Austin, TX, USA, Jan. 21, 2025 (GLOBE NEWSWIRE) -- Custom Market Insights has published a new research report titled “Artificial Intelligence in Banking Market Size, Trends and Insights By Component (Service, Solution), By Application (Fraud Detection and Prevention, Transaction Monitoring, Identity Verification, Customer Service, Virtual Assistants, Automated Customer Support, Risk Management, Credit Scoring, Market Risk Analysis, Personalized Banking, Customer Recommendations, Targeted Marketing, Compliance and Regulatory Reporting, Anti-Money Laundering (AML), Know Your Customer (KYC), Others), By Technology (Machine Learning, Supervised Learning, Unsupervised Learning, Reinforcement Learning, Natural Language Processing (NLP), Text Analysis, Speech Recognition, Chatbots and Virtual Assistants, Robotic Process Automation (RPA), Process Automation, Workflow Automation, Predictive Analytics, Risk Management, Customer Insights), By Enterprise Size (Large Enterprise, SMEs), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033” in its research database.

Click Here to Access a Free Sample Report of the Global Artificial Intelligence in Banking Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=58189

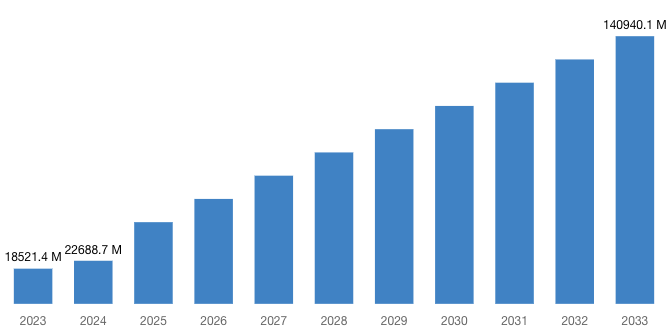

“According to the latest research study, the demand of global Artificial Intelligence in Banking Market size & share was valued at approximately USD 18,521.4 Million in 2023 and is expected to reach USD 22,688.7 Million in 2024 and is expected to reach a value of around USD 140,940.1 Million by 2033, at a compound annual growth rate (CAGR) of about 22.5% during the forecast period 2024 to 2033.”

Artificial Intelligence in Banking Market: Growth Factors and Dynamics

- Fraud Detection and Prevention: The AI system recognises transaction patterns and immediately identifies any anomalies, reducing fraud and security risks while improving financial security and confidence.

- Operational Competence: The processes automated using AI and RPA are usually executed with reduced errors and a lower cost.

- Innovative Analytics: Advanced AI-advanced data analytics may enable a system in the banks to improve analytics of risks, which certainly helps in portfolio management and decisions for maximizing overall performance and efficiency.

- Enhanced Customer Experience: AI-based technologies such as chatbots and personalised suggestions engage customers in a way that makes responses quick and financial services feel personalised, further enhancing total satisfaction and engagement.

- AI-Driven Personalization: The bank can personalize goods and services to individual client needs and preferences. This would improve acquisition as well as retention.

Request a Customized Copy of the Artificial Intelligence in Banking Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=58189

Artificial Intelligence in Banking Market: Partnership and Acquisitions

- In 2023, Temenos, a Switzerland-based software company, partnered with Amazon Web Services (AWS) to deliver core banking solutions via Software-as-a-Service (SaaS). This collaboration extends Temenos Banking Cloud’s global reach, ensuring high availability and data sovereignty without expensive onsite infrastructure.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 22,688.7 Million |

| Projected Market Size in 2033 | USD 140,940.1 Million |

| Market Size in 2023 | USD 18,521.4 Million |

| CAGR Growth Rate | 22.5% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Component, Application, Technology, Enterprise Size and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your research requirements. |

(A free sample of the Artificial Intelligence in Banking report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Artificial Intelligence in Banking report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Artificial Intelligence in Banking Market Report @ https://www.custommarketinsights.com/report/artificial-intelligence-in-banking-market/

Artificial Intelligence in Banking Market: COVID-19 Analysis

The COVID-19 pandemic has significantly impacted the Artificial Intelligence in Banking Market, with the industry experiencing both positive and negative effects. Here are some of the key impacts:

- Accelerated Digital Transformation: The pandemic pushed the curve toward accelerated digital transformation as the demand for digital banking and AI increased since banks wanted to make their remote services offerings more efficient while checking increased, more voluminous online transactions, forcing the market to adapt rapidly to evolving consumer behaviour and operational needs.

- Greater Cybersecurity Threats: E-banking and digital banking surged during the pandemic and sadly brought more cyber threats and fraud attempts against those banks. This has even baffled AI systems, which find it hard to detect and mitigate these sophisticated threats; thus, lesser trust and security is placed in the digital platforms.

- AI Security Upgrades: Today, banks are deploying advanced AI-based security measures so that the sensitive data will be kept safe and efforts of rising threats towards digital platforms will be thwarted. This helps to recover lost confidence among consumers.

- Rapid Integration of AI: The speed of changing the business due to the pandemic has forced banks to expedite AI integration into the operations. Improved systems in AI, including several others, are deployed to offer enhanced customer service, automate procedures, and smoothen operations.

- Remote Banking Solutions: Here, investment in the development and improvement of remote banking solutions using artificial intelligence to create easy online experiences, virtual customer support, and safe digital transactions keeps up with growing demand for service delivery at a distance.

- Customer Insight and Personalization: Banks are using AI more to understand customer data and preferences. They are able to deliver personalized services based on customer insights and targeted marketing; this can serve well in retaining existing customers and acquiring new ones in the aftermath of the pandemic.

- Strengthened Regulatory Compliance: In order to be entrenched within the ever-emerging regulatory compliance, banks have had to invest in AI-driven compliance tools that accelerate and make reporting comply with emerging regulations – a factor that has reduced risks and increased the transparency of operational procedures.

- Advanced AI Training and Development: In particular, the banks spend a lot of money on training and developing AI systems so that they can better present solutions to the complex scenarios that necessitate more effort to refine the skills in regard to deciding.

Request a Customized Copy of the Artificial Intelligence in Banking Market Report @ https://www.custommarketinsights.com/report/artificial-intelligence-in-banking-market/

Key questions answered in this report:

- What is the size of the Artificial Intelligence in Banking market and what is its expected growth rate?

- What are the primary driving factors that push the Artificial Intelligence in Banking market forward?

- What are the Artificial Intelligence in Banking Industry's top companies?

- What are the different categories that the Artificial Intelligence in Banking Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Artificial Intelligence in Banking market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Artificial Intelligence in Banking Research Report | Fast Delivery Available - [220+ Pages] @ https://www.custommarketinsights.com/report/artificial-intelligence-in-banking-market/

Artificial Intelligence in Banking Market: Regional Analysis

The Artificial Intelligence in Banking Market is segmented into regions: North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: North America consists of the U.S and Canada where technologically advanced banking systems and integration of technology are prevalent. There has been a significant emphasis on adopting innovative AI technologies to encourage experiences for customers, fraud detection, and adherence to regulations. Banks are investing heavily in AI-based innovation like predictive analytics and personalized financial services to stay abreast of the fast-changing dynamics due to regulations.

- Europe: Europe consists of many countries, and the extent of AI implementation is different in all these countries regarding banks. European banks have considered AI to be developed because it is a regulatory compliance measure to strictly abide by laws like GDPR. Here, the use of AI is widely accepted for risk management and AML operations. In addition, AI is integrated into the institutions of Europe, which further assist in open banking initiatives so that there can be enhanced financial transparency and innovation.

- Asia-Pacific: Asia-Pacific consists of robust growth economies and geographically diverse banking markets, with widely varied technological adoption. Asia-Pacific is quickly transforming digitally with a focus on AI for mobile banking and even for customer service automation. Banks use AI for supporting financial inclusion and offering innovative products to the growing middle class. A lot of investment is also put into AI for better efficiency in operations and handling big transaction data.

- LAMEA: The LAMEA region is also an emerging market with challenges and opportunities in terms of banking technology. In LAMEA, adoption of AI is more toward improving financial inclusion and enhancing the accessibility of banking services. Banks use AI for fraud detection, credit scoring, and customer service in regions with different economic conditions. Cost-effective AI solutions are meant to be used for the benefit of the regions with a focus on development of financial literacy and inclusion.

Request a Customized Copy of the Artificial Intelligence in Banking Market Report @ https://www.custommarketinsights.com/report/artificial-intelligence-in-banking-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Artificial Intelligence in Banking Market Size, Trends and Insights By Component (Service, Solution), By Application (Fraud Detection and Prevention, Transaction Monitoring, Identity Verification, Customer Service, Virtual Assistants, Automated Customer Support, Risk Management, Credit Scoring, Market Risk Analysis, Personalized Banking, Customer Recommendations, Targeted Marketing, Compliance and Regulatory Reporting, Anti-Money Laundering (AML), Know Your Customer (KYC), Others), By Technology (Machine Learning, Supervised Learning, Unsupervised Learning, Reinforcement Learning, Natural Language Processing (NLP), Text Analysis, Speech Recognition, Chatbots and Virtual Assistants, Robotic Process Automation (RPA), Process Automation, Workflow Automation, Predictive Analytics, Risk Management, Customer Insights), By Enterprise Size (Large Enterprise, SMEs), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033” Report at https://www.custommarketinsights.com/report/artificial-intelligence-in-banking-market/

List of the prominent players in Artificial Intelligence in Banking Market:

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Amazon Web Services (AWS)

- Salesforce.com Inc.

- SAS Institute Inc.

- Oracle Corporation

- SAP SE

- NVIDIA Corporation

- Cognizant Technology Solutions Corporation

- Accenture plc

- Infosys Limited

- TIBCO Software Inc.

- H2O.ai

- ThoughtSpot Inc.

- Others

Click Here to Access a Free Sample Report of the Global Artificial Intelligence in Banking Market @ https://www.custommarketinsights.com/report/artificial-intelligence-in-banking-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

UAE Refurbished Laptops Market: UAE Refurbished Laptops Market Size, Trends and Insights By Product Type (Business Laptops, Consumer Laptops, Gaming Laptops), By Grade (Grade A (Like New), Grade B (Lightly Used), Grade C (Used with Some Wear)), By End User (Individual Consumers, Educational Institutions, Corporate Offices, Government Agencies, Others), By Distribution Channel (Online Stores, Offline Stores, Company Websites, Third-Party Retailers), and By Region - Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Digital Payment in Healthcare Market: Digital Payment in Healthcare Market Size, Trends and Insights By Type of Payment (Direct Payments, Credit/Debit Card Payments, Bank Transfers, Digital Wallets, Indirect Payments, Third-Party Payers, Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs)), By Solution (Application Program Interface, Payment Gateway, Payment Processing, Payment Security & Fraud Management, Transaction Risk Management, Others), By End-User (Hospitals, Medical Clinics, Pharmacies, Health Insurance Companies, Telemedicine and Remote Health Services, Others), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Healthcare Digital Twins Market: Healthcare Digital Twins Market Size, Trends and Insights By Component (Software, Digital Twin Platforms, Data Analytics Tools, Simulation and Modeling Software, Services, Consulting, Integration and Implementation, Support and Maintenance), By Deployment (On-Premises, Cloud-Based), By Technology (IoT (Internet of Things), AI (Artificial Intelligence) and Machine Learning, Big Data Analytics, Cloud Computing, Blockchain), By Application (Predictive Maintenance, Personalized Medicine, Clinical Trials and Research, Operational Efficiency, Others), By End-User (Healthcare Providers, Hospitals, Clinics, Specialty Care Centers, Pharmaceutical Companies, Drug Development, Clinical Research, Medical Device Manufacturers, Research Institutions, Insurance Companies), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Harmonic Filter Market: Harmonic Filter Market Size, Trends and Insights By Product (Active, Passive, Hybrid), By Phase (Single Phase, Three Phase), By Voltage (Low Voltage, Medium Voltage, High Voltage), By End Use (Industrial, Commercial, Residential), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Traditional Radio Advertising Market: Traditional Radio Advertising Market Size, Trends and Insights By Type (Terrestrial Radio Broadcast Advertising, Satellite Radio Advertising), By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Industry Vertical (Automotive, Financial Services, Media and Entertainment, Fast-Moving Consumer Goods (FMCG), Retail, Real Estate, Education, Other Industry Verticals), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Automatic Number Plate Recognition Market: US Automatic Number Plate Recognition Market Size, Trends and Insights By Application (Traffic Management, Toll Collection, Law Enforcement, Parking Management), By Product Type (Fixed ANPR Systems, Mobile ANPR Systems, Portable ANPR Systems), By End User (Government Agencies, Law Enforcement, Toll Operators, Parking Management Firms), and By Region - Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Car as a Digital Wallet Market: Car as a Digital Wallet Market Size, Trends and Insights By Application (Parking Payments, Toll Payments, Fuel Payments, EV Charging), By Product Type (Integrated Payment Systems, App-based Wallets, NFC-enabled Payments), By End User (Private Vehicle Owners, Fleet Operators, Commercial Transport), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Data Center Rack Market: Data Center Rack Market Size, Trends and Insights By Rack Type (Open Frame Rack, Cabinet, Others), By Rack Height (Below 42 U, 42 U, Above 42 U), By Data Center Size (Large Data Centers, Small Data Centers, Mid-sized Data Centers), By End Users (BFSI, Government & Defence, Healthcare, IT & Telecom, Energy, Retail, Others), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Artificial Intelligence in Banking Market is segmented as follows:

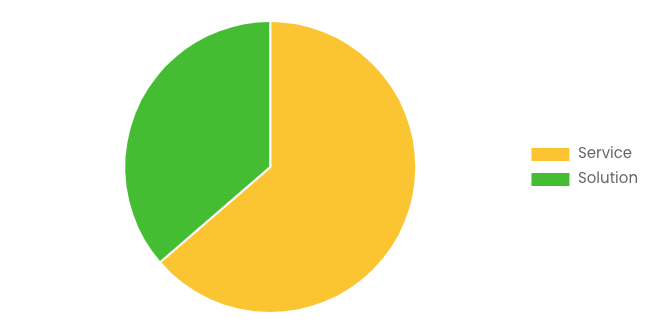

By Component

- Service

- Solution

By Application

- Fraud Detection and Prevention

- Transaction Monitoring

- Identity Verification

- Customer Service

- Virtual Assistants

- Automated Customer Support

- Risk Management

- Credit Scoring

- Market Risk Analysis

- Personalized Banking

- Customer Recommendations

- Targeted Marketing

- Compliance and Regulatory Reporting

- Anti-Money Laundering (AML)

- Know Your Customer (KYC)

- Others

By Technology

- Machine Learning

- Supervised Learning

- Unsupervised Learning

- Reinforcement Learning

- Natural Language Processing (NLP)

- Text Analysis

- Speech Recognition

- Chatbots and Virtual Assistants

- Robotic Process Automation (RPA)

- Process Automation

- Workflow Automation

- Predictive Analytics

- Risk Management

- Customer Insights

By Enterprise Size

- Large Enterprise

- SMEs

Click Here to Get a Free Sample Report of the Global Artificial Intelligence in Banking Market @ https://www.custommarketinsights.com/report/artificial-intelligence-in-banking-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Artificial Intelligence in Banking Market Research/Analysis Report Contains Answers to the following Questions.

- What Developments Are Going On in That Technology? Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Artificial Intelligence in Banking Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Artificial Intelligence in Banking Market? What Was the Capacity, Production Value, Cost and PROFIT of the Artificial Intelligence in Banking Market?

- What Is the Current Market Status of the Artificial Intelligence in Banking Industry? What's Market Competition in This Industry, Both Company and Country Wise? What's Market Analysis of Artificial Intelligence in Banking Market by Considering Applications and Types?

- What Are Projections of the Global Artificial Intelligence in Banking Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Artificial Intelligence in Banking Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Artificial Intelligence in Banking Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Artificial Intelligence in Banking Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Artificial Intelligence in Banking Industry?

Click Here to Access a Free Sample Report of the Global Artificial Intelligence in Banking Market @ https://www.custommarketinsights.com/report/artificial-intelligence-in-banking-market/

Reasons to Purchase Artificial Intelligence in Banking Market Report

- Artificial Intelligence in Banking Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Artificial Intelligence in Banking Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Artificial Intelligence in Banking Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry's current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Artificial Intelligence in Banking Market Includes in-depth market analysis from various perspectives through Porter's five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Artificial Intelligence in Banking market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Artificial Intelligence in Banking Research Report | Fast Delivery Available - [220+ Pages] @ https://www.custommarketinsights.com/report/artificial-intelligence-in-banking-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Artificial Intelligence in Banking market analysis.

- The competitive environment of current and potential participants in the Artificial Intelligence in Banking market is covered in the report, as well as those companies' strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Artificial Intelligence in Banking market should find this report useful. The research will be useful to all market participants in the Artificial Intelligence in Banking industry.

- Managers in the Artificial Intelligence in Banking sector are interested in publishing up-to-date and projected data about the worldwide Artificial Intelligence in Banking market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Artificial Intelligence in Banking products' market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Artificial Intelligence in Banking Market Report @ https://www.custommarketinsights.com/report/artificial-intelligence-in-banking-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Artificial Intelligence in Banking Research Report | Fast Delivery Available - [220+ Pages] @ https://www.custommarketinsights.com/report/artificial-intelligence-in-banking-market/