New York, Jan. 20, 2025 (GLOBE NEWSWIRE) -- Overview:

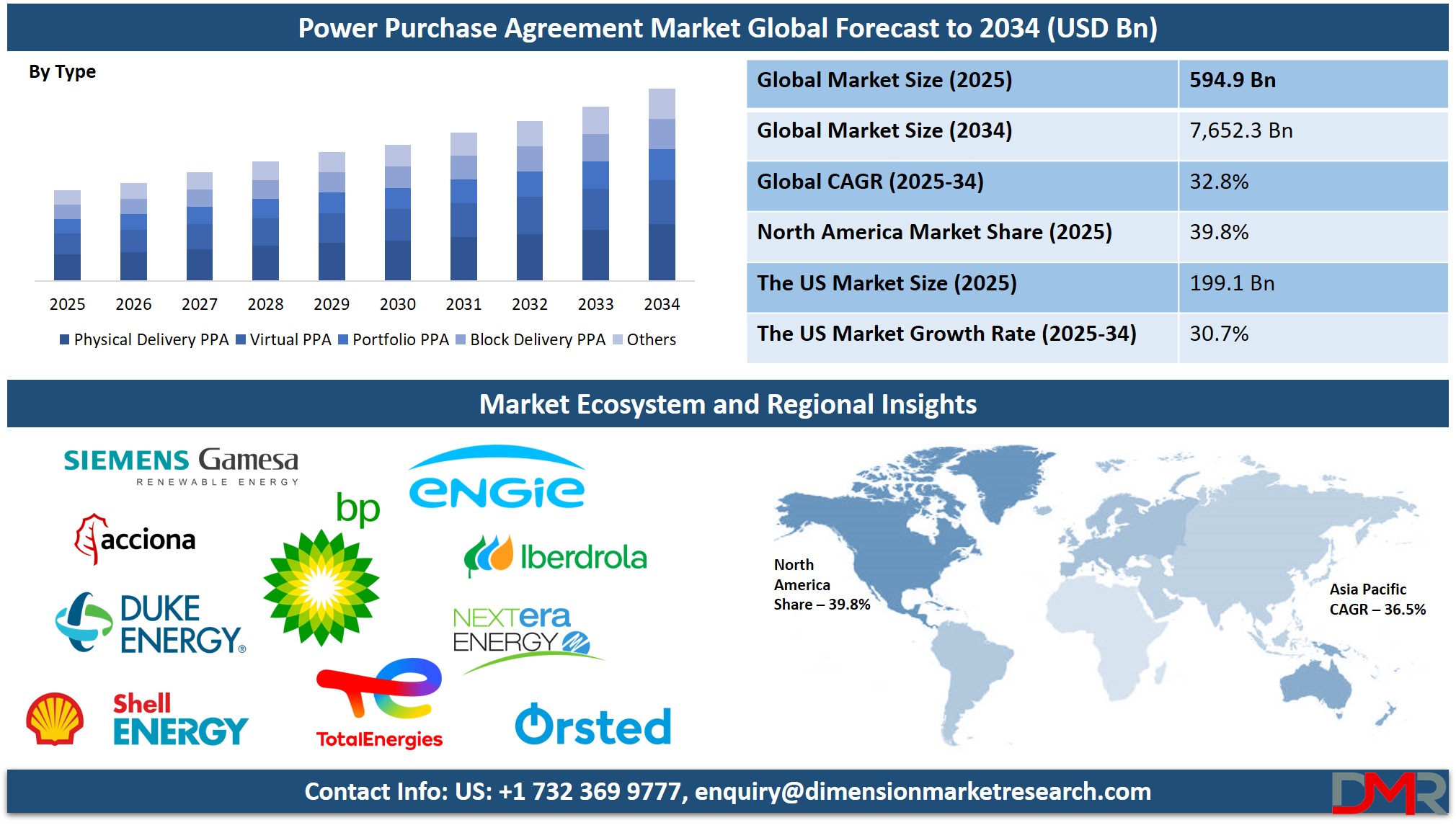

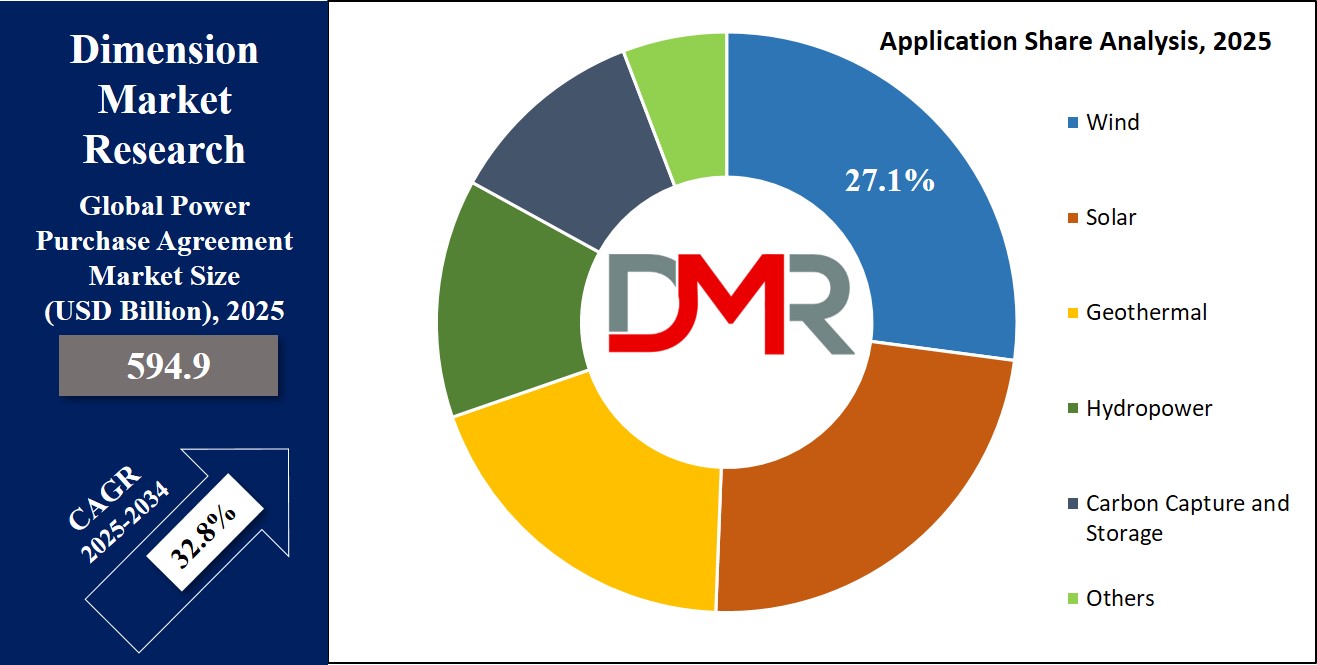

The Power Purchase Agreement Market size is expected to reach USD 594.9 billion by 2025 and is further anticipated to reach USD 7,652.3 billion by 2034 according to Dimension Market Research. The market is anticipated to register a CAGR of 32.8% from 2025 to 2034.

The global PPA market is growing in the wake of increasing demand for renewable energy, corporate sustainability objectives, and government, national, and local incentives. PPAs are long-term contracts between electricity generators and buyers that drive energy transition strategies, reduce GHG emissions, and offer cost predictability. High adoption is observed in deregulated electricity markets and regions with renewable portfolio obligations.

Virtual and aggregated PPAs, and digital negotiation platforms, are more and more permitting access to clean energy for smaller entities than before. While there is persisting regulatory complexity and dependence on the grid, opportunities in developing markets, blockchain solutions, and industrial decarbonization indicate robust growth of the global PPA market.

Click to Get Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/power-purchase-agreement-market/request-sample/

The US Market Overview

The Power Purchase Agreement Market in the US is projected to reach USD 7,652.3 billion by 2034 from the base value of USD 7,652.3 billion in 2025 at a CAGR of 30.7% over its forecast period.

It also puts the U.S. at the forefront of the global PPA market, with strong policies in place for renewables, corporate sustainability goals, and abundant solar and wind resources. Over 25 GW of contracted renewable capacity came via corporate PPAs in 2023, while key states offer an excellent environment for such deals. The market supports an increasingly broad range of consumers-from corporates to municipalities-offering ever more sophisticated PPA structures.

Advanced grid infrastructure and energy storage innovations sweeten the deal, as witnessed by Amazon and Meta's multi-gigawatt deals. The U.S., nonetheless, is a global model in spite of policy uncertainties and transmission constraints, using technology, policy, and corporate commitments as drivers for clean energy transitions.

Important Insights

- Global Market Value: The Power Purchase Agreement Market is projected to be valued at USD 594.9 billion in 2025, expected to reach USD 7,652.3 billion by 2034.

- US Market Value: The US Power Purchase Agreement Market is anticipated to grow from USD 199.1 billion in 2025 to USD 2,218.8 billion in 2034, at a 30.7% CAGR.

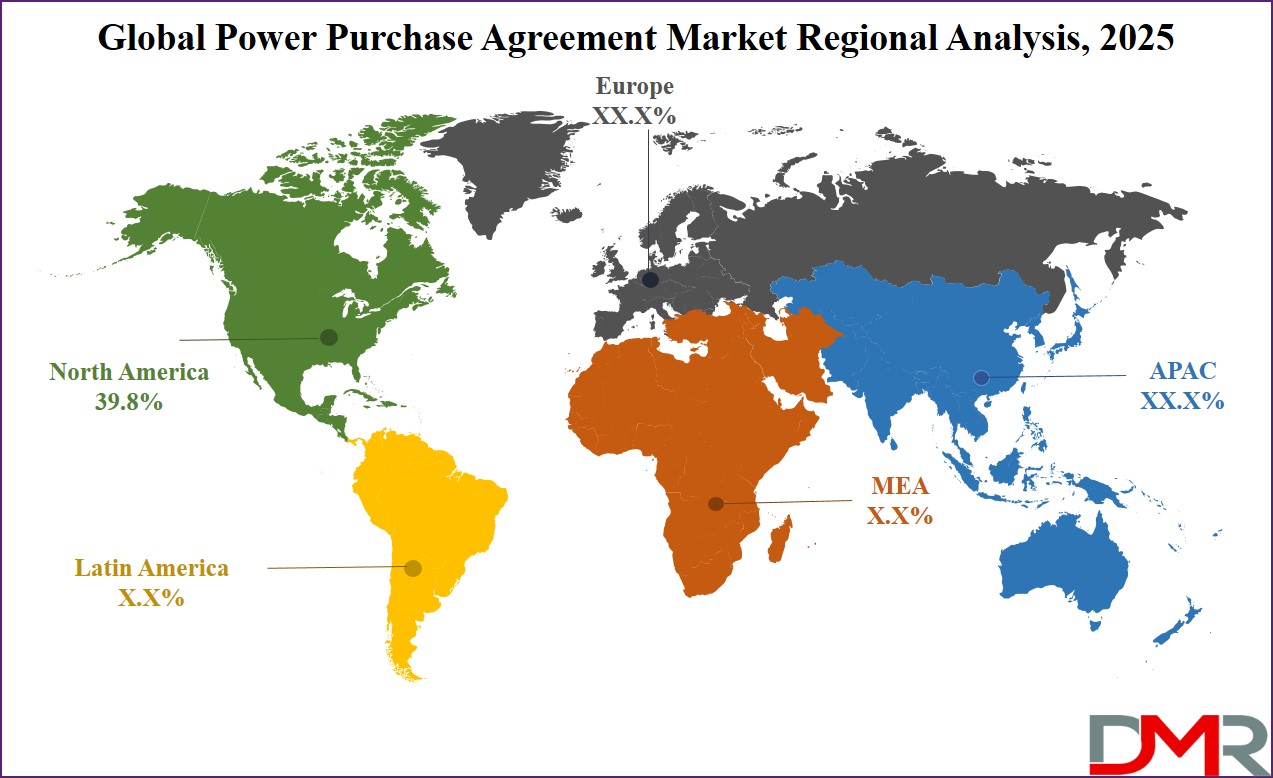

- Regional Analysis: North America leads the Global Power Purchase Agreement Market, holding approximately 39.8% of the total market share in 2025.

- Key Players: Prominent players include ENGIE, Enel Green Power, EDF Renewables, NextEra Energy Resources, Ørsted, Iberdrola, BP Renewable Energy, TotalEnergies, and Acciona.

- Global Market Growth Rate: The market is expanding at a robust CAGR of 32.8% during the forecast period.

Global Power Purchase Agreement Market: Trends

- Corporate Sustainability Integration: PPAs also help the attainment of net zero through stabilizing energy prices and consequent reduced emissions. Virtual PPAs make this even better because investment in renewables is now possible even from a distance, with leading companies like Microsoft already reaping from these deals to meet their ESG and outcompete.

- Emergence of Digital Platforms: Blockchain and AI platforms smoothen the processes of PPA. These tools optimize the price, find the best matching buyers, and minimize transaction complexities. PPA usage is growing fast all over the world, while renewable energy solutions are being decentralized.

Transform your business with strategic insights Request our brochure today! https://dimensionmarketresearch.com/report/power-purchase-agreement-market/download-reports-excerpt/

Power Purchase Agreement Market: Competitive Landscape

The global PPA market is highly diverse, with players ranging from major renewable developers such as Ørsted and Iberdrola to utilities like Dominion Energy and tech giants like Google. Developers push projects in wind, solar, and hydro while securing long-term contracts with corporates. Tech firms fire up demand by signing multi-gigawatt PPAs to meet their carbon neutrality goals. Utilities expand renewable procurement via corporate and municipal agreements. Online platforms, such as LevelTen Energy, make transactions seamless, using AI and blockchain for better market access. The high competition is forcing companies to scale up renewable portfolios, chase big contracts, and introduce newer models such as virtual and aggregated PPAs toward sustainability goals.

Some of the prominent market players:

- ENGIE

- Enel Green Power

- EDF Renewables

- NextEra Energy Resources

- Ørsted

- Iberdrola

- BP Renewable Energy

- TotalEnergies

- Acciona

- Vattenfall

- Shell Energy

- Duke Energy

- Siemens Gamesa Renewable Energy

- Other Key Players

Power Purchase Agreement Market Scope

| Report Highlights | Details |

| Market Size (2025) | USD 594.9 Bn |

| Forecast Value (2034) | USD 7,652.3 Bn |

| CAGR (2025-2034) | 32.8% |

| The US Market Size (2025) | USD 199.1 Bn |

| Leading Region in terms of Revenue Share | North America |

| Percentage of Revenue Share by Leading Region | 39.8% |

| Historical Data | 2019 – 2024 |

| Forecast Data | 2026 - 2034 |

| Base Year | 2024 |

| Estimate Year | 2025 |

| Segments Covered | By Type, By Location, By Category, By Deal Type, By Capacity, By Application, By End-User |

| Regional Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Regional Analysis

North America is projected to account for a share of 39.8% of revenue in the power purchase agreement market by the end of 2025. In the North American region, excellent policy support is seen in abundance along with enriched renewable resources that go hand-in-hand with heightening corporate demand. Factors driving solar and wind investments owing to incentives including an Investment Tax Credit have favored its leading market position. The excellence of resources on Mid-Western winds, Canadian Hydroelectricity-in the nation underlines better reasons for top positions in dominance. It reaches more corporate giants and more virtual PPAs; advanced grid infrastructures are making sure that seamless integration of renewable energy sources keeps taking place. In a world of deregulated electricity markets, all these factors result in favorable negotiations. Initiatives like the Inflation Reduction Act of 2022 keep the North at the frontiers of the PPA global market.

Purchase the Competition Analysis Dashboard Today at https://dimensionmarketresearch.com/checkout/power-purchase-agreement-market/

By Region

North America

- The U.S.

- Canada

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Segment Analysis:

The physical delivery mechanism for PPAs is leading the market, wherein renewable energy is delivered directly from the producers to the buyers, ensuring a continuing supply of energy and protecting the consumers from price volatility. Preferred by industrial facilities, data centers, and municipalities, these agreements facilitate long-term cost predictability. In this context, regulatory clarity in the deregulated markets lowers the risks of any transaction, therefore enhancing adoption. Real-time energy monitoring, on its part, establishes greater levels of trust while advanced grid infrastructure reduces the losses and streamlines the delivery of energy. Companies prefer physical PPAs for the accounting of specific renewable energy contributions, increasing their environmental credentials, and supporting ESG commitments in line with sustainability objectives.

Power Purchase Agreement Market Segmentation

By Type

- Physical Delivery PPA

- Virtual PPA

- Portfolio PPA

- Block Delivery PPA

- Others

By Location

- On-site

- Off-site

By Category

- Corporate

- Government

- Others

By Deal Type

- Wholesale

- Retail

- Others

By Capacity

- Up to 20 MW

- 20–50 MW

- 50–100 MW

- Above 100 MW

By Application

- Solar

- Wind

- Geothermal

- Hydropower

- Carbon Capture and Storage

- Others

By End-User

- Commercial

- Residential

- Industrial

Download our free PDF for key market insights and gain a competitive edge at https://dimensionmarketresearch.com/report/power-purchase-agreement-market/request-sample/

Global Power Purchase Agreement Market: Driver

- Corporate Sustainability Integration: PPAs are congruent with net-zero goals, work toward stabilizing energy prices, and reducing emissions. Virtual PPAs let companies invest even from a distance in on-site renewable investments, while their leaders, such as Microsoft, have already used them to show ESG compliance and try to create an edge in the market.

- Emergence of Digital Platforms: Blockchain and AI platforms smoothen the processes associated with PPA. It ensures tools are put in place for pricing optimization, buyer matching, and decreased transactional complications, thus driving PPA adoption globally toward a decentralized renewable energy solution.

Global Power Purchase Agreement Market: Restraints

- Corporate Sustainability Integration: PPAs are in line with net-zero goals by providing a stable energy price and, simultaneously, reducing carbon emissions. Virtual PPAs, for example, involve making renewable investments even from a distance. Indeed, leading companies like Microsoft are using this as a means of achieving ESG compliance and attaining a strategic market edge.

- Emergence of Digital Platforms: Blockchain and AI platforms smoothen the processes of PPA. Price optimization tools, buyer matching, and transaction complexity reduction are some of the driving factors for PPA adoption across the world, hence fostering decentralized renewable energy solutions.

Global Power Purchase Agreement Market: Opportunities

- Emerging Markets: Africa, Latin America, and Southeast Asia are endowed with renewable potential but suffer from energy deficits. PPAs attract investments, as can be illustrated by the case of the Lake Turkana Wind Project in Kenya, enabling the deployment of renewables to combat energy poverty.

- Technological Innovations: Smart grids and advanced batteries normalize intermittent renewables. Virtual power plants aggregate distributed resources, widening the scope of PPA viability and thus attracting more investments contributing to the sustainable growth of renewable energy markets.

Recent Developments in the Power Purchase Agreement Market

- December 2024: Amazon signed a 1.5 GW North American PPA for wind and solar, advancing its net-zero carbon emissions target for 2040.

- November 2024: Microsoft partnered with Ørsted for a 900 MW offshore wind PPA in Europe, powering data centers and supporting carbon-negative goals by 2030.

- October 2024: Enel Green Power launched a 500 MW Texas solar park for Walmart, bolstering its 100% renewable energy operations goal by 2030.

- September 2024: Google secured a 1 GW solar PPA in Asia to fuel operations in India, Japan, and Thailand, targeting carbon-free energy by 2030.

- August 2024: Meta collaborated with NextEra Energy on a 600 MW Iowa wind farm, powering data centers and expanding renewable energy infrastructure.

- July 2024: Siemens hosted a renewable energy conference, showcasing blockchain-based PPA platforms and energy storage advancements for grid integration.

- June 2024: Iberdrola signed a 700 MW wind PPA with Spanish corporations, boosting corporate participation in Europe’s energy transition.

- May 2024: LevelTen Energy introduced AI tools for PPA negotiations, simplifying contract processes with predictive analytics and market insights.

- April 2024: Dominion Energy finalized a 400 MW solar PPA with Virginia universities, supporting campus sustainability goals and local renewable growth.

Browse More Related Reports

The global energy storage market is expected to reach USD 58.9 billion in 2024 and grow to USD 204.8 billion by 2033 at a CAGR of 14.8%.

The hydrogen fueling station market is valued at USD 523 million in 2024 and projected to reach USD 3,621 million by 2033 with a CAGR of 24%.

The e-fuels market is valued at USD 11.6 billion in 2024 and anticipated to grow to USD 181.2 billion by 2033 at a CAGR of 35.7%.

The solar cells market is estimated at USD 164.2 billion in 2024 and is expected to reach USD 719.4 billion by 2033, growing at a CAGR of 17.8%.

The gasification market is projected to reach USD 574.1 billion in 2024 and grow to USD 850.9 billion by 2033 at a CAGR of 4.5%.

The distribution transformer market is valued at USD 28.4 billion in 2024 and expected to grow to USD 51.5 billion by 2033 at a CAGR of 6.9%.

The solar panel recycling market is expected to reach USD 187.7 million in 2024 and grow to USD 626.0 million by 2033 at a CAGR of 14.3%.

About Dimension Market Research (DMR)

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world. We also believe that our clients don’t always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.