Pune, Oct. 15, 2024 (GLOBE NEWSWIRE) -- RegTech Market Size Analysis:

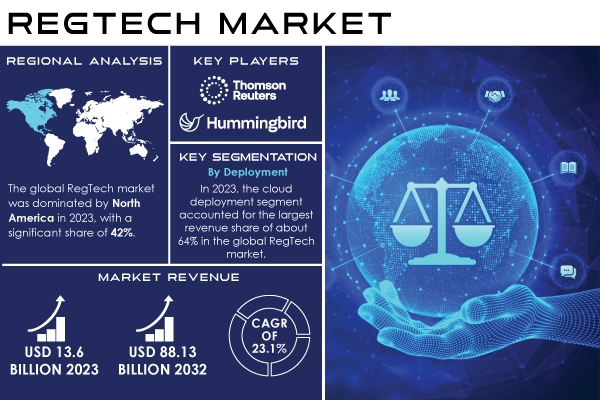

“According to the latest report from S&S Insider, the global RegTech Market was valued at USD 13.6 billion in 2023 and is projected to reach USD 88.13 billion by 2032, achieving a remarkable compound annual growth rate (CAGR) of 23.1% from 2024 to 2032.”

Regulatory Demands and Technological Innovation Propel Market Growth

The intensification of regulatory scrutiny across various sectors, particularly in financial services, has led organizations to seek advanced regulatory technology solutions. This demand is underscored by a series of recent high-profile compliance failures that have resulted in significant financial penalties for companies, highlighting the critical need for effective RegTech solutions.

Government initiatives and industry collaborations are also contributing to the growth of the RegTech market. Many regulatory bodies are encouraging the adoption of digital solutions to improve compliance processes. For instance, the European Union's Digital Finance Strategy emphasizes the need for innovative technologies to support financial regulation, leading to greater investment in RegTech solutions. Similarly, in the United States, the Financial Industry Regulatory Authority (FINRA) has called for more robust technology-driven compliance measures, further stimulating market growth. As regulatory demands continue to rise, organizations are increasingly turning to RegTech solutions to automate compliance tasks, enhance reporting accuracy, and ensure timely updates to regulatory changes. The shift toward digital transformation within organizations has also played a pivotal role in driving demand for RegTech tools, which help streamline operations and improve overall efficiency.

Get a Sample Report of RegTech Market@ https://www.snsinsider.com/sample-request/3725

Major Players Analysis Listed in this Report are:

- CUBE (Automated Regulatory Intelligence, RegPlatform)

- Thomson Reuters (Regulatory Intelligence, CLEAR Compliance)

- Hummingbird RegTech (Compliance Workflow Tools, Investigation Platform)

- Ascent Technologies, Inc. (Compliance Confidence Scorecard, Regulatory Knowledge)

- Fenergo (Client Lifecycle Management, Regulatory Rules Engine)

- ComplyAdvantage (Transaction Monitoring, Risk Monitoring)

- NICE Actimize (Surveillance, AML Solutions)

- ClauseMatch (Policy Management, Compliance Workflow)

- Trunomi (Data Rights Management, Consent Management)

- Chainalysis (Cryptocurrency Transaction Monitoring, KYT – Know Your Transaction)

RegTech Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 13.6 billion |

| Market Size by 2032 | USD 88.13 billion |

| CAGR | CAGR of 23.1 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | •Growing global regulatory frameworks demand advanced solutions to ensure compliance, and financial institutions are increasingly adopting RegTech to manage diverse and evolving regulations •Cloud technology offers scalability and flexibility for regulatory compliance operations, enhanced security and real-time data analytics are driving cloud-based RegTech deployments. •Governments are enforcing stringent AML regulations, driving demand for automated compliance tools, RegTech solutions provide rapid identification and reporting of suspicious financial activities. |

Do you have any specific queries or need any customization research on RegTech Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/3725

Segment Analysis

By Deployment | Cloud Segment Dominates

In 2023, the cloud deployment segment accounted for the largest revenue share of approximately 64% in the global RegTech market. The increasing preference for cloud-based solutions is attributed to their scalability, cost-effectiveness, and ease of integration with existing systems. Organizations are leveraging cloud technology to enhance their compliance capabilities while minimizing operational overhead. The flexibility offered by cloud deployments allows companies to quickly adapt to changing regulatory landscapes, making it an attractive choice for businesses aiming to maintain compliance without significant resource investments.

Moreover, cloud-based RegTech solutions provide businesses with the agility needed to respond to evolving regulations and facilitate collaboration across different departments. By eliminating the need for on-premises infrastructure, organizations can allocate resources more efficiently, ultimately driving down costs while improving compliance.

By End-User | BFSI Sector Leads the Market

The BFSI (Banking, Financial Services, and Insurance) segment dominated the global RegTech market in 2023, driven by the increasing regulatory scrutiny within financial services. This sector held around 26% of the global RegTech market share in 2023. Banks, insurance companies, and other financial institutions are adopting RegTech solutions to streamline compliance workflows, manage risk, and ensure adherence to stringent regulations.

The rising frequency of audits and penalties for non-compliance further emphasizes the need for effective RegTech tools in this sector. The growing trend of digital banking and fintech innovation has also heightened the urgency for organizations to adopt advanced compliance technologies to navigate complex regulatory requirements.

RegTech Market Segmentation:

By Component

- Solutions

- Services

- Professional Services

- Managed Services

By Deployment mode

- Cloud

- On-premises

By Organization Size

- Large Enterprises

- SMEs

By Application

- Risk & Compliance Management

- Identity Management

- Regulatory Reporting

- AML and Fraud Management

- Regulatory Intelligence

By End-user

- BFSI

- Manufacturing

- IT & Telecom

- Healthcare

- Government

- Others

Regional Analysis

North America led the RegTech market in 2023 and accounted for a substantial share due to its well-established regulatory framework and high adoption rates of innovative compliance technologies. The United States remains a significant contributor, driven by stringent regulations in the financial services sector and a growing emphasis on digital transformation. Key factors contributing to North America's dominance in the RegTech market include the presence of leading technology firms, robust investment in research and development, and a growing focus on cybersecurity. Organizations in North America are increasingly leveraging RegTech solutions to enhance operational efficiency, reduce compliance costs, and improve risk management practices.

The Asia-Pacific region is anticipated to experience rapid growth during the forecast period, fueled by increasing regulatory requirements and a surge in fintech innovation. Countries such as China, India, and Singapore are witnessing heightened regulatory scrutiny, prompting financial institutions to adopt RegTech solutions to ensure compliance and improve operational efficiency.

Buy an Enterprise-User PDF of RegTech Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/3725

Recent Developments

- Verafin (August 2024): Verafin, a leader in fraud detection and anti-money laundering solutions, announced enhancements to its platform, focusing on machine learning algorithms to streamline compliance processes. The updated technology aims to provide financial institutions with more accurate insights into suspicious activities, enabling them to respond swiftly to regulatory requirements.

- ComplyAdvantage (July 2024): ComplyAdvantage launched a new feature within its AML (Anti-Money Laundering) compliance tool that allows for real-time monitoring of transactions and automatic reporting of suspicious activities. This enhancement aims to reduce the compliance burden on financial institutions and improve response times to regulatory changes.

- Fenergo (June 2024): Fenergo announced a partnership with a leading global bank to enhance its client lifecycle management solutions. This collaboration focuses on integrating advanced analytics capabilities to automate the onboarding process and ensure compliance with Know Your Customer (KYC) regulations, thereby reducing operational risks for financial institutions.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. RegTech Market Segmentation, By Component

8. RegTech Market Segmentation, By Deployment Mode

9. RegTech Market Segmentation, By Organization Size

10. RegTech Market Segmentation, By Application

11. RegTech Market Segmentation, By End-user

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practices

15. Conclusion

Access Complete Report Details of RegTech Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/regtech-market-3725

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.