New York, Sept. 19, 2024 (GLOBE NEWSWIRE) -- Overview

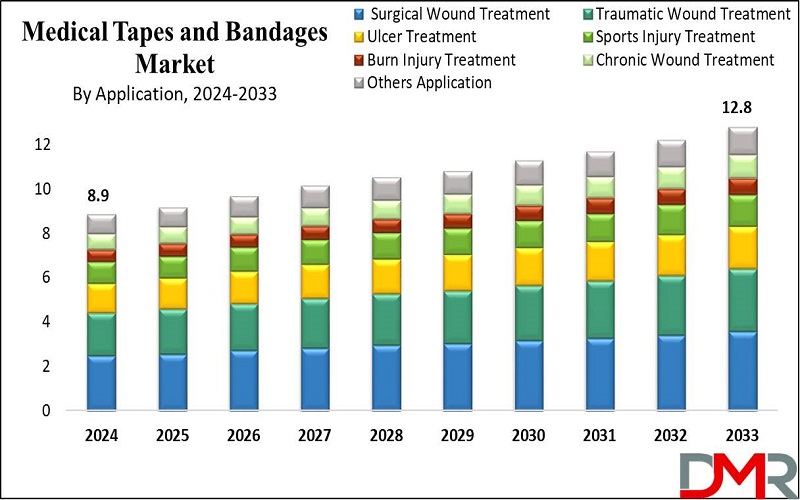

The Global Medical Tapes and Bandages Market is projected to reach USD 8.9 billion in 2024 and USD 12.8 billion by 2033, growing at a CAGR of 4.2%.

The global clinical tape and bandages market is driven by the increase in chronic wounds, surgical procedures, and sports injuries is driving the global clinical tape and bandages market. An increase in chronic diseases with huge burdens like diabetes, skin injuries, and venous ulcers generally increases demand.

Growth in adhesive bandages and water-resistant tapes reflects an aging population and more surgeries. North America leads due to its strong infrastructure and spending on healthcare followed by Europe and Asia-Pacific.

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/medical-tapes-and-bandages-market/request-sample/

The market would rise to innovations in wound care technology and rising health expenditure especially in the US. All these factors of growing demand in this area entail increased competition and market growth regarding advanced, patient-centered care.

The US Medical Tapes and Bandages Market

The US medical tapes and bandages market is expected to reach USD 3.5 billion in 2024 and USD 4.9 billion by 2033, growing at a CAGR of 3.9%.

Key trends in the US market include developing antimicrobial and hypoallergenic products based on the needs of the patient's skin. The ascendant demand for advanced wound care has boosted the market substantially toward better healing and comfort of the company's products.

Environmental-friendly products and extended distribution channels are yet some of the recent developments that have increased access to products in all settings of healthcare.

Important Insights

- Market Value: The Global Medical Tapes and Bandages Market is estimated to reach USD 8.9 billion in 2024 and is projected to grow to USD 12.8 billion by 2033, with a CAGR of 3.9%.

- US Market Size: The US Medical Tapes and Bandages market is expected to grow from USD 3.5 billion in 2024 to USD 4.9 billion by 2033, at a CAGR of 3.9%.

