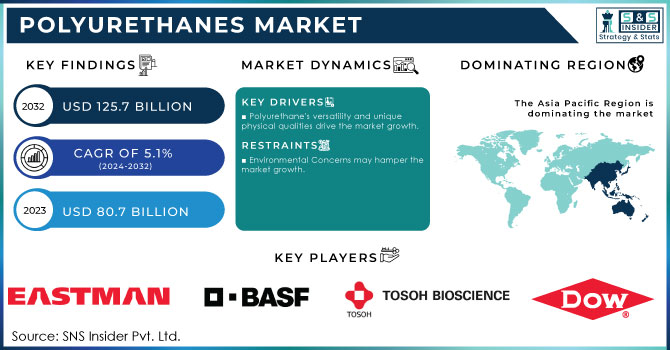

Austin, Dec. 05, 2024 (GLOBE NEWSWIRE) -- The Polyurethanes (PU) Market Size is projected to reach a valuation of USD 125.7 billion by 2032, growing at a compound annual growth rate (CAGR) of 5.1% from 2024 to 2032.

Book Your Sample PDF for Polyurethanes Market Report @ https://www.snsinsider.com/sample-request/1927

Polyurethanes Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 80.7 billion |

| Market Size by 2032 | USD 125.7 billion |

| CAGR | CAGR of 5.1% by 2024-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Growth Drivers |

|

Trends Shaping the Polyurethanes (PU) Market

A major driver in the PU market is the escalating focus on sustainability and the development of eco-friendly polyurethane formulations. Governments and international organizations are pushing industries to adopt greener materials to reduce carbon emissions and environmental impact. Innovations such as bio-based polyols and recyclable polyurethane solutions are gaining traction, aligning with global sustainability goals. Key regulatory frameworks like the European Union’s Green Deal and the U.S. Environmental Protection Agency's initiatives to promote greener materials are fostering adoption.

The building and construction sector is a significant contributor to PU demand, especially in insulation applications. Polyurethane foam is extensively used in insulation panels, roofing materials, and sealants due to its superior thermal performance and energy-saving properties. With stringent energy efficiency regulations globally, such as the U.S. Department of Energy's Energy Conservation Standards, polyurethane products are increasingly recognized for their role in achieving energy-efficient building solutions.

Additionally, the automotive industry's transition toward lightweight and fuel-efficient vehicles has spurred the adoption of PU materials. Polyurethane is widely used in vehicle interiors, seats, and structural components for its lightweight, durable, and flexible characteristics. The growing production of electric vehicles (EVs) and hybrid vehicles is further amplifying the demand for polyurethane materials in specialized applications.

Which Raw Material Type Segment Led the Market in 2023?

In 2023, Polyol held the largest market share around 42%. It is used in the formulation of virtually all kinds of PU products such as foams, coatings, adhesives, and sealants. Polyols (alongside isocyanates, an essential building block as well in the synthesis of polyurethanes), are very diverse and applicable extensively across automotive, construction, and furniture industries as well. This high demand is mainly related to the high demand for polyols where flexible and rigid foams cover a significant part of the market. Global flexible foams, which are commonly used for furniture cushions, mattresses, and automotive seating, and rigid foams, used for insulation, are also growing at a decent rate.

If you need any customization in the Report as per your Business Requirement OR Schedule Analyst Call @ https://www.snsinsider.com/request-analyst/1927

Which End-Use Industry Dominated the Polyurethanes (PU) Market in 2023?

The building and construction sector held the largest market share at around 27% in 2023. The increasing adoption of polyurethane foam for insulation, sealing, and structural applications has driven this dominance. Polyurethane’s superior thermal insulation properties contribute significantly to reducing heating and cooling energy consumption in buildings.

The shift towards sustainable construction practices has further fueled demand for PU materials. Modern construction projects emphasize energy efficiency, and PU products play a critical role in meeting these standards. Furthermore, innovations such as spray polyurethane foam (SPF), which provides seamless insulation and enhances structural integrity, are gaining widespread acceptance in the industry.

Regional Insights: Asia-Pacific Leads the Market

The Asia-Pacific region held the largest market share of approximately 56% in 2023, driven by rapid industrialization, urbanization, and robust growth in end-user industries such as construction, automotive, and furniture. Countries such as China, India, and Southeast Asian nations are witnessing significant investments in infrastructure development, boosting the demand for polyurethane materials.

China, the largest producer and consumer of polyurethane globally, dominates the regional market with its extensive manufacturing base and growing focus on green building practices. India is emerging as a key market due to government initiatives like Housing for All and Smart Cities Mission, which emphasize energy-efficient construction. Additionally, the automotive industry in Japan and South Korea, known for its advanced manufacturing practices, is adopting lightweight polyurethane components to meet stringent emission standards.

Recent Developments

- In 2023, Covestro AG launched a new range of bio-based polyurethane solutions under its Desmodur® brand, featuring increased reliance on renewable raw materials. This innovation supports industries in reducing their carbon footprint while maintaining high performance.

- In 2023, Huntsman Corporation expanded its polyurethane production capacity in Thailand to cater to the growing demand in Asia-Pacific. The facility is designed to produce specialty polyurethanes with enhanced energy efficiency properties for the construction and automotive sectors.

Conclusion

The Polyurethanes (PU) market's growth is underpinned by its versatility, eco-friendly advancements, and alignment with global sustainability trends. Industries are increasingly leveraging PU materials to enhance product performance, comply with environmental regulations, and achieve operational efficiency.

As key players continue to innovate with bio-based and recyclable solutions, the market is poised for robust growth, ensuring its vital role in building a more sustainable future. The increasing adoption of polyurethane in construction, automotive, and other industries highlights its importance as a transformative material in modern applications.

Buy this Exclusive Report Which Includes @ https://www.snsinsider.com/checkout/1927

BENEFITS:

1 No. Of Pages: 350 Pages Report

2 Regions/Countries:

- North America (3 Countries)

- Europe (~15 Countries)

- Asia Pacific (~10 Countries)

- Latin America (~5 Countries)

- Middle East & Africa (~5 Countries) (Including Israel)

3 ME Sheet: Market Estimation in Excel Format

4 Company Analysis:

- Major 16 companies covered in final report.

- Additional 5 companies will be covered as per client demand complimentary.

5 Statistical Insights and Trends Reporting:

- Vehicle Production and Sales Volumes, 2020-2032, by Region

- Emission Standards Compliance, by Region

- Vehicle Technology Adoption, by Region

- Consumer Preferences, by Region

6 Buying Options:

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

Read Full Report Description @ https://www.snsinsider.com/reports/polyurethanes-pu-market-1927

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.