Pune, Jan. 15, 2025 (GLOBE NEWSWIRE) -- Clinical Trial Imaging Market Size & Growth Analysis

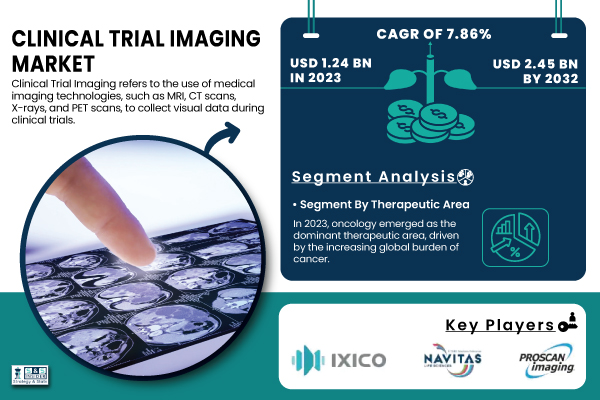

“According to SNS Insider, The Clinical Trial Imaging Market was estimated at USD 1.24 billion in 2023 and is predicted to reach USD 2.45 billion by 2032, with a growing CAGR of 7.86% throughout the forecast period of 2024-2032.”

The market is experiencing rapid growth, primarily fueled by advancements in imaging technologies and the rising demand for precision diagnostics in clinical trials across various therapeutic areas.

The Clinical Trial Imaging Market plays a pivotal role in supporting clinical trials by providing high-quality imaging solutions for evaluating the safety and efficacy of new drugs and treatments. Imaging modalities such as MRI, CT scans, and Optical Coherence Tomography (OCT) are increasingly employed in clinical trials to gather vital information for drug development processes. The growing demand for precise diagnostic tools, along with the increased focus on non-invasive methods, is significantly driving the market.

In terms of supply, a growing number of imaging service providers and pharmaceutical companies are investing in state-of-the-art imaging technologies to cater to the surging demand for clinical trial support. Furthermore, the increasing prevalence of chronic diseases and the need for personalized medicine are augmenting the demand for more robust imaging solutions. As pharmaceutical companies strive for faster drug development cycles and more accurate trial outcomes, the need for advanced imaging technologies becomes paramount.

Get a Sample Report of Clinical Trial Imaging Market@ https://www.snsinsider.com/sample-request/1761

Statistical Insights

- According to a report by the European Society of Radiology (2023), Magnetic Resonance Imaging accounted for approximately 40% of the clinical trial imaging market share, indicating its significant dominance due to its wide usage in therapeutic areas such as oncology, neurology, and cardiology.

- The adoption of Optical Coherence Tomography is growing rapidly. A report from GlobalData indicates that OCT's usage in clinical trials for ophthalmic conditions has increased by 35% year-over-year, driven by rising incidences of eye diseases and technological advancements.

- Data from ClinicalTrials.gov shows a steady increase in clinical trials utilizing imaging technologies. In 2023 alone, over 2,200 clinical trials were registered globally, involving advanced imaging techniques, with a focus on oncology and ophthalmology, marking a 10% rise from the previous year.

- According to the FDA (2024), there has been a 20% increase in approvals for medical imaging devices used in clinical trials from 2022 to 2023. This highlights the growing regulatory acceptance of imaging technologies in clinical research.

Major Players Analysis Listed in this Report are:

- IXICO plc

- Navitas Life Sciences

- ProScan Imaging

- Radiant Sage LLC

- Medpace

- Biomedical Systems Corp

- Cardiovascular Imaging Technologies

- Intrinsic Imaging

- BioTelemetry

- ICON Plc

- Clario

- Resonance Health Ltd.

Clinical Trial Imaging Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.24 billion |

| Market Size by 2032 | US$ 2.45 billion |

| CAGR | CAGR of 7.86% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | Advancements in Imaging Technologies and Growing Demand for Precision Diagnostics |

Segment Analysis

By Modality

In 2023, MRI was the dominant modality in the Clinical Trial Imaging Market, accounting for around 40% of the overall imaging modalities segment. MRI is highly valued for its ability to provide detailed images of soft tissues without using ionizing radiation, making it indispensable for various therapeutic areas such as oncology, neurology, and cardiology. Its broad application and non-invasive nature ensure its continued dominance in clinical trials.

The fastest-growing modality in the Clinical Trial Imaging Market is OCT, driven by its increasing use in ophthalmology, particularly for retinal imaging. OCT provides high-resolution cross-sectional images, which are crucial for diagnosing eye diseases like diabetic retinopathy and glaucoma. The technology's non-invasive nature, high accuracy, and ability to monitor retinal health are contributing factors to its rapid growth.

By Therapeutic Area

In 2023, oncology dominated the Clinical Trial Imaging Market, accounting for 45% of the market share. Imaging technologies, including CT scans and MRIs, play a vital role in diagnosing and staging cancers, as well as monitoring the effectiveness of treatments. The increasing global burden of cancer and the necessity for early diagnosis and treatment monitoring are the primary factors driving the growth of this segment.

The fastest-growing therapeutic area in the Clinical Trial Imaging Market is ophthalmology. The aging population and the rising incidence of eye conditions, such as macular degeneration, glaucoma, and diabetic retinopathy, are propelling the growth of this segment. Advances in imaging technologies, particularly OCT, have made ophthalmic imaging increasingly important for clinical trials, leading to a surge in demand for imaging solutions in this field.

Need any customization research on Clinical Trial Imaging Market, Enquire Now@ https://www.snsinsider.com/enquiry/1761

Clinical Trial Imaging Market Segmentation

By Modality

- Computed Tomography Scan

- Magnetic Resonance Imaging

- X-Ray

- Ultrasound

- Optical Coherence Tomography (OCT)

- Other Modalities

By Therapeutic Area

- Neurovascular Diseases

- Cardiovascular Diseases

- Orthopedics & MSK Disorders

- Oncology

- Ophthalmology

- Nephrology

- Other Therapeutic Areas

By Services

- Clinical Trial Design and Consultation Services

- Reading and Analytical Services

- Operational Imaging Services

- System and Technology Support Services

- Project and Data Management

By End Use

- Biotechnology and Pharmaceutical companies

- Medical Devices Manufacturers

- Academic and Government Research Institutes

- Contract Research Organizations (CROs)

- Other End Users

Regional Analysis

North America dominated the clinical trial imaging market with a 48.01% market share, driven by the presence of major pharmaceutical companies, research institutions, and clinical trial organizations. The U.S. and Canada lead in integrating advanced imaging technologies such as MRI, CT scans, and OCT into clinical trials. The region benefits from a robust healthcare infrastructure, favorable regulatory frameworks, and significant investments in medical research, all of which support its market leadership.

Europe ranked second, with key contributions from Germany, the UK, and France. The growing emphasis on personalized medicine, along with a rising number of clinical trials in oncology, neurology, and cardiovascular diseases, is boosting the demand for imaging services. Additionally, strong collaborations between healthcare providers, regulators, and research institutions foster the region's growth.

Asia-Pacific is rapidly emerging as the fastest-growing region, driven by expanding healthcare infrastructure, increasing clinical trials, and technological advancements in imaging. China and India are leading this growth, propelled by the rising prevalence of chronic diseases.

Recent Developments

- October 2024: NUCLIDIUM announced the successful imaging of the first patient in its Phase 1 study, which is evaluating a 61Cu-based radiotracer in patients with PSMA-positive prostate cancer. This marks a significant advancement in the development of targeted imaging agents for prostate cancer diagnosis and treatment.

- September 2024: Yunu expanded its offering to provide free access to its platform for all clinical trials conducted by the Children's Oncology Group.

Buy a Single-User PDF of Clinical Trial Imaging Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/1761

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends (2023), by Region

5.3 Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

7. Clinical Trial Imaging Market by Modality

8. Clinical Trial Imaging Market by Therapeutic Area

9. Clinical Trial Imaging Market by Services

10. Clinical Trial Imaging Market by End Use

11. Regional Analysis

11. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Details of Clinical Trial Imaging Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/reports/clinical-trial-imaging-market-1761

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.