Germany, Cologne, Oct. 28, 2024 (GLOBE NEWSWIRE) -- The Synthetic Leather Market encompasses the production, sale, and use of artificial leather materials that replicate the appearance and feel of genuine leather. Synthetic leather is manufactured primarily from plastics, with polyurethane (PU) and polyvinyl chloride (PVC) being the most common types. These materials are engineered to provide durability, flexibility, and versatility similar to natural leather but without the use of animal products.

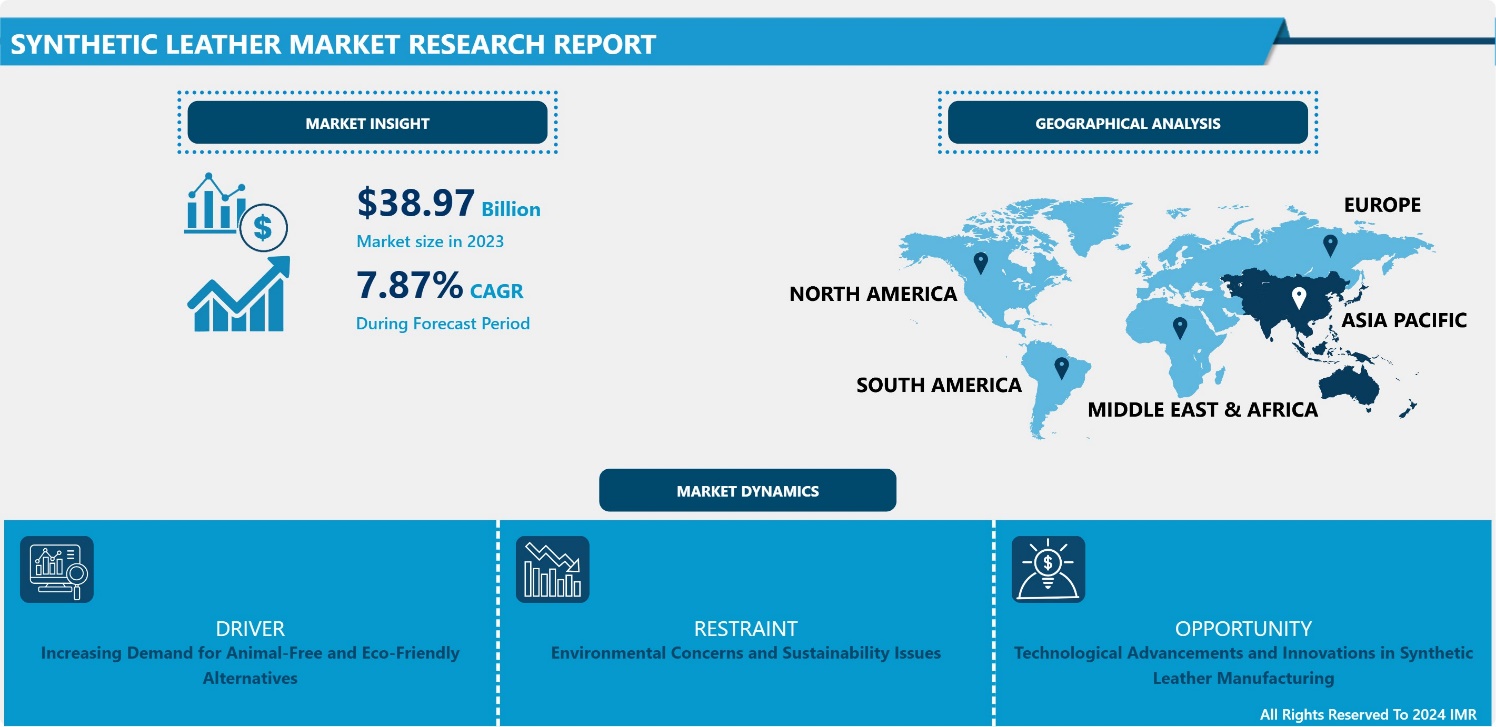

Introspective Market Research is thrilled to announce the release of its newest report, "Synthetic Leather Market." This comprehensive analysis reveals that the global Synthetic Leather Market, valued at USD 38.97 Billion in 2023, is on a trajectory of significant growth, projected to reach USD 77.08 Billion by 2032. This upward momentum corresponds to a robust CAGR of 7.87% over the forecast period from 2024 to 2032.

The synthetic leather industry is experiencing robust growth, driven by rising demand in the fashion, automotive, and furniture sectors. The industry's expansion reflects a shift toward cruelty-free, sustainable alternatives to animal leather, with polyurethane (PU) and polyvinyl chloride (PVC) as primary materials used in production. PU leather, valued for its softness and versatility, dominates the market, especially in applications like footwear, apparel, and car interiors. The automotive sector, in particular, is a significant driver, with synthetic leather widely used for upholstery and trim, reducing reliance on animal leather while maintaining durability and aesthetic appeal.

In fashion, the trend toward vegan-friendly products fuels demand, with brands like Stella McCartney and H&M integrating synthetic leather into their collections. Environmental concerns, however, remain a challenge, as both PU and PVC production involve the use of non-renewable resources and can result in harmful byproducts. Innovations, such as plant-based and biodegradable synthetic leather, are gaining traction, offering sustainable alternatives without compromising quality. Geographically, Asia-Pacific leads in synthetic leather production and consumption due to high footwear and automotive demand, followed closely by North America and Europe. The automotive industry demonstrates substantial consumption of textiles, with applications spanning carpets, upholstery, tires, belts, and airbags, totaling over 450,000 tonnes globally. Textiles constitute around 2.2% of a car’s overall weight, with an average vehicle using approximately 40 square meters of textile material, 18% of which is dedicated to upholstery. In India, synthetic leather is a popular choice for upholstery in mid-size cars due to its durability, affordability, and aesthetic appeal.

Recent growth in India’s passenger vehicle sector, reflected in a 7% CAGR increase in domestic sales over the past five years (as per the Society of Indian Automobile Manufacturers, or SIAM), supports the rising demand for synthetic leather upholstery. This increase is driven by improving economic conditions and a heightened focus on comfortable commuting options. With the Indian automotive market expanding, synthetic leather usage in car interiors is set to grow in tandem. This trend aligns with the global shift toward synthetic materials, enhancing car interior aesthetics while meeting the affordability needs of emerging markets.

With consumer preferences leaning toward eco-friendly and ethical products, the synthetic leather market is poised for continued growth and innovation, meeting evolving demands while addressing environmental impacts.

Download Sample 250 Pages Of Synthetic Leather Market Report @ https://introspectivemarketresearch.com/request/17680

Key Industry Insights

Rising Demand for Animal-Free Products

The growing demand for animal-free products is a key driver of the synthetic leather market, as consumers increasingly prioritize ethical and sustainable alternatives. With heightened awareness of animal welfare, the preference for vegan and cruelty-free options is rising, driving demand for synthetic leather across sectors such as fashion, automotive, and furniture. Leading brands like Stella McCartney and Gucci have incorporated synthetic leather into their product lines, responding to evolving consumer preferences.

In the automotive industry, synthetic leather is gaining traction for vehicle interiors due to its cost-effectiveness, durability, and low maintenance, presenting a viable alternative to genuine leather. This shift aligns with the broader push towards eco-friendly materials in manufacturing. The furniture industry is also witnessing increased adoption of synthetic leather, as consumers seek stylish and sustainable solutions for upholstery.

In markets like India, synthetic leather is especially prominent in mid-size car upholstery, reflecting its growing appeal. Overall, the increasing demand for animal-free products continues to drive growth in the synthetic leather market, with expanding applications across multiple industries.

Growing Fashion Industry

The growing fashion industry's shift towards eco-conscious materials has significantly propelled the synthetic leather market. As consumers become more environmentally aware, they seek alternatives that are stylish, cruelty-free, and sustainable. This trend is particularly evident in footwear, bags, and accessories, where brands aim to align with ethical consumer preferences. Major fashion brands such as Stella McCartney, Adidas, and H&M have embraced synthetic leather, often marketed as vegan leather, to meet these demands.

Polyurethane (PU) leather is a popular choice due to its flexibility, durability, and resemblance to genuine leather, but with a much smaller environmental footprint. For instance, the use of synthetic leather in the footwear industry alone accounted for a significant share of this growth, with brands like Nike launching collections featuring sustainable materials. The growing preference for cruelty-free fashion options continues to influence the demand for synthetic leather, making it a key driver in shaping the future of the fashion industry.

What are the Key Opportunities for Synthetic Leather Manufacturers?

The synthetic leather market is experiencing significant growth, particularly in the automotive and upholstery sectors. In the automotive industry, the shift towards cruelty-free and durable materials has led to a 25% increase in the adoption of synthetic leather for car interiors, with major manufacturers like Tesla and BMW integrating these materials into their designs. Similarly, the upholstery market is leveraging synthetic leather for its resilience and affordability, catering to consumer preferences for stylish yet durable furniture options. This growth is fueled by the demand for customizable products, as synthetic leather allows for diverse textures, patterns, and colors. Brands such as Nike and IKEA are capitalizing on this versatility, developing niche offerings that reflect current trends, thus creating lucrative opportunities for manufacturers to expand their production capabilities and product lines.

