Pune, Oct. 11, 2024 (GLOBE NEWSWIRE) -- Market size & Growth Analysis:

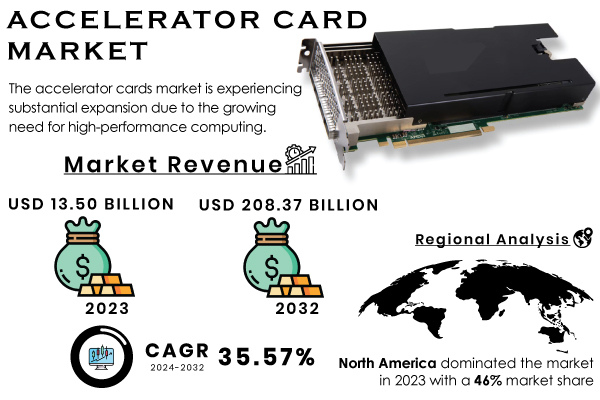

As per the SNS Insider Report, “The Accelerator Card Market Size was valued at USD 13.50 Billion in 2023 and is projected to reach USD 208.37 Billion by 2032, growing at a CAGR of 35.57% during the forecast period 2024-2032.”

Accelerator cards are commonly utilized in the gaming sector as a major application area. With the rise in popularity of high-definition gaming and virtual reality (VR), gamers are seeking systems that offer immersive experiences. By 2024, the gaming sector in the US will continue to see strong growth, driven by increasing digital sales and the popularity of mobile gaming. Almost 90% of overall income is generated from digital game purchases, as players are increasingly choosing downloadable content over physical discs. The rise in mobile gaming popularity is projected to lead in-game transactions to exceed USD 74 billion globally by 2025. Accelerator cards can boost graphics performance by raising frame rates and improving rendering quality. This has led to an increased demand for custom gaming accelerator cards made for gamers, improving the gaming experience of the users.

Get a Sample Report of Accelerator Card Market Forecast @ https://www.snsinsider.com/sample-request/2498

Top Market Players Listed in this Research Report are:

- NVIDIA (NVIDIA A100, NVIDIA RTX A6000)

- AMD (Radeon Pro VII, Radeon RX 6000 Series)

- Intel (Intel Xeon Phi, Intel FPGA PAC N3000)

- Xilinx (now part of AMD) (Versal ACAP, Kintex UltraScale FPGA)

- Micron Technology (Micron 9300 NVMe SSD, Micron 5210 ION SSD)

- Broadcom (Broadcom NetXtreme II, Broadcom StrataXGS)

- IBM (IBM Cloud Accelerator, IBM Power System AC922)

- AWS (Amazon Web Services) (AWS Inferentia, AWS Graviton)

- Qualcomm (Snapdragon 8cx, Qualcomm Cloud AI 100)

- HPE (Hewlett Packard Enterprise) (HPE Apollo 6500 Gen10, HPE ProLiant DL380 Gen10)

- Dell Technologies (Dell PowerEdge R740, Dell EMC VxRail)

- Lenovo (ThinkSystem SR670, ThinkSystem SR850)

- Mellanox Technologies (now part of NVIDIA) (Mellanox ConnectX-6, Mellanox Spectrum)

- Supermicro (SuperServer 1029P-NDR, SuperServer 2029GP-TRT)

- Oracle (Oracle Exadata Database Machine, Oracle Cloud Infrastructure)

- Fusion-io (now part of Western Digital) (ioMemory, ioScale)

- Samsung Electronics (Samsung PM1733, Samsung 970 EVO Plus)

- Seagate Technology (Seagate Exos X16, Seagate IronWolf Pro)

- Crucial (a brand of Micron Technology) (Crucial P5 SSD, Crucial MX500 SSD)

- SK Hynix (SK Hynix Gold S31 SSD, SK Hynix P31 NVMe SSD)

"Key Market Segments in Focus: Analyzing the Forces Driving Expansion and Innovation"

BY ACCELERATOR TYPE

- Cloud Accelerator

- High-performance computing accelerator

The cloud accelerator segment accounted for 58% of the market in 2023, and this is because cloud computing services are becoming increasingly common in various industries. Cloud accelerators were created to optimize the processing of workloads and data for cloud-based applications. Moreover, these accelerators can deliver scalable resources that can be programmed to adapt to the demand and are therefore ideal for firms that want to streamline their performance but are not prepared for high capital costs.

BY PROCESSOR TYPE

- Graphics Processing Units (GPU)

- Central Processing Units (CPU)

- Application Specific Integrated Circuits (ASIC)

- Field Programmable Gate Arrays (FPGA)

Graphic Processing Units segment dominated in 2023 with a 42% market share. This is mainly due to its versatility and performance in parallel processing tasks. GPUs are specifically designed to process demanding calculations, which are relevant to a variety of tasks starting from gaming, machine learning, artificial intelligence, and data presentation. The design of this type of processor allows multitudes of parallel threads, resulting in faster data processing, as compared to traditional CPUs.

Do you Have any Specific Queries or Need any Customize Research on Accelerator Card Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/2498

BY APPLICATION

- Video and image processing

- Machine learning

- Data Analytics

- Financial computing

- Mobile phones

- Others

"Regional Market Spotlight: Analyzing Performance and Prospects Across Key Regions"

In 2023, North America was the market leader with a 46% market share as a result of its advanced technology infrastructure and substantial investments in research and development. The region's growing emphasis on cloud computing and high-performance computing (HPC) is driving up the demand for accelerator cards, as businesses strive to enhance their computing power and efficiency.

APAC region is emerging as the fastest-growing market for accelerator cards due to heightened digital transformation efforts and increased adoption of advanced technologies. Countries like China, Japan, and India are experiencing substantial advancements in fields such as cloud computing, artificial intelligence, and big data analysis, resulting in a higher demand for efficient processing options.

Recent Developments in the Accelerator Card Market

- AMD Alveo V80 Compute Accelerator Card: Launched in May 2024, AMD's Alveo V80 is designed for high-performance computing (HPC) and compute-intensive workloads. It features up to 2X increase in high-bandwidth memory (HBM) bandwidth, making it ideal for demanding AI and data processing tasks. This card is part of AMD's strategy to strengthen its HPC leadership.

- Intel Infrastructure Processing Unit (IPU) E3100: Announced in mid-2024, this accelerator card is aimed at offloading cloud workloads, freeing up CPU resources for other tasks. It's designed to enhance cloud data center efficiency, addressing storage and networking challenges through its programmable architecture.

- Qualcomm 5G Distributed Unit (DU) X100 Accelerator Card: Unveiled in early 2024, this card is designed to drive the expansion of Open RAN networks, which are critical for the global rollout of 5G. It provides scalable solutions for operators looking to virtualize their networks and enhance flexibility.

Purchase an Enterprise User License of Accelerator Card Market Report at 40% Discount @ https://www.snsinsider.com/checkout/2498

Future Trends for the Accelerator Card Market

The accelerator card market is on a robust growth trajectory, driven by its critical role in optimizing AI, machine learning, and high-performance computing tasks. The market is expected to continue evolving with the rise of edge computing, quantum computing, and more AI-driven applications.

| Trend | Description |

| Increased Adoption in AI Applications | Accelerator cards will continue to be integral to the rapid deployment of AI solutions in industries like healthcare and finance. |

| Expansion of Edge Computing | Growing demand for edge computing will drive the use of specialized accelerator cards for real-time data processing at the edge. |

| Cloud-based AI Computing Growth | The proliferation of cloud-based AI services will propel the need for cloud accelerators, optimizing large-scale AI workloads. |

| Integration with Quantum Computing | Quantum computing developments may lead to the integration of accelerator cards for hybrid quantum-classical systems. |

Table of Contents - Key Points Analysis

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Accelerator Card Production Sales Volume, by Region

5.2 Accelerator Card Regulatory Impact, by Region (2023)

5.3 Accelerator Card Pricing Trends, 2023

5.4 Accelerator Card Fab Capacity Utilization (2023)

5.5 Supply Chain Metrics

6. Competitive Landscape

7. Accelerator Card Market Segmentation, by Accelerator Type

8. Accelerator Card Market Segmentation, by Processor Type

9. Accelerator Card Market Segmentation, by Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Insights of Accelerator Card Market Growth & Outlook 2024-2032@ https://www.snsinsider.com/reports/accelerator-card-market-2498

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.