New York, USA, Dec. 16, 2024 (GLOBE NEWSWIRE) -- Latest Published 5 Rare Eye Diseases Market Reports by DelveInsight: Retinitis Pigmentosa, Stargardt Disease, Ocular Melanoma, Uveitis, and Neurotrophic Keratitis

Rare eye diseases are more than just medical mysteries—they’re life-altering conditions that affect vision, independence, and quality of life for millions worldwide. From inherited retinal dystrophies to conditions like aniridia and optic neuropathies, these rare disorders often go unnoticed and underdiagnosed, yet they hold the key to understanding the intricacies of human vision. Advances in gene therapies, innovative treatments, and cutting-edge research offer hope for those living in the shadows of these challenges.

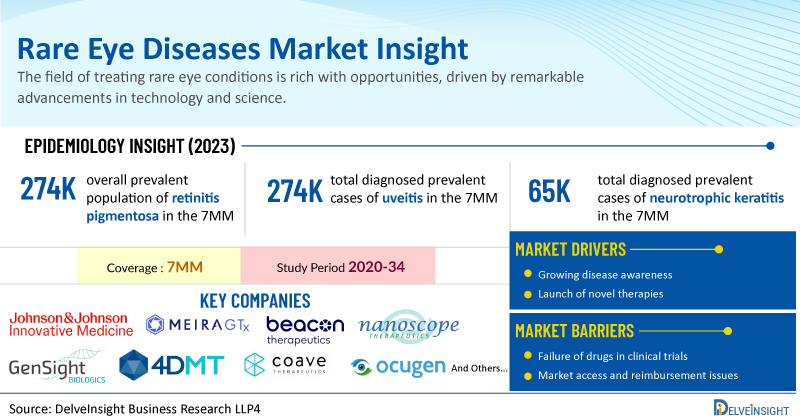

The field of treating rare eye conditions is rich with opportunities, driven by remarkable advancements in technology and science. Breakthroughs in areas like gene editing, stem cell research, and personalized medicine are revolutionizing the diagnosis and management of these conditions, offering new hope to patients who previously had limited options. The integration of artificial intelligence into healthcare is enabling earlier, more accurate diagnoses and highly customized treatment plans.

Progress is further accelerated by collaborations among medical professionals, researchers, and pharmaceutical companies, deepening our understanding and fostering the development of innovative therapies. With the growing emphasis on precision medicine and state-of-the-art technologies, the landscape for addressing rare eye diseases is evolving swiftly, paving the way for transformative treatments and enhanced patient outcomes.

DelveInsight has expertise in the rare disease market with an experienced team handling the rare disease domain proficiently. DelveInsight has recently released a series of epidemiology-based market reports on rare eye diseases including Retinitis Pigmentosa, Stargardt Disease, Ocular Melanoma, Uveitis, and Neurotrophic Keratitis. These reports include a comprehensive understanding of current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted market size from 2020 to 2034 segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Additionally, the reports feature an examination of prominent companies working with their lead candidates in different stages of clinical development. Let’s deep dive into the assessment of these rare eye disease markets individually.

Retinoblastoma is a rare childhood cancer that primarily affects children under the age of 5. Annually, it is diagnosed in approximately 200 to 300 children, occurring equally in boys and girls. Studies indicate that nonsyndromic retinitis pigmentosa constitutes approximately 65% of all retinitis pigmentosa cases. Among these, autosomal recessive inheritance accounts for around 10–15%, autosomal dominant for 20–25%, and X-linked retinitis pigmentosa (XLRP) is the least common form, characterized by early onset and severe vision loss. DelveInsight’s analysis reveals that the overall prevalent population of retinitis pigmentosa in the 7MM was reported as 274K in 2023.

The emergence of next-generation sequencing (NGS) represents a major breakthrough in understanding the genetic foundation of retinitis pigmentosa. NGS-powered diagnostic advancements enable the identification of previously undetectable genetic variants associated with the disease.

Currently, patients rely on off-label treatments that do not target the underlying cause of retinitis pigmentosa. For those without the RPE65 mutation, care is limited to supportive measures such as vitamin supplementation, protection from sunlight, and the use of visual aids.

At present, LUXTURNA is the only approved treatment for retinitis pigmentosa, specifically designed for a small subset of patients with the RPE65 mutation. Optogenetics offers a cutting-edge gene therapy that addresses the shortcomings of conventional treatments. This approach is gene-independent and demonstrates effectiveness even in advanced stages of the disease, where significant photoreceptor loss has occurred.

According to DelveInsight’s analysis, the market size for retinitis pigmentosa is expected to grow USD 500 million in 2023 with a significant ~17% CAGR by 2034. This growth is primarily driven by advancements in gene therapy and innovative treatment approaches, which hold significant potential for slowing the progression of this degenerative eye disease. Furthermore, rising research investments, increased awareness, and collaborative initiatives among pharmaceutical companies are propelling the market forward, creating a more hopeful outlook for patients and paving the way for potential therapeutic breakthroughs.

Retinitis Pigmentosa Pipeline Therapies and Key Companies

- Botaretigene sparoparvovec: Johnson & Johnson Innovative Medicine/MeiraGTx

- AGTC-501: Beacon Therapeutics

- MCO-010: Nanoscope Therapeutics

- GS030: Gensight Biologics

- 4D 125: 4D Molecular Therapeutics

- CTx PDE6B: Coave Therapeutics

- OCU 400: Ocugen

- BS01: Bionic Sight

- jCell: jCyte

- EA-2353: Endogena Therapeutics

- Ultevursen: ProQR Therapeutics

- ADX 2191: Aldeyra Therapeutics

Discover more about retinitis pigmentosa drugs in development @ Retinitis Pigmentosa Clinical Trials

Stargardt disease, also referred to as Stargardt’s macular dystrophy or juvenile macular degeneration, is a rare genetic eye condition caused by the accumulation of fatty deposits on the macula, a small area of the retina essential for clear, central vision. It is the most common type of recessively inherited macular dystrophy in children, affecting an estimated 10 to 12.5 individuals per 100,000 in the United States. In 2023, the United States accounted for the highest number of Stargardt disease cases, which is 43% of the diagnosed-prevalent cases of Stargardt disease in the 7MM, as per DelveInsight.

Current treatment options for Stargardt disease include strategies such as photoprotection and low-vision aids to help slow the progression of the condition. Other approaches, including medications to reduce the activity of the visual cycle, gene therapy, and various experimental treatments, aim to prevent lipofuscin accumulation, offering hope for long-term vision improvement.

Unbound all-trans-retinal can damage the light-sensitive ABCA4 protein, further impairing its function. Since individuals with Stargardt disease already have compromised ABCA4 activity and elevated levels of trapped all-trans-retinal in their photoreceptors, they are particularly vulnerable to the harmful effects of light exposure.

Vitamin A supplementation has been explored as a treatment for certain retinal degenerative conditions like Retinitis Pigmentosa. However, recent findings suggest that in ABCA4-related diseases, vitamin A supplementation accelerates the accumulation of lipofuscin pigments in the retinal pigment epithelium (RPE).

The dynamics of the Stargardt disease market are expected to change in the coming years. According to DelveInsight’s analysis, the market size for Stargardt disease is expected to surge from ~USD 28 million in 2023 across the 7MM with a massive CAGR of 32% by 2034. The expected launch of potential therapies may increase the Stargardt disease market size in the coming years, assisted by an increase in the diagnosed prevalent population.

As many potential therapies are being investigated for the treatment of Stargardt disease, it is safe to predict that the treatment space will significantly impact the Stargardt disease market during the forecast period. Moreover, the anticipated introduction of emerging therapies with improved efficacy and a further improvement in the diagnosis rate are expected to drive the growth of the Stargardt disease market in the 7MM.

Stargardt Disease Pipeline Therapies and Companies

- Emixustat: Kubota Pharmaceuticals

- MCO-010: Nanoscope Therapeutics

- ALK-001 (Gildeuretinol): Alkeus Pharmaceuticals

- Tinlarebant (LSB-008): Belite Bio

- IZERVAY (avacincaptad pegol): Astellas Pharma

Dive deeper for rich insights into the Stargardt Disease Clinical Trials

Ocular melanoma is a rare type of cancer that develops in the eye. Despite its rarity, it is the most common primary eye cancer in adults. “Primary” indicates that the cancer originates in the eye rather than spreading from another part of the body. In 2023, the United States accounted for 49% of all newly diagnosed ocular melanoma cases across the 7MM. Among these cases in the U.S., uveal melanoma was most frequently diagnosed in the choroid, followed by the ciliary body and iris.

The treatment approach for ocular melanoma is tailored to each patient, utilizing radiation and surgery based on factors like tumor size, location, overall health, and personal preferences. Metastatic uveal melanoma presents a major challenge due to the scarcity of approved therapies, with existing treatments like chemotherapy and immunotherapy demonstrating limited effectiveness. However, recent FDA approvals of KIMMTRAK and HEPZATO KIT provide new treatment options for patients with metastatic uveal melanoma.

The dynamics of the ocular melanoma market are expected to change in the coming years. In 2023, the total ocular melanoma market size was around USD 340 million, which is expected to increase by 2034 during the study period (2020–2034) in the 7MM. As per the estimates, by 2034, KIMMTRAK (tebentafusp) is expected to garner the highest ocular melanoma market share in the 7MM.

The development of treatments like darovasertib combined with crizotinib and belzupacap sarotalocan is anticipated to enhance the treatment landscape for ocular melanoma. In recent years, there has been an increase in ocular melanoma diagnoses, reflecting greater awareness and advancements in diagnostic techniques for this rare eye cancer. Furthermore, ongoing research and clinical trials in ocular melanoma are advancing our understanding of the disease, potentially leading to further advancements in both diagnostic and treatment approaches.

Ocular Melanoma Pipeline Therapies and Companies

- Darovasertib (IDE196): IDEAYA Biosciences

- Belzupacap Sarotalocan (AU-011): Aura Biosciences

For a deeper understanding of the ocular melanoma market landscape, explore the Ocular Melanoma Market Outlook

Uveitis is a major cause of vision-related morbidity, with more than a third of those affected experiencing visual impairment, contributing to about 10–15% of global blindness cases. It can affect individuals of all ages and its prevalence varies based on geographic location and patient age. The most common type of uveitis is anterior uveitis, which makes up around 50% of cases, while posterior uveitis is the least frequent form.

The uveitis prevalence has been increasing in the US due to the rising occurrence of uveitis-associated conditions, increasing awareness, and improved diagnosis of uveitis. As per DelveInsight analysis, the total diagnosed prevalent cases of uveitis in the 7MM were found to be around 1 million cases in 2023, which are expected to increase during the study period (2020─2034).

Uveitis treatment focuses on reducing inflammation and alleviating pain and discomfort in the eye to prevent permanent vision loss or other complications. Recent guidelines highlight the importance of early diagnosis and timely treatment to avoid further issues.

The main objective is to eliminate inflammation as quickly as possible. Currently approved treatments include XIPERE, OZURDEX, HUMIRA, YUTIQ/ILUVIEN, RETISERT, and DUREZOL. The market for uveitis pipeline drugs holds considerable promise, fueled by new therapeutic advancements and ongoing clinical trials.

The market size of uveitis in the 7MM was USD 1.5 billion in 2023, which is further expected to increase by 2034 due to the increased prevalence of uveitis, improved pathogenesis of the disease, and technological advancements.

Uveitis Pipeline Therapies and Companies

- TRS01: Tarsier Pharma

- Licaminlimab (OCS-02): Oculis Pharma

- Vamikibart (RO720220/RG6179): Roche/Eleven Biotherapeutics

- OLUMIANT (baricitinib): Eli Lilly and Company

- EYS606: Eyevensys

- Izokibep: Acelyrin/Affibody Medical

- Brepocitinib: Priovant Therapeutics

- OCS-01: Oculis Pharma

To access a complete analysis of the uveitis market, visit Uveitis Market Assessment

Neurotrophic Keratitis Market

Neurotrophic keratitis, also referred to as neurotrophic keratopathy or trigeminal neuropathic keratopathy, is an uncommon degenerative disease of the cornea. It is marked by symptoms such as reduced or absent corneal sensation, corneal epithelial damage, and impaired healing, which make the corneal surface more vulnerable to injury and hinder its recovery. In advanced stages, this condition can cause stromal thinning, corneal ulcers, and potentially corneal perforation.

In the assessment done by DelveInsight, the estimated total diagnosed prevalent cases of neurotrophic keratitis in the 7MM were nearly 65K in 2023. The highest total diagnosed prevalent cases of neurotrophic keratitis were accounted by the US in 2023, which are expected to show a rise in the future.

The treatment for neurotrophic keratitis primarily focuses on addressing the specific symptoms of each patient. It is recommended to discontinue the use of topical eye medications. OXERVATE is the first medication approved by the US FDA for treating patients with neurotrophic keratitis.

The current market of neurotrophic keratopathy includes OXERVATE, lubricants, anti-inflammatory agents, antibiotics, and antiproteases, from artificial tears to serum/plasma droplets, all provide nonspecific relief that may be temporary, making up a market size of USD 763 million in the 7MM in 2023, which is further anticipated to increase during the forecast period.

The United States accounted for the highest market size of neurotrophic keratitis approximately 97% of the total market size in 7MM in 2023, in comparison to the other major markets i.e., EU4 countries (Germany, France, Italy, and Spain), and the United Kingdom, and Japan.

Neurotrophic Keratitis Pipeline Therapies and Companies

- RGN-259 (Tß4): ReGenTree/RegeneRx Biopharmaceuticals, Inc

- REC 0559 (MT-8/Udonitrectag/REC 0/0559): Recordati Rare Diseases/MimeTech

- CSB-001: Claris Bio therapeutics

To gain a deeper understanding of the neurotrophic keratitis market, be sure to explore the Neurotrophic Keratitis Market Outlook

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Rare Disease Consulting Services

Delveinsight’s comprehensive rare disease consulting services encompass rare disease consulting, epidemiology-based market assessment, and primary research projects aimed at obtaining elusive data through their esteemed KOL panel.