Austin, Dec. 14, 2024 (GLOBE NEWSWIRE) -- Market Size & Growth Insights:

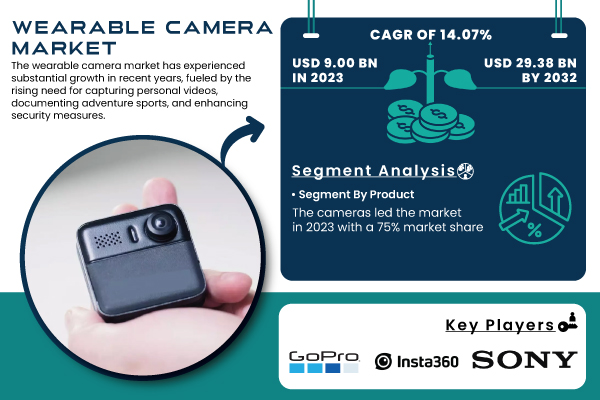

According to the SNS Insider, “The Wearable Camera Market Size was valued at USD 9.00 Billion in 2023 and is expected to reach USD 29.38 Billion by 2032 and grow at a CAGR of 14.07% over the forecast period 2024-2032.”

Growing Demand for Wearable Cameras Driven by Social Media and Adventure Sports

The wearable camera market has witnessed significant growth due to the increasing demand for capturing personal videos, documenting adventure sports, and enhancing security. The surge in social media usage, with 82% of the U.S. population actively participating, particularly on platforms like Facebook, Instagram, TikTok, and LinkedIn, has fueled this trend. Millennials and Gen Z, who prioritize authenticity in their online presence, are driving the demand for high-definition, hands-free cameras. Additionally, adventure sports enthusiasts use wearable cameras to document extreme activities like skiing and surfing. With products like the GoPro HERO 10 capturing 4K footage, these cameras offer unique perspectives that not only enrich user experiences but also serve as valuable promotional tools for brands in the adventure sports industry.

Get a Sample Report of Wearable Camera Market Forecast @ https://www.snsinsider.com/sample-request/4584

Leading Market Players with their Product Listed in this Report are:

- GoPro (Hero10 Black, Hero9 Black)

- Insta360 (Insta360 ONE X2, Insta360 GO 2)

- Sony (Sony FDR-X3000, Sony HDR-AS50)

- Garmin (Garmin VIRB Ultra 30, Garmin VIRB 360)

- DJI (DJI Osmo Action, DJI Pocket 2)

- Samsung (Samsung Gear 360, Samsung Galaxy Camera 2)

- Ricoh (Ricoh Theta Z1, Ricoh Theta SC2)

- Vuzix (Vuzix Blade, Vuzix M400)

- Snap (Snap Spectacles 3, Snap Spectacles 2)

- Kodak (Kodak PIXPRO SP360, Kodak Action Cam)

- Wearable Cameras (Wearable Cam, Wearable Pro)

- Shenzhen Witson Technology (Witson 4K, Witson 1080P)

- YI Technology (YI 4K+, YI Lite)

- Viewermore (Viewermore 1080P, Viewermore Mini)

- Zeblaze (Zeblaze Thor 4, Zeblaze Vibe 3)

- Sena Technologies (Sena Prism Tube, Sena 10C Pro)

- Bury (Bury S900, Bury 8200)

- AEE Technology (AEE S71, AEE MagiCam)

- Pulsar (Pulsar Helion 2, Pulsar Trail 2)

- Chobi Cam (Chobi Cam One, Chobi Cam Pro).

Wearable Camera Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 9.00 Billion |

| Market Size by 2032 | USD 29.38 Billion |

| CAGR | CAGR of 14.07% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Head Mount, Body Mount, Ear Mount & Smart Glass) • By Product (Cameras, Accessories) • By End-User (Sports & Adventure, Security, Healthcare, Industrial, Others) |

| Key Drivers | • The wearable camera market thrives amidst the rising trend of content creation and social media engagement. |

Do you Have any Specific Queries or Need any Customize Research on Wearable Camera Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/4584

Wearable Camera Market: Dominance of Head Mounts and Growth in Accessories and Body Mounts

By Type

In 2023, the head mount segment dominated the wearable camera market, holding a 68% share due to its versatility and ease of use. Head-mounted cameras, like the GoPro HERO series, offer hands-free recording, making them ideal for extreme sports, outdoor activities, and cinematography, providing a first-person perspective for enhanced user engagement.

The body mount segment is projected to experience rapid growth from 2023 to 2032, driven by the increasing adoption of wearable technology in law enforcement, healthcare, and sports. Body cameras, used for accountability and transparency, are gaining traction, with companies like Axon leading the way in law enforcement applications.

By Product

In 2023, cameras dominated the wearable camera market with a 75% share, driven by the demand for high-quality, compact, and lightweight devices suitable for a range of activities. These cameras are widely used in sports, adventure pursuits, and professional environments, allowing users to capture footage hands-free. Technological advancements like HD recording, image stabilization, and Wi-Fi/Bluetooth connectivity have enhanced their appeal, with GoPro being a leading brand, offering durable, water-resistant cameras for extreme sports enthusiasts.

The accessories sector is experiencing rapid growth from 2024 to 2032, fueled by the rising demand for enhanced features and customization, with companies like Insta360 and Sena offering innovative mounts, cases, and battery solutions.

Regional Market Dynamics: North America's Dominance and Asia-Pacific's Rapid Growth in Wearable Cameras

North America led the wearable camera market in 2023, holding a 44% market share, driven by technological advancements and a strong consumer base with a high affinity for innovation. The region benefits from high disposable income, a growing interest in smart devices, and increased adoption of wearable technology across industries such as healthcare, sports, and entertainment. Prominent companies like GoPro and Fitbit have catered to adventure seekers and fitness enthusiasts with products like the GoPro HERO series, known for its high-quality action video recording.

Asia-Pacific is expected to become the fastest-growing wearable camera market between 2024 and 2032, fueled by rapid urbanization, rising disposable incomes, and a tech-savvy population. Companies like Xiaomi and Sony are capitalizing on this demand with affordable, feature-rich wearable cameras, including Xiaomi's Mi Band series with camera functionality.

Purchase Single User PDF of Wearable Camera Market Report (33% Discount) @ https://www.snsinsider.com/checkout/4584

Recent Development

- August 20, 2024 – GoPro has announced plans to reduce its workforce by 15% by the end of 2024, affecting around 139 positions. The company is implementing these layoffs as part of a broader strategy to reduce operating expenses.

- June 13, 2024 – Insta360 unveiled the GO 3S, an upgraded wearable camera that captures Dolby Vision-ready 4K video at 30fps and offers smoother slow-motion footage. The compact device features enhanced processing power, compatibility with Apple's Find My network, and native waterproofing up to 33 feet.

- September 23, 2024 – Sony launched the Bravia Theatre U neckband-style wearable speakers in India, priced at Rs 24,990. These speakers offer Dolby Atmos surround sound and 360 Spatial Sound for an immersive personal listening experience when paired with compatible Sony Bravia TVs.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Wearable Camera Adoption Rate by Industry, 2023

5.2 Wearable Camera Product Lifecycle Metrics, 2023

5.3 Wearable Camera Sales Channels Performance

5.4 Usage Statistics, 2023

6. Competitive Landscape

7. Wearable Camera Market Segmentation, by Type

8. Wearable Camera Market Segmentation, by Product

9. Wearable Camera Market Segmentation, by End-User

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access More Research Insights of Wearable Camera Market Growth & Outlook Report 2024-2032@ https://www.snsinsider.com/reports/wearable-camera-market-4584

[For more information or need any customization research mail us at info@snsinsider.com]

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.