New York, USA, Dec. 17, 2024 (GLOBE NEWSWIRE) -- Rare Skin Disorders Market: Key Insights into Future Outlook and Trends of Pemphigus Vulgaris, Epidermolysis Bullosa, Palmoplantar Pustulosis, and Prurigo Nodularis | DelveInsight

Rare skin disorders, though often overlooked, affect millions of people worldwide, with some conditions being so rare that only a handful of cases are reported each year. These conditions highlight the importance of awareness and research in dermatology, as many of these disorders are lifelong, with limited treatment options. Despite their rarity, individuals with rare skin disorders continue to demonstrate incredible resilience in the face of adversity.

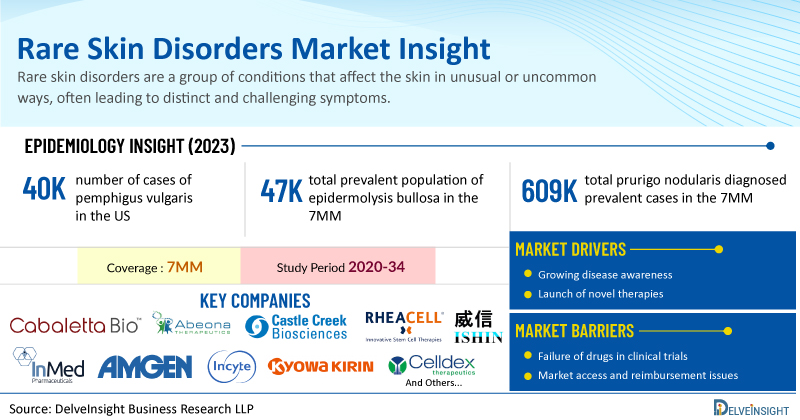

Rare skin disorders are a group of conditions that affect the skin in unusual or uncommon ways, often leading to distinct and challenging symptoms. These disorders may be genetic or result from environmental factors, and they can vary in severity from mild to life-threatening.

Due to their rarity, diagnosis and treatment can be difficult, requiring specialized care from dermatologists and other medical professionals to manage symptoms and improve the quality of life for affected individuals. Research into these conditions is ongoing, with advancements in genetic therapies offering hope for more effective treatments.

DelveInsight has expertise in the rare disease market with an experienced team handling the rare disease domain proficiently. DelveInsight has recently released a series of epidemiology-based market reports on rare skin diseases including Pemphigus Vulgaris, Epidermolysis Bullosa, Palmoplantar Pustulosis, and Prurigo Nodularis. These reports include a comprehensive understanding of current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted market size from 2020 to 2034 segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Additionally, the reports feature an examination of prominent companies working with their lead candidates in different stages of clinical development. Let’s deep dive into the assessment of these rare skin disease markets individually.

Pemphigus vulgaris is a rare and severe autoimmune condition characterized by painful blisters and sores on the skin and mucous membranes, such as the mouth, throat, and occasionally the genital region. It happens when the immune system erroneously targets desmogleins, proteins that are crucial for cell adhesion in the epidermis, causing the cells to separate and resulting in blister formation.

Among the 7MM, the United States accounted for the highest number of cases of pemphigus vulgaris in 2023, with nearly 40K cases. These cases are anticipated to increase by 2034. In the United States, individuals of the 60-69 year age group account for the highest number of cases of Pemphigus Vulgaris in 2023.

The treatment of pemphigus vulgaris has greatly advanced with systemic corticosteroids, which have lowered the disease’s mortality rate by 60%. These steroids continue to be the primary treatment, especially for mild cases, but they must be closely monitored due to potential side effects such as infections and osteoporosis.

Currently, RITUXAN (rituximab) is the only FDA-approved therapy for the treatment of pemphigus vulgaris. It serves as a key treatment, especially for moderate to severe cases. As the first biologic therapy approved by the FDA for this condition, RITUXAN represents a significant advancement in over 60 years.

Cabaletta Bio is developing a CD19-CAR T-cell therapy aimed at treating autoimmune diseases, including Pemphigus Vulgaris. Currently, in mid-stage development, CABA-201 is designed to temporarily and extensively deplete CD19-positive B cells with a single infusion, potentially facilitating an "immune system reset" and long-lasting disease remission. Cabaletta has received FDA approval for Investigational New Drug (IND) applications for CABA-201 in several autoimmune disorders, and the therapy is being tested in various RESET Phase I/II clinical trials.

In summary, there are limited therapies currently being explored for pemphigus vulgaris. While it is premature to predict whether the promising candidate mentioned above will enter the pemphigus vulgaris market during the forecast period (2024–2034), this drug has the potential to significantly impact the treatment landscape in the years ahead. The treatment space is expected to see a major positive shift due to global improvements in healthcare spending. In 2023, the United States accounted for the highest pemphigus vulgaris market share, i.e. more than 75%.

Pemphigus Vulgaris Pipeline Therapies and Key Companies

- CABA-201 (4-1BB CD19-CAR T): Cabaletta Bio

Discover more about pemphigus vulgaris drugs in development @ Pemphigus Vulgaris Clinical Trials

Epidermolysis bullosa is a hereditary skin condition marked by severe skin fragility and blistering from minimal friction or injury. It results from genetic mutations that impact the proteins necessary for maintaining the skin's structural integrity. The total prevalent population of epidermolysis bullosa in the 7MM comprised ~47K cases in 2023. These cases are projected to Increase for the study period of 2020–2034.

Currently, there are few effective treatments available for patients with epidermolysis bullosa. The primary focus of treatment and management is on supportive care, such as wound care, pain and itch management, infection control, nutritional support, and the prevention and treatment of complications.

Stem cell-based therapies are emerging as significant options, especially for conditions once considered incurable. ABCB5+ mesenchymal stromal cells (ABCB5+ MSCs) are particularly notable for their immunomodulatory and anti-inflammatory properties, making them a promising treatment for various chronic inflammatory diseases, including EB.

Japan is leading the way in cell therapy development among the 7MM, and in December 2018, it became the first country to approve a cell therapy for EB, JACE (human epidermal cell sheet), developed by Japan Tissue Engineering.

The lack of approved therapies for EB highlights the substantial unmet need among EB patients. Krystal has taken a leading role in developing gene therapy treatments for EB, with FDA approval for VYJUVEK, which is effective for both recessive and dominant forms of the disease. Abeona has also shown strong results with its gene therapy, EB-101, which functions similarly to VYJUVEK by introducing COL7A1 into the body. Although Krystal is ahead by a year, competition between the two therapies is expected.

Despite these approvals, there is still much progress to be made in meeting all the needs of EB patients, and continued research and development are crucial to improving treatment options and, ultimately, the quality of life for those living with epidermolysis bullosa globally.

However, it is predicted that in the coming years, the epidermolysis bullosa market will witness an upsurge in growth. The total epidermolysis bullosa market size in the 7MM will grow from USD ~1.7 billion in 2023 with a significant CAGR by 2034. This growth is mainly driven by increasing prevalence, patient awareness, and a robust clinical pipeline.

Epidermolysis Bullosa Pipeline Therapies and Key Companies

- EB-101: Abeona Therapeutics

- D-Fi (dabocemagene autoficel): Castle Creek Biosciences

- ABCB5+ mesenchymal stem cells (ABCB5+ MSCs): RHEACELL

- ISN001: Ishin Pharma

- RV-LAMB3-transduced epidermal stem cells: Holostem Terapie Avanzate

- PTR-01: BridgeBio (Phoenix Tissue Repair)

- INM-755: InMed Pharmaceuticals

- Redasemtide: Shionogi

- ALLO-ASC-SHEET: Anterogen

Dive deeper for rich insights into the Epidermolysis Bullosa Clinical Trials

Palmoplantar Pustulosis Market

Palmoplantar pustulosis (PPP) is a long-term skin condition marked by the presence of yellow-brown pustules on the palms and soles. Previously thought to be a form of psoriasis, PPP is now classified as a distinct condition, although 10-25% of those with PPP may also experience chronic plaque psoriasis. PPP can affect individuals of all ages, with females being more likely to be affected than males. In 2023, Japan accounted for the highest number of diagnosed prevalent cases of PPP.

Although there are currently no FDA-approved medications specifically for palmoplantar pustulosis, several therapeutic options show potential. Topical treatments can be effective for patients with localized disease, though long-term benefits are often not sustained. Systemic therapies, such as biologics, JAK inhibitors, DMARDs, and retinoids, may clear PPP but carry possible side effects. Phototherapy is also effective, though challenges related to accessibility and cost may arise.

In Japan, three drugs are approved for treating PPP: TREMFYA (Guselkumab), an IL-23 p19 subunit inhibitor approved in 2018; LUMICEF (Brodalumab), the first IL-17 pathway inhibitor for PPP approved in 2023; and SKYRIZI (Risankizumab), an IL-23 inhibitor approved for PPP in May 2023. These therapies target critical inflammatory cytokines in patients who do not respond to current treatments. However, the development pipeline for new PPP treatments remains limited, with OTEZLA (apremilast) from Amgen being the most prominent candidate.

In summary, there are few therapies under investigation for PPP, and it is too early to predict whether the promising candidates will enter the US and European markets during the forecast period (2024–2034). However, these treatments are expected to significantly impact the PPP landscape in the coming years, with the treatment space anticipated to undergo a positive transformation due to global healthcare spending increases. As per the DelveInsight analysis, the market will witness a rise from USD 400 million in the 7MM in 2023 at a significant CAGR by 2034.

Palmoplantar Pustulosis Pipeline Therapies and Key Companies

- OTEZLA (apremilast): Amgen

For a deeper understanding of the palmoplantar pustulosis market landscape, explore the Palmoplantar Pustulosis Market Outlook

Prurigo nodularis is a long-term skin condition marked by the development of numerous firm, itchy lumps on the skin, usually caused by constant scratching or rubbing. These lumps vary in size and are commonly located on areas such as the arms, legs, back, and chest. The total prurigo nodularis diagnosed prevalent cases in the 7MM were ~609K in 2023, out of which the highest prevalent cases of this disease were in the United States.

The treatment of prurigo nodularis aims to alleviate severe itching and inflammation while addressing any underlying causes if identified. First-line treatments often involve topical therapies, such as strong corticosteroids, to reduce inflammation and suppress the immune response. Topical calcineurin inhibitors, like tacrolimus, may also be used as a steroid alternative, especially for sensitive areas. Emollients and moisturizing creams are recommended to maintain skin hydration and prevent further irritation.

For more severe cases, systemic treatments may be considered. Oral antihistamines can help manage itching, while oral corticosteroids may be used for short-term flare-ups. Immunosuppressive medications, such as methotrexate, cyclosporine, or azathioprine, are sometimes prescribed to control inflammation in resistant cases. Phototherapy, specifically narrowband ultraviolet B (NB-UVB) light therapy, is another effective treatment option that can help improve symptoms by modulating immune function and reducing skin inflammation.

The prurigo nodularis market size in the 7MM was around USD 690 million in 2023 and is expected to increase with a significant CAGR during the forecast period. Among the 7MM, the United States accounted for the largest prurigo nodularis market size, i.e., approximately 76% of the overall market in 2023.

The prurigo nodularis market dynamics are anticipated to change in the coming years owing to the improvement in the diagnosis methodologies, raising awareness of the disease, and incremental healthcare spending across the world.

Prurigo Nodularis Pipeline Therapies and Key Companies

- Povorcitinib: Incyte

- Ruxolitinib: Incyte

- Rocatinlimab: Amgen/Kyowa Kirin

- Barzolvolimab (CDX-0159): Celldex Therapeutics

- Vixarelimab: Kiniksa Pharmaceuticals/Genentech

To access a complete analysis of the prurigo nodularis market, visit Prurigo Nodularis Market Assessment

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Rare Disease Consulting Services

Delveinsight’s comprehensive rare disease consulting services encompass rare disease consulting, epidemiology-based market assessment, and primary research projects aimed at obtaining elusive data through their esteemed KOL panel.