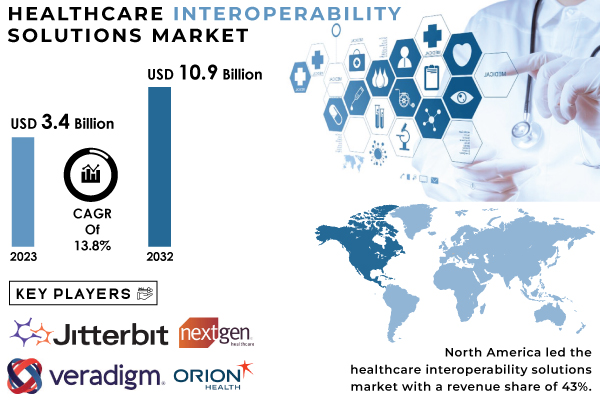

Pune, Sept. 16, 2024 (GLOBE NEWSWIRE) -- According to the new market research report “Healthcare Interoperability Solutions Market Size, Share & Segment by Type (Software Solutions, Services), by Level (Foundational, Structural, Semantic), by End User and By Regions | Global Forecast 2024-2032”, Published by SNS Insider, is expected to reach USD 10.9 billion by 2032 from USD 3.4 billion in 2023, at a CAGR of 13.8% during the forecast period.

The driving force behind this growth is the increasing necessity for efficient and seamless data exchange across diverse healthcare systems. As the demand for integrated care solutions rises and advancements in digital health technologies progress, the market for interoperability solutions is set to expand significantly.

Key factors fueling this market include the pressing need for the integration of various healthcare data sources, including Electronic Health Records (EHRs), Health Information Exchanges (HIEs), and other healthcare IT systems. On the supply side, continuous innovations in software solutions and a heightened focus on standardization and regulation are enhancing data compatibility and interoperability across healthcare systems.

Get a Sample Report of Healthcare Interoperability Solutions Market@ https://www.snsinsider.com/sample-request/1768

Key Healthcare Interoperability Solutions Companies:

- Jitterbit

- NXGN Management, LLC.

- Cerner (Oracle)

- Epic Systems Corporation

- Veradigm Inc.

- OSP Labs

- Infor (Koch Industries, Inc.)

- iNTERFACEWARE Inc.

- Koninklijke Philips NV

- InterSystems Corporation

- ViSolve.com

- Orion Health Group

- Allscripts Healthcare Solutions

- Quality Systems, Inc.

Healthcare Interoperability Solutions Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.4 Billion |

| Market Size by 2032 | US$ 10.9 Billion |

| CAGR | CAGR of 13.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Segment Analysis

By Type: Software Solutions vs. Services

In 2023, software solutions commanded the Healthcare Interoperability Solutions Market with approximately 65% of the total revenue share. This dominance is attributed to the critical role software plays in enabling data exchange, integration, and translation across healthcare systems.

Conversely, the services segment accounted for around 35% of the market share. This segment’s growth is driven by the increasing demand for expert support in implementing and managing interoperability solutions. Services include Consulting Services (e.g., Accenture, Deloitte), Implementation Services (e.g., IBM, Hewlett Packard Enterprise), Integration Services (e.g., Optum, Cognizant), and Managed Services (e.g., Amazon Web Services, Microsoft Azure).

By Level: Foundational vs. Structural vs. Semantic Interoperability

Foundational Interoperability holds the largest market share at 40%. This level establishes the groundwork for data exchange by ensuring connectivity using standardized protocols such as HL7 and DICOM. It facilitates basic data transfer but does not ensure meaningful interpretation. Structural Interoperability, representing 30% of the market, extends beyond basic connectivity by ensuring data consistency through standardized vocabularies and codes like LOINC and SNOMED CT, enhancing data analysis and comparison.

By End User: Healthcare providers

Healthcare providers i.e. Hospitals and clinics dominate the Healthcare Interoperability Solutions Market with a substantial 55% share. These institutions require robust data exchange capabilities to manage complex patient cases involving multiple specialists. The demand for interoperability solutions is driven by the need for seamless integration with Electronic Health Records (EHRs), real-time communication among healthcare teams, and secure data exchange with referring physicians.

Healthcare Interoperability Solutions Market Key Segmentation:

By Type

- Software Solutions

- EHR interoperability solutions

- Lab system interoperability solutions

- Imaging system interoperability solutions

- Healthcare information exchange interoperability solutions

- Enterprise interoperability solutions

- Services

By Level

- Foundational Interoperability

- Structural Interoperability

- Semantic Interoperability

By End User

- Healthcare Providers

- Healthcare Payers

- Pharmacies

Do you have any specific queries or need any customization research on Healthcare Interoperability Solutions Market, Enquire Now@ https://www.snsinsider.com/enquiry/1768

Regional Analysis

North America: Dominating Region

North America leads the Healthcare Interoperability Solutions Market, bolstered by a highly developed healthcare infrastructure, significant investments in healthcare IT, and favorable government initiatives. Major players such as Cerner Corporation, Epic Systems, and IBM contribute to the region’s growth by offering advanced interoperability solutions.

Asia-Pacific: Fastest-Growing Region

The Asia-Pacific region is the fastest-growing market for Healthcare Interoperability Solutions. Countries like China and India are rapidly adopting digital health technologies and investing in healthcare IT infrastructure to enhance patient care and data management. Growth in this region is driven by increasing government initiatives, such as China’s National Health Service focus on digital health and India’s push towards a national digital health ecosystem.

Recent Developments

- August 2024: InterSystems launched HealthShare Unified Care Record, a new platform designed to enhance data exchange and patient care coordination across diverse healthcare systems.

- July 2024: Epic Systems introduced EpicLink, a new EHR integration tool aimed at improving interoperability between Epic and non-Epic EHR systems.

- June 2024: IBM unveiled IBM Watson Health Data Exchange, a new service to streamline healthcare data integration and enhance decision-making capabilities.

Key Takeaways:

- The Healthcare Interoperability Solutions Market is expected to expand from USD 3.4 billion in 2023 to USD 10.9 billion by 2032, growing at a CAGR of 13.8%.

- Software solutions hold the largest market share at approximately 65% due to their crucial role in data exchange and integration.

- Foundational interoperability leads the market with a 40% share, providing essential connectivity for data exchange.

- North America dominates the market with advanced healthcare infrastructure, while Asia-Pacific is the fastest-growing region due to rapid digital health adoption.

- Hospitals and clinics account for 55% of the market share, driven by their need for robust data integration with EHRs.

- New advancements include InterSystems' HealthShare Unified Care Record, Epic Systems' EpicLink integration tool, and IBM's Watson Health Data Exchange service.

Buy a Single-User PDF of Healthcare Interoperability Solutions Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/1768

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

- Adoption Rates, 2023

- User Demographics, By User Type and Roles, 2023

- Feature Analysis, by Feature Type

- Cost Analysis, by Software

- Integration Capabilities

- Regulatory Compliance, by Region

6. Competitive Landscape

7. Healthcare Interoperability Solutions Market Segmentation, by Type

8. Healthcare Interoperability Solutions Market Segmentation, by Level

9. Healthcare Interoperability Solutions Market Segmentation, by End User

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Details of Healthcare Interoperability Solutions Market Outlook 2024-2032@ https://www.snsinsider.com/reports/healthcare-interoperability-solutions-market-1768

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.