New York, Sept. 18, 2024 (GLOBE NEWSWIRE) -- Overview

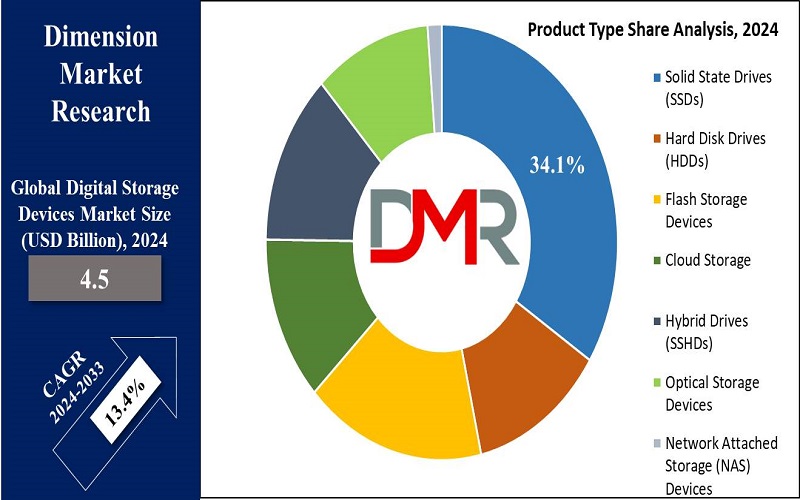

The Global Digital Storage Devices Market size is expected to reach USD 4.5 billion by 2024 and it is further anticipated to reach a market value of USD 14.0 billion by 2033, at a CAGR of 13.4% from 2024 to 2033.

The global digital storage devices market is rapidly growing due to expanding digital data across industries. Key drivers include data-intensive applications, big data, and cloud storage services.

Organizations and consumers demand improved storage devices for data retrieval and security. SSDs are favored for their superior performance. Advancements in storage technology and the need for data protection further boost market growth. The market is well-positioned to meet future data storage demands.

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/digital-storage-devices-market/request-sample/

Important Insights

- Market Size: The global digital storage devices market is projected to grow from USD 4.5 billion in 2024 to USD 14.0 billion by 2033, at a CAGR of 13.4%.

- Product Type Segment Insights: Solid state drives (SSDs) are expected to lead the product type segment, holding 34.1% of the market share in 2024.

- Capacity Segment Insights: The 1 TB to 5 TB capacity segment is anticipated to be the primary segment, capturing 39.2% of the market share in 2024.

- Application Segment Insights: Business storage is set to dominate the application segment, commanding the highest market share in 2024.

- End User Insights: Consumer electronics are projected to lead the market, with the highest market share of approximately 34.2% in 2024.

- Regional Analysis: North America is expected to dominate the global digital storage devices market, holding 38.9% of the market share in 2024.

Latest Trends

- It is important for high-frequency trading, data processing, real-time games, and many other fields to switch to NVMe SSDs from SATA SSDs as the data throughput and access times of NVMe SSDs are better than SATA SSDs. NVMe also makes use of the PCIe bus to optimize systems for user and business purposes.

- Traditional storage (pre-post cloud, on-site, and client storage) is slowly being replaced by hybrid cloud storage as it becomes easier to manage the data and provides better recovery in case of a disaster. These models bring storage benefits to the cloud virtualization platform to meet various storage requirements.

Digital Storage Devices Market: Competitive Landscape

- The global digital storage device market is highly competitive, with major players like Western Digital, Seagate, Samsung, and Intel investing heavily in research and innovation to develop high-density SSDs, advanced hard drives, and cloud storage solutions.

- New entrants targeting specific clients and providing specialized storage solutions, along with joint ventures, alliances, and acquisitions, drive competition. Companies focus on addressing data security, large data volumes, and IoT demands through continuous development and partnerships.

Some of the prominent market players:

- Lenovo

- SanDisk Corporation

- Transcend Information

- Sony Corporation

- Seagate Technology

- Toshiba Corporation

- Western Digital

- Kingston Technology

- Intel Corporation

- Samsung Electronics

- Violin Systems

- DDN IntelliFlash

- Silk (Formerly Kaminario)

- Nutanix

- Other Key Players

Transform your business approach with strategic insights from our report. Get in touch to request our brochure today! : https://dimensionmarketresearch.com/report/digital-storage-devices-market/download-reports-excerpt/

Digital Storage Devices Market Scope

| Report Highlights | Details |

| Market Size (2024) | USD 4.5 Bn |

| Forecast Value (2033) | USD 14.0 Bn |

| CAGR (2024-2033) | 13.4% |

| North America Revenue Share | 38.9% |

| Historical Data | 2018 - 2023 |

| Forecast Data | 2024 - 2033 |

| Base Year | 2023 |

| Estimate Year | 2024 |

| Segments Covered | By Product Type, By Capacity, By Application, By End-user |

| Regional Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Growth Drivers

- The growing amounts of big data and the requirements for prompt analysis stimulate the interest in effective storage systems. Products used in social media, IoT devices, and enterprise applications assume a large mass of data and, therefore, require proper storage.

- The increase in technological advancement especially in the business environment calls for well-built powerful storage devices. In the context of developing new, cloud-based, and AI-based services, as well as IoT, complex storage solutions are becoming critical for the functioning and competitiveness of companies.

Restraints

- The cost is another factor, NVMe SSDs, and other such technologies are expensive, which makes it difficult for smaller and mid-sized businesses to consider such technologies. Another factor that deters entry into the market is the concept of high initial costs impacting market penetration.

- Data security concerns pose specific problems such as data piracy and questions related to security affect the storage market. More security measures for data storage, including encrypting and restricting access, add cost and complexity to cloud and network storage systems.

Growth Opportunities

- IoT devices are growing in industries such as health care, manufacturing, smart cities, and others; to deal with the larger volumes of data generated applications require faster, reliable storage technologies.

- As the data is stored closer to the source in order to minimize latency and bandwidth, localized storage systems with high performance are required in the case of edge computing. Smart power stations, self-driving cars, and similar applications necessitate storage that resolves edge computing.

Market Analysis

Solid State Drives (SSDs) are set to dominate the digital storage devices market with a 34.1% share in 2024. Their faster data read/write speeds, reliability, and durability make them ideal for high-performance applications like gaming, content creation, and enterprise use.

SSDs' small size and low heat output suit portable devices, while advancements have increased storage sizes and reduced costs, driving demand from individuals to businesses and securing their market leadership.

Purchase the Competition Analysis Dashboard Today: https://dimensionmarketresearch.com/checkout/digital-storage-devices-market/

Digital Storage Devices Market Segmentation

By Product Type

- Solid State Drives (SSDs)

- SATA SSDs

- NVMe SSDs

- 2 SSDs

- PCIe SSDs

- Hard Disk Drives (HDDs)

- Internal HDDs

- External HDDs

- Flash Storage Devices

- USB Flash Drives

- Memory Cards

- Flash Drives

- Cloud Storage

- Hybrid Drives (SSHDs)

- Optical Storage Devices

- CDs

- DVDs

- Blu-ray Discs

- Network Attached Storage (NAS) Devices

By Capacity

- Less than 500 GB

- 500 GB to 1 TB

- 1 TB to 5 TB

- Above 5 TB

By Application

- Personal Storage

- Business Storage

- Data Centers

- Enterprise Backup

- Archiving

- Gaming Storage

- Media & Entertainment Storage

- Education & Research Storage

By End-user

- Consumer Electronics

- Personal Use

- Gaming

- Entertainment

- Enterprise Storage

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Industrial

- Manufacturing

- Energy

- Healthcare

- Automotive

Discover additional reports tailored to your industry needs

- Stealth Technology market is projected to reach USD 47.4 billion in 2024 and grow at a compound annual growth rate of 7.0% from there until 2033 to reach a value of USD 86.8 billion.

- Remote Sensing Technology market is projected to reach USD 24.9 billion in 2024 and grow at a compound annual growth rate of 19.7% from there until 2033.

- Process Analytical Technology Market size is expected to be valued at USD 4.1 billion in 2024, and it is further expected to reach a market value of USD 13.8 billion by 2033 at a CAGR of 14.3%.

- Gi-Fi Technology market is projected to reach USD 1.4 billion in 2024 and grow at a compound annual growth rate of 14.9% from there until 2033 to reach a value of USD 4.8 billion.

- Automotive Battery Thermal Management System Market is projected to reach USD 3.5 billion in 2024 and grow at a compound annual growth rate of 21.7% from there until 2033 to reach a value of USD 20.7 billion.

Regional Analysis

North America is projected to dominate the global digital storage devices market with a 38.9% share in 2024, driven by technological innovation, large data centers, and leading manufacturers like Western Digital, Seagate, and Intel.

High IT penetration, big data integration, and cloud services fuel demand. Legal data security requirements, high disposable income, and consumer tech awareness further elevate North America's prominent market position, with continued growth expected through 2033.

By Region

North America

- The U.S.

- Canada

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Recent Developments in the Digital Storage Devices Market

June 2024

- Western Digital released its new UltraStar DC HC650 20TB hard drives, enhancing data center storage with higher density and lower power consumption.

- Samsung introduced the 990 Pro SSDs with PCIe 5.0 interface, significantly improving speeds for gaming and professional workloads.

May 2024

- Seagate Technology launched MACH.2 multi-actuator hard drives, doubling the performance of traditional HDDs for enterprise data centers.

- Kingston Technology released high-capacity DataTraveler Max USB 3.2 Gen 2 flash drives, offering up to 1TB for portable and high-speed data transfer.

April 2024

- Toshiba unveiled the MG10 Series 20TB HDDs, featuring Conventional Magnetic Recording (CMR) technology for cloud-scale and enterprise storage.

- Micron Technology expanded its Crucial P5 Plus NVMe SSD lineup, enhancing performance for gaming and content creation.

December 2023

- Intel introduced Optane H20 SSDs, combining Optane Memory with QLC 3D NAND for faster performance and improved storage efficiency in laptops and desktops.

- SanDisk released the Extreme Pro portable SSD V2, offering up to 4TB capacity and enhanced durability for on-the-go storage.

November 2023

- Western Digital expanded the WD_BLACK portfolio with new external SSDs for gamers, including the WD_BLACK P50 Game Drive SSD with USB 3.2 Gen 2x2 interface.

- ADATA launched Premier Pro microSDXC UHS-I memory cards with up to 512GB capacity, catering to the high-resolution video recording demand of consumers.

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/digital-storage-devices-market/request-sample/

About Dimension Market Research (DMR):

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world.

We also believe that our clients don’t always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.