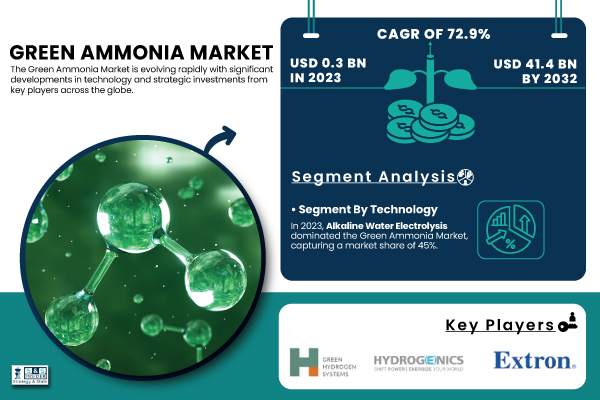

Austin, Jan. 31, 2025 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that, “The Green Ammonia Market is projected to reach USD 41.4 billion by 2032, growing at a compound annual growth rate (CAGR) of 72.9% from 2024 to 2032.”

Trends Shaping the Green Ammonia Market

One of the primary drivers of the Green Ammonia market is the growing demand for sustainable fertilizers. Green Ammonia is a crucial component in agricultural fertilizers, and its production traditionally relies on natural gas, contributing significantly to carbon emissions. Green Ammonia, produced by using renewable energy sources such as wind, solar, and hydropower, offers a sustainable alternative to conventional Green Ammonia production. This shift towards Green Ammonia aligns with the global emphasis on reducing environmental impact and adopting eco-friendly farming practices. The increasing adoption of green fertilizers is further accelerated by government incentives and policies aimed at promoting sustainable agriculture.

In addition, government initiatives and global regulatory frameworks are driving the Green Ammonia market's growth. Many governments have introduced legislation and incentives to reduce carbon footprints, and the demand for low-carbon products like Green Ammonia is expected to rise in response. This is particularly evident in Europe and Asia, where countries are aggressively pushing for renewable energy adoption and sustainable farming practices. The European Union, for instance, is investing heavily in Green Ammonia production to support its decarbonization targets and hydrogen infrastructure development.

Download PDF Sample of Green Ammonia Market @ https://www.snsinsider.com/sample-request/2894

Key Companies:

- Electrochaea (Power-to-Gas Technology, Biogas-to-Methane Conversion)

- EXYTRON (Green Ammonia Production Systems, Hydrogen Storage Solutions)

- Green Hydrogen Systems (Green Hydrogen Electrolyzers, Electrolyzer Systems)

- Hydrogenics (HySTAT Electrolyzers, Hydrogen Generation Systems)

- ITM Power PLC (ITM Megawatt-scale Electrolyzers, Hydrogen Production Solutions)

- MAN Energy Solutions (MAN Green Ammonia Solutions, Power-to-X Technologies)

- McPhy Energy (McLyzer Electrolyzers, Green Hydrogen Solutions)

- Nel Hydrogen (Nel A-series Electrolyzers, Hydrogen Refueling Stations)

- Siemens Energy (SIE-IC Electrolyzer Technology, Hydrogen Solutions)

- ThyssenKrupp AG (Water Electrolysis Systems, Hydrogen Generation Technology)

- Yara International (Yara International Ammonia, Green Fertilizers)

- Air Products and Chemicals, Inc. (Hydrogen Production Systems, Ammonia Synthesis Technology)

- CF Industries Holdings, Inc. (Green Ammonia, Low-Carbon Ammonia)

- Haldor Topsoe A/S (Ammonia Synthesis Catalysts, Hydrogen Production Catalysts)

- Iberdrola (Renewable Hydrogen Projects, Green Ammonia Solutions)

- Koch Industries, Inc. (Green Hydrogen Solutions, Ammonia Synthesis Technology)

- Linde Group (Linde Hydrogen Plants, Green Ammonia Production Systems)

- Mitsubishi Power (Power-to-Ammonia Technology, Hydrogen Production Systems)

- Snam S.p.A. (Hydrogen Storage Solutions, Green Hydrogen Systems)

- Plug Power Inc. (Plug Power Green Hydrogen Systems, Ammonia Synthesis Technology)

Green Ammonia Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 0.3 Billion |

| Market Size by 2032 | USD 41.4 Billion |

| CAGR | CAGR of 72.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Technology (Proton Exchange Membrane, Solid Oxide Electrolysis, Alkaline Water Electrolysis) •By Capacity (Small scale, Medium Scale, Large Scale) •By Application (Power Generation, Fertilizer, Refrigeration, Transportation, Others) •By End-use Industry (Agriculture, Energy, Automotive, Chemical, Others) |

| Key Drivers | •Government Support and Incentives for Clean Energy Technologies Drive Green Ammonia Market Adoption •Increasing Global Demand for Clean Hydrogen Fuels Green Ammonia Market Development |

If You Need Any Customization on Green Ammonia Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/2894

Regional Insights

In 2023, Europe dominated the Green Ammonia market, accounting for approximately 45% of the global market share. The region’s commitment to reducing greenhouse gas emissions and increasing renewable energy use has positioned it as a global leader in Green Ammonia production. Germany, the Netherlands, and Denmark are at the forefront of the Green Ammonia market in Europe, with large-scale projects aimed at integrating Green Ammonia into industrial processes, agriculture, and energy storage. The European Commission's Green Deal and the emphasis on achieving net-zero emissions by 2050 are expected to further support the growth of Green Ammonia in the region.

The Asia Pacific region is poised to experience substantial growth in the Green Ammonia market due to the increasing focus on renewable energy and agricultural sustainability. China, India, and Japan are leading the charge in the adoption of Green Ammonia technologies. In China, the government has set ambitious targets to reduce carbon emissions and boost clean energy use, with Green Ammonia playing a crucial role in its decarbonization plans. Meanwhile, India’s agricultural sector, one of the largest in the world, is embracing Green Ammonia to meet the growing demand for sustainable farming practices. Japan, on the other hand, has become a key player in the development of Green Ammonia as part of its broader hydrogen strategy to reduce reliance on fossil fuels.

Market Segmentation

By Technology

Alkaline Water Electrolysis held the largest market share around 45% in 2023. It is due to its maturity, cost-effectiveness, and reliability in hydrogen generation via water electrolysis, this technology currently dominates this application in Green Ammonia production. As such alkaline water electrolyzers can be easily scaled up and are particularly favorable for areas rich in renewable resources such as wind and solar making it highly favorable in Green Ammonia production. Green Ammonia synthesis is carried out at very high pressures, and this process handles such high-pressure operations efficiently. In addition, alkaline electrolysis systems are also less expensive and have lower operational costs as compared to the Proton Exchange Membrane (PEM) and Solid Oxide Electrolysis.

By Capacity

The Large-Scale production segment held the largest share of more than 55% in the Green Ammonia market in 2023. As demand for low-carbon Green Ammonia rises for fertilizers and energy, large-scale Green Ammonia plants are starting to be built. Economies of scale make the cost of producing Green Ammonia much lower on a per-unity basis for these plants, allowing it to be competitive (cost-wise) with traditional Green Ammonia production via the Haber-Bosch process. The mass production also allows for a greater degree of coupling with renewables, like wind and solar, which are required for the electrolysis. The upfront capital to build a large-scale plant is high, but the scale of the operations can lead to more efficient processes and lower long-term costs. Yara International, CF Industries and others are leading the way on Green Ammonia projects, leveraging their existing facilities and decades of experience in the market.

By End-Use Industry

In 2023, the agriculture sector held the largest market share in the Green Ammonia market, accounting for 50% of the total market value. Green Ammonia is a key component in fertilizers, and the shift towards Green Ammonia aligns with global efforts to adopt more sustainable farming practices. The use of Green Ammonia as a bio-based fertilizer is gaining traction as farmers seek alternatives to conventional fertilizers that are harmful to the environment. Additionally, Green Ammonia is being used in organic farming, where the demand for eco-friendly agricultural solutions is on the rise. The increasing need to meet the global food demand while reducing environmental impact is expected to drive the demand for Green Ammonia in the agriculture sector.

Buy Full Research Report on Green Ammonia Market 2024-2032 @ https://www.snsinsider.com/checkout/2894

Recent Developments

- In 2023, Yara International launched its first Green Ammonia plant in Norway, marking a significant milestone in the company’s sustainability efforts. The plant uses renewable energy to produce Green Ammonia, which is expected to be used in fertilizers, reducing the carbon footprint of the agricultural sector.

- In 2023, Maersk partnered with Copenhagen Infrastructure Partners to explore the use of Green Ammonia as a marine fuel. The collaboration aims to test Green Ammonia in shipping applications, reducing emissions in the maritime industry, which is one of the largest contributors to global greenhouse gas emissions.

- In 2023, CF Industries announced plans to build a Green Ammonia facility in Louisiana, USA, using hydrogen produced from renewable sources. The facility is expected to meet the growing demand for sustainable fertilizers in the U.S. market.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Region, 2023

5.2 Feedstock Prices, by Country, by Region, 2023

5.3 Regulatory Impact, by Country, by Region, 2023

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Region, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.4 Strategic Initiatives

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Green Ammonia Market Segmentation, by Technology

7.1 Chapter Overview

7.2 Proton Exchange Membrane

7.3 Solid Oxide Electrolysis

7.4 Alkaline Water Electrolysis

8. Green Ammonia Market Segmentation, by Capacity

8.1 Chapter Overview

8.2 Small scale

8.3 Medium Scale

8.4 Large Scale

9. Green Ammonia Market Segmentation, by Application

9.1 Chapter Overview

9.2 Power Generation

9.3 Fertilizer

9.4 Refrigeration

9.5 Transportation

9.6 Others

10. Green Ammonia Market Segmentation, by End-use Industry

10.1 Chapter Overview

10.2 Agriculture

10.3 Energy

10.4 Automotive

10.5 Chemical

10.6 Others

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/2894

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.