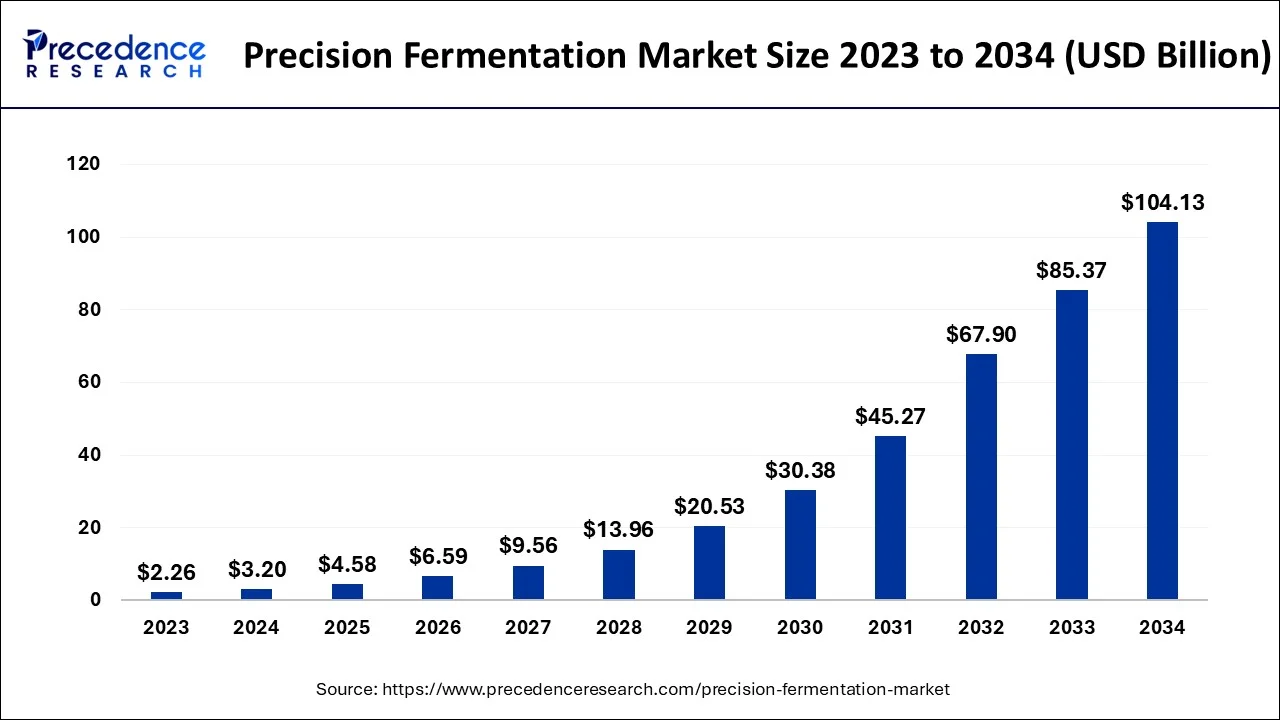

Ottawa, Dec. 19, 2024 (GLOBE NEWSWIRE) -- In terms of revenue, the precision fermentation market is predicted to increase from USD 4.58 billion in 2025 to approximately USD 85.37 billion by 2033, According to Precedence Research. Precision fermentation is in high demand because it is advanced compared to traditional fermentation and a more precise end-product can be achieved in the process.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/2821

Precision Fermentation Market Overview

Microbial hosts are used in precision fermentation to create a specific final product. Microbial and bacterial fermentation are other names for precise fermentation. Both the food and pharmaceutical industries employ precision fermentation in a number of methods to create biopharmaceuticals. A more sophisticated kind of metabolic fermentation known as precision fermentation uses live organisms to transform organic compounds from the feedstock into components that may be used.

A large amount of biomass is created with the aid of certain enzymes, and the microorganisms are bred and multiplied in tiny factories. After reaching a critical mass, the desired product is recovered and refined to create a working product. The method depends on cooperation between teams from fermentation, purification, downstream processing, and strain engineering.

Precision Fermentation Market Highlights:

- Europe dominated the precision fermentation market with the highest market share of 40.77% in 2024.

- By Application, the dairy alternative segment accounted for the largest market share of 44.03% in 2024.

- By Ingredient, the whey & casein protein segment captured the biggest market share of 36.28% in 2024.

- By Microbe, the yeast segment has held a major market share of 30.72% in 2024.

- By fermentation type, the biomass fermentation segment recorded the maximum market share in 2024.

Precision Fermentation Market Revenue Analysis by Segments and Regions

Precision Fermentation Market Revenue (USD Million) 2022 to 2024, By Application

| By Application | 2022 | 2023 | 2024 |

| Meat and Seafood | 363.9 | 514.7 | 733.3 |

| Dairy Alternative | 722.2 | 1,022.7 | 1,458.6 |

| Egg alternative | 277.8 | 395.3 | 566.5 |

| Others | 236.1 | 323.2 | 3,203.5 |

Precision Fermentation Market Revenue (USD Million) 2022 to 2024, By Ingredient

| By Ingredient | 2022 | 2023 | 2024 |

| Whey & Casein Protein | 575.4 | 814.8 | 1,162.2 |

| Egg White | 341.9 | 485.1 | 693.1 |

| Collagen Protein | 404.4 | 572.2 | 815.2 |

| Heme Protein | 278.3 | 383.9 | 533.1 |

Precision Fermentation Market Revenue (USD Million) 2022 to 2024, By Microbe

| By Microbe | 2022 | 2023 | 2024 |

| Yeast | 486.9 | 689.8 | 984.1 |

| Algae | 413.1 | 584.1 | 831.7 |

| Fungi | 379.7 | 538.4 | 768.7 |

| Bacteria | 320.3 | 443.7 | 619.0 |

Precision Fermentation Market Revenue (USD Million) 2022 to 2024, By Regions

| By Regions | 2022 | 2023 | 2024 |

| North America | 528.2 | 747.4 | 1,065.1 |

| Europe | 647.0 | 916.1 | 1,306.1 |

| Asia Pacific | 247.0 | 350.9 | 502.1 |

| LAMEA | 177.8 | 241.6 | 330.2 |

Note: The Precision Fermentation Market Report is Readily Available for Immediate Delivery.

Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2821

Growth Factors in the Precision Fermentation Market

- Addresses food crises and environmental issues: With precision fermentation, target food constituents like proteins and lipids are produced by fermenting microbes with particular gene insertions. As a novel food production method to solve environmental problems and food crises, it is gaining attention.

- Growing vegan food demand: At the moment, plant-based meat for vegan customers and dairy products free of animal components are the primary uses for precision fermentation ingredients.

- Technological advancements: A significant subset of precision fermentation, metabolic engineering optimizes microbial strains, metabolic pathways, product yields, and bioprocess scale-up by utilizing precision techniques including next-generation sequencing, high-throughput library screening, molecular cloning, and multiomics.

- High-value and high-yield: Microbial cell factories are used in precision fermentation to provide high-value functional food components with reduced environmental impact, high yields, and purity.

Opportunities in the Precision Fermentation Market

- In Q3, fermentation start-ups raised USD $174 million, while plant-based and grown meat startups raised $56 million and $3 million, respectively. The funding was dominated by two agreements. A $61 million investment was made in the fermented cheese products made by the German business Formo. Helaina, a bioactive protein supplement manufacturer located in New York, raised $45 million in Series B investment. As a result, the total investment in fermentation technologies for 2024 has increased from $443 million in 2023 to $572 million. In the meanwhile, investments in plant-based and farmed meat are declining in 2023.

- In September 2024, Earth First Food Ventures (EFFV), a venture capital platform, tokenized a $10 million Series A fundraising transaction. The investment will enable team expansion, establish a $50 million precision fermentation fund, and broaden EFFV's portfolio in the alt-dairy industry.

Precision Fermentation Market Report Coverage

| Report Attribute | Key Statistics | |

| Market Size in 2024 | USD 3.2 Billion | |

| Market Size in 2025 | USD 4.58 Billion | |

| Market Size by 2034 | USD 104.13 Billion | |

| CAGR from 2024 to 2034 | 46 | % |

| Leading Region | North America | |

| Fastest Growing Region | Asia-Pacific | |

| Base Year | 2023 | |

| Forecast Period | 2024 to 2034 | |

| Segments Covered | Application, Ingredient, Microbe, Fermentation Type, and Region | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa | |

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

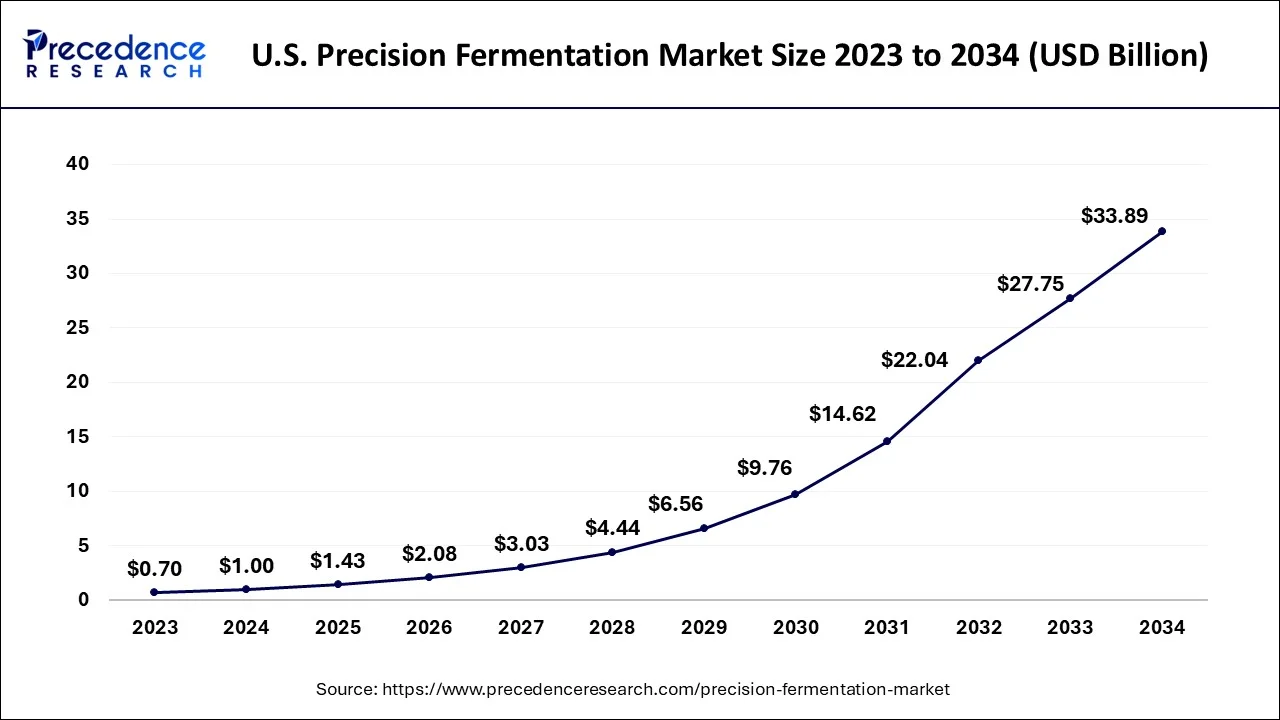

U.S. Precision Fermentation Market Size 2024 to 2034

The U.S. precision fermentation market size was valued at USD 1 billion in 2024 and is estimated to grow from USD 1.43 billion in 2025 to approximately USD 33.89 billion by 2034, registering a double digit CAGR of 46.70% between 2024 and 2034.

Analysis By Regions

Growing Demand for Animal Food Substitutes Drives Europe’s Dominance

Europe dominated the precision fermentation market in 2023. Many people are moving from conventional meat derived from animals to safer and more environmentally friendly meat substitutes. One of the top marketplaces in the world, Europe is investing more and more in the search for and production of animal proteins that are less polluting while yet tasting and feeling like animal goods. France, Germany, and the United Kingdom are the top producers of precision-fermented proteins. In order to satisfy the increasing demand for alternative proteins in the area, a number of businesses are also making investments to expand their manufacturing capacities.

Dairy companies that use precision fermentation have begun to apply for pre-market approval in the EU for innovative foods. The European Food Safety Authority (EFSA) has received innovative food applications for dairy proteins generated from precision fermentation from two businesses thus far. This is what we currently know. Remilk, an Israeli dairy firm based on animals, also applied for EU approval of a unique product in 2023. The submission focused on Komagataella phaffi, the yeast in issue, and beta-lactoglobulin, the main whey protein found in cow and sheep's milk.

For instance,

- In December 2023, as part of the European Innovation Council's Work Programme 2024, which is a component of the bloc's flagship Horizon Europe program, the EU announced a €50 million funding package for startups and small enterprises using precision fermentation. The investment's main goal is to assist these businesses in growing so they can overcome Europe's infrastructure shortage and bottleneck issues. In order to enhance the effectiveness, resilience, and sustainability of the region's supply chain and assist the EU's climate initiatives, the call for applications will open in May.

Advantageous Policies: Asian Countries to Boom in the Upcoming Period

Asia Pacific is estimated to grow at the fastest CAGR in the precision fermentation market during the forecast period. In order to create proteins and enzymes with broader end applications in the food and beverage, cosmetics, and pharmaceutical industries, China, Japan, and Thailand are using this technique. The market's expansion is also being aided by the implementation of advantageous policies, which calls for diversification and the use of innovative protein production techniques.

For instance,

- On March 27, 2024, the International Forum on Precision Fermentation concluded two fruitful days in Shanghai, China. Under the theme, Intelligent Biomanufacturing, Shared Future, the T&J Bioengineering-hosted event brought together over 70 eminent professionals from both domestic and foreign fields to explore the future of biotechnology. The event focused on the practical difficulties of scaling up innovative technologies in industrial settings as well as the growing role of artificial intelligence (AI) in fermentation.

Precision Fermentation Market Segmentation Analysis

Analysis By Application:

The dairy alternative segment held the largest share of the precision fermentation market in 2023. Behind the dairy aisle, a silent revolution is taking place. Animal-free dairy products that taste, look, and feel like genuine things are now possible thanks to precise fermentation, plant-based substitutes are gaining market share, and dairy farms are using high technology to reach new levels of efficiency. Precision fermentation appears to be a crucial component for food producers seeking to more sustainably satisfy the world's expanding demand for dairy products.

Analysis By ingredient

The whey & casein protein segment dominated the precision fermentation market in 2023. The demand for dairy proteins is anticipated to soar as the world's population is forecast to reach 8.5 billion people by 2030 and 9.7 billion by 2050. As a result, conventional dairy production could find it difficult to satisfy these rising needs. Precision fermentation, sometimes referred to as the "Brewing of Proteins," is a method frequently used in the biopharmaceutical sector and in the manufacturing of microbial rennet.

Analysis By Microbe

The yeast segment registered dominance in the precision fermentation market in 2023. Saccharomyces cerevisiae, a bacterium known as yeast, is used in the fermentation process to make alcohol. Yeast is used in fermentation because it has enzymes like zymase that can break down carbohydrates without the need for oxygen. The result is the production of carbon dioxide and ethanol molecules. Therefore, brewing companies that make beverages like beer and whiskey need yeast to make alcohol.

Browse More Research Reports:

- Microbial Fermentation Technology Market: The global market size was USD 32.18 billion in 2023, accounted for USD 34.17 billion in 2024, and is expected to reach around USD 58.72 billion by 2033, expanding at a CAGR of 6.2% from 2024 to 2033.

- Fermented Ingredients Market: The global market size accounted for USD 39.25 billion in 2024 and is predicted to surpass around USD 112.65 billion by 2034, growing at a CAGR of 11.12% from 2024 to 2034.

- Biotechnology Market: The global market size accounted for USD 1.55 trillion in 2024 and is expected to reach around USD 4.61 trillion by 2034, expanding at a CAGR of 11.5% from 2024 to 2034.

- White Biotechnology Market: The global market size is worth around USD 252.92 billion in 2024 and is anticipated to reach around USD 397.69 billion by 2034, growing at a CAGR of 4.63% over the forecast period 2024 to 2034.

- Collagen Market: The global market size is expected to be valued at USD 11.40 billion in 2024 and is anticipated to reach around USD 27.47 billion by 2034, expanding at a CAGR of 8.9% over the forecast period from 2024 to 2034.

- Biological Treatment Technologies Market: The global biological treatment technologies market size was USD 2.76 billion in 2023, accounted for USD 2.94 billion in 2024 and is expected to reach around USD 5.20 billion by 2033. The market is expanding at a solid CAGR of 6.55% over the forecast period 2024 to 2033.

Competitive Landscape & Major Breakthroughs in the Precision Fermentation Market

Change Foods, Geltor, Helania Inc, Formo, FUMI Ingredients, Fybraworks Foods, Imagindairy Ltd, Eden Brew, Impossible Foods Inc, Melt & Marble, Motif Foodworks, Inc., Mycorena, Myco Technology, New Culture, Nourish Ingredients, Perfect Day Inc, Remilk Ltd, Shiru Inc, The Every Co., and Triton Algae Innovations.

In October 2024, Funding for Liberation Labs has increased by $3.39 million. The start-up of precision fermentation Liberation Labs was established to give the industry the means to commercialize the production of new proteins at the scale and cost structure that the market demands. Agronomics provided $2 million of the finance through a Secured Promissory Note that matures on October 10, 2027 and earns 10% interest annually. With this further investment, Agronomics has now invested $19.6 million in Liberation Labs, giving it a 37.5% fully diluted ownership share. The current building of Liberation Labs' Launch Facility in Richmond, Indiana, USA, will be aided by Agronomics' $2 million investment.

What is Going Around the Globe?

- In September 2024, in addition to launching cheeses with koji protein in more than 2,000 REWE, BILLA, and Metro stores throughout Germany and Austria, Berlin-based fermentation firm Formo secured $61 million in a Series B transaction. Formo is well renowned for its work using precision fermentation to modify microorganisms to express dairy proteins like casein.

- In March 2024, in a series A investment led by Horizons Ventures, the Australian firm Cauldron secured AUD9.5 million ($6.25 million) to expand a manufacturing platform that would allow its partners to more effectively create high-value ingredients through precise fermentation in a continuous process.

Segments Covered in the Report

By Application

- Meat & Seafood

- Dairy Alternatives

- Egg Alternatives

- Others

By Ingredient

- Whey & Casein Protein

- Egg White

- Collagen Protein

- Heme Protein

- Enzymes

- Others

By Microbe

- Yeast

- Algae

- Fungi

- Bacteria

By Fermentation Type

- Precision Fermentation

- Biomass Fermentation

- Traditional Fermentation

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2821

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsevsolutions.com

Get Recent News:

https://www.precedenceresearch.com/news

For Latest Update Follow Us: