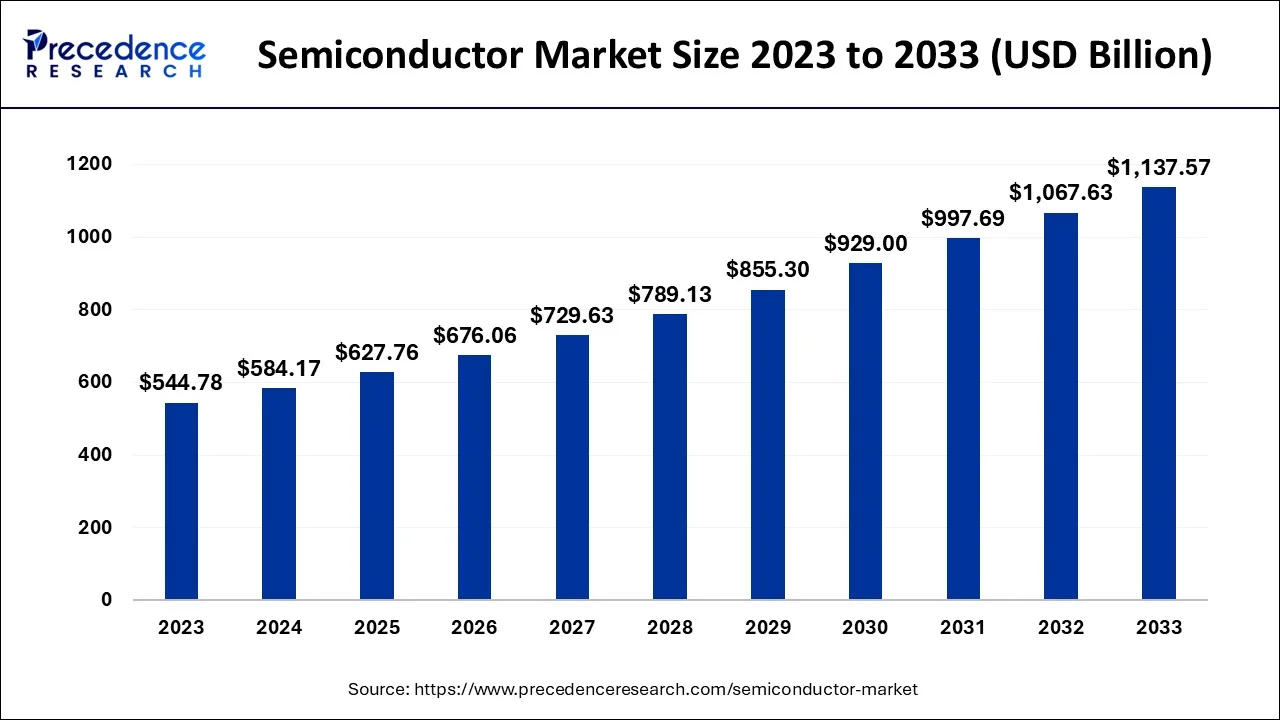

Ottawa, Nov. 19, 2024 (GLOBE NEWSWIRE) -- The global semiconductor market size is predicted to increase from USD 627.76 billion in 2025 to approximately USD 1,137.57 billion by 2033, According to Precedence Research. North America and Europe are expected to have a substantial growth rate owing to the presence of a strong telecom and automotive industry.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1376

Semiconductors: A Part of All the Electronics

The semiconductor market is an aggregate of organizations/companies involved in the designing and fabrication of semiconductors and semiconductor devices like integrated circuits and transistors. Semiconductors are moderate conductors of electricity and fall in between conductors and insulators. Some of the examples of semiconductors are boron, antimony, germanium, carbon, silicon, selenium, and tellurium.

The growth of the semiconductor market is attributed to technological advancements and the usage of various electronic gadgets in different industries as well as in daily life. A major boost in the semiconductor industry occurred due to the growing use of electric vehicles. In the future, the market’s growth will be due to increased use of EVs and electronics.

Semiconductor Market Key Insights:

- Asia Pacific dominated the market with the largest market share of 52.8% in 2023.

- By application, the network and communication segment accounted for the biggest market share of 29.2% in 2023.

- By component, the memory devices segment captured the highest market share of 23% in 2023.

Semiconductor Market Regional Revenue (USD Billion), By Component

| By Component | 2021 | 2022 | 2023 |

| North America | 126.09 | 130.80 | 123.82 |

| Europe | 90.83 | 92.59 | 86.13 |

| Asia Pacific | 298.61 | 306.86 | 287.79 |

| Middle East and Africa | 24.73 | 24.58 | 22.27 |

| Latin America | 27.23 | 27.20 | 24.78 |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1376

Major Trends/Growth Factors in Semiconductor Market

Increased usage of consumer electronics: Semiconductors are used in each and every electronic gadget, such as mobiles, laptops, computers, refrigerators, AC, irons, and fans, and the list is very long. With increased technological advancements and increased dependency on consumer electronics, the demand for semiconductors in electronics tends to increase.

Growing electric vehicle demand: Compared to traditional internal combustion engine (ICE) vehicles, which contain around 300-1000 semiconductors, EVs consist of up to 3000 semiconductors. Therefore, with increased demand for electric vehicles, the usage of semiconductors has also increased. According to the International Energy Agency, the sale of EVs was 14 million in 2023, out of which 95% of sales were in China, Europe, and the U.S.

Quantum computing is the future: With its unmatched computational power and ground-breaking applications, quantum computing has become a game-changing technology. When combined with the capabilities of semiconductors, it offers up new avenues for information technology and processing.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Semiconductor Market Report Coverage

| Report Attribute | Key Statistics | |

| Market Size in 2024 | USD 584.17 Billion | |

| Market Size in 2025 | USD 627.76 Billion | |

| Market Size in 2033 | USD 1,137.57 Billion | |

| Growth Rate from 2024 to 2033 | 7.64% | |

| Base Year | 2023 | |

| Forecast Period | 2024 to 2033 | |

| Leading Region | Asia Pacific | |

| Fastest Growing Region | North America and Europe | |

| Segments Covered | Component, Application, and Region | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa | |

| Companies Covered | Broadcom, Inc., Intel Corporation, Qualcomm Technologies, Inc., Taiwan Semiconductors, NXP Semiconductors, Samsung Electronics, Texas Instruments, SK Hynix, Micron Technology, Maxim Integrated Products, Inc. | |

Why Precedence Research for AI Industry Reports?

- Comprehensive Insights: Gain access to in-depth analyses covering market trends, competitive landscapes, and growth opportunities tailored specifically for the semiconductor industry.

- Expert Research Team: Benefit from the expertise of a dedicated team of analysts with extensive knowledge and experience in semiconductor market dynamics and emerging technologies.

- Data-Driven Decisions: Leverage our meticulously gathered data and insights to make informed strategic decisions and drive business growth in a rapidly evolving market.

- Customizable Reports: Enjoy tailored research solutions that meet your unique business needs, providing relevant insights for your specific market segment.

- Global Perspective: Explore semiconductor market trends across various regions, allowing you to understand local dynamics while strategizing for global expansion.

Other Industries Supported by the Expansion of Semiconductor Market:

- Artificial Intelligence (AI) in Semiconductor Market

The global artificial intelligence (AI) in semiconductor market size was USD 48.96 billion in 2023, accounted for USD 56.42 billion in 2024, and is expected to reach around USD 232.85 billion by 2034, expanding at a CAGR of 15.23% from 2024 to 2034. AI has become an integral part of every industry semiconductor. AI is used to design chips based on data analysis. It is also helpful in detecting defects in semiconductors, which reduces downtime, improves problem-solving, and boosts productivity.

- Compound Semiconductor Market

The global compound semiconductor market size was USD 48.07 billion in 2023, calculated at USD 53.46 billion in 2024, and is expected to reach around USD 154.54 billion by 2034, expanding at a CAGR of 11.2% from 2024 to 2034. The market’s growth is associated with its usage of electronics, GPS, and satellites. Compound semiconductors are becoming popular due to their properties, such as variation of the band gap, variable thermal conductivity, high frequencies, functionality at high temperatures, etc.

- Automotive Semiconductor Market

The global automotive semiconductor market size was estimated at USD 48.52 billion in 2022 and is expected to hit over USD 115.78 billion by 2030, poised to grow at a compound annual growth rate (CAGR) of 11.5% from 2022 to 2030. 300-3000 semiconductors are used in automotive. Rising demand for electric and hybrid vehicles tends to increase the need for semiconductors in the automotive industry.

- Semiconductor Materials Market

The global semiconductor materials market size was valued at USD 62.4 billion in 2023. It is expected to reach USD 96.87 billion by 2033, growing at a registered CAGR of 4.54% from 2024 to 2033. With the rising demand for semiconductors in various industries, the demand for semiconductor materials tends to increase in the future.

