New York, Nov. 25, 2024 (GLOBE NEWSWIRE) -- Overview

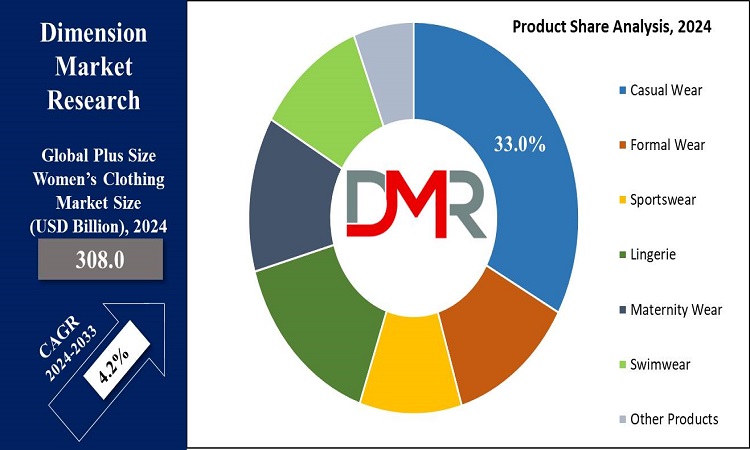

The Global Plus Size Women’s Clothing Market is projected to reach USD 308.0 billion in 2024 which is further anticipated to reach USD 444.4 billion by 2033 at a CAGR of 4.2%.

The plus-size women's clothing market is gaining global recognition, owing to the rise of body positivity, inclusiveness drives, and increasing demand by consumers for a great variety of sizes. Brands also focus on expanding their size range while manufacturing to meet this demand in the underserved segment of the market.

E-commerce offers a great deal of variety and personal interaction with shoppers. Casual wear, formal wear, sportswear, and more are the types that make up the market segmentation.

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/plus-size-womens-clothing-market/request-sample/

Casual wear leads the way, as it is an everyday-wear product in nature. It is expected that increasing disposable incomes, improved brand offerings, and the trend for influencer collaborations continue to boost this market in North America and Europe.

The US Plus Size Women’s Clothing Market

The US Plus Size Women’s Clothing Market with an estimated value of USD 107.0 billion in 2024 is projected to increase at a compound annual growth rate of 3.9% until reaching USD 151.6 billion by 2033.

Plus-size women's clothing is one of the rapidly growing markets in the U.S., as many major brands and retailers in this region have been increasingly pushing to incorporate more diverse body types in various categories. Key trends include the expansion of plus-size ranges by mainstream brands a focus on sustainable clothing and increased online shopping.

Some of the leading players in the market deal with Torrid, Lane Bryant, and Eloquii. E-commerce innovations, such as AI-powered recommendations and virtual fitting rooms, are further boosting the experience. This is indicative of the growing trends of activewear and casual wear for comfort and fashion, hence driving the market.

Important Insights

- Global Market Size: This market is estimated to be worth USD 308.0 billion in 2024 and is expected to reach USD 444.4 billion by 2033.

- S. Market Value: The U.S. plus-size women's clothing market is projected to grow from USD 107.0 billion in 2024 to USD 151.6 billion by 2033, with a CAGR of 3.9%.

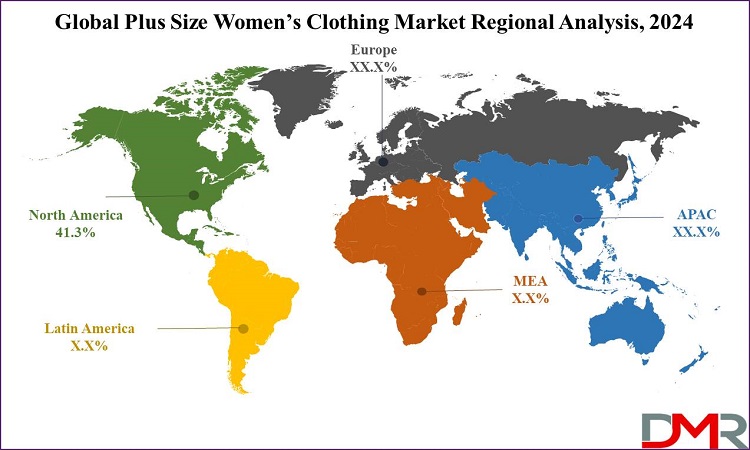

- Regional Analysis: North America is anticipated to hold the largest share of the global market, accounting for approximately 41.3% in 2024.

- Product Segment Insights: Casual wear is expected to dominate the market, holding 33.0% of the product segment in 2024.

- Price Range Segment Insights: Mid-range priced women's clothing is projected to lead the market with a 44.9% share in 2024.

- Global Growth Rate: This market is growing at a compound annual growth rate of 4.2% over the forecast period of 2024 to 2033.

Latest Trends

- Increasing focus on size inclusivity, with more brands now offering plus-size clothes, from large sets to diverse body shapes and different tastes.

- The rapid growth of online shopping, especially with virtual fitting tools, is transforming the shopping experience for plus-size consumers globally.

- Rising demand for sustainable fashion is prompting brands to introduce eco-friendly and ethically produced plus-size collections to attract conscious consumers.

- Collaborations between fashion brands and plus-size influencers are boosting brand visibility and enhancing engagement with the target demographic.

Plus Size Women’s Clothing Market: Competitive Landscape

The plus-size women's clothing market is extremely competitive, with key players holding large shares, including Lane Bryant, Torrid, and Eloquii. In addition, mainstream brands added size ranges, such as Old Navy, H&M, and ASOS, which further raised the level of competition in this market.

E-commerce giants like Amazon and Zalando have wide selections and improved ease of access, while niche plus-size brands creating sustainable and customizable clothes find success. Some of the competitive strategies include influencer marketing, product diversification, and innovations in fit and fabric.

The market also is a witness to collaborations with fashion designers for offering exclusive plus-size collections.

Some of the prominent market players:

- ASOS plc

- H&M Group

- Nike, Inc.

- Adidas AG

- Forever 21, Inc.

- Macy's, Inc.

- Torrid LLC

- Lane Bryant (Ascena Retail Group)

- Ralph Lauren Corporation

- C&A

- Eloquii

- Marks & Spencer Group plc

- Other Key Players

Transform your business approach with strategic insights from our report. Get in touch to request our brochure today! : https://dimensionmarketresearch.com/report/plus-size-womens-clothing-market/download-reports-excerpt/

Plus Size Women’s Clothing Market Scope

| Report Highlights | Details |

| Market Size (2024) | USD 308.0 Bn |

| Forecast Value (2033) | USD 444.4 Bn |

| CAGR (2024-2033) | 4.2% |

| North America Revenue Share (2024) | 41.3% |

| The US Market Size (2024) | USD 107.0 Bn |

| Historical Data | 2018 - 2023 |

| Forecast Data | 2024 - 2033 |

| Base Year | 2023 |

| Estimate Year | 2024 |

| Segments Covered | By Product, By Raw Material, By Age Group, By Pricing, and By Distribution Channel |

| Regional Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Analysis

Casual wear is anticipated to dominate the plus-size women’s clothing market based on product type with 33.0% of the market share in 2024. Casual wear dominates the plus-size women's apparel market due to several prime factors there is an increasing preference for comfortable, relaxed styles for everyday wear.

Second, the increasingly common acceptance of casual attire in the workplace and social settings reaches a wider audience. Thirdly, the pandemic accelerated demand for loungewear and athletic wear, which merely secured casual wear as a basic in anyone's wardrobe.

Finally, the plus-size consumer identifies comfort, ease of movement, and versatility as major needs in the casual wear segment, which then becomes the one-stop destination for daily wear.

Plus Size Women’s Clothing Market Segmentation

By Product

- Casual Wear

- T-shirts

- Jeans

- Casual Dresses

- Leggings

- Hoodies

- Formal Wear

- Office Suits

- Blazers

- Trousers

- Formal Dresses

- Skirts

- Sportswear

- Activewear

- Gym Wear

- Yoga Pants

- Joggers

- Sports Bras

- Lingerie

- Everyday Bras

- Shapewear

- Panties

- Sleepwear

- Maternity Wear

- Maternity Dresses

- Nursing Bras

- Maternity Leggings

- Swimwear

- One-Piece

- Tankinis

- Swim Dresses

- Beachwear Accessories

- Other Products

By Age Group

- 15–30 Years

- 31–45 Years

- 46–60 Years

- 60+ Years

By Raw Material

- Cotton

- Wool

- Silk

- Chemical

- Others

By Pricing

- Low-Priced

- Mid-Priced

- Premium

By Distribution Channel

- Online

- E-commerce Platforms

- Official Websites

- Offline

- Department Stores

- Specialty Stores

- Hypermarkets and Supermarkets

- Fashion Boutiques

- Outlet Stores

Purchase the Competition Analysis Dashboard Today: https://dimensionmarketresearch.com/checkout/plus-size-womens-clothing-market/

Growth Drivers

- Rising body positivity movements have emboldened plus-size consumers to express themselves confidently through fashion choices, increasing demand for additional clothing options.

- Expanding fashion options across casual wear, athleisure, and formal wear in more sizes are meeting rising consumer demand for plus-size fashion.

- Rising disposable income levels in emerging markets are leading to greater spending on plus-size apparel which further boosts market expansion.

- With so many online retailers providing personalized recommendations to simplify the shopping experience for consumers and help them quickly identify appropriate sizes, there may be less of a constraint on finding what consumers need for clothing purchases.

Restraints

- Lack of standardized sizing across brands results in inconsistent fits, frustrating plus-size consumers and hindering market growth.

- Higher production costs for plus-size clothing due to increased fabric and specialized design requirements limit profit margins for some brands.

- The limited availability of premium, high-fashion options for plus-size consumers leaves a gap in the market that is yet to be addressed.

- Social stigma and persistent negative perceptions around plus-size fashion continue to challenge the growth of the industry, limiting its reach.

Growth Opportunities

- Expanding plus-size options in formal and business attire, currently underserved, presents an opportunity for brands to capture more market share.

- Untapped markets in regions like Asia-Pacific and Latin America offer growth potential, with rising fashion demand among plus-size consumers.

- Collaborating with eco-friendly fashion initiatives allows brands to tap into the growing market of environmentally conscious plus-size consumers.

- Bespoke and customizable clothing options for plus-size consumers, addressing fit and comfort issues, present an avenue for market differentiation.

Regional Analysis

North America is projected to dominate the plus-size women’s clothing market as it will hold 41.3% of the market share in 2024. North America accounted for the highest share in the plus-size women's wear market, due to rising demand in the industry for more fashionable products and high purchasing power.

The U.S., being a leading contributor to the market, attaches importance to body positivity and inclusivity, driving up the market. Enhanced retail infrastructure, improved e-commerce penetration, and higher digital marketing in this region would boost up the market.

Besides, North American consumers are more open to sustainable and eco-friendly fashion, which further drives the demand for plus-size fashion. Increasing partnerships with several influencers and celebrities also strengthen the market presence of this region.

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/plus-size-womens-clothing-market/request-sample/

By Region

North America

- The U.S.

- Canada

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Discover additional reports tailored to your industry needs

- Public Safety and Security Market is projected to reach USD 455.7 billion in 2024 and grow at a compound annual growth rate of 9.8% from there until 2033 to reach a value of USD 1,053.6 billion.

- Retail Analytics Market is projected to reach USD 9.5 billion in 2024 and grow at a compound annual growth rate of 17.8% from there until 2033 to reach a value of USD 41.5 billion.

- Contact Lenses Market size is expected to reach a value of USD 8.9 billion in 2024, and it is further anticipated to reach a market value of USD 16.3 billion by 2033 at a CAGR of 7.0%.

- Athleisure Market size is expected to reach a value of USD 393.7 billion in 2024, and it is further anticipated to reach a market value of USD 902.4 billion by 2033 at a CAGR of 9.7%.

- Airless Packaging Market size is estimated to reach USD 5.4 Billion in 2024 and is further anticipated to value USD 8.6 Billion by 2033, at a CAGR of 5.3%.

- Musical Instruments Market size is estimated to reach USD 9.6 Billion in 2024 and is further anticipated to value USD 13.0 Billion by 2033, at a CAGR of 3.5%.

- Bamboo Cosmetic Packaging Market size is estimated to reach USD 458.8 Million in 2024 and is further anticipated to value USD 923.4 Million by 2033, at a CAGR of 8.2%.

- Citrus Oil Market size was valued at USD 10.2 Bn in 2024 and it is further anticipated to reach a market value of USD 21.1 Bn in 2033 at a CAGR of 8.4%.

- Home Improvement Services Market size is estimated to reach USD 419.7 Billion in 2024 and is further anticipated to value USD 742.5 Billion by 2033, at a CAGR of 6.5%.

- Airsoft Guns Market size was valued at USD 2.18 Bn in 2023 and it is further anticipated to reach a market value of USD 4.29 Bn in 2033 at a CAGR of 7.8%.

Recent Developments in the Plus Size Women’s Clothing Market

- September 2024: Torrid introduced a sustainable plus-size collection featuring garments made from recycled and eco-friendly materials, appealing to environmentally conscious consumers.

- August 2024: ASOS launched a virtual fitting room for its plus-size range, enhancing the online shopping experience with better size accuracy and customer satisfaction.

- July 2024: Lane Bryant expanded its activewear line, responding to the growing demand for stylish and functional plus-size athleisure and fitness clothing.

- June 2024: Eloquii collaborated with a celebrity plus-size influencer to release a limited-edition collection, capitalizing on influencer marketing to drive sales.

- May 2024: H&M responded to customer feedback by extending its plus-size range, adding more stylish and affordable clothing options in larger sizes.

- April 2024: Amazon introduced AI-powered size recommendation tools tailored specifically for plus-size clothing, improving the online shopping experience for consumers.

About Dimension Market Research (DMR):

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world.

We also believe that our clients don’t always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.