Austin, Feb. 06, 2025 (GLOBE NEWSWIRE) -- Global Navigation Satellite System (GNSS) Market Size & Growth Insights:

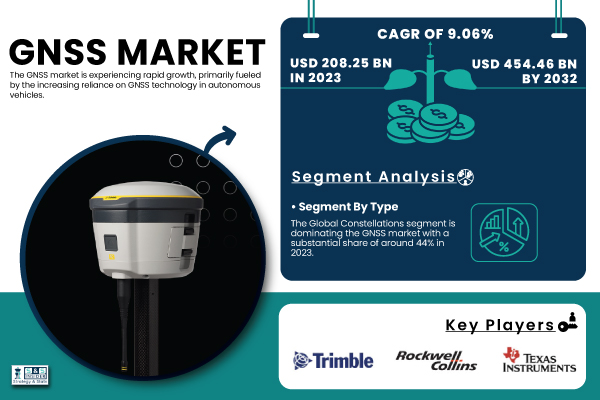

According to the SNS Insider, “The GNSS Market Size was valued at USD 208.25 billion in 2023 and is expected to reach USD 454.46 billion by 2032, and grow at a CAGR of 9.06% over the forecast period 2024-2032.”

Rapid Growth of GNSS Market Driven by Autonomous Vehicle Advancements

The GNSS market is experiencing significant growth, largely driven by the increasing adoption of GNSS technology in autonomous vehicles. A key example is Tier IV’s Minibus 2.0, which meets Japan’s Level 4 autonomous driving standards, emphasizing the need for precise GNSS-based positioning. By combining GNSS with sensors like LiDAR, radars, cameras, and IMUs, autonomous systems achieve enhanced safety, precision, and performance. Modern GNSS solutions utilize multiple global satellite constellations, delivering lane-level accuracy and near-perfect integrity, which is critical for Level 4 vehicles. The integration of GNSS with LiDAR also improves system robustness, supporting vehicle-to-everything (V2X) communication for better interaction with surroundings. Moreover, advanced methods like dual-input interval type-2 fuzzy inference systems, improving accuracy by over 63%, enhance GNSS’s reliability. Automotive-grade GNSS chipsets, compact and cost-effective, are fueling the widespread adoption of GNSS in the automotive sector, driving further growth in the market.

Get a Sample Report of Global Navigation Satellite System (GNSS) Market @ https://www.snsinsider.com/sample-request/1363

Global Navigation Satellite System (GNSS) Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 208.25 Billion |

| Market Size by 2032 | USD 454.46 Billion |

| CAGR | CAGR of 9.06% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Key Drivers | • The Expanding Role of GNSS in Meeting the Rising Demand for Location-Based Services. |

GNSS Market Dominance and Rapid Growth: Global Constellations Lead, LBS and Agriculture Drive Future Expansion

By Type

The Global Constellations segment is leading the GNSS market, accounting for around 44% of the share in 2023. This dominance is attributed to the widespread use of global satellite systems like GPS (USA), GLONASS (Russia), Galileo (EU), and BeiDou (China), which provide comprehensive coverage for applications in autonomous vehicles, aviation, and maritime navigation. These systems are critical for accurate navigation and geolocation worldwide.

The Satellite-based Augmentation System (SBAS) segment is the fastest-growing, driven by the increasing demand for enhanced accuracy and reliability in sectors such as aviation, transportation, and precision agriculture. As SBAS continues to support high-precision and safety-critical applications, its integration with technologies like AI and machine learning is expected to drive its growth, making it a key player in the evolving GNSS market.

By Application

The Location-Based Services (LBS) segment is leading the GNSS market, representing around 25% of the market share in 2023. LBS utilizes GNSS technology for applications like navigation, real-time tracking, and mapping, driven by the widespread use of smartphones, wearables, and IoT devices. The growth of on-demand services, such as ride-hailing and food delivery, further boosts LBS demand, making it integral to sectors like transportation, logistics, and tourism. As GNSS technology advances with multi-constellation systems and 5G networks, LBS continues to improve in accuracy and efficiency.

The Agriculture segment is the fastest-growing, fueled by the adoption of precision agriculture, which optimizes farming operations through GNSS-enabled equipment for mapping, irrigation, and crop management. This technology, combined with drones and IoT, enhances productivity, sustainability, and resource management, driving significant growth in agriculture.

Global Navigation Satellite System (GNSS) Market - Key Segments

By Type

- Global Constellations

- Regional Constellations

- Satellite-based Augmentation

By Application

- Rail

- Aviation

- Maritime

- Surveying

- Time Synch

- Agriculture

- LBS

- Road

- Others

For A Detailed Briefing Sessions with Our Team of Analyst, Connect Now @ https://www.snsinsider.com/request-analyst/1363

North America Dominates GNSS Market in 2023, While Asia-Pacific Set to Drive Rapid Growth from 2024 to 2032

In 2023, North America leads the GNSS market, holding approximately 44% of the global share, driven by advanced technological infrastructure and high demand for GNSS applications in industries such as autonomous vehicles, aerospace, telecommunications, and defense. The United States and Canada are at the forefront, with substantial investments in these sectors, where GNSS plays a critical role in precision navigation and positioning. The U.S. military's reliance on GNSS for defense and security, along with the growth of smart cities and IoT applications, further accelerates demand. North America is also a major contributor to satellite-based augmentation systems, enhancing GNSS accuracy. Ongoing public and private sector investments, along with strong government support for initiatives like GPS infrastructure modernization and autonomous vehicle development, ensure the region's continued leadership in the global GNSS market.

The Asia-Pacific region is expected to experience the fastest growth from 2024 to 2032, driven by advancements in automotive technology, precision farming, infrastructure development, and consumer electronics adoption. Countries like China, India, and Japan are key contributors to this growth.

Leading Market Players with their Product Listed in this Report are:

- Qualcomm Inc. (U.S.) – GNSS chipsets, GPS receivers

- Texas Instruments Inc. (U.S.) – GNSS receivers, signal processors

- Trimble Inc. (U.S.) – GNSS receivers, software for surveying and mapping

- Rockwell Collins (U.S.) – GNSS receivers for aviation, military-grade GNSS products

- Broadcom Inc. (U.S.) – GNSS chipsets, GPS and GNSS receivers

- Hexagon AB (Sweden) – GNSS solutions for surveying, precision farming

- Furuno Electric Co. Ltd. (Japan) – Marine GNSS navigation systems, GPS receivers

- Laird Plc. (U.K.) – GNSS antennas, positioning solutions

- Cobham Plc. (U.K.) – GNSS products for defense, aviation applications

- L3Harris Corporation (U.S.) – Military GNSS receivers, tactical navigation systems

- Topcon Corporation (Japan) – GNSS receivers for construction and agriculture

- Garmin Ltd. (U.S.) – GNSS navigation systems for automotive and marine

- Septentrio (Belgium) – High-precision GNSS receivers, industrial solutions

- NavCom Technology, Inc. (U.S.) – GNSS receivers for agriculture and mapping

- Syntony GNSS (France) – GNSS simulation and testing equipment

Recent Development

- December 16, 2024 – Collins Aerospace, an RTX business, has launched a comprehensive avionics modernization program for Beechcraft King Air and Hawker aircraft, upgrading them with Pro Line Fusion and Pro Line 21 systems. The initiative aims to enhance aircraft performance, safety, and efficiency while reducing pilot workload and improving situational awareness.

- October 6, 2024 – Garmin's Forerunner 945 smartwatch, which is now 52% off, leverages GNSS technology for precise fitness tracking and navigation. This includes support for multiple satellite systems like GPS, GLONASS, and Galileo, ensuring accurate location data for outdoor activities such as running, cycling, and hiking.

Table of Contents - Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Technology Adoption by Region

5.2 Usage and Demand, by Region

5.3 Regulatory and Policy Data

5.4 Customer Demographics

6. Competitive Landscape

7. Global Navigation Satellite System (GNSS) Market, by Type

8. Global Navigation Satellite System (GNSS) Market, by Application

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Buy a Single-User PDF of Global Navigation Satellite System (GNSS) Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/1363

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.