What are the Challenges Faced in the Synthetic Leather Market?

Consumer awareness and perception pose significant challenges for the synthetic leather market. Many consumers remain unaware of the advancements in synthetic leather technology, such as innovations in durability, breathability, and eco-friendliness. For example, brands like Ultrafabrics and Miko Lush are creating high-performance synthetic leathers that rival genuine leather in quality and texture, yet many consumers still associate synthetic options with lower quality. This perception hampers market growth, as genuine leather continues to dominate with a market share of approximately 60%, primarily due to its association with luxury and status. Additionally, the reluctance to adopt synthetic alternatives is evident, with a 2023 survey indicating that 55% of consumers prefer genuine leather for its durability. Overcoming these entrenched views will require targeted marketing strategies, education on the benefits of synthetic materials, and collaborations with influencers to highlight the quality and sustainability of modern synthetic leather products.

Key Manufacturers

Market key players and organizations within a specific industry or market that significantly influence its dynamics. Identifying these key players is essential for understanding competitive positioning, market trends, and strategic opportunities.

- Kuraray Co., Ltd. (Japan)

- H.R. Polycoats Pvt. Ltd. (India)

- Alfatex Italia SRL (Italy)

- Filwel Co., Ltd. (Japan)

- Yantai Wanhua Synthetic Leather Group Co., Ltd. (China)

- San Fang Chemical Industry Co., Ltd. (Taiwan)

- Mayur Uniquoters Limited (India)

- Teijin Limited (Japan)

- Nan Ya Plastics Corporation (Taiwan)

- Other

In July 2024, BASF unveiled Haptex® 4.0, an innovative polyurethane solution that revolutionizes synthetic leather manufacturing by making it 100% recyclable. Designed to work seamlessly with polyethylene terephthalate (PET) fabric, synthetic leather produced with Haptex 4.0 can be recycled without the need for layer separation, addressing the longstanding challenge of reusing end-of-life synthetic leather composites. This new formulation enables a sustainable manufacturing process with zero waste residue. Haptex 4.0 represents a significant step towards enhancing sustainability in the synthetic leather industry, paving the way for a circular economy in material usage.

In March 2024, Dow launched a groundbreaking polyolefin elastomer (POE) artificial leather, addressing the automotive industry's demand for animal-free alternatives. Commercialized by China-based HIUV Materials Technology and qualified by an electric car manufacturer, this solution offers ultra-soft tactility, exceptional color stability, and resistance to aging and low temperatures. With no hazardous chemicals and lower weight (25% to 40% lighter than PVC), it meets strict industry standards. Dow aims to collaborate with brands to explore new applications in automotive, sporting goods, furniture, and fashion.

Do you need any industry insights on Synthetic Leather Market, Make an enquiry now >>? https://introspectivemarketresearch.com/inquiry/17680

Key Segments of Market Report

By Type:

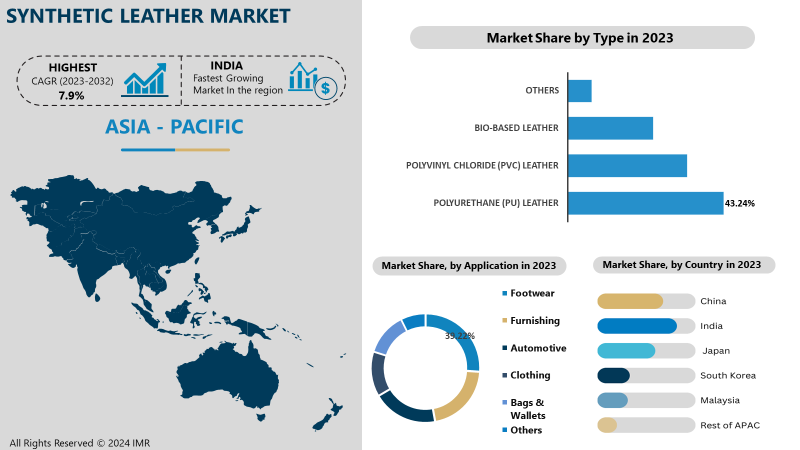

The Polyurethane (PU) leather segment is poised to dominate the synthetic leather market during the forecast period, driven by its versatility, durability, and consumer preference for sustainable alternatives. PU leather offers a range of advantages, including a soft texture, water resistance, and ease of maintenance, making it a popular choice in various applications, such as automotive interiors, fashion, and furniture. Major brands like Adidas and H&M are increasingly adopting PU leather in their product lines, reflecting a broader shift towards eco-friendly materials. Additionally, advancements in production techniques have enhanced the material's quality and reduced environmental impact, further boosting its appeal. As consumer awareness of sustainability rises, the PU leather segment is expected to continue its upward trajectory, capitalizing on the growing demand for high-quality, animal-free leather alternatives.

By Application:

The footwear segment is anticipated to hold the largest share of the synthetic leather market in 2023, driven by increasing consumer demand for stylish, durable, and sustainable footwear options. The rise in athleisure trends and eco-conscious consumer behavior is fueling growth, with brands like Nike and Adidas actively incorporating synthetic leather into their shoe lines. These companies are leveraging advancements in synthetic materials to offer lightweight, breathable, and water-resistant products that enhance performance and comfort. Additionally, the shift towards animal-free alternatives has further propelled the adoption of synthetic leather in footwear manufacturing. For example, Adidas' "Stan Smith" sneaker line features synthetic leather, catering to environmentally aware consumers. As the demand for sustainable and innovative footwear continues to grow, reflecting the industry’s commitment to providing stylish yet sustainable options for consumers.

By End-User:

In 2023, the automotive segment emerged as the largest end-user of synthetic leather, capturing a significant share of the market due to increasing consumer demand for sustainable and cruelty-free materials. Many leading automobile manufacturers, including Tesla, BMW, and Mercedes-Benz, have shifted towards synthetic leather alternatives for their interiors, driven by a commitment to sustainability and innovation.

For instance, Tesla has replaced traditional leather seats with high-quality synthetic options that offer durability and aesthetic appeal. Additionally, advancements in materials science have led to the development of innovative solutions like BASF's Haptex® 4.0 and Dow's polyolefin elastomers (POE) leather, which provide enhanced performance without compromising on luxury or comfort. This trend reflects a broader industry movement towards reducing the environmental impact of vehicle production while meeting consumer preferences for animal-free products. As sustainability continues to be a top priority for consumers, the automotive segment is expected to maintain its dominance in the synthetic leather market.

If you require any specific information that is not covered currently, we will provide the same as a part of the customization >> https://introspectivemarketresearch.com/custom-research/17680

By Region:

The Asia Pacific region is anticipated to dominate the synthetic leather market over the forecast period, driven by rapid industrialization, increasing consumer demand for sustainable products, and significant investments in manufacturing capabilities. Countries like China, India, and Japan are leading this growth, with China alone being the largest producer and consumer of synthetic leather.

China's robust automotive and fashion industries are major contributors to this growth. Leading brands such as Nike and Adidas are increasingly adopting synthetic leather in their product lines, reflecting a broader trend towards sustainable fashion. Additionally, the automotive sector in countries like Japan and South Korea is witnessing a shift towards synthetic leather for car interiors, driven by consumer preferences for animal-free alternatives and environmental consciousness.

Moreover, innovations in production technology and a growing focus on eco-friendly materials are further propelling the market. For instance, manufacturers are developing advanced PU and polyolefin elastomer (POE) leathers that provide durability and aesthetic appeal while minimizing environmental impact. With supportive government policies and a strong manufacturing base, the Asia Pacific region is well-positioned to lead the synthetic leather market, catering to both local and international demands for high-quality, sustainable products.

In North America, the market is significant, primarily fueled by the automotive and upholstery sectors. Growing focus on sustainability and cruelty-free products is leading to increased adoption of synthetic leather, with brands like Tesla shifting towards eco-friendly alternatives. The market is expected to grow steadily, focusing on innovative product offerings and environmentally friendly manufacturing processes. Europe is experiencing robust growth due to increasing regulations on animal-derived materials and a strong demand for sustainable fashion. Countries like Germany, Italy, and the UK are investing heavily in research and development for advanced synthetic materials. The region is projected to witness a CAGR of around 7%, driven by consumer preferences for high-quality, sustainable products in both the automotive and fashion industries.

Comprehensive Offerings:

- Historical Market Size and Competitive Analysis (2017–2023): Detailed assessment of market size and competitive landscape over the past years.

- Historical Pricing Trends and Regional Price Curve (2017–2023): Analysis of historical pricing data and price trends across different regions.

- Market Size, Share, and Forecast by Segment (2024–2032): Projections and detailed insights into market size, share, and future growth by segment.

- Market Dynamics: In-depth analysis of growth drivers, restraints, opportunities, and key trends, with a focus on regional variations.

- Market Trend Analysis: Evaluation of emerging trends that are shaping the market landscape.

- Import and Export Analysis: Examination of trade patterns and their impact on market dynamics.

- Market Segmentation: Comprehensive analysis of market segments and sub-segments, with a regional breakdown.

- Competitive Landscape: Strategic profiles of key players across regions, including competitive benchmarking.

- PESTLE Analysis: Evaluation of the market through Political, Economic, Social, Technological, Legal, and Environmental factors.

- PORTER’s Five Forces Analysis: Assessment of competitive forces influencing the market.

- Industry Value Chain Analysis: Examination of the value chain to identify key stages and contributors.

- Legal and Regulatory Environment by Region: Analysis of the legal landscape and its implications for business operations.

- Strategic Opportunities and SWOT Analysis: Identification of lucrative business opportunities, coupled with a SWOT analysis.

- Conclusion and Strategic Recommendations: Final insights and actionable recommendations for stakeholders.

Related Report Links:

Salmon Leather Market: Still, to this date, salmon leather is considered as a new generation substitute for conventional leathers derived from animal skins and it is produced from the skin of the salmon fish.

Plant Based Leather Market: Plant Based Leather Market Size Was Valued at USD 73.10 Million in 2023 and is Projected to Reach USD 140.15 Million by 2032, Growing at a CAGR of 7.50% From 2024-2032.

Silicone Synthetic Leather Market: Silicone Synthetic Leather Market Size Was Valued at USD 44.00 Billion in 2023, and is Projected to Reach USD 87.95 Billion by 2032, Growing at a CAGR of 8.00% From 2024-2032.

Bio-based Leather market: The Global Bio-based Leather market was valued at USD 676.44 million in 2021 and is expected to reach USD 942.34 million by the year 2028, at a CAGR of 4.85%.

Leather Goods Market: The Global Leather Goods Market size is expected to grow from USD 259.19 billion in 2022 to USD 349.30 billion by 2030, at a CAGR of 3.8% during the forecast period (2023-2030).

Drinkware Accessories Market: Drinkware Accessories Market Size is Valued at USD 4.02 Billion in 2023 and is Projected to Reach USD 5.13 Billion by 2032, Growing at a CAGR of 3.10% From 2024-2032.

Industrial Protective Footwear Market: Industrial Protective Footwear Market Size Was Valued at USD 10.6 Billion in 2023, and is Projected to Reach USD 18.4 Billion by 2032, Growing at a CAGR of 6.3% From 2024-2032.

Formic Acid Market: Formic Acid Market Size is Valued at USD 1.7 Billion in 2023 and is Projected to Reach USD 2.59 Billion by 2032, Growing at a CAGR of 4.79% From 2024-2032.

Polymer Emulsion Market: Polymer Emulsion Market Size is Valued at USD 34.10 Billion in 2023, and is Projected to Reach USD 56.43 Billion by 2032, Growing at a CAGR of 6.50% From 2024-2032.

Passenger Car Seat Market: Passenger Car Seat Market Size Was Valued at USD 42.50 Billion in 2023, and is Projected to Reach USD 46.90 Billion by 2032, Growing at a CAGR of 1.10% From 2024-2032.

About Us:

Introspective Market Research is a premier global market research firm, leveraging big data and advanced analytics to provide strategic insights and consulting solutions that empower clients to anticipate future market dynamics. Our team of experts at IMR enables businesses to gain a comprehensive understanding of historical and current market trends, offering a clear vision for future developments.

Our strong professional network with industry-leading companies grants us access to critical market data, ensuring the generation of precise research data tables and the highest level of accuracy in market forecasting. Under the leadership of CEO Mrs. Swati Kalagate, who fosters a culture of excellence, we are committed to delivering high-quality data and supporting our clients in achieving their business goals.

The insights in our reports are derived from primary interviews with key executives of top companies in the relevant sectors. Our robust secondary data collection process includes extensive online and offline research, coupled with in-depth discussions with knowledgeable industry professionals and analysts.

IMR Knowledge Cluster Reports:

Drone and Robot Delivery: Pioneering the Next Generation of Logistics

India's Chemical Industry Boom

China Manufacturing Hub Market

Contact Us:

Canada Office

Introspective Market Research Private Limited, 138 Downes Street Unit 6203- M5E 0E4, Toronto, Canada.

APAC Office

Introspective Market Research Private Limited, Office No. 401, Saudamini Commercial Complex, Kothrud, Pune, India 411038

Ph no: +91-81800-96367 / +91-7410103736

Email: sales@introspectivemarketresearch.com

LinkedIn| Twitter| Facebook | Instagram

Ours Websites : https://introspectivemarketresearch.com | https://imrknowledgecluster.com/knowledge-cluster | https://imrtechsolutions.com | https://imrnewswire.com/ | https://marketnresearch.de |

Drone and Robot Delivery: Pioneering the Next Generation of Logistics