Pune, Oct. 01, 2024 (GLOBE NEWSWIRE) -- Market Size:

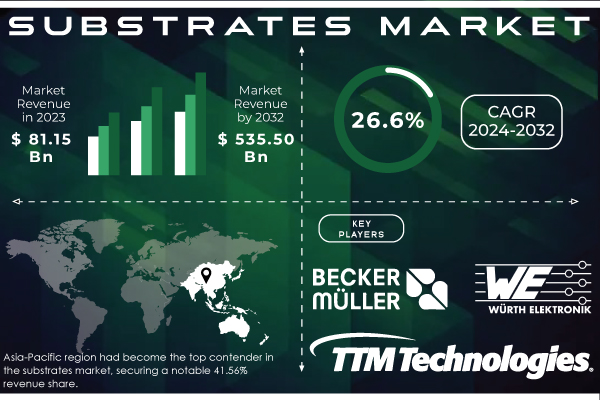

The Substrates Market Size was valued at USD 81.15 Million in 2023 and is expected to grow to USD 535.50 Million by 2032 and grow at a CAGR of 26.6% over the forecast period of 2024-2032.

The Pivotal Role of Substrates in Advancing Electronic Innovation

The substrates market is integral to various sectors, including electronics, automotive, aerospace, and medical devices, where substrates serve as essential materials for thin-film deposition and coating processes. As the demand for compact, high-performing electronic devices like smartphones and wearables surges, the need for advanced substrates becomes increasingly critical. Key materials such as silicon wafers are at the forefront of this evolution, enabling the creation of smaller, more efficient, and powerful components. The drive for miniaturization and enhanced performance is propelling manufacturers to seek substrates with superior electrical properties, thermal stability, and durability. As a result, the substrates market is poised for significant growth, particularly in regions with established electronics manufacturing, such as Asia-Pacific, emphasizing their vital role in shaping future technological advancements.

Get a Sample Report of Substrates Market Forecast @ https://www.snsinsider.com/sample-request/3782

Major Market Players Listed in this Research Report are:

- TTM Technologies Inc. (PCB, flexible circuits, and advanced packaging solutions)

- BECKER & MULLER (specialty substrates for electronic applications)

- SCHALTUNGSDRUCK GMBH (printed circuit boards and hybrid substrates)

- Advanced Circuits (custom PCBs and quick-turn prototyping)

- Sumitomo Electric Industries Ltd (high-performance substrates for electronic devices)

- Wurth Elektronik Group (Wurth Group) (electronic components and substrates)

- AMD (advanced semiconductor substrates for CPUs and GPUs)

- Viettel High Tech (communication substrates and electronic solutions)

- NextFlex (flexible hybrid electronics and advanced substrates)

- Infineon Technologies Inc. (power semiconductor substrates and integrated circuits)

- LG Innotek (multi-layer ceramic substrates and advanced electronic components)

- Onsemi (silicon substrates for power management and automotive applications)

- NXP Semiconductors (RF and high-performance substrates for automotive and IoT)

- Taiwan Semiconductor Manufacturing Company (TSMC) (advanced semiconductor substrates for chips)

- Sankyo Oilless Industry Corp. (high-quality substrates for electronic applications)

- Imasen Electric Industrial Co., Ltd. (ceramic substrates for automotive and industrial use)

- Mitsubishi Materials Corporation (high-performance substrates and materials for electronics)

Substrates Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 81.15 Million |

| Market Size by 2032 | USD 535.50 Million |

| CAGR | CAGR of 26.6% From 2024 to 2032 |

| Key Segments | • By Raw Material (GaSb, InSb, Bulk GaN, Ga2O3, Bulk AlN, Single crystal diamond, Engineered substrates and templates) • By Application (Computing, Consumer, Industrial/Medical, Communication, Automotive, Military/Aerospace) |

| Key Drivers | • Innovation in Flexible Substrates for Solar Cells and Emerging Applications • The Emergence of Eco-Friendly Substrates in the Electronics Industry and the Focus on Sustainability |

Changing the Automotive Industry with Increasing Need for Advanced Substrates.

The automotive sector is undergoing a profound transformation driven by the surge in electric vehicles (EVs) and autonomous driving technologies, which are significantly boosting the demand for advanced substrates. Essential for battery management systems (BMS), advanced driver-assistance systems (ADAS), and in-vehicle infotainment, these substrates require exceptional electrical conductivity, heat resistance, and durability. With EV sales rising from 4% to 14% of new car sales in just two years, and supportive government initiatives like the EU's Fit for 55 plan and the U.S. Bipartisan Infrastructure Law, the need for high-performance substrates is paramount. Materials such as silicon carbide (SiC) and gallium nitride (GaN) are increasingly essential for high-voltage applications, underscoring the substrates market's critical role in shaping the future of the automotive industry.

Do you Have any Specific Queries or Need any Customize Research on Substrates Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/3782

In 2023, Gallium Nitride and the Computing Sector will be the dominant forces in the Substrates Market Landscape.

In 2023, Bulk Gallium Nitride (GaN) solidified its position as the leading raw material in the substrates market, accounting for 37.51% of the revenue. GaN's exceptional electrical properties make it indispensable for power electronics and high-frequency applications. The recent launch of new GaN products by companies like Wolfspeed and Transphorm highlights the material's growing importance, especially in electric vehicles and renewable energy technologies. These advancements in GaN technology, driven by novel fabrication methods and enhanced thermal management, ensure its continued dominance and pivotal role in the development of next-generation electronics.

The computing sector was the largest segment in the substrates market in 2023, holding 35.44% of the revenue. This growth is fueled by the increasing demand for high-performance computing (HPC) solutions and advancements in semiconductor technology. Major companies like Intel and NVIDIA are leveraging advanced substrates to enhance the performance of their processors and GPUs, thereby driving further innovation in the market. The rise of AI and machine learning applications is accelerating the need for faster data processing and energy efficiency in data centers, underscoring the critical role of substrates in the evolution of computing technology.

Asia-Pacific leads in the Substrates Market with North America experiencing swift expansion.

The Asia-Pacific region emerged as the leader in the substrates market in 2023, capturing a significant revenue share of 41.56%. The rapid advancements in semiconductor technology and substantial investments in production facilities in countries like China, Japan, and South Korea are driving this growth. China’s focus on bolstering its semiconductor sector has resulted in increased demand for high-quality substrates, facilitating innovation and production capacity. Industry giants such as TSMC and Samsung Electronics are spearheading developments in advanced substrate technologies that enhance computing and consumer electronics performance. For instance, TSMC’s progress in its 5nm and 3nm process nodes through innovative substrates highlights the region's pivotal role in the global electronics landscape.

Purchase Single User License of Substrates Market Report at USD 3350 (33% Discount) @ https://www.snsinsider.com/checkout/3782

North America is anticipated to be the fastest-growing region in the substrates market, spurred by significant technological advancements and a robust demand for high-performance materials. The region accounted for a notable share of the global substrates market, fueled by the increasing need for advanced electronics across various sectors, including computing and telecommunications. Companies such as GlobalWafers and Silicon Valley Microelectronics are innovating solutions that cater to the surging demand for efficient semiconductor devices. For example, GlobalWafers' expansion of manufacturing capabilities in the U.S. focuses on producing advanced silicon wafers aligned with trends in electric vehicles and renewable energy. The supportive regulatory environment and investments driven by initiatives like the CHIPS Act further position North America as a critical hub for substrate development, enhancing competitiveness in the global market.

Recent Development

- Dec 2022: AMD and Viettel High Tech tested a 5G mobile network using AMD Xilinx Zynq UltraScale MPSoCs, boosting deployment efficiency for Vietnam’s largest telecom with 130 million+ subscribers.

- Feb 2022: NextFlex launched Project Call 7.0 to enhance Flexible Hybrid Electronics (FHE) for the Department of Defense, allocating $100 million for investments and projects exceeding $11.5 million.

- Jul 2023: Magna and Onsemi entered a long-term supply agreement to integrate Onsemi’s EliteSiC solutions into Magna's eDrive systems, improving EV performance and charging efficiency.

- Mar 2023: LG Innotek unveiled the 2-Metal COF at CES, enabling smaller bezels and miniaturization in TVs and laptops by connecting displays to PCBs.

Table of Contents - Analysis of Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Wafer Production Volumes, by Region (2023)

5.2 Chip Design Trends (Historic and Future)

5.3 Fab Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

7. Substrates Market Segmentation, by Raw Material

8. Substrates Market Segmentation, by Application

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Get Full Report Details of Substrates Market Growth & Outlook 2024-2032@ https://www.snsinsider.com/reports/substrates-market-3782

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.