Pune, Oct. 08, 2024 (GLOBE NEWSWIRE) -- Over-The-Counter (OTC) Drug Market Size & Growth Analysis:

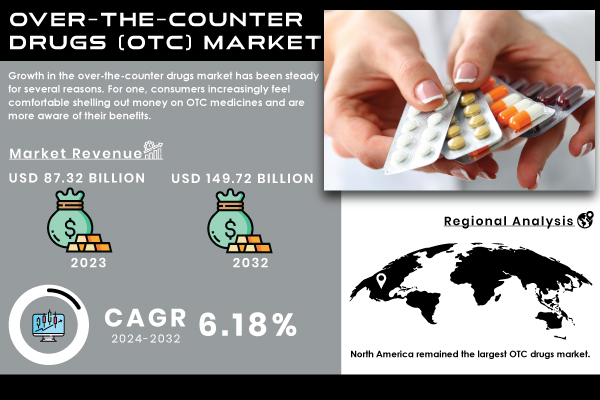

According to SNS Insider, The Over-the-Counter Drugs Market valued at USD 87.32 billion in 2023 is projected to grow at a CAGR of 6.18% from 2024 to 2032 and reach USD 149.72 billion by 2032.

Major growth drivers are increased consumer awareness of health and wellness, self-medication trends, and growing numbers of cases for various medical disorders. The easy accessibility of over the counter through expansion in retail pharmacies and portals also enhances the availability of products. Major hikes have been seen in new product launches that are innovative and cater to a vast spectrum of health issues in the past few years. The huge healthcare expenditure witnessed globally has compelled patients to seek inexpensive alternatives. The rising interest of patients in OTC medicines, therefore, consolidates demand. Due to this high demand, the supply chain has responded by increasing manufacturers' production capacity so that they can provide enough products on time because the consumer's needs are higher.

Get a Sample Report of Over-The-Counter Drugs Market@ https://www.snsinsider.com/sample-request/2904

Key Over-The-Counter Drugs Market Players:

- Johnson & Johnson Services Inc.

- Bayer AG

- Novartis AG

- Sanofi S.A.

- Pfizer

- Mylan

- GlaxoSmithKline Plc

- Boehringer Ingelheim International GmbH

- Reckitt Benckiser Group PLC

- Takeda Pharmaceutical Company Ltd.

- Perrigo Company plc

- The Blackstone Group, Inc. (Alinamin Pharmaceutical Co., Ltd.)

- Aytu Biopharma, Inc. (Aytu Consumer Health, Inc.)

- Dr. Reddy's Laboratories

- Viatris, Inc.

Over-The-Counter Drugs Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 87.32 Billion |

| Market Size by 2032 | US$ 149.22 Billion |

| CAGR | CAGR of 6.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Segmentation

By Product Type

Cold & Cough Remedies was the market leader of the Over-the-Counter drugs market in 2023, with a share of 21.9% of the total market. The segment is dominantly led by the rising prevalence of seasonal colds and coughs, mostly among young children under 10 years, as well as the elderly above 65 years. CDC has highlighted the need for proper therapeutic interventions within this segment, which has increased the demand. Easy availability and self-administration suitability have also placed this segment in a very robust market position.

The analgesics segment is the market's second-largest, supported by the aging population and high demand for pain relief products. Another innovation of late that has added muscle to this segment is new product launches like OTC Diclofenac Sodium topical gel, which was launched in the U.S. by Dr. Reddy's Laboratories Ltd. in September 2020. Analgesics are popular because of their availability and ease of use; there are no worries with self-medication since they also work well.

By Distribution Channel

Drug stores and retail pharmacies dominated the OTC drugs market in 2023. They took up 38.6% of the market share. This is because consumers have a strong desire to buy OTC products from drug stores and other retail pharmacies that are in very large numbers. Accessibility and the ability to approach pharmacy staff for guidance have placed the segment on a higher pedestal.

The second largest market size is the hospital's pharmacies. This is primarily because increasing presence of OTC drugs in a hospital. Online pharmacies will grow at a strong pace because of the penetration of the Internet in emerging markets and competitive discounts offered through online channels.

Over-The-Counter Drugs Market Key Segmentation:

By Product Type

- Analgesics

- Cold & Cough Remedies

- Digestives & Intestinal Remedies

- Skin Treatment

- Vitamins & Minerals

- Others

By Distribution Channel

- Drug Stores & Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

Do you have any specific queries or need any customization research on Over-The-Counter Drugs Market, Enquire Now@ https://www.snsinsider.com/enquiry/2904

Regional Market

The Over-the-Counter drugs market was dominated by North America in 2023, mainly due to the prevalence of emergency contraceptive pills like Plan B One-Step that are available without any age restrictions. Approvals of drugs such as Narcan and RiVive nasal sprays for emergency treatment of opioid overdose, and Opill, a progestin-only oral birth control pill, have driven the growth of this market. Pfizer and Johnson & Johnson, two of the leading players in the market, continue to diversify their OTC product lines to best serve the consumer.

However, with growing disposable income and increased health and wellness awareness among consumers, the Asia Pacific region is expected to grow strongly in the projection period. Expansion in retailing and rising e-commerce penetration in the region have expanded access to OTC products. GlaxoSmithKline and Bayer are some companies that are investing in this region to tap market potential.

Recent Developments

- June 2023- McKesson Corporation has launched Foster & Thrive, a branded private offering of OTC health and wellness products responding to the evolving needs of patients.

- July 2022- RLG Limited entered an agreement with AFT Pharmaceuticals to sell its OTC drugs via Tmall Global, further penetrating the Chinese online market.

- February 2023: The Company launched its new line of CBD-infused OTC wellness products to help manage the continually growing demand for alternative treatments.

- March 2023: Reckitt Benckiser announced it is now launching a new formulation of its leading allergy relief product, Nasacort, targeting seasonal sufferers of allergies with enhanced efficacy.

- April 2023: Bayer AG launched a new group of Over-the-counter digestive health products under the "Gut Guardian" brand name, with probiotics and gut health as leading themes.

- August 2023: Pfizer Inc. continues to strengthen its brand portfolio of over-the-counter products with the launch of a pain relief patches line that gives consumers more options for helping manage localized pain.

Buy a Single-User PDF of Over-The-Counter Drugs Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/2904

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

- Incidence and Prevalence (2023)

- Prescription Trends, (2023), by Region

- Drug Volume: Production and usage volumes of pharmaceuticals.

- Healthcare Spending: Expenditure data by government, insurers, and out-of-pocket by patients.

6. Competitive Landscape

7. Over-The-Counter Drugs Market Segmentation, by Product Type

8. Over-The-Counter Drugs Market Segmentation, by Distribution Channel

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Request An Analyst Call@ https://www.snsinsider.com/request-analyst/2904

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.