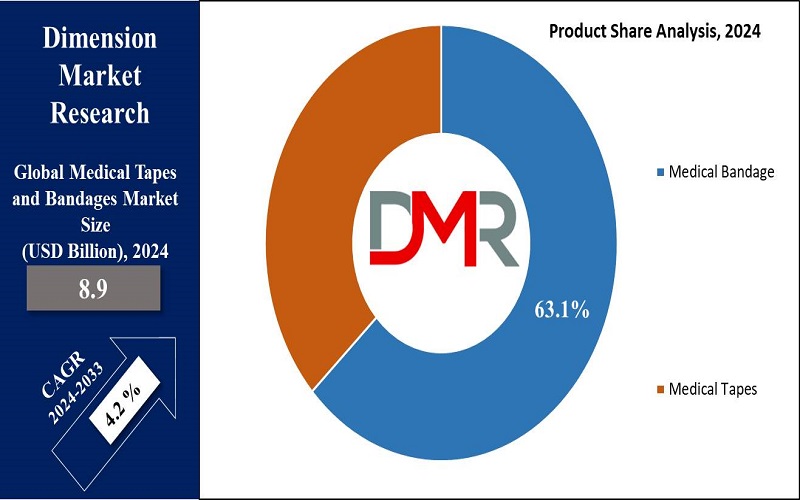

- Product Segment Analysis: Medical bandages are anticipated to hold 63.1% of the market share in 2024.

- Application Segment Analysis: Surgical wound treatment is forecasted to lead the market, holding 28.0% of the market share by 2024.

- End User Segment Analysis: Hospitals are set to dominate the market, holding the highest share in 2024.

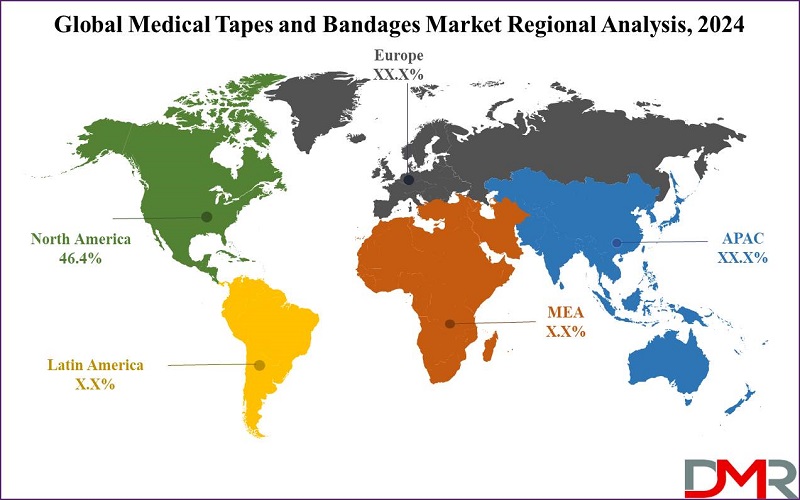

- Regional Analysis: North America is projected to lead the Global Medical Tapes and Bandages Market with a share of approximately 46.4% in 2024.

Latest Trends

- Advances in technology: It has been the introduction of antibacterial and waterproof tapes that elevated the status of bandages in wound care management. These evolved materials enhance breathability, and adhesive elasticity—providing comfort to patients—and reduce infection risks, which often accelerate the healing process. In that direction, health sectors are trying to develop biodegradable and hypoallergic tapes through R&D initiatives.

- Increased Chronic Wound Incidence: This encompasses an aging population, which, coupled with the rising pervasiveness of other chronic diseases such as diabetes and obesity, has contributed to increased cases of chronic wounds across the globe. As a result, this adds to the higher demand for specialized wound care products like medical tapes and bandages that improve patients' results in general and enhance their quality of life.

Medical Tapes and Bandages Market: Competitive Landscape

Major players in the market, such as 3M, Johnson & Johnson, and Smith & Nephew, lean toward R&D to help bring about wound-care solutions including antibacterial and waterproof bandages that will have a big impact on the comfort and healing of patients.

R&D oriented toward advanced wound-care solutions, including antibacterial and waterproof bandages, is a major part of the overall business strategy among 3M, Johnson & Johnson, and Smith & Nephew.

Mergers and acquisitions have increasingly helped expand the product range and geographical presence. Small players and new entrants offer niche products, opening a new line for innovation in the market.

