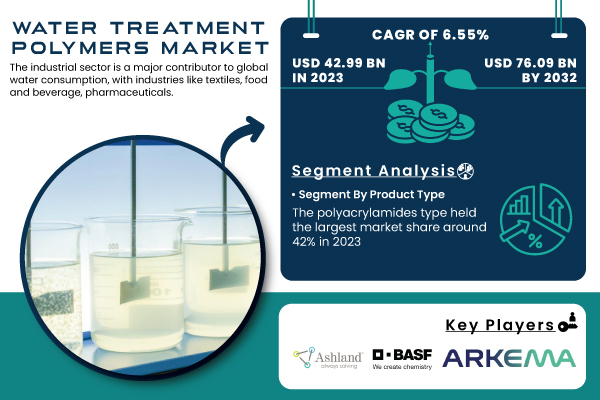

Austin, Dec. 14, 2024 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that, “The Water Treatment Polymers Market is projected to achieve a valuation of USD 76.09 billion by 2032, growing at a compound annual growth rate (CAGR) of 6.55% from 2024 to 2032.”

This growth is underpinned by the rising adoption of water treatment polymers across municipal and industrial sectors, aimed at addressing challenges such as water scarcity and stringent environmental regulations.

Key Trends Fueling the Water Treatment Polymers Market

Escalating Water Scarcity and Recycling Initiatives

With global freshwater resources under increasing strain, the demand for water recycling and reuse technologies has surged. Advanced polymer-based solutions, such as flocculants and coagulants, are being widely adopted to treat and recycle wastewater efficiently. These polymers enhance particle aggregation, sedimentation, and filtration processes, facilitating the safe reuse of treated water for industrial and municipal applications.

Governments worldwide, including initiatives like the U.S. EPA’s Water Reuse Action Plan, are promoting water recycling, creating substantial demand for high-performance water treatment polymers.

Stringent Environmental Regulations on Discharge Limits

Environmental agencies such as the European Environment Agency (EEA) and the U.S. Environmental Protection Agency (EPA) are imposing strict limits on wastewater discharge. These regulations are driving the adoption of eco-friendly and biodegradable water treatment polymers that minimize environmental impact while maintaining treatment efficiency.

For instance, wastewater discharge from heavy industries, including textiles, oil and gas, and pharmaceuticals, often contains hazardous pollutants. Polymers are crucial in ensuring compliance with these regulations, reducing penalties, and supporting sustainability goals.

Rapid industrial expansion in regions like Asia-Pacific and Latin America has significantly increased the demand for effective water treatment solutions. Water treatment polymers are indispensable in industrial wastewater management, offering cost-effective and efficient treatment processes. Industries such as power generation, food and beverage, and mining are key contributors to market growth, relying heavily on polymer solutions to maintain operational efficiency and adhere to environmental standards.

Download PDF Sample of Water Treatment Polymers Market @ https://www.snsinsider.com/sample-request/1924

Key Players:

- Ashland (Aqualon Water-Soluble Polymers, VersaFlex Polymeric Coatings)

- Arkema (Rilsan PA11, Pebax Polymers)

- BASF SE (Polymers for Water Treatment, Sokalan Polymers)

- CP Kelco US Inc. (Kelzan XCD, Keltrol XR)

- DuPont (Corian Water Treatment Solutions, Hytrel Thermoplastic Elastomers)

- Gantrade Corporation (Galoryl Polymers, Luvitec)

- SNF Group (Superfloc Polymers, Zetag)

- Kemira (Kemira Water Treatment Polymers, Kemira Flocculants)

- Kuraray Co. Ltd (Kuraray Polymers, Clearol Polyacrylamide)

- Merck KGaA (Millipore Water Purification, Millipore Filters)

- Mitsubishi Chemical Corporation (Mitsubishi Polymer Flocculants, Sumikagel)

- Nouryon (Dissolvine Chelating Agents, Peridur Flocculants)

- Polysciences Inc. (Polyacrylamide-based Polymers, Flocculant and Coagulant Polymers)

- Sumitomo Seika Chemicals Company (Seprod Series, Seakem Flocculants)

- Suez Water Technologies (Polymers for Water Treatment, Thermax Ion Exchange Resins)

- Solvay (Aflammit Polymers, Aquafloc Water Treatment Products)

- Lanxess (Baypure Polymers, Lewatit Ion Exchange Resins)

- Solenis (Baker Hughes Polymers, Trident Flocculants)

- Clariant (Hostafloc Polymers, Flocculants for Water Treatment)

- Dow Chemical Company (Nalco Water Solutions, Acumer Specialty Polymers)

Water Treatment Polymers Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 42.99 Billion |

| Market Size by 2032 | USD 76.09 Billion |

| CAGR | CAGR of 6.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Application (Fresh-Water Treatment, Waste-Water Treatment) • By End-use (Residential Buildings, Commercial Buildings, Municipality, Industrial) • By Product Type (Organic Water Treatment Polymers, Inorganic Water Treatment Polymers) |

| Key Drivers | • Growing demand over oil and gas industry in the water treatment polymer market. |

If You Need Any Customization on Water Treatment Polymers Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/1924

Which Product Type Segment Led the Market in 2023?

In 2023, the polyacrylamides segment held the largest market share, accounting for approximately 38.14%. These polymers are extensively utilized as flocculants and coagulants in water treatment processes, owing to their exceptional efficiency in particle aggregation and sludge dewatering.

The growing adoption of polyacrylamides in industries such as oil and gas, chemical processing, and municipal water treatment has been pivotal. Additionally, advancements in eco-friendly polyacrylamide formulations have further boosted their demand, aligning with the global focus on sustainable water treatment solutions.

Which Application Segment Held the Highest Market Share in 2023?

In 2023, sludge treatment held the largest market share around 38% of the water treatment polymer market. This is specifically aimed at byproducts of the wastewater treatment process namely the solids that get separated from the water. As urbanization and industrialization have increased, the volume and type of wastewater, which consequently produces a huge quantity of sludge, has increased dramatically and thus the world needs efficient and cost-effective sludge treatment technologies. These are namely thickener, dewatered, stabilizer, slurry, and sludge disposal respectively for sustainable waste management to meet required environmental standards to minimize waste degradation of environmental safety.

Regional Insights

In 2023, the North America region held the largest market share, accounting for approximately 48% of the global water treatment polymers market. This is due to comparatively longer operational decades of the industrial and municipal water treatment infrastructure in the region coupled with increasingly stringent environmental regulations. Government authorities such as the U.S. Environment Protection Agency (EPA) and Environment Canada impose stringent standards regarding wastewater discharge and pollutants control, forcing industries and municipalities to implement advanced water treatment technologies. The substantial emphasis on sustainability and water reuse in the region has also propelled the need for high-performance, as well as sustainable polymers. Moreover, North America has a strong industrial base, including oil and gas, power generation, manufacturing, etc., which creates significant amounts of wastewater that must be treated. The market growth has also been positively influenced by research and development investments, along with innovations in polymer technologies by essential companies. The growing adoption of tertiary treatment processes and zero-liquid discharge (ZLD) systems across the region is expected to amplify the importance of water treatment polymers in combating water scarcity and environmental issues.

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/1924

Recent Developments in the Market

- In 2023, Kemira Oyj introduced a new line of sustainable water treatment polymers designed for industrial and municipal applications. These polymers boast improved biodegradability and reduced sludge production, addressing critical sustainability challenges.

- In 2023, SNF Group, a leading manufacturer of polyacrylamides, announced the establishment of a new production facility in Brazil. This expansion aims to cater to the growing demand for water treatment polymers across South America.

- In 2023, Solvay SA partnered with a municipal water authority in Europe to pilot-test innovative polymer solutions that enhance phosphate removal in wastewater treatment processes.

Conclusion

The Water Treatment Polymers Market is poised for significant growth, fueled by advancements in polymer technology and the increasing focus on water conservation and sustainability. Polyacrylamides and other high-performance polymers are playing a pivotal role in transforming wastewater management, ensuring compliance with stringent regulations and supporting global sustainability goals.

As industries and municipalities strive to address water scarcity and pollution, the demand for efficient, cost-effective, and eco-friendly water treatment polymers will continue to rise. This market’s alignment with pressing environmental concerns and its role in enabling sustainable water management position it as a critical enabler of global water security.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Water Treatment Polymers Market Segmentation, by Product Type

7.1 Chapter Overview

7.2 Polyacrylates

7.3 Quaternary Ammonium Polymers

7.4 Polyacrylamides

7.4 Polyamines

8. Water Treatment Polymers Market Segmentation, by Application

8.1 Chapter Overview

8.2 Water Treatment

8.3 Preliminary Treatment

8.4 Sludge Treatment

9. Water Treatment Polymers Market Segmentation, by End-User

9.1 Chapter Overview

9.2 Industrial

9.3 Commercial Buildings

9.4 Residential Buildings

9.5 Municipality

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Buy Full Research Report on Water Treatment Polymers Market 2024-2032 @ https://www.snsinsider.com/checkout/1924

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.