.

End-User Outlook:

The big pharmaceutical companies led the market in 2023.

Large-size pharmaceutical companies usually manufacture drugs in large quantities. However, contract development manufacturing organizations (CDMOs) can help large pharmaceutical companies save money by allowing them to outsource certain processes. Moreover, CDMOs offer pharmaceutical giants unique or specialized production techniques, enhancing efficiency and accelerating drug manufacturing.

- In July 2024, MedPharm merged with Tergus Pharma to become a top-notch contract development and manufacturing organization (CDMO) that possesses strong manufacturing capabilities.

Browse More Insights:

- Oncology Market: The global oncology market size accounted for USD 225.01 billion in 2024 and is expected to reach around USD 668.26 billion by 2034, expanding at a CAGR of 11.5% from 2024 to 2034.

- Drug Formulation Market: The global drug formulation market size was estimated at USD 1.64 trillion in 2022 and is expected to hit around USD 2.95 trillion by 2032 with a noteworthy CAGR of 6.05% during the forecast period.

- Precision Medicine Market: The global precision medicine market size accounted for USD 102.17 billion in 2024 and is expected to reach around USD 470.53 billion by 2034, expanding at a CAGR of 16.5% during the forecast period.

- Active Pharmaceutical Ingredients Market: The global active pharmaceutical ingredients market size accounted for USD 214.72 billion in 2023 and it is expected to surpass around USD 384.51 billion by 2033, at a CAGR of 6.08% during the forecast period.

- Generic Drugs Market: The global generic drugs market size was valued at USD 464.98 billion in 2023 and is projected to hit around USD 776.78 billion by 2033, growing at a CAGR of 5.2% over the forecast period from 2024 to 2033.

- AI in Pharmaceutical Market: The global AI in pharmaceutical market was valued at USD 908 million in 2022 and is expected to reach over USD 11813.56 million by 2032, poised to grow at a compound annual growth rate (CAGR) of 29.30% during the forecast period.

- Biotechnology and Pharmaceutical Services Outsourcing Market: The global biotechnology & pharmaceutical services outsourcing market size was estimated at US$ 71 billion in 2022 and is expected to reach US$ 123.01 billion by 2032, growing at a registered CAGR of 5.70% during the forecast period.

- Pharmaceutical Drug Delivery Market: The global pharmaceutical drug delivery market size was valued at USD 1.80 trillion in 2022 and expected to surpass around USD 2.89 trillion by 2032, growing at a CAGR of 4.90% during the forecast period.

- Pharmaceutical Chemicals Market: The global pharmaceutical chemicals market size accounted for USD 123.42 billion in 2024 and is expected to be worth around USD 240.52 billion by 2034, at a CAGR of 6.9% during the forecast period.

Pharmaceutical CDMO Market Dynamics:

Driver:

Shift toward personalized medicine

The increasing demand for personalized medicine is expected to drive the market in the coming years. However, conventional manufacturing techniques cannot meet this demand. Therefore, it is essential to partner with a contract manufacturing organization (CMO) that has adequate expertise for purposefully undertaking small-scale complex projects while maintaining effectiveness, safety, and dependability.

Restraint:

Regulatory affairs

There are numerous challenges faced by pharmaceutical CDMO market, such as adhering to regulations, meeting patient requirements while ensuring medicine security and efficiency, and coping up with changes in healthcare technologies. Effectively responding to these challenges may hamper the productivity of pharmaceutical companies. Moreover, small pharmaceutical firms may find it difficult to survive if they spend more on regulations, making it necessary to outsource services form CDMOs.

Opportunity:

Advancement in technology

AI and machine learning have revolutionized CDMO operations through improved efficiency and cost reduction. They are changing how CDMO works by making it efficient, cheap, and faster. The Internet of Things enables remote tracing and quality control in addition to real-time monitoring, which enhances supply chain performance and dependability.

Pharmaceutical CDMO Market Key Companies

- Bushu Pharmaceuticals Ltd.

- Laboratory Corporation of America Holdings

- Nipro Corporation

- Thermo Fisher Scientific Inc.

- Wuxi Apptec

- Samsung Biologics

- Piramal Pharma Solutions

- Siegfried Holding Ag

- Cordenpharma International

- Catalent, Inc

- Lonza Group AG

- Recipharm Ab

- Cambrex Corporation

Pharmaceutical CDMO Market Recent News:

- In August 2024, PCI Pharma Services, a global contract development and manufacturing organization, successfully completed an inspection by the International Coalition of Medicines Regulatory Authorities.

- In June 2024, Advent International-backed Suven Pharmaceuticals reached an agreement to purchase a controlling share in Sapala Organic, a Hyderabad-based organization engaged in contract research and development, under a complete cash deal.

- In June 2024, Lupin formed a subsidiary under the name of Lupin Manufacturing Solutions (LMS) to enter the business of Contract Development and Manufacturing Organization (CDMO).

- In February 2024, Suven Pharmaceuticals is planning an expansion of their manufacturing ability through the merger with Cohance Lifesciences which is a CDMO located in India.

Market Segments Covered

By Product

- API

- Synthetic

- Solid

- Liquid

- Type

- Traditional Active Pharmaceutical Ingredient (Traditional API)

- Highly Potent Active Pharmaceutical Ingredient (HP-API)

- Antibody Drug Conjugate (ADC)

- Others

- Drug

- Innovative

- Generics

- Manufacturing

- Continuous manufacturing

- Batch manufacturing

- Biotech

- Synthetic

By Drug Product

- Oral Solid Dose

- Semi-solid dose

- Liquid Dose

- Others

By Dosage Form

- Solid

- Tablets

- Capsules

- Powder

- Semi-Solid

- Cream

- Paste

- Gel

- Liquid Dose Formulation

- Injectables

- Sterile Vials

- Single Use/Single Dose

- Multi-Use

- Ampules

- Prefilled Syringes

- Suspension

- Emulsion

- Gas Dose Formulation

- Inhaler

- Aerosols

By Indication

- Cancer

- Cardiovascular Disease

- Diabetes

- Pain

- Respiratory disease

- Other Disease

By End-User

- Big Pharmaceutical Companies

- Small & Medium-Sized Pharmaceutical Companies

- Generic Pharmaceutical Companies

- Other End Users

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Key Points of Table of Content:

Chapter 1. Introduction

Chapter 2. Research Methodology (Premium Insights)

Chapter 3. Executive Summary

Chapter 4. Market Variables and Scope

Chapter 5. COVID 19 Impact on Pharmaceutical CDMO Market

Chapter 6. Market Dynamics Analysis and Trends

Chapter 7. Competitive Landscape

Chapter 8. Global Pharmaceutical CDMO Market, By Product

Chapter 9. Global Pharmaceutical CDMO Market, By Drug Product

Chapter 10. Global Pharmaceutical CDMO Market, By Dosage Form

Chapter 11. Global Pharmaceutical CDMO Market, By Indication

Chapter 12. Global Pharmaceutical CDMO Market, By End-User

Chapter 13. Global Pharmaceutical CDMO Market, Regional Estimates and Trend Forecast

Chapter 14. Company Profiles

Chapter 15. Research Methodology

Chapter 16. Appendix

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2936

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsautomotive.com

For Latest Update Follow Us: