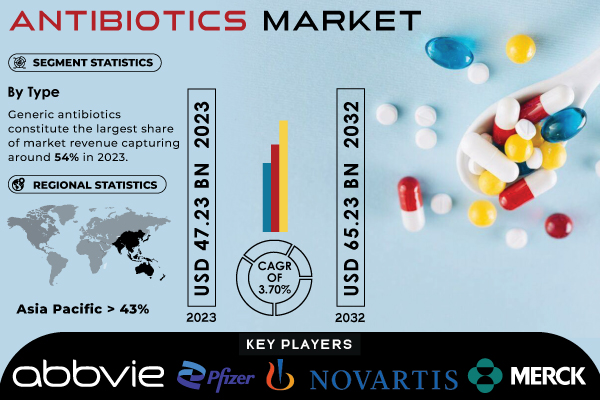

Austin, Oct. 23, 2024 (GLOBE NEWSWIRE) -- According to SNS Insider, The Antibiotics Market Size was valued at USD 47.23 Billion in 2023 and is projected to reach USD 65.23 Billion by 2032, growing at a compound annual growth rate (CAGR) of 3.70% from 2024 to 2032.

Key Antibiotics Companies:

- AbbVie Inc.

- Pfizer Inc.

- Novartis AG

- Merck & Co. Inc.

- Teva Pharmaceutical Industries Ltd.

- Lupin Pharmaceuticals Inc.

- Viatris Inc.

- Melinta Therapeutics LLC

- Johnson & Johnson

- F. Hoffmann-La Roche AG

- AstraZeneca PLC

- Bayer AG

- Abbott Laboratories

- Eli Lilly and Company

- Bristol-Myers Squibb Company

- Astellas Pharma Inc.

- Cipla Ltd

- Shionogi & Co. Ltd.

- KYORIN Pharmaceutical Co. Ltd.

- Nabriva Therapeutics PLC

- GSK Plc and Others

Get a Sample Report of Antibiotics Market@ https://www.snsinsider.com/sample-request/2966

Antibiotics Market Trends

- Growth of Antibiotics Market Accelerates in Response to Escalating Infectious Diseases and Antimicrobial Resistance Concerns

The antibiotics market is seeing rapid growth driven by a growing concern over infectious diseases along with an awakening to the dangers of antimicrobial resistance, which could claim 10 million lives annually by 2050. An estimated 154 million antibiotic prescriptions are written for patients annually in the United States, translating into an urgent need for accessing the right type of antibiotics and usage to combat AMR. Furthermore, with the increased use of retail pharmacies for antibiotics, the online pharmacy market today realizes over USD 20 billion in annual revenue with convenient home delivery and easy access to prescription and over-the-counter medications.

Looking forward, increased AMR calls for new treatment approaches and a high level of research and development investments of an estimated USD 250 to USD 400 million annually. The imperative of the urgent innovation in antibiotic research is thus the future: more efforts on aspects of regulatory strategies to optimize antibiotic use. Future progress will focus on developing individualized treatments as well as ways to make antibiotics more effective, both are expected to face the challenge of resistance.

- Expansion of Online Pharmacy Usage and Market Growth

The adoption of digital pharmacies sped up extremely at the beginning of the COVID-19 pandemic and then spread across all countries. In 2020, pharmaceutical e-commerce platforms sold 42 million items worldwide. By the end of 2023, internet pharmacy usage users in the United Kingdom are expected to nearly double to an average of 60%. The growth is based on the increased demand for home delivery and convenience associated with antibiotic access. The online pharmacy industry is transforming and redefining the way patients receive medications, with the integration of digital healthcare into the daily lives of most people.

- Increased R&D Investments Propel Antibiotics Innovation

Investments by pharmaceutical companies in antibiotic R&D can be expected to increase significantly to deal with resistant bacterial strains. During 2022 alone, for instance, the US pharmaceutical industry sector had spent over USD 100 billion on R&D and those are rising costs of innovation. Consequently, high investments have therefore fostered antibiotic discovery and encouraged alternative efforts to combat emerging resistance. A move forward into biologics and targeted antibiotics will increasingly target resistant infections. Future investment in R&D will be required to underpin the development of next-generation experimental methods that may ultimately deliver a breakthrough therapy and sustain additional growth in the market.

Antibiotics Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 47.23 Billion |

| Market Size by 2032 | US$ 65.23 Billion |

| CAGR | CAGR of 3.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Global Antibiotics Market Segmentation:

By Drug Class

- Cephalosporin

- Penicillin

- Fluoroquinolone

- Macrolides

- Tetracycline

- Aminoglycosides

- Sulfonamides

- Others

By Type

- Branded Antibiotics

- Generic Antibiotics

By Action Mechanism

- Cell Wall Synthesis Inhibitors

- Protein Synthesis Inhibitors

- DNA Synthesis Inhibitors

- RNA Synthesis Inhibitors

- Mycolic Acid Inhibitors

- Others

By Application

- Skin Infections

- Respiratory Infections

- Urinary Tract Infections

- Septicemia

- Ear Infection

- Gastrointestinal Infections

- Others

By End Use

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Do you have any specific queries or need any customization research on Antibiotics Market, Enquire Now@ https://www.snsinsider.com/enquiry/2966

Generic Antibiotics Dominate Market, While Branded Segment Sees Strong Growth Amid Rising Resistance

Generic antibiotics have captured 54% of the market revenue since 2023, more or less following the trend because they are cheap and are being used after the patents have expired. For low-income regions, these are the best medicines because of their proven safety and effectiveness. The branded antibiotics segment is expected to grow at a CAGR of 4.01% from 2024 to 2032 because the demand for new antibiotics is high because of the generally resistant strains; although significant investment is required in branded products, their specialized nature makes it well worth the usage.

Respiratory Infections Lead Antibiotics Market, While UTI Segment Poised for Rapid Growth Amid Resistance Challenges

In 2023, respiratory infections generated nearly 29% of the antibiotics market revenue. High incidence rates of the conditions-pneumonia, bronchitis, and COPD-all of which are accompanied by bacterial infections-drive this share. The category places a heavy burden on vulnerable populations, including the elderly and immunocompromised, often increasing demand for effective treatments. Conversely, urinary tract infections are expected to increase at the highest CAGR of 5.12% during 2024-2032 mainly because of increasing chronic diseases such as diabetes and the inability of UTI-causing bacteria to be responsive to antibiotics. UTIs, again, mainly in females, remain an increased need for antibiotics that drives the growth of the market focused on discovering better therapy against resistant strains.

Asia Pacific Leads Antibiotic Market as North America Accelerates Growth Amid Rising Resistance Concerns

The Asia Pacific region stood out as the largest share for the antibiotics market in 2023, taking in 43% of global revenue, sustained by large populations and increasing healthcare demands, especially after a serious economic loss from antibiotic resistance in China, estimated at USD 77 billion. Aside from this urgent need for effective therapies, it has also spurred greater investment in innovations in antibiotic development.

North America is anticipated to grow more than 4.66% annually up to 2032, fueled by keen interest in research on pharmaceutical drugs and a healthy environment for supportive regulations. Concerns over increasing resistance factors have led to efforts at improvement for stewardship as well as new antibiotic development. The synergy between academia and industry has further driven drug discovery aimed at maximizing growth in the market.

Key Developments in the Antibiotics Market

- In 2024, Pfizer's New antibiotic combination for patients with limited available treatment options in multidrug-resistant infections received a positive opinion from the CHMP. This does indicate that Pfizer is committed to solving some of the world's key healthcare challenges in antibiotic resistance.

- In March 2024, Wockhardt released promising results from its candidate antibiotic Zidebactam/Cefepime, which in turn demonstrated efficacy in treating a refractory drug-resistant skull bone infection and pneumonia in a patient who had undergone a renal transplant.

Buy a Single-User PDF of Antibiotics Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/2966

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.