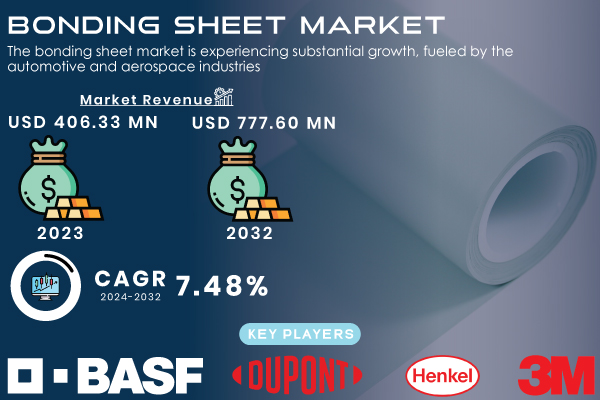

Austin, Nov. 08, 2024 (GLOBE NEWSWIRE) -- According to S&S Insider Research, The Bonding Sheet Market Size was valued at USD 406.33 Million in 2023 and is supposed to reach USD 777.60 Million by 2032 and grow at a CAGR of 7.48% over the forecast period 2024-2032.

Increasing demand for lightweight and high-strength materials, especially within the automotive and aerospace industries.

Manufacturers increasingly adopt bonding sheets to improve product performance, and durability, and reduce weight. Additionally, the electronics sector's expansion, driven by the need for effective insulation and protection in devices, is further enhancing market growth. Innovations in adhesive technologies are expected to play a significant role in market expansion, enabling versatile applications across various industries, including construction and consumer goods, thus contributing to a dynamic and evolving market landscape.

Growth Driven by Automotive and Aerospace Demand for Lightweight Solutions

The bonding sheet market is experiencing robust growth, primarily driven by the increasing demand for lightweight materials in the automotive and aerospace industries, enhancing fuel efficiency. Manufacturers are utilizing bonding sheets to join dissimilar materials, such as metals and composites, without compromising structural integrity. This is crucial for automotive companies like LG Chem, which are expanding their presence in the automotive adhesives market. Additionally, the aerospace sector is adopting bonding sheets to optimize performance while minimizing weight, thus ensuring safety and efficiency. The rise of electric vehicles (EVs) is also propelling growth, as these vehicles require advanced materials and assembly methods. Overall, there is a significant shift toward lightweight, sustainable solutions across various industries.

Request Sample Report of Bonding Sheet Market 2024 @ https://www.snsinsider.com/sample-request/2554

Dominance of Polyimides and 12µM Adhesive Thickness in the Bonding Sheet Market

In 2023, polyimides (PI) held the largest revenue share in the bonding sheet market, accounting for approximately 35%. This dominance is attributed to their outstanding thermal stability, chemical resistance, and superior mechanical properties. Capable of withstanding high temperatures above 250 °C (482 °F), polyimides are ideal for demanding applications in the aerospace and automotive sectors, where materials face extreme conditions. Their excellent chemical resistance enhances the longevity of bonded joints, minimizing maintenance costs for users. The versatility of polyimides allows them to bond with various substrates, including metals, ceramics, and plastics, making them suitable for electronic components and flexible printed circuits. Innovations like DuPont's Kapton films and 3M's polyimide bonding sheets continue to advance this segment, improving adhesion strength and curing times.

In terms of adhesive thickness, 12µM (0.5MIL) accounted for approximately 30% of market revenue in 2023, favored for its optimal balance of flexibility and strength. This thin adhesive profile facilitates seamless integration into compact designs, crucial for industries such as electronics, automotive, and aerospace. Its strong adhesion and durability drive widespread adoption. As manufacturers prioritize miniaturization and lightweight solutions, the demand for 12µM bonding sheets is expected to rise, further solidifying their position in the market.

Bonding Sheet Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 406.33 Million |

| Market Size by 2032 | US$ 777.60 Million |

| CAGR | CAGR of 7.48% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By adhesive material (Polyesters (PET), Polyimides (PI), Acrylics, Modified Epoxies, Others) • By adhesive thickness (12µM (0.5MIL), 25µM (1MIL), 50µM (2MIL), 75µM (3MIL), 100µM (4MIL)) • By application (Electronics/Optoelectronics, Telecommunication/5G Communication, Automotive, Building & Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Key Drivers | • Bonding Sheet Market Growth Driven by Innovations and Diverse Applications Across Industries |

| Market Restraints | • Temperature resistance restricts the bonding sheet market, as polymer adhesives are weaker than metals, limiting high-temperature applications. |

If You Need Any Customization on the Bonding Sheet Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/2554

Regional Trends in the Bonding Sheet Market Highlighting North America's Dominance and Asia Pacific's Accelerated Growth

In 2023, North America emerged as the dominant region in the bonding sheet market, accounting for approximately 35% of the total revenue share. This leadership is attributed to a strong industrial foundation encompassing critical sectors such as aerospace, automotive, electronics, and construction, all of which require high-performance bonding solutions. The region is recognized for its technological innovation, with advancements in bonding materials that enhance heat resistance, chemical stability, and adhesion strength. Additionally, stringent regulatory standards compel manufacturers to utilize high-quality bonding sheets. With an increasing emphasis on sustainability and eco-friendly products, North America's bonding sheet market is well positioned for ongoing growth.

The Asia Pacific region has become the fastest-growing market for bonding sheets, driven by rapid industrialization and enhanced manufacturing capabilities. Leading countries like China, India, and Japan are fueling this growth, particularly in automotive production, electronics manufacturing, and construction. The demand for lightweight, high-performance bonding materials is being propelled by technological advancements that improve heat resistance and adhesion strength. Notable innovations include Henkel’s new bonding sheets for electronics, 3M’s advanced polyimide solutions for the automotive industry, and Sika AG’s sustainable solutions for construction, ensuring continued expansion in the region.

Buy the Full Research Report on the Bonding Sheet Market 2024-2032 @ https://www.snsinsider.com/checkout/2554

Recent Development

- In April 2024, Permabond introduced its fast-curing two-part epoxy, Permabond ET503, which features a fixture time of just 6 minutes and achieves working strength in 20 minutes. Despite its rapid cure, ET503 delivers exceptional strength, toughness, and environmental durability, surpassing other adhesives in its category.

- June 26, 2024: DuPont is set to present its Kalrez custom parts at SEMICON West 2024, featuring innovations like the Kalrez Bonded Door Seal and low permeation seals tailored for semiconductor manufacturing. This event also commemorates the 50th anniversary of Kalrez, underscoring the brand's dedication to sustainability and high performance in essential applications.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

7. Bonding Sheet Market Segmentation, by Adhesive Material

8. Bonding Sheet Market Segmentation, by Adhesive Thickness

9. Bonding Sheet Market Segmentation, by Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Description of Bonding Sheet Market Report 2024-2032 @ https://www.snsinsider.com/reports/bonding-sheet-market-2554

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain