United Kingdom, London, Nov. 20, 2024 (GLOBE NEWSWIRE) -- Cannabis multistate operator Curaleaf Holdings finalized its $16 million acquisition of Northern Green Canada, a licensed producer based in Ontario with a focus on international markets. The transaction, completed recently, involved an initial payment valued at approximately $16 million (22 million Canadian dollars) in Curaleaf's subordinate voting shares. This strategic move aligns with Curaleaf's ongoing efforts to expand its presence in the global cannabis market. Northern Green Canada's established international footprint complements Curaleaf's growth objectives, enhancing its ability to serve diverse markets. The acquisition further underscores Curaleaf's commitment to strengthening its position as a leading player in the cannabis industry.

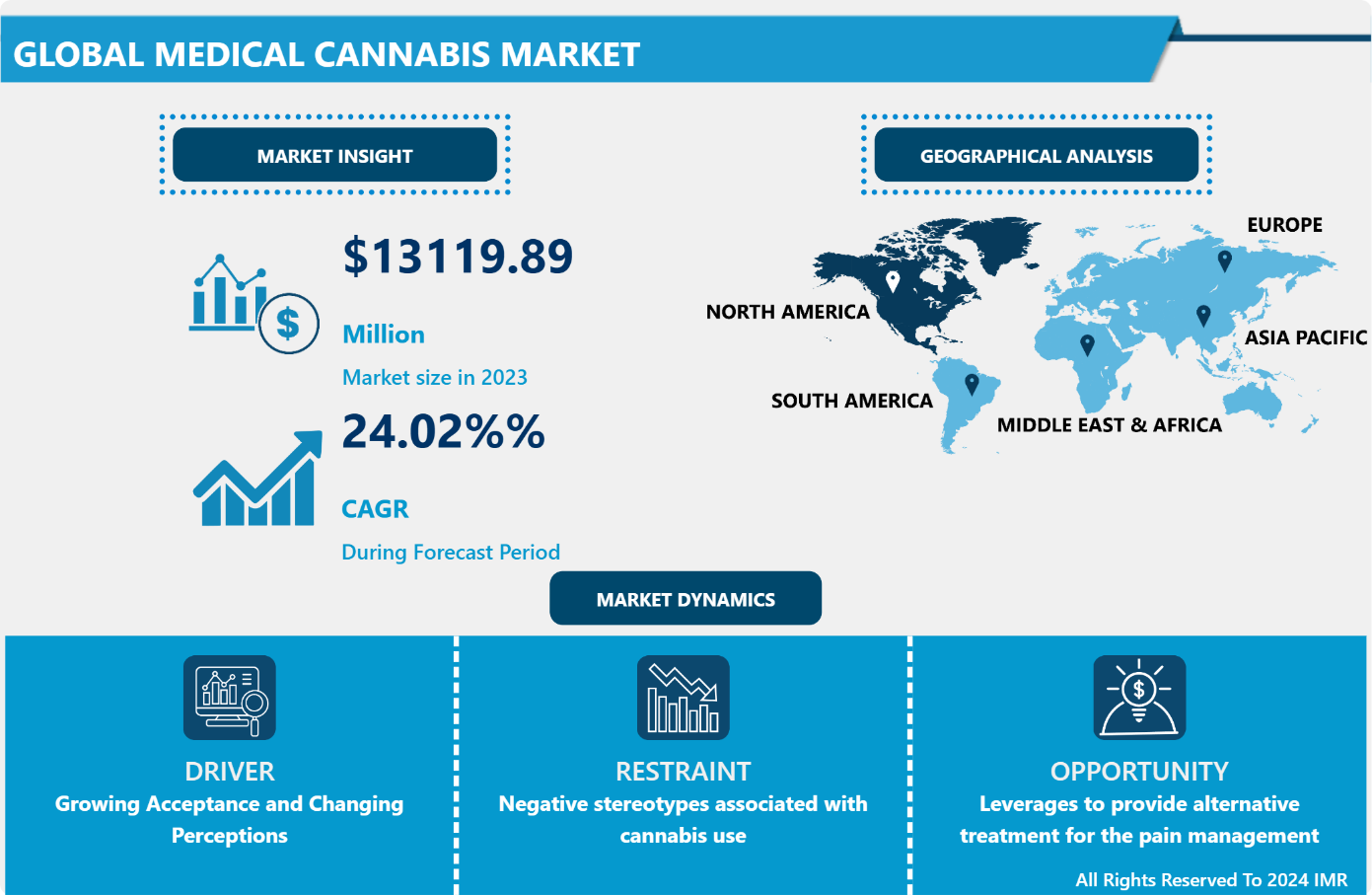

Introspective Market Research is thrilled to announce the release of its newest report, "Medical Cannabis Market." This comprehensive analysis reveals that the global Medical Cannabis market, valued at USD 13119.89 million in 2023, is on a trajectory of significant growth, projected to reach USD 91065.89 Million by 2032. This upward momentum corresponds to a robust CAGR of 24.02% over the forecast period from 2024 to 2032.

Medical cannabis, also known as medicinal cannabis or medical marijuana (MMJ), comprises cannabis products and cannabinoid compounds prescribed by licensed healthcare professionals for medical use. While cannabis has a long history as a medicinal plant, its clinical research has been limited due to legal and regulatory barriers. Consequently, the safety and efficacy of cannabis in treating various conditions are not as well-defined as those of other medicinal plants. Despite these limitations, medical cannabis is increasingly recognized for its therapeutic potential.

In many countries, medical cannabis is legal but subject to strict regulations. It is commonly prescribed to manage conditions such as chronic pain, cancer-related symptoms, and epilepsy. Patients require a prescription from a registered doctor or participation in an authorized medical trial to access these treatments. However, medicinal cannabis is not covered under the Pharmaceutical Benefits Scheme (PBS), meaning patients must bear the full cost of their treatment.

Despite cannabis's long history, formal evidence to guide doctors in prescribing medicinal cannabis remains limited. However, some studies suggest that specific medicinal cannabis products may help manage conditions such as epilepsy, multiple sclerosis, cancer-related symptoms (including nausea, pain, and appetite loss), chronic pain, and provide symptom relief in palliative care. The Commonwealth Government has published documents summarizing the current evidence on its potential benefits for these conditions.

Download Sample 250 Pages Of Medical Cannabis Market Report@ https://introspectivemarketresearch.com/request/17049

Key Industry Insights

Growing Acceptance and Changing Perceptions

Increasing support from healthcare professionals, advancements in scientific research, and changing social attitudes are all contributing to the fast-paced rise in acceptance of medical cannabis. Research shows the medical benefits of cannabinoids in treating chronic pain, anxiety, epilepsy, and multiple sclerosis, establishing a strong basis for its therapeutic use. This increasing amount of proof is changing public views, lessening the negative connotations linked to marijuana, and encouraging wider societal approval of its medical uses. At the same time, medical professionals are increasingly willing to suggest medical cannabis due to its acknowledged positive impact on patient results.

Rising Prevalence of Chronic Diseases

The increasing occurrence of long-term illnesses is strongly connected to two main reasons: the growing number of elderly individuals and current lifestyle habits. As the worldwide population gets older, the prevalence of chronic illnesses like arthritis, heart disease, and diabetes rises significantly. This change in population demographics results in an increasing need for efficient methods of pain management and symptom relief, due to the higher vulnerability of older people to chronic health problems. Moreover, the increase in conditions such as anxiety, depression, and insomnia can be attributed to contemporary lifestyles which involve high levels of stress, lack of physical activity, and inadequate sleep. These elements increase the need for alternative treatment choices like non-invasive therapies and holistic methods to enhance the quality of life and tackle the complex challenges presented by chronic illnesses.

Economic Opportunities and Investment

The medical cannabis industry offers a thriving economic landscape, drawing substantial investments from diverse sectors such as pharmaceuticals, agriculture, and technology. This burgeoning market is driven by increasing acceptance of cannabis-based treatments and the development of innovative products, making it highly lucrative for stakeholders. As the industry expands, it fosters job creation across multiple stages of the supply chain, including cultivation, processing, distribution, and retail. These opportunities not only stimulate economic growth but also support ancillary industries such as research, compliance, and technology integration, making the medical cannabis sector a catalyst for broader economic development.

"Research made simple and affordable – Trusted Research Tailored just for you – IMR Knowledge Cluster"

https://www.imrknowledgecluster.com/

Innovation in Product Development

Advancements in product development are fueling substantial market expansion and variety, emphasizing the importance of catering to diverse patient requirements and desires. The range of product options, including dried flowers, oils, tinctures, edibles, and topicals, ensures patients can find options that suit their unique medical or wellness needs. These items accommodate a variety of consumption preferences such as oral, topical, or inhalation methods. Adding to this variation, innovative delivery methods like vaporizers and sublingual sprays are improving the patient's experience through accurate dosage and increased effectiveness. These advancements not just enhance accessibility, but also play a role in boosting the popularity and usage of these products in the medical and consumer sectors.

How can medical cannabis be leveraged to provide alternative treatments for pain management, mental health disorders, neurological conditions, and cancer-related symptoms?

Growing attention is being given to cannabis-derived medications due to their ability to potentially alleviate long-lasting pain, particularly in conditions such as arthritis, fibromyalgia, and back pain. By engaging with the body's endocannabinoid system, marijuana can lower pain signals, potentially serving as a replacement for opioids. Medical marijuana is seen as a safer option for managing chronic pain in the long run since it reduces the risk of becoming dependent on opioids and experiencing their side effects.

There is a growing recognition of cannabis's therapeutic potential for mental health disorders. Studies suggest that cannabis could help manage symptoms of anxiety, depression, and PTSD. The calming effects of it may provide solace to people who haven't found success with traditional medications, introducing a new way to tackle these often-difficult conditions. Cannabis has shown promise in alleviating symptoms associated with neurological conditions, including epilepsy, multiple sclerosis, and Parkinson's disease in the context of cancer therapy.

Decreasing muscle spasms and improving movement may be a result of its capability to shield the nervous system. Moreover, cannabis aids in cancer treatment by reducing chemotherapy-induced nausea, vomiting, and pain, improving the quality of life for cancer patients. This showcases cannabis as a flexible option for individuals dealing with chronic health conditions.

How can the medical cannabis market overcome the negative stereotypes associated with cannabis use?

The medical cannabis market faces significant limitations due to persistent negative stereotypes about cannabis use. Despite increasing evidence supporting its therapeutic benefits, the stigma surrounding cannabis use, particularly its recreational use, remains a barrier to broader acceptance. Many individuals still associate cannabis with illegal or recreational activities, which can overshadow its legitimate medical applications.

Additionally, misinformation and a lack of proper education about medical cannabis contribute to skepticism, especially among healthcare professionals and the general public. Without accurate information, misconceptions about safety, efficacy, and potential side effects continue to circulate, creating hesitation and resistance to its integration into conventional medical treatments.

The combination of these issues hampers the progress of medical cannabis in the healthcare sector. The stigma surrounding cannabis use not only affects patient willingness to seek treatment but also discourages healthcare providers from recommending it. Moreover, the limited knowledge surrounding its use restricts its adoption in mainstream medical practices.

Do you need any industry insights on Medical Cannabis Market, Make an enquiry now >>? https://introspectivemarketresearch.com/inquiry/17049

Regulations on the Medical Cannabis Market:

Controlled Substances Act (CSA): The Controlled Substances Act (CSA) classifies marijuana as a Schedule I drug, meaning it is considered to have a high potential for abuse and no accepted medical use in the United States. Under the CSA, marijuana is referred to as "marihuana" and includes the cannabis plant, its seeds, and any derivative products. The Act specifically highlights marijuana with a delta-9 tetrahydrocannabinol (THC) concentration greater than 0.3 percent on a dry-weight basis. THC is the primary psychoactive compound in cannabis, responsible for the drug’s mind-altering effects. Marijuana's classification as a Schedule I drug reflects concerns over its safety, addiction potential, and lack of widespread medical approval.

Cannabis Act (Bill C-45): Bill C-45, known as the Cannabis Act, is a significant piece of Canadian legislation that legalized the recreational use of cannabis in Canada. It received Royal Assent on June 21, 2018, and came into force on October 17, 2018, marking a historic shift in the country’s approach to cannabis. The Cannabis Act allows adults aged 18 or 19, depending on the province, to legally possess and consume cannabis for recreational purposes. The law regulates the production, distribution, and sale of cannabis, with strict controls in place to ensure public safety and prevent access to minors. It also permits individuals to grow up to four cannabis plants per household for personal use.

Key Manufacturers

Identify the main players and organizations in a particular industry or market that have a strong impact on its dynamics. Recognizing these important individuals is crucial for grasping competitive positioning, market trends, and strategic opportunities.

- Canopy Growth Corporation (Canada)

- Aurora Cannabis Inc. (Canada)

- Tilray, Inc. (Canada)

- GW Pharmaceuticals plc (United Kingdom)

- Cronos Group Inc. (Canada)

- Aphria Inc. (Canada)

- MedMen Enterprises Inc. (USA)

- Green Thumb Industries (GTI) (USA)

- Trulieve Cannabis Corp. (USA)

- Curaleaf Holdings, Inc. (USA)

- Cresco Labs (USA)

- Harvest Health & Recreation Inc. (USA)

- Acreage Holdings, Inc. (USA)

- Innovative Industrial Properties, Inc. (USA)

- HEXO Corp. (Canada)

- Organigram Holdings Inc. (Canada)

- MedReleaf Corp. (Canada)

- The Green Organic Dutchman Holdings Ltd. (TGOD) (Canada)

- TerrAscend Corp. (Canada)

- Valens GroWorks Corp. (Canada)

- Village Farms International, Inc. (Canada)

- VIVO Cannabis Inc. (Canada)

- iAnthus Capital Holdings, Inc. (USA)

- Planet 13 Holdings Inc. (USA)

- Columbia Care Inc. (USA)

- MariMed Inc. (USA)

- Liberty Health Sciences Inc. (Canada) and Other Active Players

In July 2024, Weedmaps partnered with NuggMD to launch a medical cannabis card program aimed at streamlining the education and application process for patients. The collaboration connected potential patients on Weedmaps with NuggMD's telehealth platform, enhancing access to medical cannabis. This initiative created a seamless e-commerce experience, allowing patients to shop and learn about medicinal cannabis products on Weedmaps after completing their application.

In May 2024, Synbiotic Se, a German industrial hemp and cannabis group, acquired WEECO Pharma GmbH from Hildesheim, Germany, significantly expanding its position in the medical cannabis market. This merger made SYNBIOTIC one of the leading players in the German and European medicinal cannabis sectors. With the acquisition of WEECO Pharma, SYNBIOTIC’s portfolio was enhanced to include a full range of high-quality cannabis flowers, alongside extracts and dronabinol, particularly in alternative administration forms.

If you require any specific information that is not covered currently, we will provide the same as a part of the customization >> https://introspectivemarketresearch.com/custom-research/17049

Key Segments of Market Report

By Species:

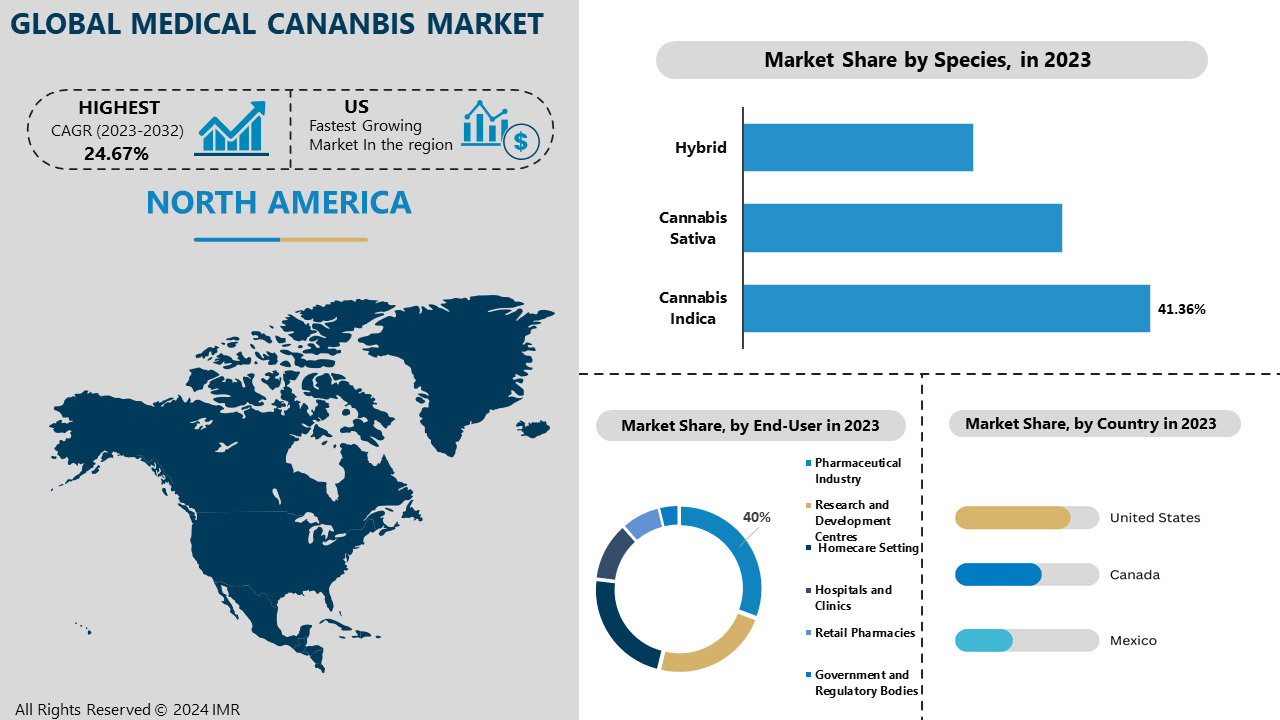

Cannabis Indica is known for its compact size, bushy growth, and broader leaves, with a quicker flowering period than Cannabis Sativa. It typically contains higher levels of THC and lower levels of CBD, leading to distinct effects and medicinal benefits. Indica strains are particularly effective in managing pain, including chronic and nerve-related pain, arthritis, fibromyalgia, and muscle spasms. These strains also help with sleep disorders, promoting relaxation and triggering sleep, which makes them ideal for those with insomnia or high-stress levels. Additionally, Indica varieties are known for their calming effects, providing relief from anxiety, stress, and conditions such as PTSD, multiple sclerosis, and epilepsy. Clinical research supports the inclusion of Indica strains in medical cannabis protocols, with many regulatory agencies recognizing their effectiveness. Patient testimonials further confirm the therapeutic advantages of these strains, driving their popularity in medical applications.

By End-User:

Pharmaceutical companies allocate significant resources to research and development to explore the medicinal benefits of cannabinoids derived from cannabis. They focus on understanding how these compounds impact various health conditions, the most effective methods of administration, appropriate dosages, and safety levels. Clinical trials play a crucial role in gathering evidence on the effectiveness and safety of cannabis-based medicines, and scientific validation is essential for medical and regulatory approval. Regulatory bodies like the FDA in the US and the EMA in Europe impose strict guidelines to ensure the safety and quality of medical cannabis products. Pharmaceutical firms, with their expertise and resources, are equipped to meet these stringent regulations through comprehensive testing and clinical trials, providing evidence of the therapeutic benefits.

By Region:

North America is dominating in the Medical Cannabis Market, despite federal laws prohibiting it, medical cannabis is legal in several U.S. states, including California, Colorado, and Massachusetts, where programs for cultivation, distribution, and use of marijuana for medical purposes are helping patients with conditions like chronic pain, epilepsy, PTSD, and multiple sclerosis. In Canada, medical cannabis was legalized in 2001, and in 2018, the country also legalized recreational cannabis, with Health Canada overseeing production and distribution to ensure safety and quality standards. North American organizations are at the forefront of cannabis research, developing new medications and delivery methods to improve patient care.

Public perception of cannabis has improved due to advocacy campaigns and educational efforts, while dispensaries, clinics, and telemedicine advancements have made medical marijuana more accessible. Significant investment from venture capital and private equity firms has fueled the growth of cannabis companies, many of which are publicly listed for funding and research purposes. However, regulatory differences between state and federal laws in the U.S. continue to create both challenges and opportunities. In 2023, Florida led the U.S. medical cannabis market with 831,775 patients, followed by Pennsylvania and Oklahoma, while states like Ohio and Missouri showed moderate numbers, and New York had relatively low patient numbers, indicating significant market growth potential.

Comprehensive Offerings:

Market Size and Competitive Landscape (2017–2023): A detailed analysis of the market size and the competitive environment over recent years.

Pricing Trends and Regional Price Analysis (2017–2023): A review of past pricing trends and data across different regions.

Market Size, Share, and Forecast by Segment (2024–2032): Forecasts and insights into the market size, share, and expected growth by segment.

Market Dynamics: A comprehensive analysis of growth drivers, challenges, opportunities, and major trends, with a focus on regional variations.

Trend Analysis: Evaluation of emerging trends influencing the market environment.

Trade Overview: An examination of import and export patterns and their impact on market dynamics.

Market Segmentation: A detailed analysis of market segments and sub-segments, including a regional breakdown.

Competitive Landscape: Strategic profiles of key players in various regions, along with competitive benchmarking.

PESTLE Analysis: An evaluation of the market based on political, economic, social, technological, legal, and environmental factors.

Porter’s Five Forces Analysis: An examination of the competitive forces that affect the market.

Industry Value Chain Analysis: A look at the value chain to identify key stages and contributors.

Legal and Regulatory Framework by Region: An analysis of the legal environment and its implications for business operations.

Strategic Opportunities and SWOT Analysis: Identification of profitable business opportunities, along with a SWOT analysis.

Conclusion and Strategic Recommendations: Final insights and actionable recommendations for stakeholders.

Related Report Links:

Continuous Blood Glucose Market: Continuous Blood Glucose Market Size Was Valued at USD 9.58 Billion in 2023 and is Projected to Reach USD 54.67 Billion by 2032, Growing at a CAGR of 21.35 % From 2024-2032.

Surgical Pliers Market: Surgical Pliers Market Size Was Valued at USD 161.41 Million in 2023 and is Projected to Reach USD 236.79 Million by 2032, Growing at a CAGR of 4.35% From 2024-2032.

Surgical Hemostat Market: Surgical Hemostat Market Size Was Valued at USD 4.91 Billion in 2023 and is Projected to Reach USD 8.95 Billion by 2032, Growing at a CAGR of 6.9% From 2024-2032.

Surgical Rasps Market: Surgical Rasps Market Size Was Valued at USD 39.4 Million in 2023 and is Projected to Reach USD 62.98 Million by 2032, Growing at a CAGR of 5.35 % From 2024-2032.

Surgical Mask Market: Global Surgical Mask Market Size Was Valued at USD 4.25 Billion in 2023 and is Projected to Reach USD 8.60 Billion by 2032, Growing at a CAGR of 8.14% From 2024-2032.

Surgical Instruments Packaging Market: Surgical Instruments Packaging Market Size Was Valued at USD 30.16 Billion in 2023 and is Projected to Reach USD 51.56 Billion by 2032, Growing at a CAGR of 5.51% From 2024-2032.

Surgical Forceps Market: Surgical Forceps Market Size Was Valued at USD 35.80 Billion in 2023, and is Projected to Reach USD 54.53 Billion by 2032, Growing at a CAGR of 5.4% From 2024-2032.

3D Printed Surgical Models Market: 3D Printed Surgical Models Market Size is Valued at USD 600.68 Million in 2023, and is Projected to Reach USD 1837.49 Million by 2032, Growing at a CAGR of 15% From 2024-2032.

Surgical Clamps Market: Surgical Clamps Market Size Was Valued at USD 214.85 Billion in 2023 and is Projected to Reach USD 292.82 Billion by 2032, Growing at a CAGR of 3.5% From 2024-2032.

Wireless Surgical Cameras Market: Wireless Surgical Cameras Market Size Was Valued at USD 95.09 Million in 2023 and is Projected to Reach USD 213.27 Million by 2032, Growing at a CAGR of 9.39% From 2024-2032.

About Us:

Introspective Market Research is a leading global market research firm that harnesses the power of big data and advanced analytics to provide strategic insights and consulting solutions. Our expertise enables clients to predict future market trends with accuracy. The IMR team is dedicated to helping businesses understand both historical and current market dynamics, offering a clear view of potential future developments. Through strong industry connections, we gain access to critical market data, allowing us to create reliable research tables and precise forecasts. Led by CEO Mrs. Swati Kalagate, who fosters a culture of excellence, we are committed to delivering high-quality data that drives our clients' business success.

Our reports are built upon comprehensive primary research, including interviews with key executives from leading companies across relevant industries. Our secondary research process includes thorough online and offline investigations, in-depth discussions with industry experts, and collaboration with seasoned analysts. This rigorous approach ensures the accuracy and reliability of the insights we provide, empowering our clients with the information they need to make informed decisions, stay ahead of market trends, and achieve sustainable growth in their respective sectors. At IMR, we are focused on delivering data that helps businesses navigate the complexities of evolving markets with confidence.

Contact Us:

Canada Office

Introspective Market Research Private Limited, 138 Downes Street Unit 6203- M5E 0E4, Toronto, Canada.

APAC Office

Introspective Market Research Private Limited, Office No. 401, Saudamini Commercial Complex, Kothrud, Pune, India 411038

Ph no: +91-81800-96367 / +91-7410103736

Email: sales@introspectivemarketresearch.com

LinkedIn| Twitter| Facebook | Instagram

Ours Websites : https://introspectivemarketresearch.com | https://imrknowledgecluster.com/knowledge-cluster | https://imrtechsolutions.com | https://imrnewswire.com/ | https://marketnresearch.de |