Caufield, Australia, Sept. 20, 2024 (GLOBE NEWSWIRE) -- Nova Minerals Limited (“Nova” and the “Company”) (NASDAQ: NVA) (ASX: NVA) (FRA: QM3), a gold and critical minerals exploration stage company focused on advancing the Estelle Gold Project in Alaska, U.S.A., is pleased to advise the Company has executed a variation agreement with its largest institutional shareholder and convertible note holder Nebari Gold Fund 1, LP (Nebari) to reduce the month end cash covenant required under the previously announced loan agreement dated 21 November 2022 from US$2m to A$1m, and with the option to extend the convertible facility for a further 12 months out to 29 November 2026. In addition to the recent US NASDAQ listing, the freeing up of this additional ~A$2m gives the Company the ability to accelerate the RPM early start up option to a Feasibility Study (FS) for delivery in 2025 by undertaking internal optimization studies aimed to investigate how it can potentially generate as much early cashflow as possible to organically fund the Company’s expansion plans across the Estelle Project. It also gives the Company the ability to continue its advanced discussions with the US Dept. of Defense (DoD) in relation to potentially establishing a starter antimony operation at Stibium in parallel.

Further details in respect to the variations of the Nebari convertible facility agreement are set out below.

Nova CEO, Mr Christopher Gerteisen commented: “It is a pleasure to work with Nebari, our largest institutional shareholder and note holder, who have shown strong support and indicated an unwavering commitment towards advancing the project through to production. We are certainly both aligned with the current fast track RPM FS completion strategy aimed at achieving production as soon as possible. Working together we have now freed up more than US$1.3m in cash to strengthen our financial position to facilitate this effort to deliver a lower capex, high margin, scale-able project focused initially on development of the RPM gold deposit to generate free cash flow as soon as possible to enable future growth across the larger Estelle Project area. With the continued support of Nebari, and all of our shareholders, we will work together for the ongoing progress and success of the Company as we continue to advance on our path towards commercial production.”

Nebari Senior Managing Director, Mr Roderik van Losenoord adds: “We are very pleased to be supporting Nova and its Estelle Project, as the company explores routes to develop RPM. Support and partnership is what the Nebari-lending relationship with our borrowers is all about.”

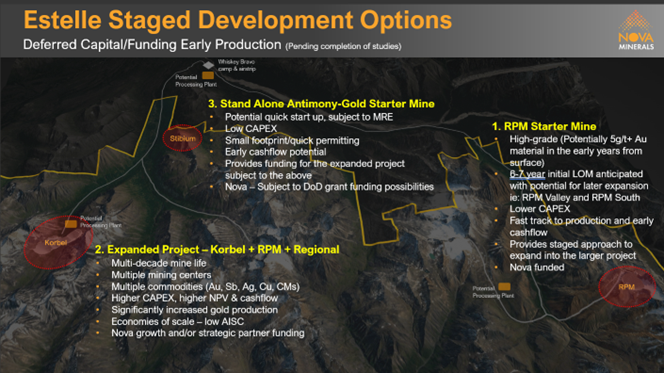

With an already defined multi-million ounce gold resource across 4 deposits, the Estelle Project has development optionality in terms of initial project size and scale. The PFS currently underway is considering a strategy to achieve production with a scalable operation, subject to market conditions and strategic partners, by;

1. Establishing an initial lower capex smaller scale operation at the high-grade RPM deposit for potential near term cashflow at high margins to self-fund expansion plans; and/or

2. Develop the higher capex larger mining operation with increased gold production, cash flow, and mine life, which is of interest to potential future large gold company strategic partners.

3. With China announcing export restrictions on antimony, the Stibium Antimony-Gold Prospect is being advanced and investigated as an additional small scale, stand-alone, quick start up cash flow opportunity, with potential US Dept. of Defense (DoD) support.

Nebari Convertible Note Variation

1. Nebari Gold Fund 1, LP continues to hold all its equity and remains a top 20 supporting shareholder. Nebari also continues to be a potential future funding partner for the lower capex, higher margin RPM project development currently going through PFS.

2. The variation agreement allows Nova an additional ~A$2m in free cashflow to further advance the project, with the minimum month-end consolidated cash balance of the Group required under the current loan agreement being reduced from US$2m to A$1m.

3. The variation agreement allows Nova to extend the term of the convertible facility by written notification prior to 29 November 2024, by an additional 12 months to 29 November 2026, at its option, subject to shareholder approval.

4. In return for Nebari’s support in reducing the month end cash covenant and providing Nova with the option to extend the convertible facility for an additional 12 months, Nova has agreed to amend the conversion price from A$0.53 to A$0.25, subject to shareholder approval.

About Nova Minerals Limited

Nova Minerals Limited is a Gold, Antimony and Critical Minerals exploration and development company focused on advancing the Estelle Project, comprised of 514 km2 of State of Alaska mining claims, which contains multiple mining complexes across a 35 km long mineralized corridor of over 20 advanced Gold and Antimony prospects, including two already defined multi-million ounce resources, and several drill ready Antimony prospects with massive outcropping stibnite vein systems observed at surface. The 85% owned project is located 150 km northwest of Anchorage, Alaska, USA, in the prolific Tintina Gold Belt, a province which hosts a >220 million ounce (Moz) documented gold endowment and some of the world's largest gold mines and discoveries including, Barrick's Donlin Creek Gold Project and Kinross Gold Corporation's Fort Knox Gold Mine. The belt also hosts significant Antimony deposits and was a historical North American Antimony producer.

Further discussion and analysis of the Estelle Gold Project is available through the interactive Vrify 3D animations presentations and videos all available on the Company’s website.

www.novaminerals.com.au

Forward-Looking Statements

Certain statements made in this announcement are forward-looking statements including with respect to the creation of a trading market for ADSs representing the Ordinary Shares in the United States. These forward-looking statements are not historical facts but rather are based on the Company’s current expectations, estimates, and projections about its industry; its beliefs; and assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties, and other factors, some of which are beyond the Company’s control, are difficult to predict, and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including if the Company’s registration statement is not declared effective by the SEC. The Company cautions security holders and prospective security holders not to place undue reliance on these forward-looking statements, which reflect the view of the Company only as of the date of this announcement. The forward-looking statements made in this announcement relate only to events as of the date on which the statements are made. The Company will not undertake any obligation to release publicly any revisions or updates to these forward-looking statements to reflect events, circumstances, or unanticipated events occurring after the date of this announcement except as required by law or by any appropriate regulatory authority.

For Additional Information Please Contact

Craig Bentley

Director of Finance & Compliance & Investor Relations

E: craig@novaminerals.com.au

M: +61 414 714 196

Attachment