US & Canada, Nov. 14, 2024 (GLOBE NEWSWIRE) -- According to a new comprehensive report from The Insight Partners, the Global One-Component Polyurethane Foam Market is observing significant growth owing to rapid growth in residential construction sector.

The report runs an in-depth analysis of market trends, key players, and future opportunities. In general, the one-component polyurethane foam market has a soaring demand from automotive and packaging industry that are expected to register strength during the coming years.

The report from The Insight Partners, therefore, provides several stakeholders—including raw material suppliers, manufacturers, distributors, end-users and others—with valuable insights into how to successfully navigate this evolving market landscape and unlock new opportunities.

For Detailed Market Insights, Visit: https://www.theinsightpartners.com/sample/TIPRE00010437/

Overview of Report Findings

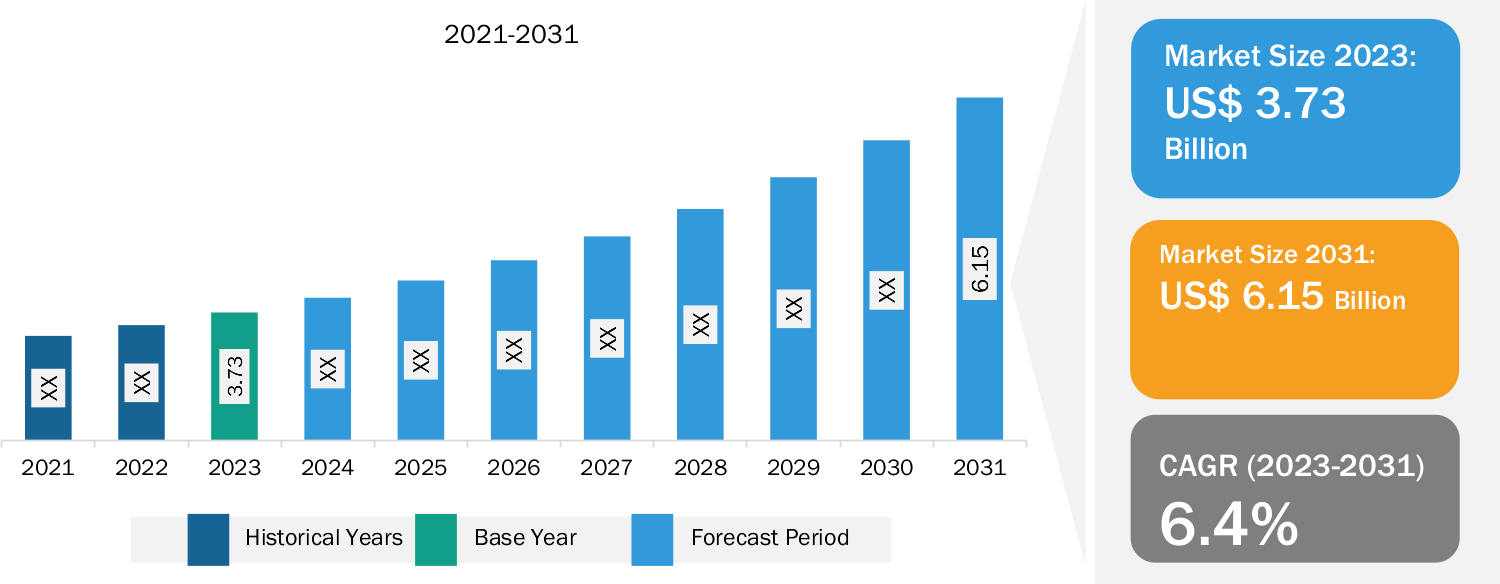

- Market Growth: The one-component polyurethane foam market is expected to reach US$ 6.15 Billion by 2031 from US 3.73 billion in 2023, at a CAGR of 6.4% during the forecast period. The one-component polyurethane foam market has emerged as a critical segment within the broader polymer and construction material industry. One-component polyurethane foam is a prepolymer that cures upon exposure to moisture, expanding and hardening to form a durable and resilient material. This foam is predominantly used for sealing, insulating, filling gaps, and adhering in building construction due to its excellent thermal and acoustic insulation properties, ease of use, and efficiency in improving energy efficiency in buildings.

- Increasing Demand from Automotive and Packaging Industries: The automotive and packaging industries are major end-use industries of one-component polyurethane foam. In the automotive industry, one-component polyurethane foam is used to provide sound and vibration dampening, seal joints or cavities to prevent water and oil penetration and provide energy absorption in case of a crash. The automotive industry is growing in various countries across the world due to factors such as the transition toward electric vehicles, economic growth, increasing population, government support for automotive production, and rising investments in the industry. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), the global sales of passenger cars increased from 84.8 million in 2022 to 93.5 million in 2023. In December 2022, the passenger vehicle market in China expanded due to increased retail sales. According to the China Passenger Car Association, ~2.17 million passenger cars were sold through retail channels in December 2022, an increase of 3% year-on-year. From January to December 2022, 20.54 million passenger cars were sold in China, a rise of 1.9% year-on-year.

- Advancements in Product Technology: Innovations in formulation and application techniques have significantly enhanced the performance characteristics of polyurethane foam, making it more versatile and efficient. Modern one-component polyurethane foams are engineered to offer superior adhesion, faster curing times, and improved thermal and acoustic insulation properties. These enhancements expand the foam's applicability across various industries, including construction, automotive, and packaging, driving broader market adoption. In the construction sector, technological advancements have led to the development of polyurethane foams with enhanced fire resistance and environmental sustainability. These new formulations meet stricter building codes and regulations, particularly in terms of fire safety and reduced emissions of VOCs. Such improvements make one-component polyurethane foams attractive for builders and contractors looking for reliable, compliant, and eco-friendly insulation and sealing solutions. The construction industry's shift toward sustainable building practices further amplifies the demand for advanced polyurethane foam products.

- Geographical Insights: In 2023, APAC led the market with a substantial revenue share, followed by Europe and North America. Asia Pacific is expected to register the highest CAGR during the forecast period.

Read full market research report, "One-Component Polyurethane Foam Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Raw Material (Methylene Diphenyl Diisocyanate, Toluene Diisocyanate, Polyether Polyols, Polyester Polyols, and Others), Application (Construction, Insulation, Packaging, Automotive, and Others), End Use (Residential and Commercial), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)", published by The Insight Partners.

Market Segmentation

- Based on raw material, the one-component polyurethane foam market is MDI (methylene diphenyl diisocyanate), TDI (toluene diisocyanate), polyether polyols, polyester polyols, and others. The polyether polyols segment held a larger share of the one-component polyurethane foam market in 2023.

- By application, the one-component polyurethane foam market is segmented into construction, insulation, packaging, automotive, and others. The construction segment held the largest share of the one-component polyurethane foam market in 2023.

- In terms of end-use, the one-component polyurethane foam market is divided into residential and commercial. The commercial segment held a larger share of the one-component polyurethane foam market in 2023.

- The one-component polyurethane foam market is segmented into five major regions: North America, Europe, APAC, Middle East and Africa, and South and Central America.

Competitive Strategy and Development

- Key Players: A few major companies operating in the one-component polyurethane foam market include Henkel AG & Co KGaA, Sika AG, The Dow Chemical Co, BASF SE, Huntsman Corp, Industrial Products LTD., Selena Group, BOSTIK BENELUX B.V. (Den Braven), Tremco CPG Inc, and Soudal Group.

- Trending Topics: Low-GWP (Global Warming Potential) Formulations, HVAC System Insulation, VOC Reduction Initiatives, Fire-Retardant Formulations, among others.

Get Sample Pages of Research analysis: https://www.theinsightpartners.com/sample/TIPRE00010437/

Global Headlines on One-Component Polyurethane Foam

- " Covestro, Selena Launched Bio-Attributed Polyurethane Foams"

- "Huntsman launched new SHOKLESS™ polyurethane systems to help protect electric vehicle batteries"

- "Huntsman’s European Polyurethanes Plants Achieve Mass Balance Certification"

- "BASF’s Polyol and Polyurethane Systems plant in Nansha ISCC+ certified"

Purchase Premium Copy of Global One-Component Polyurethane Foam Market Growth Report at: https://www.theinsightpartners.com/buy/TIPRE00010437/

Conclusion

The market is expected to grow continuosly, driven by its widespread applications in construction, automotive, and packaging. With the demand for energy-efficient and environmentally sustainable building solutions on the rise, PU foam’s insulating properties, durability, and ease of application have made it a preferred choice across industries. Technological advancements have further enhanced its versatility, offering new formulations that are safer, more environmentally friendly, and more effective. Market expansion in emerging regions, supported by rapid urbanization and infrastructure development, is contributing significantly to demand. However, the market faces challenges from fluctuating raw material costs and increasing regulatory pressures aimed at reducing volatile organic compound (VOC) emissions. Companies are investing in research and development to produce low-emission, eco-friendly foam products to align with stricter environmental standards and cater to the growing green construction trend. Hence, the one-component PU foam market is expected to grow steadily, propelled by innovation and the need for sustainable solutions across diverse applications.

Check out more related reports by The Insight Partners:

Polyurethane Dispersions Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis

Rigid Polyurethane Form Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis

Foamed Plastics (Polyurethane) Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis

Engineered Thermoplastic Polyurethane Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis

Polyurethane Additives Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis

Flexible Polyurethane Foam (FPF) Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person:

Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Press Release: https://www.theinsightpartner.com/pr/one-component-polyurethane-foam-market

Browse more The Insight Partners chemicals and materials Industry Reports