Pune, Oct. 16, 2024 (GLOBE NEWSWIRE) -- FemTech Market Size Analysis:

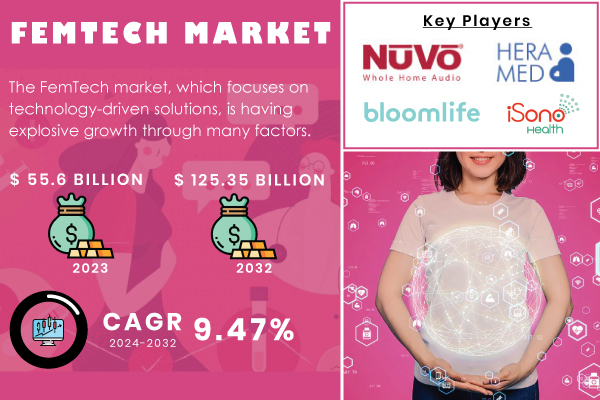

According to SNS Insider, The FemTech Market was valued at USD 55.6 billion in 2023 and is projected to reach USD 125.35 billion by 2032, with a CAGR of 9.47% during the forecast period 2024-2032. All these are positively affecting the market's growth. Most importantly, the adoption of mobile health applications and wearable devices has soared recently, and FemTech will be one of the markets that will boom because it covers a wide range of diverse healthcare necessities unique to women.

Market Overview

FemTech refers to the entire spectrum of technologies and seeks to alleviate as well as serve the health needs of women, from issues about reproductive health to management during pregnancy and menstrual health. Demand for FemTech is increasing because women are becoming increasingly health conscious about issues uniquely affecting them, and the awareness is driving demand for technology-based solutions for health monitoring and wellness. To a large extent, the supply side has also seen innovations and advancements in technology, thus improving product offerings. Mobile health applications, wearable devices, and digital platforms are being developed at a very fast pace to drive this market. Furthermore, increased spending on research and development in women-centric healthcare solutions is also paving the way for augmenting the supply chain. This makes it a crucial aspect of the overall healthcare situation by providing the most essential services that focus exclusively on women.

Get a Sample Report of FemTech Market@ https://www.snsinsider.com/sample-request/2691

Key FemTech Market Players:

- Chiaro Technology Limited

- HeraMED

- Natural Cycles USA Corp

- Bloomlife

- iSono Health, Inc.

- Allara Health

- Syrona Health

- Sirona Hygiene Private Limited

- Flo Health, Inc.

- Glow, Inc.

- Samplytics Technologies Private Limited

- NUVO Inc.

- Athena Feminine Technologies

FemTech Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 55.6 Billion |

| Market Size by 2032 | US$ 125.35 Billion |

| CAGR | CAGR of 9.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Segment Analysis

By Type

Devices is the market leader in the FemTech market, accounting for 33.2% of the revenues generated during 2023, and is likely to grow at the highest rate in the forecast period. The primary drivers behind this are heightened levels of awareness about women's health and a trend toward value-based care. Consumers are increasingly emphasizing wellness and self-care, which has been fueling the adoption of FemTech devices, especially wearable technology. The advantage of wearable devices is they make it easier and flexible for women to manage their health through smartphones. Enhanced appealability comes with features like wireless connectivity and the fact that they last longer. This popularity might continue, as tremendous growth in the use of fitness trackers and smartwatches is expected from now and onwards, with improvements in user experience and functionality catching up.

The software segment also holds tremendous promise and is expected to achieve significant growth within the next couple of years, primarily due to the growth in preventive health care and a high penetration of smartphones. Novel applications are being designed that will assist a woman in navigating her health-care journey effectively. For example, Guidea introduced Femovate, a UX design program for early-stage FemTech startups to help build products that are more usable and accessible for women's health.

By Application

It was the largest share contributor in 2023 at 17.7% of the general revenue. This growth is driven by heightened awareness and innovative technological advancements that cater specifically to expectant and postpartum mothers. Companies are focused on developing solutions that support women during pregnancy and postpartum stages, including mobile applications that track pregnancy progress and provide mental health resources. An example is the Janam App that launched in October 2023 and supports South Asian women through multilingual pregnancy care.

The coming years will witness the fastest growth in the menstrual health area based on the increased attention from women seeking tools for menstrual hygiene management and awareness about reproductive health.

By End-Use

The DTC segment showed the largest market share in the FemTech market, with 30.68% revenue contribution as of 2023, and thus had the highest growth rate. DTC models are straightforward and facilitate buying products directly from online stores, which further helps in building trust between brands and consumers. One such example is the UK-based company Unfabled, whose bespoke platform for women's health was launched in June 2024, namely Unfabled Labs.

The increase is significant in the hospital segment because health providers will look for FemTech-based care delivery that will improve patient care. Oova and Babyscripts are two integral changes inside a clinical setting since they provide real-time data to create unique care plans for women.

FemTech Market Key Segmentation:

By Type

- Devices

- Software

- Services

- Consumer Products

By Application

- Pregnancy and Nursing Care

- Reproductive Health & Contraception

- Menstrual Health

- General Health

- Pelvic & Uterine Health

- Sexual Health

- Womens Wellness

- Menopause Care

- Longevity & Mental Health

By End-Use

- Direct to Consumer

- Hospitals

- Surgical Centers

- Fertility Clinics

- Diagnostic Centers

- Others

Do you have any specific queries or need any customization research on FemTech Market, Enquire Now@ https://www.snsinsider.com/enquiry/2691

Regional Analysis

North America

North America holds the largest share of the FemTech market with a strong focus on the innovation and investments put into the development of women's health technologies. FemTech has a major chunk of companies located in the U.S., with thousands of startups and established companies operating in this space with good venture capital investments. Applications such as Clue, which is a menstrual tracking application, and Modern Fertility, offering hormone testing for fertility at home, are transforming the health industry. Personalized healthcare solutions and women's health attention among the residents in this region will surely boost the growth.

Asia-Pacific

The fastest growth is happening in the Asia-Pacific region in the FemTech market, wherein with a growing aware and middle-class population, the issues related to women's health are also surfacing in countries such as India and China, which further fuels demand for these products. Support is provided by this rising smartphone penetration and improving internet connectivity. Among the current significant applications are Mylo, an application for support during pregnancy and parenting, and Femtech Labs, which specializes in the digital development of women's health. The region is also witnessing an upward growth curve in the healthcare structure and is leaning toward consumer-driven health solutions, which would further enhance the market growth rate.

Recent Development

- In June 2024, Unfabled launched Unfabled Labs, a DTC platform focusing on women's health products.

- In 2023, Guidea launched the Femovate UX design program to support early-stage FemTech startups.

Buy a Single-User PDF of FemTech Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/2691

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence of Women's Health Issues (2023)

- Usage Trends of FemTech Devices and Applications (2023)

- Prescription Trends by Region (2023)

- Device Volume and Sales Trends by Region (2020-2032)

- Healthcare Spending on FemTech Solutions (2023)

- Consumer Demographics and Preferences (2023)

6. Competitive Landscape

7. FemTech Market Segmentation, by Type

8. FemTech Market Segmentation, by Application

9. FemTech Market Segmentation, by End-Use

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Request An Analyst Call@ https://www.snsinsider.com/request-analyst/2691

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.