Some of the prominent market players:

- Smith & Nephew PLC

- Mölnlycke Health Care AB

- 3M

- McKesson Corporation

- Ethicon Inc. (JOHNSON & JOHNSON)

- Braun Melsungen AG

- Paul Hartmann AG

- Coloplast

- Integra Lifesciences

- Medtronic Industries

- Other Key Players

Transform your business approach with strategic insights from our report. Get in touch to request our brochure today! : https://dimensionmarketresearch.com/report/medical-tapes-and-bandages-market/download-reports-excerpt/

Medical Tapes and Bandages Market Scope

| Report Highlights | Details |

| Market Size (2024) | USD 8.9 Bn |

| Forecast Value (2033) | USD 12.8 Bn |

| CAGR (2024-2033) | 4.2% |

| North America Revenue Share | 46.4% |

| The US Market Size (2024) | USD 3.5 Bn |

| Historical Data | 2018 - 2023 |

| Forecast Data | 2024 - 2033 |

| Base Year | 2023 |

| Estimate Year | 2024 |

| Segments Covered | By Product, By Application, By End User |

| Regional Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Analysis

Medical bandages are expected to hold 63.1% of the market share in 2024 due to their extensive use in wound care. Types include muslin, elastic, triangular, orthopedic, and specialty bandages. Popular for their breathability and cost-effectiveness, muslin and elastic bandages provide essential support and compression.

Orthopedic bandages aid in immobilization. Specialty bandages like crepe, gauze, and knitted ones are versatile. Continuous innovation in materials and design ensures bandages' global market leadership by enhancing patient comfort and healing outcomes.

Medical Tapes and Bandages Market Segmentation

By Product

- Medical Bandage

- Muslin Bandage Rolls

- Standard Muslin Bandage Rolls

- Antibacterial Muslin Bandage Rolls

- Elastic Bandage Rolls

- Triangular Bandage Rolls

- Cotton Triangular Bandages

- Non-Woven Triangular Bandages

- Orthopedic Bandage Rolls

- Elastic Plaster Bandages

- Specialty Bandages

- Crepe Bandages

- Gauze Bandages

- Knitted Bandages

- Other Bandages

- Muslin Bandage Rolls

- Medical Tapes

- Fabric Tapes

- Acetate

- Viscose

- Cotton

- Silk

- Polyester

- Other Fabric Tape

- Paper Tapes

- Standard Paper Tapes

- Hypoallergenic Paper Tapes

- Plastic Tapes

- Propylene

- Polyethylene

- Polyvinyl Chloride (PVC)

- Other Plastic Tapes

- Other Tapes

- Fabric Tapes

By Application

- Surgical Wound Treatment

- Traumatic Wound Treatment

- Lacerations

- Abrasions

- Puncture Wounds

- Contusions

- Ulcer Treatment

- Diabetic Ulcers

- Venous Ulcers

- Pressure Ulcers

- Arterial Ulcers

- Sports Injury Treatment

- Sprains and Strains

- Fractures

- Muscle Injuries

- Burn Injury Treatment

- First-Degree Burns

- Second-Degree Burns

- Third-Degree Burns

- Chronic Wound Treatment

- Non-Healing Wounds

- Infected Wounds

- Others Application

By End User

- Hospitals

- Ambulatory Surgery Center

- Clinics

- Retail

- Home Healthcare

- Others

Purchase the Competition Analysis Dashboard Today: https://dimensionmarketresearch.com/checkout/medical-tapes-and-bandages-market/

Growth Drivers

- Aging Population: A growing geriatric population increases demand for medical adhesive tapes and bandages because the elderly show a greater incidence of chronic wounds and surgical interventions. Demographic changes boost the premium wound care products market.

- Surgeries Increasing: With the advent of medical technology and increasing awareness about health, surgical operations have increased. This, in turn, increases the consumption of medical tapes and bandages by preventing infections and during post-operative care, hence growing the market.

Restraints

- High Costs: Advanced medical tapes and dressings are advanced and thus expensive, not cost-effective for low-income regions. Although the performance of advanced medical tapes and dressings was said to be better with improved outcomes for the patients, the price attached to accessing them is a barrier to entry into value-sensitive markets with small healthcare budgets.

- Regulatory Challenges: The bar for entry is high because of the regulatory requirements and the standard quality expectations for approval of products. Adherence to such regulation may cause delays in market entry and increase costs, which would require great investment in the assurance of quality and building of regulatory capabilities to sail through such a complex environment.

Growth Opportunities

- Emerging Markets: The emerging markets of the world offer huge growth potential because of increased spending on healthcare infrastructure, rising health expenditure, and growing awareness about sophisticated wound care solutions. Companies could expand in regions using local partnerships and region-specific product offerings.

- Product Innovation: Another major driver is innovation in skin-friendly, biodegradable wound care products, like smart bandages with sensor elements. All these solutions are patient-centric, boost the effectiveness and comfort of treatments, and help propel the global market forward.

Discover additional reports tailored to your industry needs

- Next Generation Sequencing Market size is expected to hold a market value of USD 13.5 billion in 2024 and is projected to show subsequent growth with a market value of USD 92.2 billion by the end of 2033 at a CAGR of 23.8%.

- Monoclonal Antibodies Market size is expected to reach a value of USD 279.8 billion in 2024, and it is further anticipated to reach a market value of USD 804.7 billion by 2033 at a CAGR of 12.5%.

- Medical Engineered Material Market is expected to dominate with USD 23.9 billion in 2024 and is anticipated to grow to USD 82.9 billion by 2033 at a CAGR of 14.8 %.

- Electrosurgical Generator Market is expected to reach a valuation of USD 1.8 billion in 2024 and is anticipated to achieve a remarkable CAGR of 8.0% for the forecast period to reach a value of 3.7 billion in 2033.

- Fabry Disease Treatment Market size is expected to value USD 2.4 billion in 2024 and reach a market value of USD 4.9 billion in 2033 at a CAGR of 8.3%.

- Hearth Market is expected to value USD 13.6 billion in 2024, and it is further anticipated to reach a market value of USD 24.5 billion by 2033 at a CAGR of 6.8 %.

- Sinus Dilation Devices Market size is estimated to reach a value of USD 3.5 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of 10.0% for the forecasted period (2024-2033).

Regional Analysis

North America is projected to lead the global medical tape and bandages market, holding 46.4% of total market revenue by 2024. The region's advanced healthcare infrastructure, high spending, and prevalence of chronic diseases like diabetes and obesity drive demand. A significant number of surgical procedures also contribute to market growth.

Ongoing R&D and major player activities fuel product innovation. Rising awareness and advanced wound care solutions further accelerate market growth, positioning North America as a leader.

By Region

North America

- The U.S.

- Canada

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Experience Growth: Request Your Sample Copy of the Report Now! https://dimensionmarketresearch.com/report/medical-tapes-and-bandages-market/request-sample/

Recent Developments in the Medical Tapes and Bandages Market

2024

- June: 3M launched eco-friendly medical tapes, focusing on sustainability and patient comfort, addressing the demand for sustainable healthcare solutions.

- May: Johnson & Johnson introduced an advanced antibacterial bandage for faster healing of chronic wounds, reducing infection rates and improving healing times.

- March: Smith & Nephew expanded its portfolio with waterproof bandages for active patients, providing secure, durable protection during activities.

- January: Mölnlycke Health Care invested in a new facility to boost the production of advanced wound care products, meeting growing global demand.

2023

- December: Medline Industries launched hypoallergenic medical tapes for sensitive skin, minimizing irritation while ensuring effective adhesion.

- October: B. Braun Melsungen AG introduced orthopedic bandages with enhanced support and comfort for orthopedic injuries.

- August: Cardinal Health collaborated with healthcare providers to create customized wound care solutions, improving patient outcomes.

- July: ConvaTec Group developed next-generation adhesive bandages with superior sticking properties and breathability.

- May: Coloplast launched elastic bandages for better compression and support in sports injuries, aiding athlete recovery.

- March: Hartmann Group unveiled antimicrobial gauze bandages to reduce infection risk and promote faster healing.

About Dimension Market Research (DMR):

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world.

We also believe that our clients don’t always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.