New York, Dec. 09, 2024 (GLOBE NEWSWIRE) -- Overview

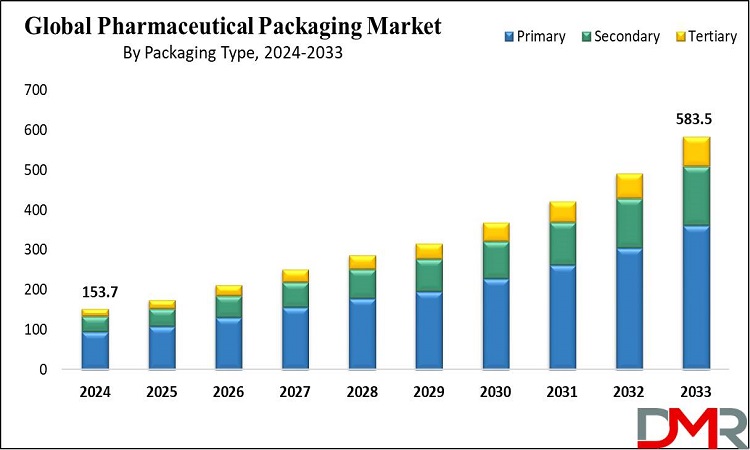

The Global Pharmaceutical Packaging Market is projected to reach USD 153.7 billion in 2024 which is further anticipated to reach USD 583.5 billion by 2033 at a CAGR of 16.0%.

The pharmaceutical packaging market is steadily growing worldwide due to the need for more progressive packaging approaching enhancing drug efficacy combined with sustainable packaging packaging.

The numerous classes of drugs especially biologics, like specialty drugs, and personalized medicine have led to the emergence of complex packaging forms such as vials, prefilled syringes, and blister packs. Indeed, more demands for eco-friendly packing such as recyclable and biodegradable materials are the trends that are defining the future of the industry.

Technological growth of smart packaging accompanied by temperature monitors and other features, indicating tampering and enabling better drug safety, adherence, and control at every stage of the supply chain.

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/pharmaceutical-packaging-market/request-sample/

The US Pharmaceutical Packaging Market

The US Pharmaceutical Packaging Market with an estimated value of USD 55.8 billion in 2024 is projected to increase at a CAGR of 15.0% until reaching USD 196.6 billion by 2033.

The US market has a large share of the global pharmaceutical packaging market due to the high production of pharmaceuticals and the stringent rules and regulations of the FDA. They include the use of smart packaging technologies such as tamper and temperature indicators and a higher inclination towards the usage of bio-degradable and recyclable packaging material.

The usage of prefilling of syringes, vials, and blister packs is completed largely with conformities passing through regulatory bodies in America and customers firmly emphasizing security related to dosage. The demand for biologics and vaccines has also increased the need for the development of new packaging technologies that have acted as drivers for the growth of the market.

Important Insights

- Global Market Value: This market is expected to be valued at USD 153.7 billion in 2024 and is projected to reach USD 583.5 billion by 2033.

- US Market Size: The U.S. pharmaceutical packaging market is estimated to grow from USD 55.8 billion in 2024 to USD 196.6 billion by 2033, at a CAGR of 15.0%.

- Packaging Type Segment: Primary packaging is set to dominate the packaging type segment, accounting for 61.9% of the market share in 2024.

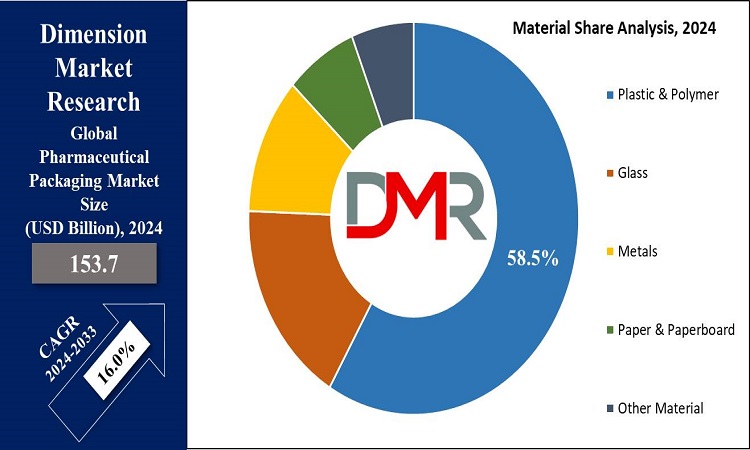

- Material Segment: Plastic and polymer materials are anticipated to lead the material segment, capturing 58.5% of the market share in 2024.

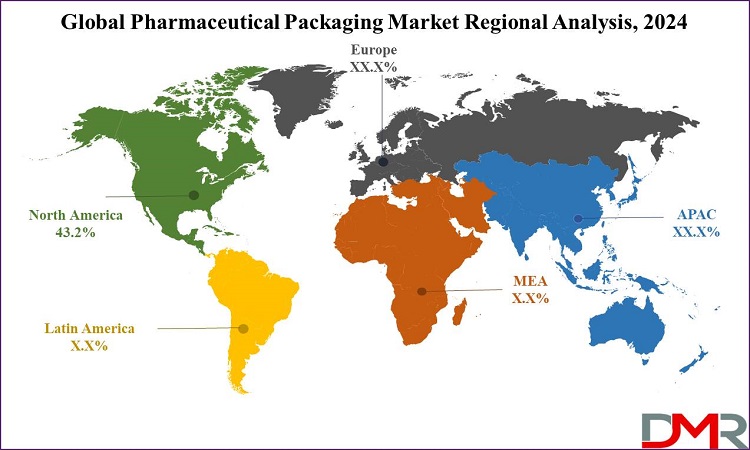

- Regional Analysis: North America is projected to hold the largest share of the global pharmaceutical packaging market, with 43.2% of the market share in 2024.

- Global Growth Rate: The global market is anticipated to grow at a CAGR of 16.0% during the forecast period.

Latest Trends

- A new trend among manufacturers is relocating to eco-friendly packaging. The recyclable, biodegradable, and reusable materials reduce environmental impact while guaranteeing safety.

- Technological advantages in packaging such as RFID and sensors used to increase the transparency of the supply chain as well as to check the drugs’ condition and patient compliance.

- The growth in the usage of Bio-Logics including vaccines and gene therapies puts pressure on the packaging requirements for drugs like pre-filled syringes and vials to support the drug stability and effectiveness.

- Personalized packaging is an important need for medicine packaging due to its small volume production and easy labeling, thus a flexible packaging method is necessary for the medication.

Pharmaceutical Packaging Market: Competitive Landscape

The pharmaceutical packaging industry is intensely competitive with several companies including West Pharmaceutical Services, Berry Global Inc., and Amcor Plc driving advances in the market. These firms target enhancing the development of future pharmaceutical packaging services including injectable and smart packaging to support the delivery of biologics and specialty drugs.

Berry Global focused on sustainable packaging, and West Pharmaceutical also focused on the delivery system, including vials and syringes for injectables. The market is also defined by the growing consolidation of players through mergers, acquisitions, and collaborations to build a wider portfolio of BIODE and smart packaging solutions to increase their market share.

Some of the prominent market players:

- Amcor plc

- Gerresheimer AG

- Schott AG

- West Pharmaceutical Services, Inc.

- Berry Global Group, Inc.

- AptarGroup, Inc.

- SGD Pharma

- Catalent, Inc.

- WestRock Company

- CCL Industries Inc.

- Nipro Corporation

- Bemis Healthcare Packaging

- Other Key Players

Transform your business approach with strategic insights from our report. Get in touch to request our brochure today! : https://dimensionmarketresearch.com/report/pharmaceutical-packaging-market/download-reports-excerpt/

Pharmaceutical Packaging Market Scope

| Report Highlights | Details |

| Market Size (2024) | USD 153.4 Bn |

| Forecast Value (2033) | USD 583.5 Bn |

| CAGR (2024-2033) | 16.0% |

| The US Market Size (2024) | USD 55.8 Bn |

| Historical Data | 2018 - 2023 |

| Forecast Data | 2024 - 2033 |

| Base Year | 2023 |

| Estimate Year | 2024 |

| Segments Covered | By Packaging Type, By Material, By Drug Delivery Mode, By Sustainability, and By End-user |

| Regional Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Analysis

Primary packaging is projected to dominate the pharmaceutical packaging market with 61.9% of market share in 2024. Primary packaging is mostly preferred in the pharmaceutical packaging market because it offers immediate protection to the pharmaceutical products and hence acts as a guarantee of the efficacy of the drugs and patient compliance.

It incorporates critical packaging products such as blister packs, bottles, vials, and prefilled syringes, which protect products from contamination moisture, and physical damage. Today’s regulations from the FDA and EMA, particularly on labeling, accountability, and anti-tampering, mean packaging must be rigid. The growth of biologics and injectables that require accurate and safe containment adds to the prevalence of primary packaging in this market.

Pharmaceutical Packaging Market Segmentation

By Packaging Type

- Primary

- Plastic Bottles

- Caps & Closures

- Parenteral Containers

- Syringes

- Vials & Ampoules

- Others

- Pre-Fillable Inhalers

- Pre-Fillable Syringes

- Vials & Ampoules

- Blister Packs

- Bags & Pouches

- Jars & Canisters

- Others

- Secondary

- Prescription Containers

- Pharmaceutical Packaging Accessories

- Tertiary

By Material

- Plastic & Polymer

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Homo-Polypropylene

- Random-Polypropylene

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- High-Density Polyethylene (HDPE)

- Low-density polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polystyrene (PS)

- Others

- Glass

- Type I (Borosilicate Glass)

- Type II (Treated Soda-Lime Glass)

- Type III (Regular Soda-Lime Glass)

- Metals

- Aluminum

- Stainless Steel

- Tin

- Other Metal Alloys

- Paper & Paperboard

- Other Material

By Drug Delivery Mode

- Oral Drug Delivery Packaging

- Injectable Packaging

- Topical Drug Delivery Packaging

- Pulmonary Drug Delivery Packaging

- Transdermal Drug Delivery Packaging

- Ocular Drug Delivery Packaging

- Nasal Drug Delivery Packaging

- Other Drug Delivery Mode

By Sustainability

- Recyclable Packaging

- Biodegradable Packaging

- Compostable Packaging

By End-user

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Contract Manufacturing Organizations (CMOs)

- Contract Packaging Organizations (CPOs)

Purchase the Competition Analysis Dashboard Today: https://dimensionmarketresearch.com/checkout/pharmaceutical-packaging-market/

Growth Drivers

- The current advancement of the global pharmaceutical industries due to the aging population and chronic diseases leads the packaging process due to the innovation of good drug transportation containers.

- The demand from regulatory authorities such as the FDA for safety in packaging, packing that shows tamper evidence, child resistance, and overall compliance creates value in the drug packaging market.

- They also claim that the increasing use of biologics and specialty drugs requires a specialized container that protects drugs from environmental conditions thereby increasing the usage of vials, ampoules, and prefilled syringes.

- Technological advancements in smart packaging, and temperature control solutions raise drug safety, and compliance, and minimize administration errors for market growth.

Restraints

- High costs associated with state of art packaging materials, especially for biologics and smart packaging are some of the issues that can hinder small-scale manufacturers from widely adopting innovative packaging.

- Stringent regulatory compliance across different regions can complicate market entry, increasing production costs and slowing down packaging manufacturers' ability to meet global standards.

- Price volatility of essential raw materials, such as plastics, polymers, and glass, affects profitability, creating challenges for pharmaceutical packaging manufacturers' supply chains and cost management.

- Balancing sustainability with drug safety is difficult, as finding materials that are both eco-friendly and maintain drug integrity under strict conditions limits broader adoption.

Growth Opportunities

- Emerging markets in regions like Asia-Pacific and Latin America offer significant growth opportunities with expanding healthcare infrastructure and increasing demand for pharmaceutical packaging.

- Sustainable packaging is a major growth area as manufacturers develop eco-friendly materials that meet both regulatory and consumer demand for reduced environmental impact.

- Outsourcing packaging operations to contract packaging services provides opportunities for specialized packaging companies offering assembly, labeling, and sterilization solutions to pharmaceutical firms.

- Innovations in drug delivery systems, such as microneedle patches and transdermal devices, open opportunities for unique packaging designs that ensure stability and ease of use.

Regional Analysis

North America will lead the global pharmaceutical packaging market with 43.2% of the market share in 2024. North America is the largest market for pharmaceutical packaging mostly influenced by the developed pharma industry, especially in the U.S. The region has original equipment manufacturers, namely, Pfizer and Johnson & Johnson, for pharmaceuticals, boosting the need for new packaging concepts.

Tough regulatory standards from the FDA drive the use of tamper-proof and baby.resize(package) resistant closures. North America is also not trailing behind when it comes to Sustainable Packaging as companies use friendly materials and technologies.

Furthermore, the growth of chronic diseases such as diabetes, and the increase in population over the age of 65 also create more demand for sophisticated drug packaging solutions.

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/pharmaceutical-packaging-market/request-sample/

By Region

North America

- The U.S.

- Canada

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Discover additional reports tailored to your industry needs.

- Biodegradable Packaging Market is forecasted to reach USD 533.5 billion by the end of 2024 and grow to USD 927.3 billion in 2033, with a CAGR of 6.3%.

- Paperboard Packaging Market is projected to reach USD 193.5 billion in 2024 and grow at a compound annual growth rate of 4.2% from there until 2033 to reach a value of USD 279.2 billion.

- Airless Packaging Market size is estimated to reach USD 5.4 Billion in 2024 and is further anticipated to value USD 8.6 Billion by 2033, at a CAGR of 5.3%.

- Bamboo Cosmetic Packaging Market size is estimated to reach USD 458.8 Million in 2024 and is further anticipated to value USD 923.4 Million by 2033, at a CAGR of 8.2%.

- Packaging Automation Market size is expected to reach a value of USD 76.7 billion in 2024, and it is further anticipated to reach a market value of USD 145.8 billion by 2033 at a CAGR of 7.4%.

- Industrial Bulk Packaging Market size is expected to reach a value of USD 25.2 billion in 2024, and it is further anticipated to reach a market value of USD 35.7 billion by 2033 at a CAGR of 3.9%.

- Paper Packaging Material Market size is expected to reach a value of USD 419.9 billion in 2024, and it is further anticipated to reach a market value of USD 656.5 billion by 2033 at a CAGR of 5.1%.

- Cold Form Blister Packaging Market size was valued USD 4,367.7 million in 2023 and it is further anticipated to reach a market value of USD 9,089.2 million in 2033 at a CAGR of 7.6%.

- Automotive Parts Packaging Market was valued at USD 9.9 billion in 2023, and it is further anticipated to reach a market value of USD 14.9 billion by 2033 at a CAGR of 4.7%.

- medical packaging film market will be valued at USD 8.5 billion in 2024 and will continue to grow to USD 14.7 billion by 2033 at the rate of 6.2% CAGR.

Recent Developments in the Pharmaceutical Packaging Market

- September 2024: West Pharmaceutical Services launched smart connected packaging solutions to enhance drug monitoring and patient compliance.

- July 2024: Amcor Plc introduced a fully recyclable flexible packaging line specifically designed for oral pharmaceutical drug delivery.

- June 2024: Gerresheimer AG expanded its European production capacity for glass vials to meet the growing demand for injectables.

- May 2024: Berry Global Inc. acquired a sustainable packaging technology firm to enhance its eco-friendly packaging offerings for pharmaceuticals.

- April 2024: West Pharmaceutical partnered with a biotech firm to develop advanced packaging solutions for injectable biologics.

- March 2024: Amcor Plc opened a new manufacturing plant in the Asia-Pacific region, focusing on pharmaceutical packaging solutions.

- February 2024: Gerresheimer AG introduced bio-based polymer syringes to promote sustainability in pharmaceutical packaging.

- December 2023: Berry Global Inc. launched child-resistant closures for oral drugs, improving safety and compliance in pharmaceutical packaging.

About Dimension Market Research (DMR):

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world.

We also believe that our clients don’t always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.