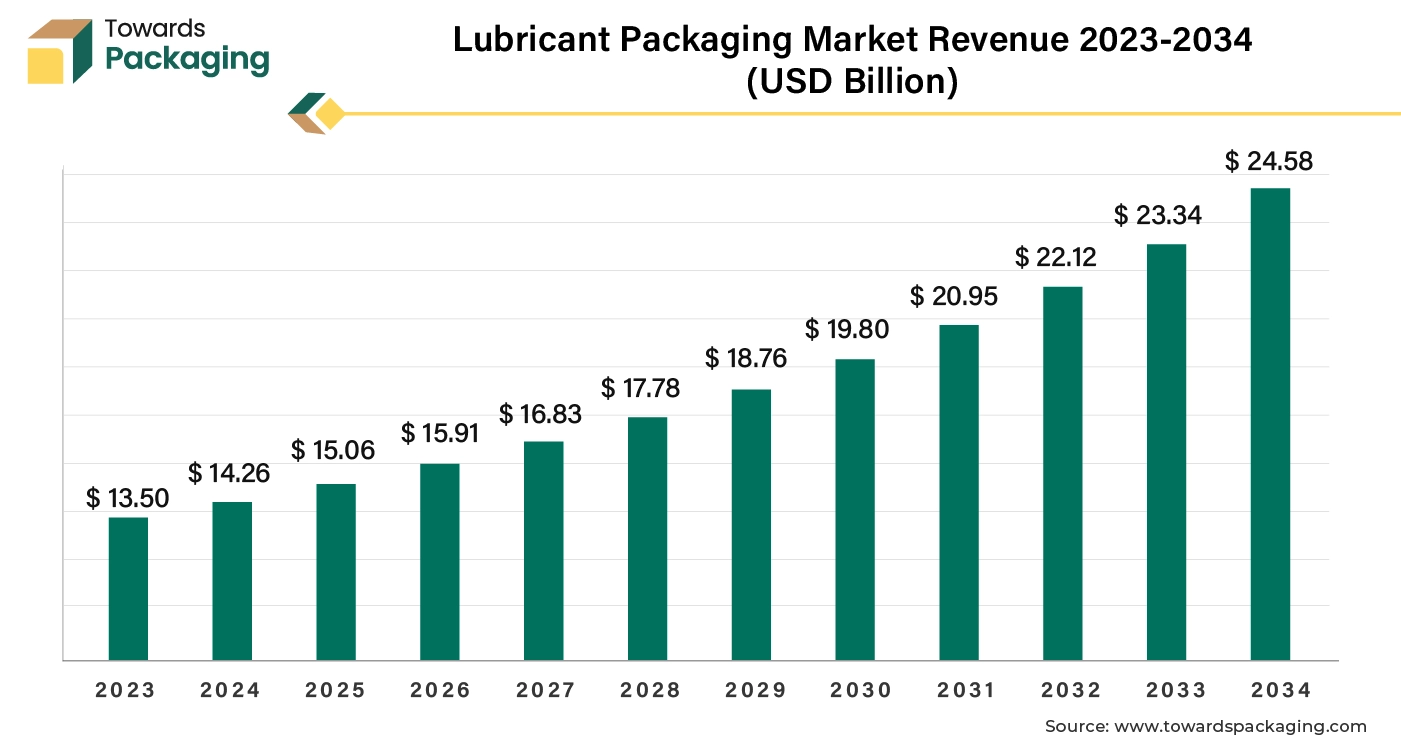

Ottawa, Dec. 03, 2024 (GLOBE NEWSWIRE) -- The global lubricant packaging market size was evaluated at USD 14.26 billion in 2024 and is predicted to exceed around USD 23.34 billion by 2033, a study published by Towards Packaging a sister firm of Precedence Statistics.

Access Statistical Data: https://www.towardspackaging.com/download-statistics/5269

Exploring the Growth Potential of the Lubricant Packaging Market

The market for lubricant packaging deals with efficiently packaging various lubricants, including engine oils, transmission fluids, and greases. The primary function of lubricant packaging is to protect the lubricants from external factors like oxygen and moisture. Lubricants, being resistant substances, require efficient packaging to prevent contamination and degradation. With the increasing demand for lubricants, the need for rigid packaging is rising, contributing to the market expansion.

Rigid packaging is in high demand store or transport lubricants, protecting their high boiling point and high viscosity index, meeting the requirements of various end-users. Rigid plastic packaging helps prevent lubricants from rusting and minimizes the risk of leakage due to their lightweight containers. Additionally, both rigid and flexible packaging provides high resistance to the chemical formula of the lubricants.

Apart from this, packaging like drums and tubes are specifically used to store lubricants due to their robustness. Plastic bottles are lightweight and made from high-density polyethylene (HDPE), which ensures no leakage or breakage. Plastic bottles with leak-proof caps are in high demand. Jars made from polypropylene are used to package grease and are mostly preferred due to their tamper-proof and straight-sided wide-mouth opening.

Join now to access the latest packaging industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Lubricant Packaging Market Trends

- Sustainable Packaging: There is a rapid shift toward sustainable packaging solutions due to the rising concerns about the environmental impact of plastic packaging waste. Thus, manufacturers are focusing on developing lubricant packaging made from biodegradable and recyclable materials. For instance, in November 2023, SCGC collaborated with Shell Thailand Limited and launched '100% Recycled Plastic Packaging' for the premium engine oil brand 'Shell Helix Ultra', which is made from high-quality post-consumer recycled resin (PCR) under the brand SCGC GREEN POLYMER.

- Demand for Flexible Packaging: The demand for flexible lubricant packaging is increasing due to its lightweight nature and cost-effectiveness. Flexible packaging solutions such as pouches and stand-up bags are gaining immense popularity in the automotive industry due to their ease of use and convenience.

- Rising Automobile Production: With the increasing production of vehicles, the demand for automobile lubricants such as engine oil, transmission fluids, and greases is also increasing. This significantly impacts the market.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Regional Insights

Rising Lubricants Demand Contributed to Asia Pacific’s Dominance: What till 2034?

Asia Pacific dominated the lubricant packaging market with a significant share in 2023. This is mainly due to its expanding automotive sector, which increased the demand for automotive lubricants such as engine oil, gear oil, brake fluids, and greases. China held the maximum market share, as it is the world’s largest manufacturer of vehicles. The rising vehicle ownership in the region is expected to boost the demand for lubricants in the coming years, ultimately boosting the demand for lubricant packaging.

Rising industrialization in countries like India, China, and Japan increases the consumption of lubricants, which further boosts the need for efficient packaging. In addition, regional market players are focusing on developing innovative packaging solutions to meet the various end-use industries’ varying demands, thus fueling the regional market growth.

- For instance, in October 2022, Castrol, a leading lubricant player in India, introduced new, more sustainable packaging for its premium engine oil brand, Castrol POWER1 ULTIMATE. The oil is now being packed in a 100% post-consumer recycled (PCR) bottle, made from reprocessed plastic waste instead of virgin plastic.

Europe is a significant and mature market that drives the lubricant packaging industry by focusing on improving and adopting sustainable choices. Using recycled plastic packaging and post-consumer resin (PCR) for used lubricants is a region's proactive step toward promoting a circular economy. The demand for environmental packaging often drives the adoption of recyclable materials.

The European manufacturing industry relies on grease-based lubricants with high viscosity and are specifically designed for machinery and equipment requiring slow and precise movements. These lubricants are essential for ensuring smooth and efficient operation in various industrial applications across the continent.

North America is the fastest-growing region in the lubricant packaging market

North America is expected to experience rapid growth in the market during the forecast period. This is mainly due to its robust automotive industry. There is a high demand for oil-based lubricants in the region. The packaging industry in North America is investing heavily in research and development activities to develop high-quality lubricant packaging, thus contributing to regional market growth.

Lubricant Packaging Market Segmentation

- By product, the engine oil segment led the market in 2023. The segmental dominance is attributed to a rise in adoption and production of automobiles around the globe. Engine oils are crucial in vehicles as they ensure optimal performance and efficiency.

- By packaging type, the drums segment led the market in 2023. Drums are widely used to store and transport lubricants due to their large space. Their high robustness prevent damage during transport and storage. In addition, drums can be recycled. Thus, they are in high demand in various industries.

- By material, the plastic segment dominated the market with a significant share in 2023 due to its flexibility and versatility. The availability of various sizes and shapes makes it the most demanding material. Plastic containers such as stand-up pouches and bag-in-box are widely favored due to their lightweight and convenient nature compared to rigid plastic bottles. Additionally, these containers consume 60% less plastic, making them an environmentally friendly choice. Furthermore, the use of post-consumer resin (PCR) or recycled plastic is highly preferred as it reduces waste and promotes a circular economy, contributing to sustainable practices in the packaging industry.

- By end-use industry, the automotive segment led the lubricant packaging market in 2023. Automotive industry heavily uses oil-based lubricants. These lubricants play a vital role in reducing corrosion and regulating temperature during the motion of engines, thereby contributing to the overall efficiency and longevity of machinery. In addition, they effectively minimize heat friction, ensuring the smooth and uninterrupted operation of engines, which is essential for optimal performance and reduced wear and tear. With the increasing usage of lubricants in the automotive industry, the demand for lubricant packaging increases.

More Insights Towards Packaging:

- The global reclosable zipper market size is estimated to reach USD 4.53 billion by 2033, up from USD 2.85 billion in 2023, at a compound annual growth rate (CAGR) of 4.88% from 2024 to 2033.

- The global bubble wrap packaging market size is estimated to reach USD 4.78 billion by 2033, up from USD 3.42 billion in 2023, at a compound annual growth rate (CAGR) of 3.52% from 2024 to 2033.

- The global rigid sleeve boxes market size reached US$ 2.34 billion in 2024 and is projected to hit around US$ 3.26 billion by 2034, expanding at a CAGR of 3.54% during the forecast period from 2024 to 2034.

- The global industrial drums market size reached USD 15.94 billion in 2024 and is projected to hit around USD 32.89 billion by 2034, expanding at a CAGR of 7.35% during the forecast period from 2024 to 2034.

- The global multi depth corrugated box market size reached US$ 4.68 billion in 2023 and is projected to hit around US$ 8.65 billion by 2034, expanding at a CAGR of 5.23% during the forecast period from 2023 to 2034.

- The global non-corrugated boxes market size reached USD 67.22 billion in 2024 and is projected to hit around USD 137.79 billion by 2034, expanding at a CAGR of 7.5% during the forecast period from 2024 to 2034.

- The global inflatable bags packaging market size is estimated to reach USD 277.68 million by 2033, up from USD 175.14 million in 2023, at a compound annual growth rate (CAGR) of 4.86% from 2024 to 2033.

- The global airless packaging market size is estimated to reach USD 15.91 billion by 2033, up from USD 8.38 billion in 2023, at a compound annual growth rate (CAGR) of 6.79% from 2024 to 2033.

- The global heavy duty corrugated packaging market size reached US$ 23.11 billion in 2023 and is projected to hit around US$ 44.5 billion by 2034, expanding at a CAGR of 5.57% during the forecast period from 2024 to 2034.

- The global pre-made pouch packaging market size is estimated to reach USD 17.46 billion by 2033, up from USD 11.05 billion in 2023, at a compound annual growth rate (CAGR) of 4.82% from 2024 to 2033.

Competitive Landscape

- Key players operating in the lubricant packaging market are Mold Tek Packaging Ltd., Balmer Lawrie & Co. Ltd., Glenroy Inc., Time Technoplast Ltd., Grief Inc., CYL Corporation Berhad, Duplas Al Sharq LLC, Scholle IPN, Mauser Group B.V., and Martin Operating Partnership L.P. These companies These companies are leveraging their vast resources to drive innovation and expand their product portfolio.

Recent Developments in the Market

- In March 2024, Repsol launched its new lubricant containers, with 60% recycled post-consumer plastic.

- In February 2024, TotalEnergies and Bericap join forces to launch a new cap for lubricant cans made from recycled plastic.

- In December 2023, Oman Oil Marketing Company (OOMCO) introduced a new era in lubricant packaging by launching an innovative, eco-friendly design.

Segments Covered in the Report

By Product

- Engine Oil

- Transmission & Hydraulic Fluid

- Process Oil

- Metal Working Fluid

- General Industrial Fluid

- Gear Oil

- Greases

By Packaging Type

- Drums

- Stand up pouches

- Bottles

- Pails

- Cans

- Tubes

- Kegs

- Bag-in-box

- Intermediate Bulk Containers

By Material

- Metal

- Tin

- Steel

- Plastic

- Polyethylene

- HDPE

- LDPE

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polypropylene (PP)

- Polyamide (PA)

- Others

By End-use Industry

- Automotive

- Metal working

- Oil & Gas

- Power Generation

- Machine Industry

- Chemicals

- Other Manufacturing

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Review the Full TOC for the Lubricant Packaging Market Report: https://www.towardspackaging.com/table-of-content/lubricant-packaging-market-sizing

Invest in Premium Global Insights @ https://www.towardspackaging.com/price/5269

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/