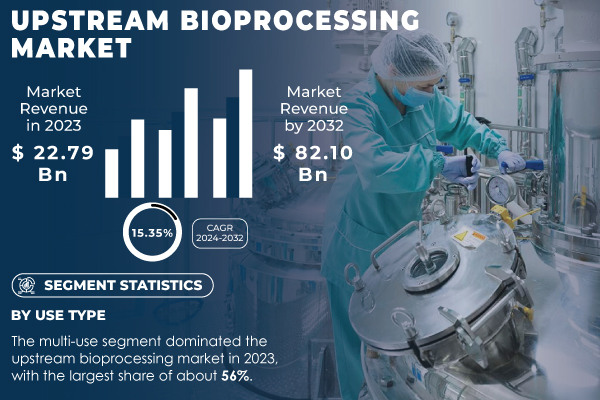

Austin, Nov. 26, 2024 (GLOBE NEWSWIRE) -- The S&S Insider report indicates that, “The Upstream Bioprocessing Market was valued at USD 22.79 Billion in 2023 and is projected to reach USD 82.10 Billion by 2032, growing at a compound annual growth rate (CAGR) of 15.35% from 2024 to 2032.”

Driving Growth in the Upstream Bioprocessing Market: Innovation and Flexibility at the Forefront

The upstream bioprocessing market is growing rapidly, driven by the demand for biopharmaceuticals in healthcare and advances in biologic production. During 2023, U.S. and EU biotech firms combined raised USD 81.1 billion in 2023, while within the first quarter of 2024, 115 R&D partnerships were reported worth a total of USD 36 billion, indicating an emphasis on innovation. Single-use bioreactors and their automation are driving efficiencies, pushing production processes to newer heights, increasing quality, and controlling costs. This aligns with the industry's trend toward scalable and flexible manufacturing solutions designed to meet the increasing demand for biologics, vaccines, and advanced therapies.

These advancements in customized medicine and biosimilars are only building on the pressure to produce more flexible production platforms. New technologies such as AI and advanced sensing will optimize processes, including real-time monitoring capabilities, while changes in policies for sustainable practice direct the course for long-term growth toward a low environmental impact future.

Download PDF Sample of Upstream Bioprocessing Market @ https://www.snsinsider.com/sample-request/3940

Major Players:

- Thermo Fisher Scientific, Inc. (Nalgene Labware, HyClone Cell Culture Media)

- Merck KGaA (Millipore Sigma Cell Culture Media, Merck Millipore Bioreactors)

- Corning Incorporated (Cell Culture Dishes, Bioprocess Containers)

- Sartorius AG (BIOSTAT Bioreactors, Sartorius Stedim Biotech Single-Use Systems)

- Eppendorf AG (Bioreactor Systems, Cell Culture Equipment)

- Danaher (Ultipor Membranes, XRS Bioreactor)

- Boehringer Ingelheim GmbH (Cell Culture Media, Bioprocess Systems)

- Applikon Biotechnology (Bioreactor Systems, Control Systems)

- PBS Biotech, Inc (Wave Bioreactor, Bioreactor Systems)

- Lonza (CHO Media, Disposable Bioreactors)

- VWR International, LLC (Bioprocessing Buffers, Single-Use Bioreactors)

- Meissner Filtration Products, Inc. (Bioprocess Filtration, Single-Use Systems)

- Repligen Corporation (Protein A Chromatography Resins, Filtration Solutions)

- Entegris (Bioprocessing Filtration, Single-Use Systems)

- Kuhner AG (ShakeFlask, Bioreactor Systems)

- GE Healthcare Life Sciences (Xcellerex Single-Use Bioreactors, HyClone Cell Culture Media)

- AbbVie (CHO Media, Cell Line Development Services)

- Fisher Scientific (Nalgene Labware, HyClone Cell Culture Media)

- Bio-Rad Laboratories, Inc. (Bio-Plex Pro Assays, Protein Purification Systems)

- Cytiva (Bioprocess Single-Use Systems, Flow Cytometry Solutions)

Upstream Bioprocessing Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 22.79 Billion |

| Market Size by 2032 | USD 82.10 Billion |

| CAGR | CAGR of 15.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Bioreactors/Fermenters, Cell Culture Products, Filters, Bioreactors Accessories, Bags & Containers, Others) • By Workflow (Media Preparation, Cell Culture, Cell Separation) • By Use Type (Multi-use, Single-use) • By Mode (In-house, Outsourced) |

| Key Drivers | • Advancements in Bioprocessing Technologies Transforming the Biopharma Market with Innovation • The Impact of Emerging Biotech Companies on the Upstream Bioprocessing Market Fueling Growth through Novel Therapies and Precision Medicine |

If You Need Any Customization on Upstream Bioprocessing Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/3940

By Use Type, Multi-Use Dominance, and Rapid Growth of Single-Use Technologies

Multi-use leads the upstream bioprocessing market in 2023, with about 56% market share. It is dominating because of its well-established demand, proven technology, and scalable ability for large volumes of production. Multi-use systems are preferred for their competitive capital and lifecycle costs as well as long-term operational stability, which cements their leading position in the market.

The single-use segment is expected to grow at the fastest CAGR of 16.35% from 2024 to 2032. This is due to various benefits such as flexibility, reduced setup times, and lower risk of contamination. Innovations in materials and design are making single-use technologies increasingly attractive, especially for smaller-scale, personalized biomanufacturing, potentially reshaping market competition and investment opportunities.

By Mode, In-House Leadership and Outsourced Growth

In-house segment dominated the upstream bioprocessing market in 2023, at 59% in the market share in 2023, as this process enables the firm to retain control over product quality, intellectual property, and process integration. Further advances in automation technologies have ensured even greater scalability and efficiency from in-house operations and thereby reinforced leadership status in this segment.

The outsourced segment is expected to grow at the fastest CAGR of 16.39% from 2024 to 2032, due to higher demand for cost efficiency, flexibility, and specialized expertise by end-users in biopharma. Contract manufacturing innovations and the growth of small to mid-sized biopharma companies are driving it. As outsourcing increases, market dynamics will shift toward more partnerships and investments in specialized service providers.

By Product, Dominance of Bioreactors and Growth of Cell Culture Products

The bioreactors/fermenters segment dominated the upstream bioprocessing market in 2023, accounting for a 32% revenue share. The large-scale demand for biologics keeps raising these segments' demand across the globe. Bioreactors are important for optimizing cell growth and better yields; with automation and real-time monitoring, operational efficiency is improved. Significant investments within this area facilitate it to grasp the top position in biopharmaceutical manufacturing.

Cell culture products segment are expected to grow at the fastest CAGR of 17.04% during 2024-2032 due to innovation in cell culture media and equipment. The demand for customized or high-end therapies and complex biologics increases the requirement for sophisticated, tailored cell culture solutions. This leads to increased competition and spurs new investments in the development of customized solutions.

North America's Market Dominance and Asia Pacific's Rapid Growth

North America Region dominated the upstream bioprocessing market with the highest revenue share of about 38% in 2023, supported by strong demand for biopharmaceuticals from leading industry players and solid infrastructures. More favorable regulations, advanced manufacturing capabilities, and cutting-edge technologies will continue to add strength to the region's competitive edge, thus ensuring sustained investments and market leadership.

The Asia Pacific region is expected to grow at the fastest CAGR of 17.74% from 2024 through 2032. The region is taking advantage of large inflows in investments, surging healthcare needs, and government support for biotechnology. With the changing competitive landscape, Asia Pacific's developing capabilities in contract manufacturing as well as its increasing share of the global biopharma market are forcing production strategies and investment alternatives.

Buy Full Research Report on Upstream Bioprocessing Market 2024-2032 @ https://www.snsinsider.com/checkout/3940

Key Developments in the Upstream Bioprocessing Market

- In 2024, Thermo Fisher Scientific launched biobased solutions, including sustainable single-use containers, to reduce the climate impact of biologics manufacturing while maintaining product performance.

- In August 2024, Merck KGaA acquired Mirus Bio, bolstering its leadership in upstream bioprocessing and advancing innovations in cell and gene therapy production

Table of Contents – Major Key Points

1. Introduction

- Market Definition

- Scope (Inclusion and Exclusions)

- Research Assumptions

2. Executive Summary

- Market Overview

- Regional Synopsis

- Competitive Summary

3. Research Methodology

- Top-Down Approach

- Bottom-up Approach

- Data Validation

- Primary Interviews

4. Market Dynamics Impact Analysis

- Market Driving Factors Analysis

- PESTLE Analysis

- Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

- Increased R&D Investment

- Technological Distribution

- Outsourcing of Biopharmaceutical Manufacturing

- Technological Innovations

6. Competitive Landscape

- List of Major Companies, By Region

- Market Share Analysis, By Region

- Product Benchmarking

- Strategic Initiatives

- Technological Advancements

- Market Positioning and Branding

7. Upstream Bioprocessing Market Segmentation, by Product

8. Upstream Bioprocessing Market Segmentation, by Workflow

9. Upstream Bioprocessing Market Segmentation, by Mode

10. Upstream Bioprocessing Market Segmentation, By Use Type

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/3940

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.