LOS ANGELES, Jan. 21, 2025 (GLOBE NEWSWIRE) -- Economists often predict the future by projecting that what’s happening right now will continue. Payden & Rygel takes a different approach in Profiles of the Future: Our 2025 Macro Outlook, imagining how interest rates, inflation, employment and asset performance may surprise us in 2025.

“We’ve suggested spending less time prophesying and more on myth-busting, narrative-bursting, and meme-mincing,” the Payden economics team explains. “The common thread in all our annual exercises is that misconceptions about the present, not forecasts, are the main issues that plague investors and their portfolios.”

The annual guide lays out a contrarian but data-rich case for unexpected outcomes, including:

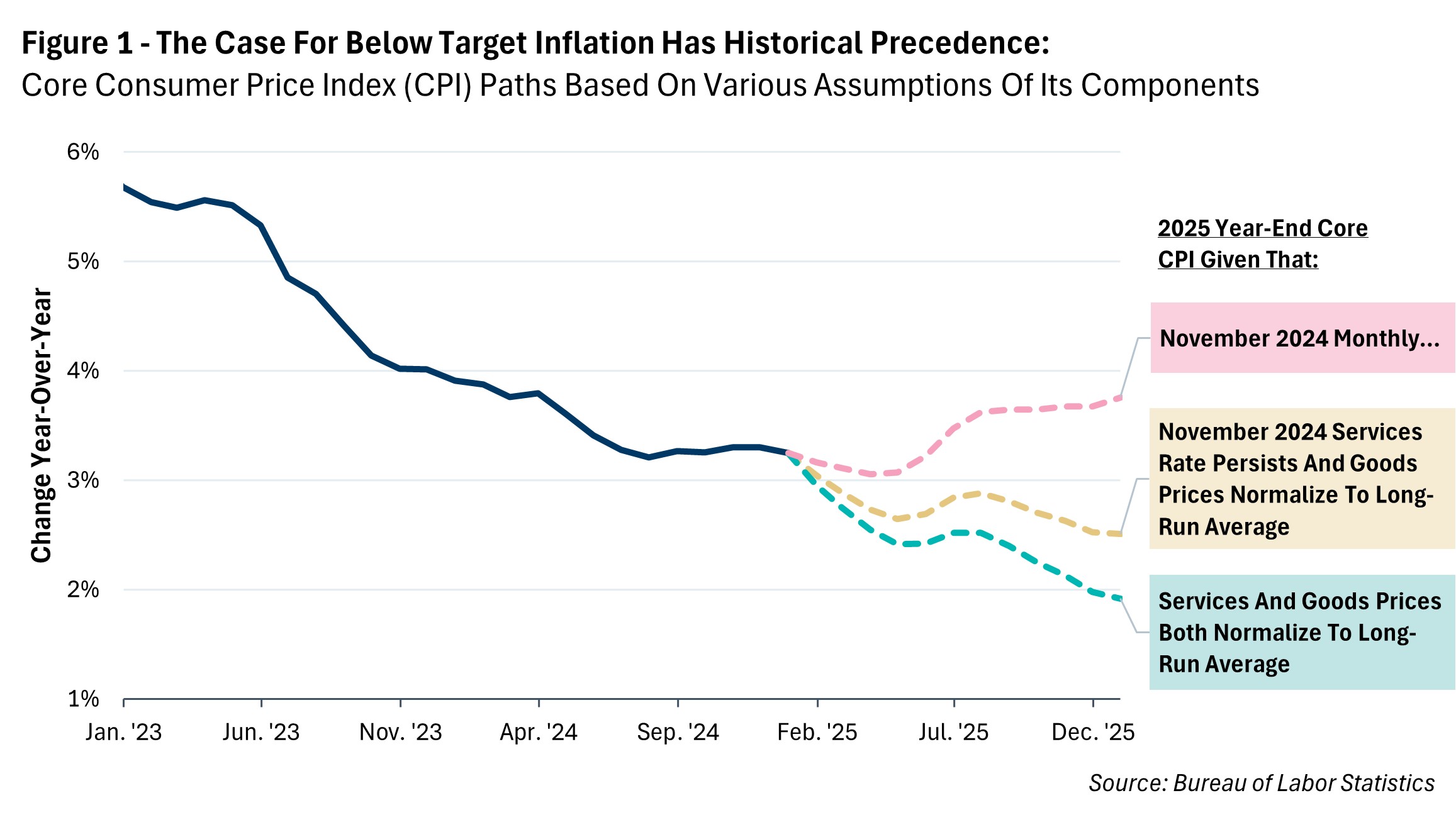

- Does the market look for accelerating inflation? Payden & Rygel identifies factors that may keep Consumer Price Index (CPI) at or below Federal Reserve Bank targets, observing, “The recent overall core inflation print was driven by a pickup in used vehicle prices in core goods, which could be easily reversed in the months ahead. If core goods return to their long-run average trend, even if shelter remains at current rates, core CPI could still return to 2.5% by 2025 year-end. And, if shelter moderates back to its long-run average trend as suggested by falling new rents, core CPI would reach the Fed’s 2% target in 2025,”

- Are most economists expecting continued job strength? Payden & Rygel looks at reasons that unemployment may reach as high as 4.4% in the year ahead. “While permanent layoffs only accounted for 20% of the total unemployed population in the summer of 2024, its share has now increased to 30%—not a severe warning sign but indicates accumulating weakness in the labor market,” say the report’s authors. “[Additionally], the quarterly census of employment and wages (QCEW) report for Q3 also suggests that previous payroll data could be softer than expected. Under a scenario with job growth slowing to 130k and the labor force participation rate returning to its levels in the summer of 2024, the unemployment rate would still rise to 4.4% by December 2025.”

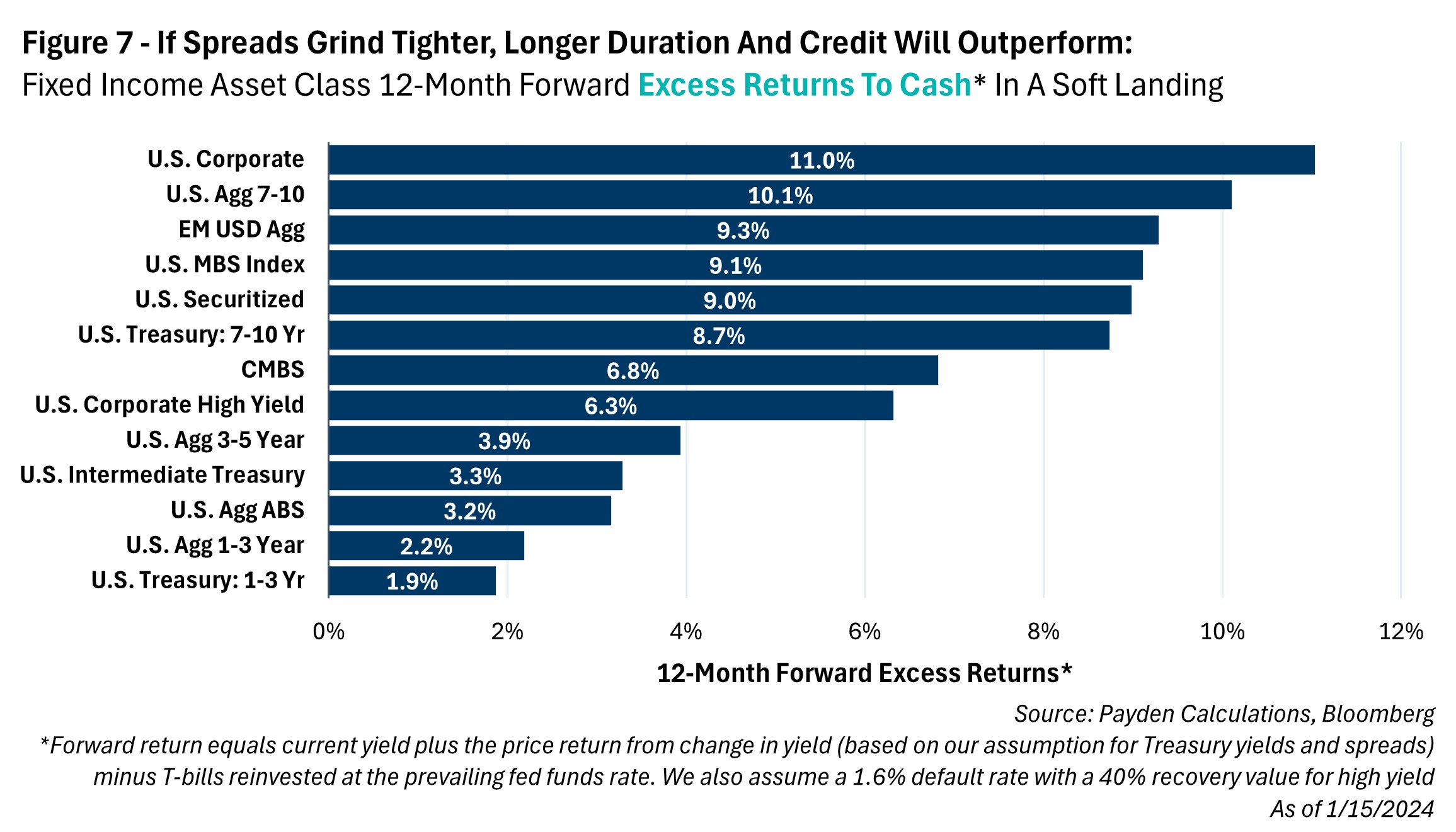

- After outstanding performance in 2024, are asset returns tapped out for 2025? Payden & Rygel finds evidence for a possible strong year ahead for stock and bond performance. Equities could rise further in 2025 as interest rates fall by more than forecast, consumers spend and corporate profits remain strong, analysts at investment manager Payden & Rygel says. This could lift the U.S. S&P 500 index above 7000, equivalent to a 15% price return, they say. Additional boosts to equities could come from “the carrot of tax cuts and easing regulatory environment" under President-elect Donald Trump.

The Macro Outlook is an annual must-read, outlining a contrarian view of the future with wit, style and a wealth of supporting charts and data. Download the full report here.

ABOUT PAYDEN & RYGEL

With $159 billion under management, Payden & Rygel is one of the largest privately-owned global investment advisers focused on the active management of fixed income and equity portfolios. Payden & Rygel provides a full range of investment strategies and solutions to investors around the globe, including Central Banks, Pension Funds, Insurance Companies, Private Banks, and Foundations. Independent and privately-owned, Payden is headquartered in Los Angeles and has offices in Boston, London, and Milan. Visit www.payden.com for more information about Payden’s investment offerings, including US mutual funds and Irish-domiciled funds (subject to investor eligibility).

This material is intended solely for institutional investors and is not intended for retail investors or general distribution. This material may not be reproduced or distributed without Payden & Rygel’s written permission. This presentation is for illustrative purposes only and does not constitute investment advice or an offer to sell or buy any security. The statements and opinions herein are current as of the date of this document and are subject to change without notice. Past performance is no guarantee of future results.

Contact information:

Kate Ennis

DAI Partners PR

ennis@daipartnerspr.com

(301)580-6726

Phots accompanying this announcement are available at https://www.globenewswire.com/NewsRoom/AttachmentNg/2650b905-a73d-4916-8bd9-176b7d43a141

https://www.globenewswire.com/NewsRoom/AttachmentNg/8d4c5877-4da6-470d-8d95-bad0a80e43ed

This press release was published by a CLEAR® Verified individual.