Pune, Oct. 22, 2024 (GLOBE NEWSWIRE) -- Insurance Telematics Market Size Analysis:

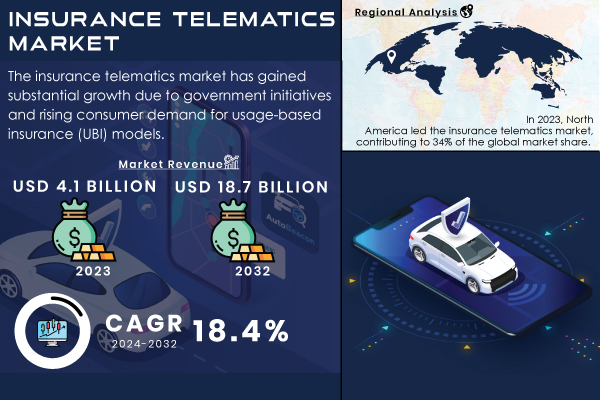

“According to SNS insider, the Insurance Telematics Market was valued at USD 4.1 billion in 2023 and is projected to reach USD 18.7 billion by 2032, growing at a robust CAGR of 18.4% during the forecast period of 2024-2032.”

The integration of telematics technology in insurance is enabling insurers to gather real-time data on driver behavior, vehicle conditions, and usage patterns. This data-driven approach allows insurers to tailor policies based on individual risk profiles, fostering a more competitive insurance landscape. As such, Insurance Telematics not only enhances customer engagement but also contributes to risk mitigation and better loss prevention strategies. Moreover, as road safety becomes a more significant concern globally, insurers are leveraging telematics solutions to monitor driving habits and reduce accidents. This is particularly relevant in the context of rising traffic fatalities, prompting both consumers and insurers to prioritize safety and risk management.

Additionally, regulatory bodies are increasingly advocating for the use of telematics to promote safer driving practices, further driving the demand for telematics-based insurance solutions. The rise of pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD) models is reshaping the insurance landscape, making it more adaptable to individual driving patterns and lifestyle choices. These models not only help insurers optimize pricing strategies but also encourage safer driving behaviors among policyholders.

Get a Sample Report of Insurance Telematics Market@ https://www.snsinsider.com/sample-request/3346

Major Players Analysis Listed in this Report are:

- Verizon Connect (Reveal, Fleetmatics)

- Octo Telematics (OCTO SmartDiag, OCTO Vantage)

- TomTom Telematics (Webfleet, LINK)

- Trimble Inc. (FieldMaster, GeoManager)

- Teletrac Navman (Director, GPS Fleet Tracking)

- Mix Telematics (MiX Fleet Manager, MiX DriveMate)

- CalAmp (LenderOutlook, iOn Tag)

- Vodafone Automotive (U-Tag, Fleet Performance)

- Cambridge Mobile Telematics (CMT) (DriveWell, Safestop)

- Geotab (Geotab GO9, MyGeotab)

- Progressive Corporation

- Allianz SE

- AXA Group

- State Farm Insurance

- Liberty Mutual Insurance

- Zurich Insurance Group

- Generali Group

- Nationwide Mutual Insurance Company

- Aviva plc

- The Hartford

Insurance Telematics Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.1 Bn |

| Market Size by 2032 | US$ 18.7 Bn |

| CAGR | CAGR of 18.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | • Growing consumer demand for personalized premiums based on driving behaviour is driving the adoption of UBI, supported by telematics devices. • Improved IoT connectivity and big data analytics are enabling insurers to collect and analyze real-time driving data, enhancing risk assessment accuracy. • Mandates and regulations in various countries are pushing for telematics systems to improve road safety and reduce accidents, increasing telematics usage. |

Do you have any specific queries or need any customization research on Insurance Telematics Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/3346

What Are the Growth Factors of the Insurance Telematics Market?

- Rising Demand for Personalized Insurance Products: As consumers become more aware of their driving habits and associated risks, there is a growing demand for insurance products that reflect individual behaviors. Telematics solutions allow insurers to offer usage-based insurance (UBI) models, which can lead to significant savings for low-risk drivers.

- Technological Advancements: Innovations in telematics technology, including GPS tracking, IoT devices, and mobile applications, are improving the quality of data collected. Enhanced data analytics capabilities allow insurers to better understand risk profiles and implement more effective pricing models.

- Increased Road Safety and Risk Management: Insurance telematics provides valuable insights into driving behaviors such as speeding, hard braking, and sharp cornering. This data can help insurers proactively engage with drivers to promote safer habits, thus reducing claims and enhancing overall road safety.

- Regulatory Push for Safer Roads: Governments around the world are increasingly focusing on road safety, leading to regulations that encourage the adoption of telematics solutions. For example, initiatives promoting connected vehicles and smart transportation systems are gaining traction, further pushing the need for telematics in insurance.

- Growing Adoption of Connected Cars: The rise of connected car technology is playing a crucial role in the expansion of the Insurance Telematics market. As more vehicles are equipped with advanced telematics systems, insurers can access real-time data to assess risks more accurately and tailor their offerings accordingly.

Market Segmentation Analysis

By Component

The hardware segment dominated the insurance telematics market and held approximately 68% revenue share in 2023. Hardware components typically include devices like telematics boxes, GPS systems, and onboard diagnostic (OBD) devices that collect and transmit data regarding driving behavior, vehicle location, and engine performance.

- Hardware: The hardware segment's dominance can be attributed to the increasing installation of telematics devices in vehicles. Insurers often provide these devices at subsidized rates to promote usage-based insurance models.

- Software: The software segment is also witnessing substantial growth as insurers invest in sophisticated analytics platforms to interpret the data collected from telematics devices, leading to more refined risk assessment and policy pricing strategies.

By Vehicle Type

In terms of vehicle type, passenger cars emerged as the leading segment in 2023, capturing the highest market share in the Insurance Telematics market. This trend is primarily driven by the high number of registered passenger vehicles globally and the growing interest in personalized insurance products.

- Passenger Cars: The passenger car segment's growth can be attributed to the increasing adoption of telematics-based insurance solutions among personal vehicle owners. This demographic is more likely to opt for UBI policies, which reward safe driving habits with lower premiums.

- Commercial Vehicles: The commercial vehicle segment is also poised for significant growth, driven by the need for fleet management and risk reduction in commercial operations. Businesses are increasingly using telematics to monitor vehicle conditions, optimize routes, and reduce operational costs.

Insurance Telematics Market Segmentation:

By Component

- Hardware

- Software

By Deployment

- On-premises

- Cloud

By Usage Type

- Pay-As-You-Drive (PAYD)

- Pay-How-You-Drive (PHYD)

- Manage-How-You-Drive (MHYD)

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

The Insurance Telematics market is witnessing diverse growth patterns across different regions.

North America dominated the insurance telematics market in 2023 and accounted for a substantial revenue share of 34%. This dominance is attributed to the mature automotive sector, high adoption rates of telematics solutions, and the presence of leading insurance providers investing in advanced telematics technologies. Regulatory frameworks in the U.S. and Canada also encourage the adoption of telematics solutions, promoting road safety and efficient insurance practices.

The Asia-Pacific region is expected to experience the fastest growth during the forecast period, driven by rapid urbanization, increasing vehicle ownership, and the adoption of connected vehicle technologies. Countries like China and India are witnessing significant investments in telematics infrastructure, paving the way for growth in the Insurance Telematics market. Additionally, the region's growing emphasis on digital transformation and smart mobility initiatives is expected to further enhance the market landscape.

Buy an Enterprise-User PDF of Insurance Telematics Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/3346

Recent Developments

- Allstate (2023) - Allstate announced the launch of its new telematics-based insurance program, which leverages advanced analytics to assess driver behavior and provide personalized discounts for safe driving.

- Progressive Insurance (2023) - Progressive introduced an upgraded version of its Snapshot telematics program, featuring enhanced data collection methods and machine learning capabilities to better evaluate risk and offer personalized premium pricing.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Insurance Telematics Market Segmentation, By Component

8. Insurance Telematics Market Segmentation, By Usage Type

9. Insurance Telematics Market Segmentation, By Deployment

10. Insurance Telematics Market Segmentation, By Vehicle Type

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Details of Insurance Telematics Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/insurance-telematics-market-3346

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.