Semiconductor Market Regional Analysis

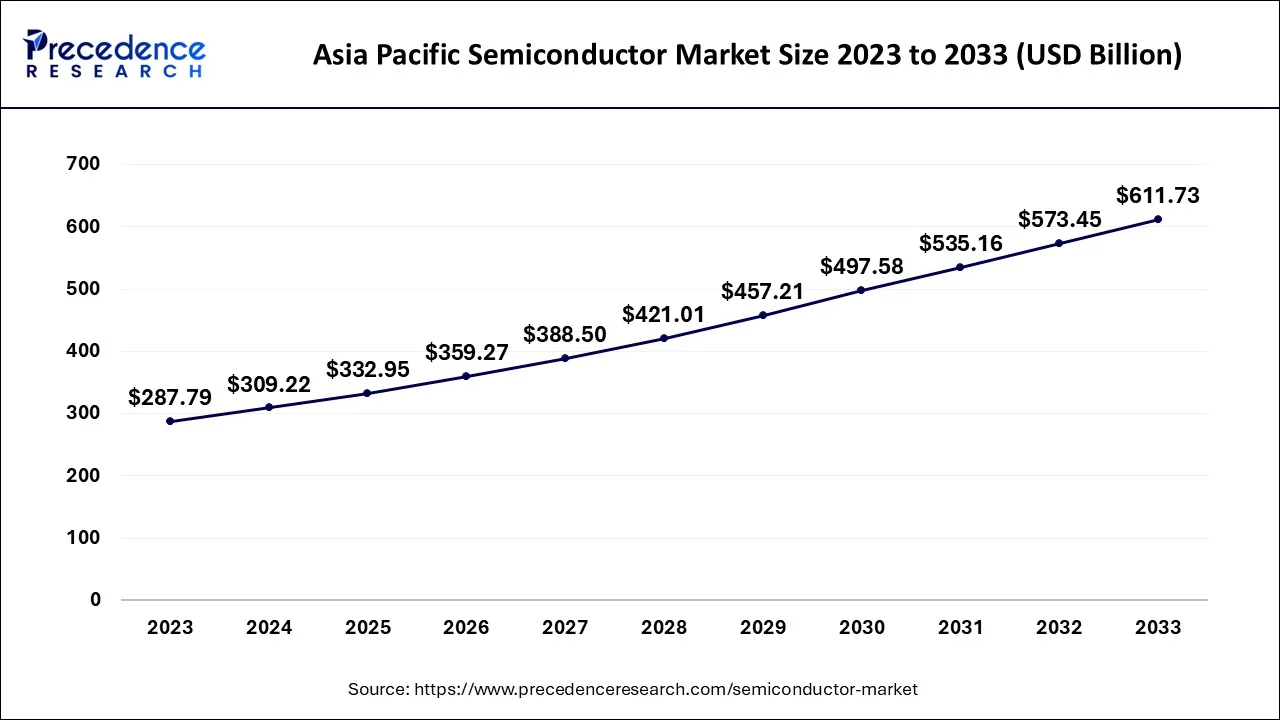

Asia Pacific Semiconductor Market Size and Forecast 2024 to 2033

The Asia Pacific semiconductor market size accounted for USD 309.22 billion in 2024 and is expected to be worth around USD 611.73 billion by 2033, poised to grow at a CAGR of 7.83% from 2024 to 2033.

Huge Consumer Demand: Asia Pacific’s Dominance to Sustain

Asia Pacific held the largest share of the semiconductor market in 2023. One of the major reasons is the huge consumer base responsible for buying electronics, automotive, and other products that consist of semiconductors.

Apart from this, there are growing technological advancements in various sectors, which are promoting the market’s growth. Asia Pacific is also the largest consumer of EVs, and it uses semiconductors on a large scale. The major countries that contribute to the market’s growth are China, India, Japan, and South Korea.

Semiconductor Industry Trends in Asian Countries:

- Between 2021 and 2022, China accounted for 55% of all semiconductor patent applications worldwide (with China's applications more than double America's), and Chinese companies outnumbered U.S. and Japanese companies in terms of 2022 semiconductor patents.

- A number of programs, such as the manufacture Linked Incentive (PLI) program for the electronics industry, have been introduced to encourage the manufacture of semiconductors. A $1.7 billion incentive package is provided by this program to businesses setting up semiconductor manufacturing plants in India.

- From fiscal 2021 to fiscal 2023, Japan spent ¥3.9 trillion on its semiconductor sector, a larger share of its GDP than either Germany or the U.S.

Growing Usage of Electronics: North America’s Projection to Grow

North America is estimated to grow at a significant rate during the forecast period. With its high-value innovation and cutting-edge technological advancement, North America is a major player in the global semiconductor business as well. Because of the cooperation between government agencies, businesses, and academia, the area is well known for its R&D skills.

“The North American semiconductor market was dominated by the US. According to the most recent data, 97.6% of U.S. customers presently own a smartphone, making it the most popular gadget among consumers. It represents a meager 1.2% rise over the prior year.”

The CHIPS and Science Act (CHIPS) was passed in 2022, and between 2022 and 2032, the U.S. would increase its domestic semiconductor production capacity. The world's biggest expected percentage rise throughout that period is the projected 203% growth. Since CHIPS was initially presented to Congress, firms in the semiconductor ecosystem have announced over 90 new manufacturing projects in the U.S., with a total of approximately $450 billion in announced investments across 28 states as of August 2024.

The number of cellular mobile connections in the U.S. is correlated with the high smartphone ownership rate. In actuality, this figure, at 396 million, accounts for 116.2% of the U.S. population. To put it another way, there are more mobile lines than Americans. Nearly half (48.4%) of Americans own tablets, and slightly more than two out of three (68.3%) own a laptop or desktop computer.

Semiconductor Market Segmentation Analysis:

- By Component, the memory devices segment held the largest share of the market in 2023. Semiconductor memory, which is present in everything from computers and cellphones to intricate systems, is the unseen backbone of our digital world. Its continual progress ensures much faster, denser, and more efficient ways to store and manage the information that defines life.

- On the other hand, the MCU segment is estimated to grow at the fastest rate during the predicted period due to advantages like cost effectiveness, ease of use, less performance time, effective task performance, small in size, and flexibility.

- By Application, the networking & communications segment dominated the semiconductor market in 2023. With the advent of digital exchanges, the telecom sector became the first significant consumer of semiconductors. Since then, semiconductor firms have kept up their innovation, offering fast data speeds, pervasive connections, and services that offer a rich user experience. The automotive segment is expected to achieve the fastest growth rate during the forecast period.

- The automobile sector has seen significant change in the past several years. The quick growth of smart cars is a result of the constant changes in technical trends. The use of semiconductor technology is one such invention that has had a significant influence and transformed the automotive sector.

Browse More Press Releases:

- Artificial Intelligence Market Size Projected to Hit USD 3,680.47 Bn by 2034

- Artificial Intelligence Robots Market Size to Worth USD 124.26 Bn by 2034

- Aerospace Market Size to Worth Around USD 791.78 Billion by 2034

- LIDAR Market Size Set to Reach USD 13.74 Billion by 2033

- Data Center Market Size Expected to Reach USD 775.73 Billion by 2034

- OLED Market Size Expected to Reach USD 344.58 Billion by 2034

- Blockchain Technology Market Size to Achieve USD 1,879.30 Billion by 2034

Competitive Landscape & Major Breakthroughs in the Semiconductor Market

Semiconductor Market Top Companies

- Intel Corporation

- Qualcomm Technologies, Inc.

- Broadcom, Inc.

- Taiwan Semiconductors

- Samsung Electronics

- Texas Instruments

- SK Hynix

- Micron Technology

- NXP Semiconductors

- Maxim Integrated Products, Inc.

The market players continuously invest in developing semiconductors, which are used in almost all industries. For instance, by 2026, the Tata Group hopes to start commercial production from India's first semiconductor fabrication facility. This is a bold goal, given the nation's protracted wait to become self-sufficient in chips that power everything from defense systems to cell phones.

* Interested in Company Profiles? Connect with Us for Detailed Profiles

What is Going Around the Globe?

- In November 2024, with the goal of becoming a semiconductor manufacturing powerhouse, Gujarat introduced India's first "Gujarat Semiconductor Policy 2022-2027," in keeping with Prime Minister Narendra Modi's Viksit Bharat@2047 vision.

- In July 2024, Secretary of State Antony Blinken presented a new plan for the Americas to increase semiconductor production, a sector dominated by China and essential to contemporary industry almost everywhere.

The research report categorizes the semiconductor market into the following segments and subsegments:

By Component

- Logic Devices

- MPU

- Power Devices

- MCU

- Analog IC

- Memory Devices

- Sensors

- Discrete Power Devices

- Others

By Application

- Data Processing

- Industrial

- Networking & Communications

- Consumer Electronics

- Automotive

- Government

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa (MEA)

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1376

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsevsolutions.com

For Latest Update Follow Us: