Austin, Dec. 17, 2024 (GLOBE NEWSWIRE) -- Market Size & Growth Analysis:

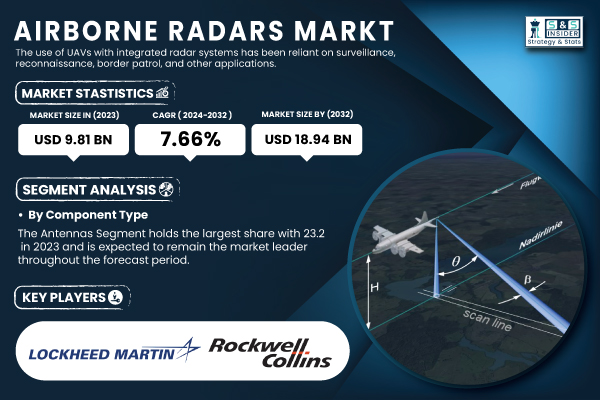

The SNS Insider report indicates that,“The Airborne Radars Market Size was valued at USD 9.81 Billion in 2023 and is expected to reach USD 18.94 Billion by 2032 and grow at a CAGR of 7.66% over the forecast period 2024-2032.”

Growth of Airborne Radars Market Driven by UAV Integration and Defense Investments

The airborne radars market is experiencing significant growth driven by the increasing use of UAVs with integrated radar systems for surveillance, reconnaissance, border patrol, and other applications across military, civil, and commercial sectors. Rising investments in defense modernization programs and aerospace advancements further propel the market as governments and defense organizations allocate substantial budgets to upgrade airborne platforms with cutting-edge radar technologies. For instance, India's Defence Acquisition Council approved acquisitions worth USD 10.18 billion, including Air Defence Tactical Control Radars to enhance surveillance and detect low-flying targets.

Get a Sample Report of Airborne Radars Market Forecast @ https://www.snsinsider.com/sample-request/4638

Dominant Market Players with their Products Listed in this Report are:

- Lockheed Martin Corporation (AN/APG-81 AESA Radar, AN/APS-147 Multi-Function Radar)

- Rockwell Collins Inc. (APG-70 AESA Radar, APG-67 Radar)

- Saab AB (Gripen E Radar, ERIEYE AEW&C Radar)

- Honeywell International Inc. (AN/APG-79 AESA Radar, AN/APS-125 Radar)

- General Dynamics Corporation (AN/APG-63 Radar, AN/APG-66 Radar)

- Rheinmetall AG (Fire Control Radar, Ground Surveillance Radar)

- BAE Systems (ASTA Radar, SEA SPY Radar)

- Northrop Grumman Corporation (AN/APG-77 AESA Radar, AN/SPY-6 AESA Radar)

- Raytheon Technologies (AN/APG-83 AESA Radar, AN/SPY-1 Radar)

- Thales Group (Ground Master 400 Radar, Sea Fire Radar)

- Leonardo S.p.A. (Grifo AESA Radar, Seaspray Radar)

- Hensoldt (Twister AESA Radar, Multi-Mission Radar)

- L3Harris Technologies, Inc. (AN/APG-67 Radar, AN/APS-153 Radar)

- Elbit Systems Ltd. (EL/M-2080 Radar, EL/M-2075 Radar)

- Israel Aerospace Industries (EL/M-2075 Radar, EL/M-2080 Radar)

- Indra (IRIS-M Radar, Radar Systems for UAVs)

- Telephonics Corporation (AN/APS-154 Radar, AN/APS-137 Radar)

- OPTIMARE Systems GmbH (OPTIMARE Radar, OPTIMARE Maritime Radar)

- Echodyne Corp. (EchoGuard Radar, EchoMapper Radar)

- Saab Group (Gripen E Radar, ERIEYE AEW&C Radar).

Impact of Advanced Weather Monitoring Radars on Aviation, Disaster Management, and Agriculture

Extreme weather disrupts aviation, but advanced weather monitoring radars provide real-time data for safer navigation and disaster prediction. Pilots use these systems to avoid turbulence, while governments and disaster agencies rely on radar data to forecast floods and storms. For instance, NATO’s Boeing E-3A Sentry aircraft ensures airspace surveillance and disaster management.

In agriculture, these radars aid farmers by predicting rainfall and optimizing crop management through accurate weather insights. The growing demand for precise weather monitoring solutions significantly drives the airborne radar market, supporting safety and decision-making across diverse applications.

Airborne Radars Market growth is driven by improvements in antennas, interfaces, and Air-To-Ground modes.

By Component Type

The Antennas segment, holding the largest share at 23.2% in 2023, is expected to maintain its market dominance throughout the forecast period. Phased-array antennas and electronically scanned arrays (ESAs) enhance airborne radar systems' performance by enabling high frequency, ultra-wideband scanning with rapid precision for target acquisition and tracking.

The Graphical User Interfaces segment is anticipated to grow at the fastest rate of 10.48% CAGR, driven by the rising demand for improved situational awareness, as modern radar systems generate vast datasets for air, ground, and environmental monitoring.

By Mode Type

The Airborne Radars Market is primarily driven by the Air-To-Ground Segment, which held a 46.2% share in 2023, fueled by the rising demand for multi-role aircraft equipped with multifunctional radar systems. These systems enable military forces to perform air-to-ground missions with enhanced precision, agility, and efficiency.

Meanwhile, the Air-To-Air Segment is expected to grow at a 9.30% CAGR due to advancements in fifth-generation fighter aircraft, featuring radar systems with superior range, stealth detection, and long-range target engagement capabilities.

By Installation Type

The Retrofit Segment dominated the market in 2023 with a 67.2% revenue share, driven by the integration of advanced cybersecurity features to protect against cyber threats and ensure data integrity. The retrofit approach allows modern radar systems to benefit from enhanced security while maintaining mission-critical data confidentiality.

The New Installation Segment is expected to grow at a 9.79% CAGR, offering advanced technology and a cost advantage over retrofitting existing systems, attracting customers seeking a competitive edge.

Do you Have any Specific Queries or Need any Customize Research on Airborne Radars Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/4638

Key Market Segments:

BY COMPONENT TYPE

- Antennas

- Receivers

- Processors

- Transmitters

- Graphical User Interfaces

- Stabilization Systems

- Others

BY MODE TYPE

- Air-to-Ground

- Air-to-Air

- Air-to-Sea

BY RANGE TYPE

- Long Range

- Medium Range

- Short Range

- Very Short Range

BY DIMENSION TYPE

- 2D

- 3D

- 4D

BY FREQUENCY TYPE

- X-band

- C-band

- KU-band

- S-band

- HF/VHF/UHF

- KA-band

- Multi-band

- L-band

BY INSTALLATION TYPE

- New Installation

- Retrofit

BY TECHNOLOGY TYPE

- Active Electronically Scanned Array

- Software-Defined Radar

- Synthetic Aperture Radar

- Digital Beamforming

- Multistatic Radar Systems

- Low Probability of Intercept

BY APPLICATION TYPE

- Defense and Military

- Commercial and Business

BY WAVEFORM TYPE

- Frequency Modulated Continuous Wave (FMCW)

- Doppler

- Ultra-wideband Impulse

North America and Asia-Pacific Driving Growth in the Airborne Radars Market

North America dominated the airborne radars market in 2023 with a 32.8% share. The region's growth is driven by expanding ISR and border surveillance capabilities, with the U.S. significantly boosting its spending on ISR programs. For instance, the FY 2023 U.S. Air Force budget includes substantial investments in radar-based platforms such as the E-3 Sentry and E-8C Joint Surveillance Target Attack Radar System for real-time intelligence.

Asia-Pacific is expected to witness the fastest CAGR of 10.32%, fueled by rising demand for airborne surveillance, weather monitoring, and defense radar systems, with countries like Australia and South Korea prioritizing radar modernization and defense investments.

Purchase an Enterprise User License of Airborne Radars Market Report at 40% Discount @ https://www.snsinsider.com/checkout/4638

Recent Development

- 2 October 2024: Saab and Korea Aerospace Industries have signed a Memorandum of Understanding for industrial cooperation and technology transfer regarding the AEW&C II competition and future domestic opportunities in Korea. The MoU, signed at KADEX, highlights Saab's commitment to the program, with its GlobalEye proposal offering superior performance and cost advantages.

- 31 July 2024: Rheinmetall has ordered Hensoldt’s SPEXER 2000M 3D MkIII radars for the Skyranger air defense systems, which will be deployed on tanks in Germany and Austria, with Denmark also announcing a corresponding procurement.

- 8 November 2024: The U.S. Air Force has placed a usd 30 million order with Northrop Grumman for additional AESA radar systems for F-16 aircraft, bringing the total value of the contract to USD 1.7 billion.

Table of Contents - Key Points Analysis

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Vehicle Production and Sales Volumes, 2020-2032, by Region

5.2 Emission Standards Compliance, by Region

5.3 Vehicle Technology Adoption, by Region

5.4 Consumer Preferences, by Region

5.4 Aftermarket Trends (Data on vehicle maintenance, parts, and services)

6. Competitive Landscape

7. Airborne Radars Market Segmentation, by Component Type

8. Airborne Radars Market Segmentation, by Mode Type

9. Airborne Radars Market Segmentation, by Range Type

10. Airborne Radars Market Segmentation, by Dimension type

11. Airborne Radars Market Segmentation, by Frequency Type

12. Airborne Radars Market Segmentation, by Installation Type

13. Airborne Radars Market Segmentation, by Technology Type

14. Airborne Radars Market Segmentation, by Application Type

15. Airborne Radars Market Segmentation, by Waveform type

16. Regional Analysis

17. Company Profiles

18. Use Cases and Best Practices

19. Conclusion

Access Complete Report Insights of Airborne Radars Market Growth & Outlook 2024-2032@ https://www.snsinsider.com/reports/airborne-radars-market-4638

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.